Trump's 100-Day Plan & Bitcoin: A Price Prediction Analysis

Table of Contents

Trump's 100-Day Plan: Key Policies and Their Potential Impact on Bitcoin

Trump's 100-Day Plan encompassed a range of economic and regulatory proposals with potentially far-reaching consequences for Bitcoin. Let's examine key areas:

Fiscal Policy and Inflation

The plan's emphasis on infrastructure spending and tax cuts could lead to inflationary pressure. This could, in turn, impact Bitcoin's value as a potential safe haven asset. If traditional fiat currencies lose purchasing power due to inflation, investors might seek alternative stores of value, driving up demand for Bitcoin and its price.

- Increased infrastructure spending: Could lead to increased demand for materials, potentially driving up inflation.

- Tax cuts: While stimulating economic growth, this could also fuel inflation if not carefully managed.

- Impact on Bitcoin: Increased inflation could boost Bitcoin's appeal as a hedge against inflation, increasing its price. This makes Bitcoin investment a more attractive proposition for those seeking to preserve their wealth.

Regulatory Uncertainty and its Influence on Cryptocurrencies

The regulatory landscape for cryptocurrencies remained uncertain during Trump's presidency. The stance of agencies like the SEC (Securities and Exchange Commission) and the CFTC (Commodity Futures Trading Commission) significantly impacted Bitcoin legality and adoption. Trump's administration's approach could have either boosted or hindered Bitcoin's growth.

- Positive Scenario: A clear regulatory framework could have legitimized Bitcoin and increased institutional investment.

- Negative Scenario: Unfavorable or unclear regulations could have dampened investor confidence and suppressed Bitcoin's price.

- Crypto regulation's impact: The lack of consistent, clear crypto regulation during this period created volatility and uncertainty for Bitcoin's price.

Economic Growth and Bitcoin Adoption

Trump's plan aimed to stimulate economic growth through tax cuts and deregulation. Increased economic activity could positively influence Bitcoin adoption. As more people engage in the economy, interest in alternative investment vehicles like Bitcoin might rise, leading to increased demand.

- Increased economic activity: More disposable income could lead to increased investments in riskier assets, including Bitcoin.

- Greater market participation: A booming economy might attract new investors to the cryptocurrency market, boosting Bitcoin adoption rate and market capitalization.

- Impact on Bitcoin price: Higher economic growth and adoption typically lead to price increases for Bitcoin.

Historical Bitcoin Price Analysis During Periods of Political Uncertainty

Analyzing historical Bitcoin price history during periods of political uncertainty can provide valuable insights.

