Trump Tariffs And Their Devastating Impact On Fintech IPOs: The Affirm (AFRM) Example

Table of Contents

The Economic Fallout of Trump Tariffs

The Trump administration's tariffs triggered a chain reaction of negative economic consequences that significantly hampered the Fintech sector, particularly impacting companies preparing for IPOs.

Disruption of Global Supply Chains

Tariffs increased the cost of imported goods, creating significant challenges for Fintech companies reliant on international components or services. This disruption rippled through the entire supply chain.

- Increased manufacturing costs: The added tariff costs were passed down the supply chain, increasing the price of everything from server components to software licenses.

- Delayed product launches: Companies faced delays in receiving necessary materials, pushing back product launch dates and impacting market entry strategies.

- Higher operational expenses: The increased cost of goods and services directly translated to higher operational expenses, squeezing profit margins and impacting profitability.

For example, cloud-based Fintech platforms heavily reliant on servers manufactured overseas experienced significant increases in infrastructure costs, impacting their scalability and bottom line.

Reduced Consumer Spending

Tariffs contributed to inflation and reduced consumer disposable income, directly impacting demand for Fintech products and services. This decreased demand created a double whammy for companies planning IPOs.

- Lower transaction volumes: Consumers, facing higher prices for everyday goods, reduced their spending, leading to lower transaction volumes for payment platforms like Affirm.

- Decreased loan applications: With less disposable income, consumers were less likely to apply for loans, impacting the origination volume for lending platforms.

- Reduced investment in Fintech startups: Investors, facing economic uncertainty, became more risk-averse, reducing investment in early-stage Fintech startups and making it harder for them to reach IPO readiness.

Affirm, for example, likely saw a decrease in loan origination volume as consumers tightened their belts in response to increased inflation driven, in part, by tariffs.

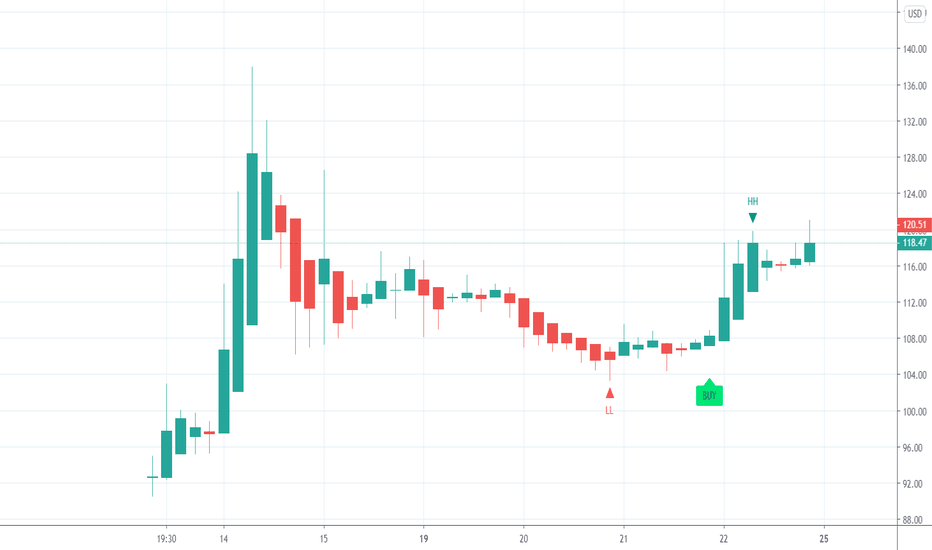

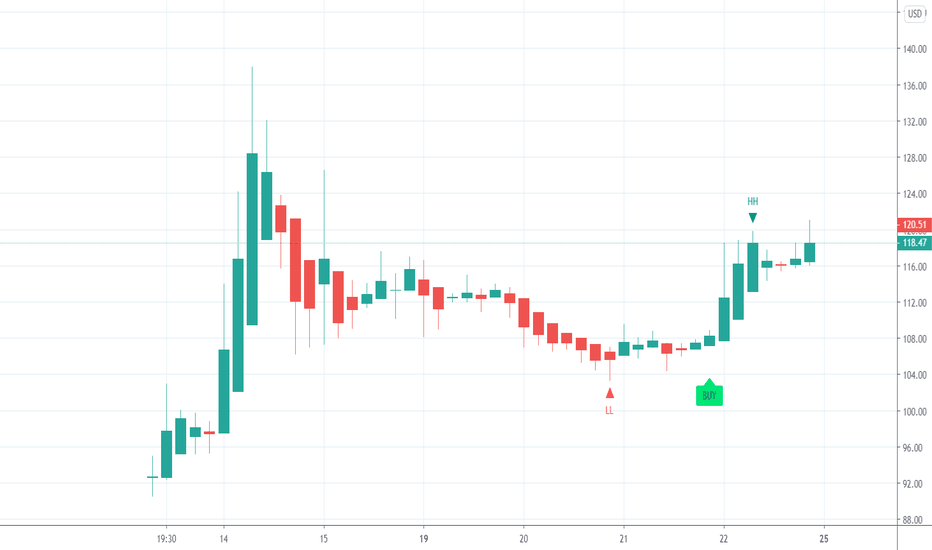

Increased Uncertainty in the Market

The trade wars initiated by the Trump administration created significant market uncertainty, negatively impacting investor confidence and Fintech IPO valuations.

