Trump's China Tariffs: Higher Prices And Empty Shelves For The US Economy?

Table of Contents

Increased Prices for Consumers

The most immediate argument against the tariffs centers on their impact on consumer prices. Let's examine this in detail.

The Direct Impact of Tariffs

Tariffs, essentially taxes on imported goods, directly increase the cost of goods imported from China. This is a fundamental principle of economics. The effect is most noticeable on goods heavily reliant on Chinese imports, such as:

- Electronics: Smartphones, laptops, and televisions experienced price increases due to tariffs on imported components.

- Furniture: Many furniture pieces, particularly those made with imported materials, saw a rise in price.

- Clothing and Textiles: Garments and fabrics imported from China became more expensive for consumers.

While precise figures vary depending on the product and the timing of the tariffs, studies suggest noticeable price increases. For example, a study by the Federal Reserve Bank of New York found that tariffs contributed to a 0.3 percentage point increase in the Consumer Price Index (CPI). This increase disproportionately affected lower-income households, who spend a larger portion of their income on these goods.

Indirect Effects on Inflation

The impact of tariffs extended beyond direct price increases. The ripple effect on inflation was significant. Businesses that relied on Chinese imports faced higher production costs, which they often passed on to consumers. This created a domino effect:

- Increased Production Costs: Manufacturers saw increased input costs, leading to higher prices for their products.

- Cost-Push Inflation: This increase in production costs contributed to a broader inflationary pressure across the economy.

- CPI Impact: The overall Consumer Price Index reflected this inflationary pressure, showcasing the indirect impact of the tariffs. Analysis of CPI data during the period of tariff implementation demonstrates a correlation between increased tariffs and increased inflation.

Tariff Evasion and Shifting Costs

The effectiveness of the tariffs was challenged by the prevalence of tariff evasion. Businesses explored various strategies to circumvent the tariffs, including:

- Shifting Sourcing: Companies moved their sourcing to other countries like Vietnam or Mexico to avoid tariffs.

- Product Re-routing: Goods were re-routed through third countries before entering the US to mask their origin.

- Price Adjustments: Companies adjusted pricing strategies to offset some of the tariff costs.

These strategies mitigated the impact on some goods, but often led to other complexities, such as increased transportation costs or longer lead times, further stressing supply chains.

Disruptions to Supply Chains and Potential Shortages

Beyond price increases, the tariffs disrupted established supply chains, leading to potential shortages and challenges for US businesses.

Impact on US Businesses

American businesses heavily reliant on Chinese imports faced significant challenges:

- Supply Chain Disruptions: Delays in receiving goods became commonplace, leading to production slowdowns and inventory shortages.

- Increased Lead Times: The search for alternative suppliers and longer transportation routes added significant time to the supply chain.

- Case Studies: Numerous businesses, ranging from small manufacturers to large retailers, reported negative impacts due to tariff-induced supply chain disruptions.

Increased Uncertainty and Investment Hesitation

The unpredictability of trade policy created significant uncertainty among businesses, affecting investment decisions:

- Long-Term Planning: Businesses hesitated to invest in expansion or new projects due to the fear of further trade disruptions.

- Job Creation: The lack of investment negatively affected job creation and economic growth.

- Trade War Uncertainty: The ongoing trade war created a volatile economic climate, impacting investor confidence.

Alternatives to Chinese Imports and Reshoring

In response to the tariffs, some companies explored alternatives:

- Diversification of Suppliers: Businesses sought new suppliers in other countries to reduce their reliance on China.

- Reshoring: Some companies brought manufacturing back to the US ("reshoring"), although this proved expensive for many.

- Nearshoring: Others opted for "nearshoring," moving production to nearby countries like Mexico or Canada.

However, shifting away from well-established Chinese supply chains proved complex and costly for many businesses. The cost-benefit analysis of reshoring versus maintaining cheaper Chinese imports was a major consideration.

The Broader Economic Context

It's crucial to consider the broader economic landscape when assessing the impact of the tariffs.

The Role of Global Trade

Critics of the tariffs argue that protectionist measures like these distort global trade and harm overall economic efficiency. They point to:

- Retaliatory Tariffs: China responded with its own tariffs on US goods, escalating the trade war.

- Global Trade Slowdown: The trade war contributed to a slowdown in global economic growth.

- Counterarguments: Some economists argued that the price increases were smaller than initially predicted, and that other factors influenced inflation more significantly.

Other Contributing Factors

It's important to acknowledge other factors influencing prices and supply chains:

- COVID-19 Pandemic: The pandemic severely disrupted global supply chains, independent of the tariffs.

- Global Inflation: Global inflationary pressures added to the price increases experienced in the US.

- Other Economic Policies: Domestic policies, such as monetary policy, also played a role in shaping the economic climate.

Conclusion: Evaluating the Legacy of Trump's China Tariffs

This analysis reveals that the impact of Trump's China tariffs on prices and supply chains was complex and multifaceted. While the tariffs undeniably increased the cost of some goods and disrupted supply chains, attributing all price increases and shortages solely to the tariffs is an oversimplification. Other significant factors, such as the COVID-19 pandemic and broader global economic trends, played a crucial role. Further research is needed to fully understand the long-term consequences of these tariffs on the US economy. To gain a complete picture of this important economic policy and its lasting implications, continue your research into the impact of Trump's China tariffs and their effects on US-China trade relations.

Featured Posts

-

Mapping The Rise Of New Business Hubs Across The Nation

Apr 29, 2025

Mapping The Rise Of New Business Hubs Across The Nation

Apr 29, 2025 -

Clearwater Boat Accident One Fatality Several Injuries Reported

Apr 29, 2025

Clearwater Boat Accident One Fatality Several Injuries Reported

Apr 29, 2025 -

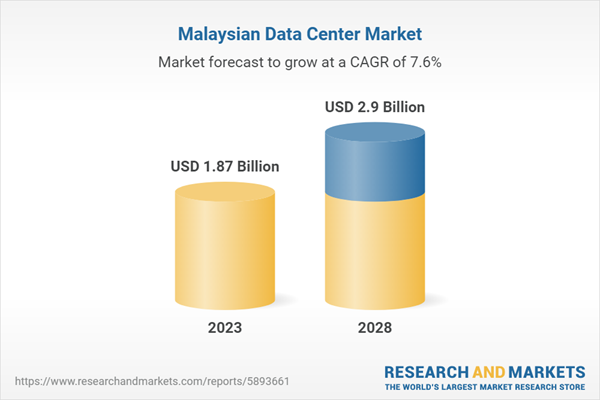

Data Center Development Booms In Negeri Sembilan Malaysia

Apr 29, 2025

Data Center Development Booms In Negeri Sembilan Malaysia

Apr 29, 2025 -

The Uks Legal Definition Of Woman Implications For Transgender Individuals And Sex Based Rights

Apr 29, 2025

The Uks Legal Definition Of Woman Implications For Transgender Individuals And Sex Based Rights

Apr 29, 2025 -

67 Killed In D C Black Hawk Crash Pilots Actions Under Investigation

Apr 29, 2025

67 Killed In D C Black Hawk Crash Pilots Actions Under Investigation

Apr 29, 2025

50 Godini Praznuva Lyubimetst Na Milioni

50 Godini Praznuva Lyubimetst Na Milioni