Past Presidential Elections and Bitcoin's Performance

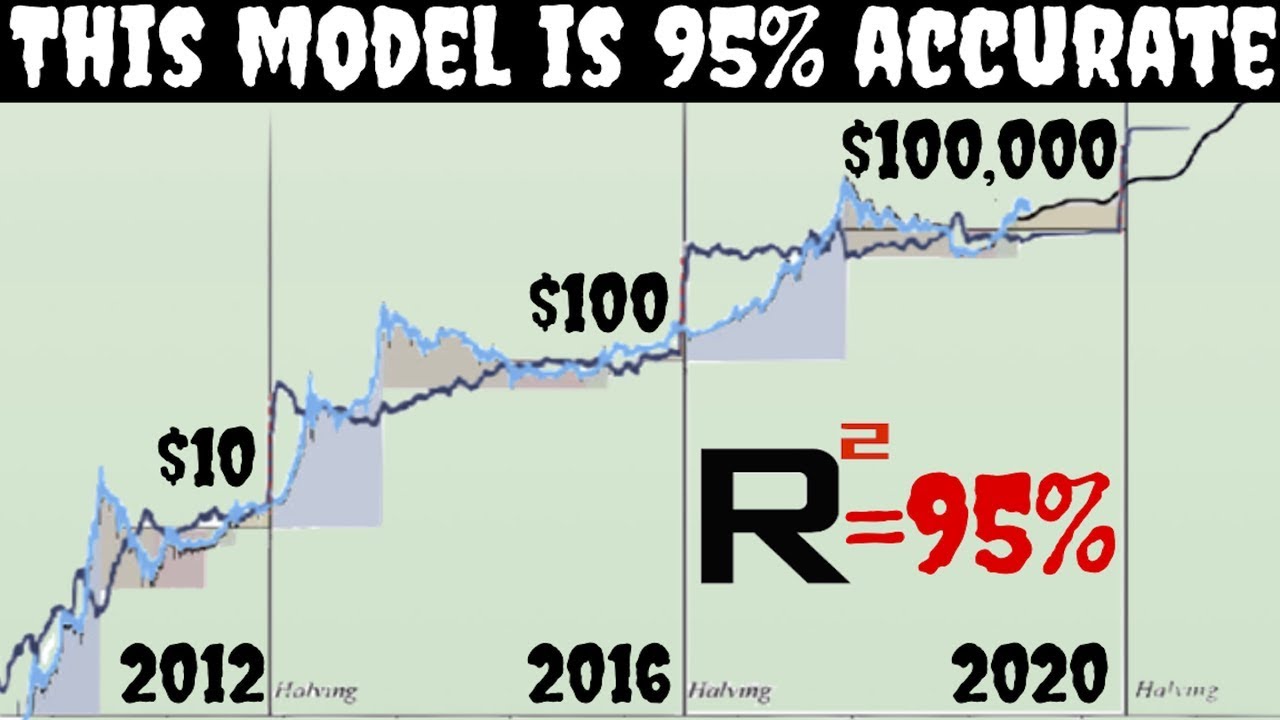

Examining Bitcoin's performance during previous presidential elections reveals some correlations, though not always linear. Generally, periods of high political uncertainty tend to increase market volatility, affecting Bitcoin's price. (Charts and graphs illustrating past performance would be included here).

- Increased volatility: Political uncertainty tends to increase market volatility, leading to unpredictable price swings for Bitcoin.

- Investor sentiment: News and events relating to elections can heavily influence investor sentiment and cause significant price fluctuations.

- Safe-haven demand: In times of uncertainty, Bitcoin is sometimes perceived as a safe-haven asset, leading to increased demand and price increases.

Comparing Trump's 100-Day Plan to Past Economic Policies

Comparing the key elements of Trump's 100-Day Plan to past economic policies allows us to assess potential parallels in market reaction. For instance, comparing his tax cuts to previous administrations' fiscal policies, and observing the subsequent impact on Bitcoin (if any), provides a valuable point of reference. (Bullet points highlighting similarities and differences would be included here).

Predictive Modeling and Potential Bitcoin Price Scenarios

Predicting Bitcoin's price is complex, requiring consideration of factors beyond Trump's 100-Day Plan.

Factors Influencing Bitcoin Price Beyond Trump's Plan

Several other factors impact Bitcoin price, independent of political events:

- Technological advancements: Upgrades to the Bitcoin network and the emergence of competing cryptocurrencies.

- Regulatory changes in other countries: Global regulatory developments significantly affect Bitcoin's price.

- Market sentiment: General investor sentiment and media coverage heavily influence Bitcoin’s price.

Developing a Realistic Price Prediction

Based on our analysis of Trump's 100-Day Plan and other relevant factors, we can develop a range of potential price scenarios:

- Scenario 1 (Optimistic): Significant economic growth coupled with favorable regulatory developments could drive Bitcoin's price to [Insert Price Range].

- Scenario 2 (Neutral): Moderate economic growth and continued regulatory uncertainty could result in a price range of [Insert Price Range].

- Scenario 3 (Pessimistic): Economic slowdown or unfavorable regulatory changes could lead to a price decrease to [Insert Price Range].

Conclusion

Analyzing the potential impact of Trump's 100-Day Plan on Bitcoin price reveals a complex interplay of economic and political factors. While the plan's inflationary pressures could boost Bitcoin's value as a hedge against inflation, regulatory uncertainty posed a significant risk. Historical data suggests that periods of political uncertainty often lead to increased market volatility for Bitcoin. Our predictive modeling suggests a range of potential Bitcoin price scenarios, from optimistic to pessimistic, depending on the actual implementation of the plan and other market forces. This analysis underscores the importance of conducting further research on Trump's 100-Day Plan and its effects on Bitcoin price prediction, along with staying informed on both political and cryptocurrency market developments. Resources such as [link to relevant research or news sources] can provide valuable insights. Understanding the intricate relationship between political policies and the cryptocurrency market is key to navigating the future of Bitcoin. The interplay between Trump's 100-Day Plan and the future of Bitcoin remains a compelling area for ongoing study and analysis.

Featured Posts

-

Nyt Strands Game 403 Hints And Solutions For April 10th

May 09, 2025

Nyt Strands Game 403 Hints And Solutions For April 10th

May 09, 2025 -

Uy Scuti Release Date Young Thugs Latest Album Update

May 09, 2025

Uy Scuti Release Date Young Thugs Latest Album Update

May 09, 2025 -

Snegopad V Sverdlovskoy Oblasti 45 Tysyach Chelovek Bez Sveta

May 09, 2025

Snegopad V Sverdlovskoy Oblasti 45 Tysyach Chelovek Bez Sveta

May 09, 2025 -

Mans 3 000 Babysitting Bill Snowballs Into 3 600 Daycare Expense

May 09, 2025

Mans 3 000 Babysitting Bill Snowballs Into 3 600 Daycare Expense

May 09, 2025 -

Hl Ysttye Barys San Jyrman Thqyq Injaz Tarykhy Fy Dwry Abtal Awrwba

May 09, 2025

Hl Ysttye Barys San Jyrman Thqyq Injaz Tarykhy Fy Dwry Abtal Awrwba

May 09, 2025