- Market volatility: The fluctuating trade policies created an unpredictable market environment, leading to increased volatility and making it difficult for companies to accurately forecast future performance.

- Decreased investor appetite for risk: Uncertainty made investors more risk-averse, reducing their willingness to invest in potentially volatile Fintech stocks, particularly those preparing for IPOs.

- Lower IPO valuations: The combination of reduced investor confidence and economic uncertainty led to lower IPO valuations than anticipated for many Fintech companies.

Affirm's IPO likely experienced a dampened valuation due to the overall market uncertainty generated by the Trump tariffs and the associated trade disputes.

The Specific Impact on Affirm (AFRM) IPO

Affirm, like many Fintech companies, felt the full weight of the economic fallout caused by the Trump tariffs.

Increased Costs and Reduced Margins

The tariffs directly impacted Affirm's operational costs, potentially impacting profitability and investor perception.

- Higher interest rates on debt: The economic uncertainty increased interest rates, making it more expensive for Affirm to secure debt financing.

- Increased cost of goods and services: As discussed earlier, the tariffs increased the cost of various goods and services needed for Affirm's operations.

- Pressure on profit margins: The combination of increased costs and reduced consumer spending significantly pressured Affirm's profit margins, potentially impacting its attractiveness to investors.

Challenges in Attracting Investors

The uncertain economic climate, fueled by tariffs, made it more challenging for Affirm to secure favorable IPO terms.

- Lower IPO valuation than anticipated: Investor hesitancy led to a lower valuation than initially projected.

- Decreased investor interest: The overall economic uncertainty reduced the level of interest from potential investors.

- Difficulties in raising capital: Securing sufficient capital became more challenging in this volatile market environment.

Long-Term Effects on Growth and Expansion

The lingering effects of the tariffs hampered Affirm's post-IPO growth and expansion plans.

- Reduced market share: Competition from other players became more intense in a slower-growth market.

- Slower expansion into new markets: The economic downturn made expansion into new markets more challenging and expensive.

- Challenges in scaling the business: The need to control costs and manage profitability hampered aggressive scaling efforts.

Broader Implications for the Fintech Sector

The consequences of Trump tariffs extended far beyond individual companies, impacting the entire Fintech sector.

Increased Regulatory Scrutiny

The economic instability caused by tariffs might have led to stricter regulatory oversight of Fintech companies.

- Increased compliance costs: Companies faced higher compliance costs due to increased regulatory scrutiny.

- More stringent regulations: The instability could have prompted regulators to implement stricter regulations for the Fintech sector.

- Potential delays in product launches: Navigating increased regulatory hurdles caused delays in bringing new products to market.

Slowdown in Fintech Innovation

The economic downturn discouraged investment in research and development within the Fintech sector.

- Reduced innovation: Less investment meant fewer resources allocated to innovation and new product development.

- Fewer new Fintech startups: The challenging economic environment discouraged new entrepreneurs from entering the Fintech market.

- Slower adoption of new technologies: The focus shifted from innovation to cost-cutting and survival.

The Shift in Global Fintech Landscape

Tariffs may have accelerated the shift towards regional Fintech hubs outside of the US.

- Emergence of Fintech hubs in Asia and Europe: Companies may have sought alternative locations with more stable economic environments.

- Reduced US dominance in the Fintech market: The challenges faced by US Fintech companies might have contributed to a shift in global market share.

Conclusion: Trump Tariffs and Their Lingering Impact on Fintech IPOs

Trump tariffs and their resulting economic fallout significantly impacted Fintech IPOs, as evidenced by the challenges faced by Affirm (AFRM). The disruption of global supply chains, reduced consumer spending, and increased market uncertainty created a perfect storm that negatively affected IPO valuations, investor confidence, and long-term growth prospects. This analysis reaffirms the thesis that Trump tariffs exerted a devastating influence on the Fintech IPO landscape. Understanding the lasting repercussions of events like the implementation of Trump tariffs is crucial for anyone investing in or analyzing the Fintech market. Further research into the impact of trade policies on Fintech IPOs like Affirm (AFRM) is essential for navigating the complexities of this dynamic sector.

Featured Posts

-

Can Basel Deliver A Diverse And Inclusive Eurovision Despite Tensions

May 14, 2025

Can Basel Deliver A Diverse And Inclusive Eurovision Despite Tensions

May 14, 2025 -

Safety Alert Walmart Recalls Electric Ride Ons And Phone Chargers

May 14, 2025

Safety Alert Walmart Recalls Electric Ride Ons And Phone Chargers

May 14, 2025 -

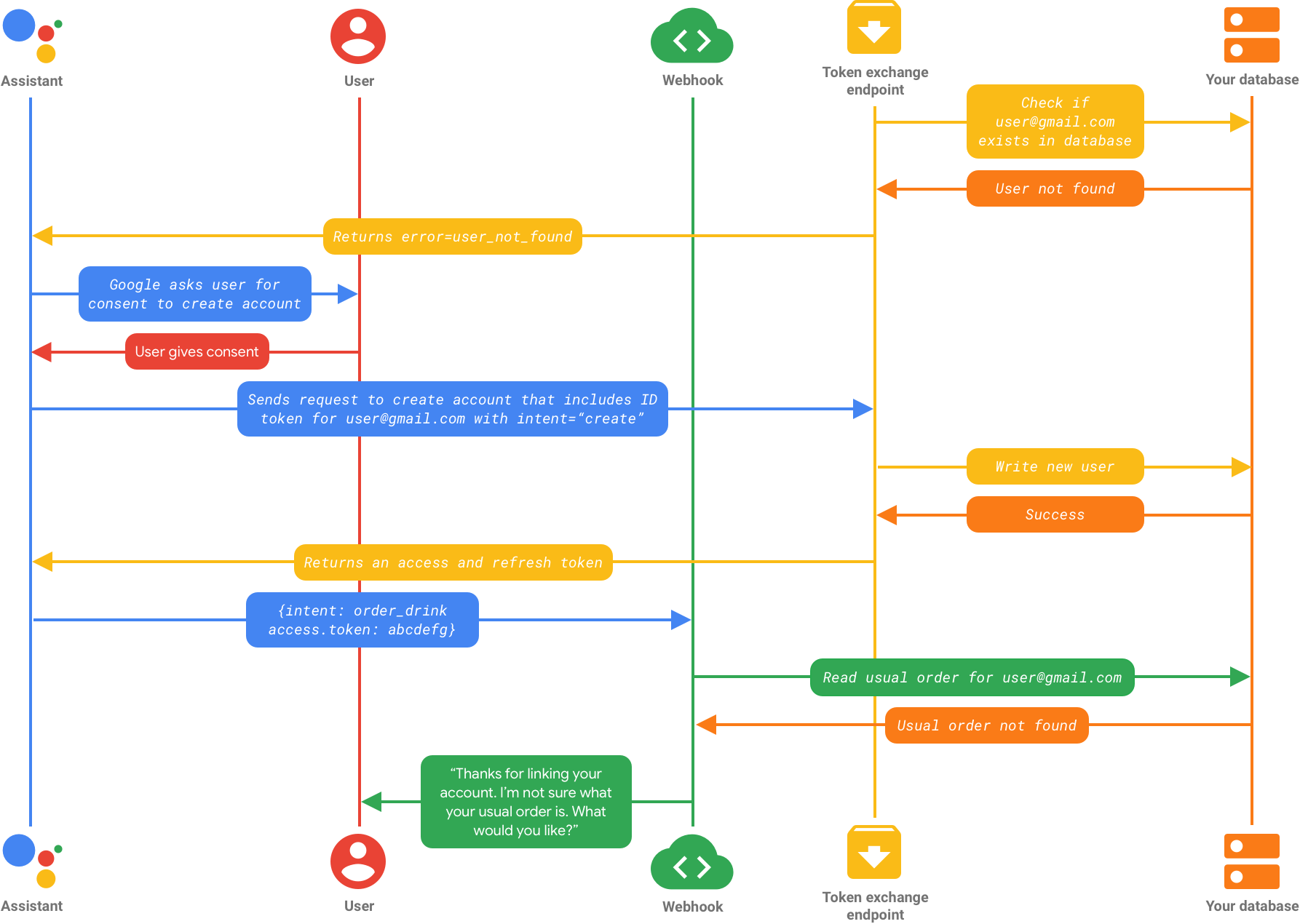

Open Ai 2024 Streamlined Voice Assistant Creation For Developers

May 14, 2025

Open Ai 2024 Streamlined Voice Assistant Creation For Developers

May 14, 2025 -

Data Breach Exposes Executive Office365 Accounts Millions Stolen

May 14, 2025

Data Breach Exposes Executive Office365 Accounts Millions Stolen

May 14, 2025 -

Chi Povernetsya Damiano David Na Yevrobachennya

May 14, 2025

Chi Povernetsya Damiano David Na Yevrobachennya

May 14, 2025

Latest Posts

-

Luksuzne Sportske Patike Inspirisane Novakom Za 1 500 Evra

May 14, 2025

Luksuzne Sportske Patike Inspirisane Novakom Za 1 500 Evra

May 14, 2025 -

Novakove Patike Pogled Na Modele Od 1 500 Evra I Vishe

May 14, 2025

Novakove Patike Pogled Na Modele Od 1 500 Evra I Vishe

May 14, 2025 -

500 Evra Za Novakove Patike Da Li Vrede Toliko

May 14, 2025

500 Evra Za Novakove Patike Da Li Vrede Toliko

May 14, 2025 -

Prestizhne Patike Novakov Stil Za 1 500 Evra

May 14, 2025

Prestizhne Patike Novakov Stil Za 1 500 Evra

May 14, 2025 -

Novakove Patike Tsena Od 1 500 Evra I Vrednost Za Novats

May 14, 2025

Novakove Patike Tsena Od 1 500 Evra I Vrednost Za Novats

May 14, 2025