Trump Tariffs And Disinflation: ECB Member Holzmann's Perspective

Table of Contents

Holzmann's Stance on the Impact of Trump Tariffs

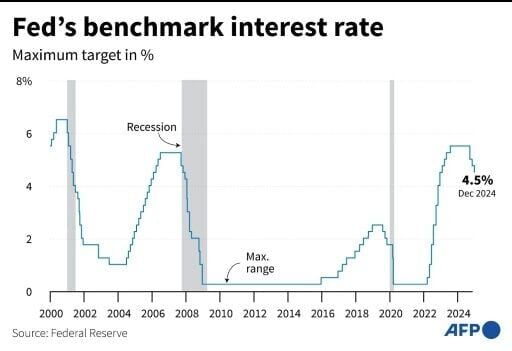

Robert Holzmann, a prominent member of the European Central Bank's Governing Council, has offered insightful commentary on the impact of the Trump-era tariffs. His core argument centers on the disinflationary pressures stemming from these trade barriers. While he acknowledges the complexity of the issue, Holzmann suggests that the tariffs disrupted global supply chains, leading to higher production costs and ultimately dampening inflationary pressures. He hasn't explicitly stated his argument in one succinct quote, but his numerous public statements consistently point to this conclusion.

His key arguments can be summarized as follows:

- Impact on supply chains: Tariffs disrupted established global supply chains, forcing businesses to seek alternative, often more expensive, sources of goods and materials.

- Effect on consumer prices: While not always directly resulting in higher prices for consumers, the increased production costs created by tariffs put downward pressure on overall inflation.

- Influence on global trade: The trade wars sparked by the tariffs led to a reduction in global trade volume, further contributing to slower price growth.

- Specific sectors affected: Sectors heavily reliant on imported goods, such as the automotive and steel industries, were particularly vulnerable to the negative effects of these tariffs.

The Mechanisms Behind the Disinflationary Effect

The disinflationary impact of Trump's tariffs operates through several key mechanisms:

- Supply Chain Disruptions: Tariffs increased the cost of imported goods and materials, leading to:

- Increased transportation costs due to logistical complexities and longer shipping routes.

- Reduced import competition, as businesses faced higher costs for imported inputs.

- Dampened Consumer Demand: Higher prices resulting from tariffs reduced consumer purchasing power, leading to:

- Lower overall demand for goods and services.

- Reduced incentive for businesses to raise prices, contributing to disinflation.

- Uncertainty and Reduced Investment: The trade tensions created by the tariffs fostered uncertainty among businesses, leading to:

- Delayed investment decisions.

- A decline in business confidence and overall economic activity.

Alternative Perspectives and Critiques of Holzmann's View

While Holzmann's perspective is influential, it's crucial to acknowledge alternative viewpoints. Some economists argue that the initial impact of Trump tariffs might have been inflationary, at least in the short term. Increased prices for certain imported goods could temporarily boost the overall inflation rate. Furthermore, critics might point to the complexity of disentangling the specific effect of Trump’s tariffs from other simultaneous economic factors influencing global inflation.

Contrasting perspectives include:

- Arguments for a short-term inflationary effect: The immediate impact of tariffs on specific goods could lead to temporary price increases.

- Criticisms of the methodology: Assessing the precise impact of tariffs on inflation is challenging due to the multitude of interacting economic forces.

- Alternative explanations for disinflationary trends: Other global economic factors, such as technological advancements or changes in labor markets, could independently contribute to disinflationary trends.

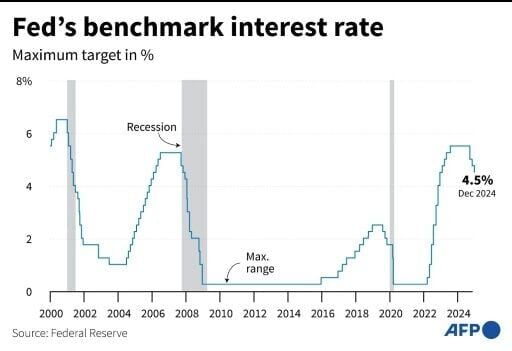

Implications for the ECB's Monetary Policy

Holzmann's analysis of Trump tariffs and disinflation has significant implications for the ECB's monetary policy. His insights help the ECB to better understand the complex interplay between global trade and inflation in the Eurozone. The uncertainty caused by trade disputes presents challenges for policymakers when setting interest rates and other monetary policy tools.

The key implications include:

- Effect on inflation forecasts: The ECB must account for the potential disinflationary effects of trade disputes when formulating its inflation forecasts.

- Potential adjustments to monetary policy: If disinflationary pressures intensify due to trade wars, the ECB might need to adjust its monetary policy to stimulate economic growth.

- Uncertainty for investors and businesses: The uncertainty surrounding trade policy makes it challenging for businesses to make investment decisions and for investors to plan for the future.

Conclusion: Understanding Trump Tariffs and Disinflation: Key Takeaways and Call to Action

Robert Holzmann's perspective highlights the intricate link between Trump tariffs, global trade, and disinflation. While his arguments emphasize the disinflationary pressures stemming from supply chain disruptions and reduced consumer demand, it is crucial to recognize the complexity of this relationship and the existence of alternative perspectives. Understanding these dynamics is vital for policymakers like the ECB in navigating the complexities of the global economy and for investors in making informed decisions. To stay informed about this ongoing debate, research related materials, follow economic news, and continue to engage with the discussion on Trump tariffs and disinflation. [Link to relevant research papers/economic news sites].

Featured Posts

-

California Economy A New Global Ranking Fourth Largest In The World

Apr 26, 2025

California Economy A New Global Ranking Fourth Largest In The World

Apr 26, 2025 -

Review Mission Impossible Dead Reckoning Part One Teaser

Apr 26, 2025

Review Mission Impossible Dead Reckoning Part One Teaser

Apr 26, 2025 -

Quem E Benson Boone Descubra O Hitmaker De Beautiful Thing E Astro Do Lollapalooza

Apr 26, 2025

Quem E Benson Boone Descubra O Hitmaker De Beautiful Thing E Astro Do Lollapalooza

Apr 26, 2025 -

George Santos Faces Up To 7 Years In Federal Fraud Case

Apr 26, 2025

George Santos Faces Up To 7 Years In Federal Fraud Case

Apr 26, 2025 -

Deion Sanders Son Shedeur A Different Kind Of Success

Apr 26, 2025

Deion Sanders Son Shedeur A Different Kind Of Success

Apr 26, 2025

Latest Posts

-

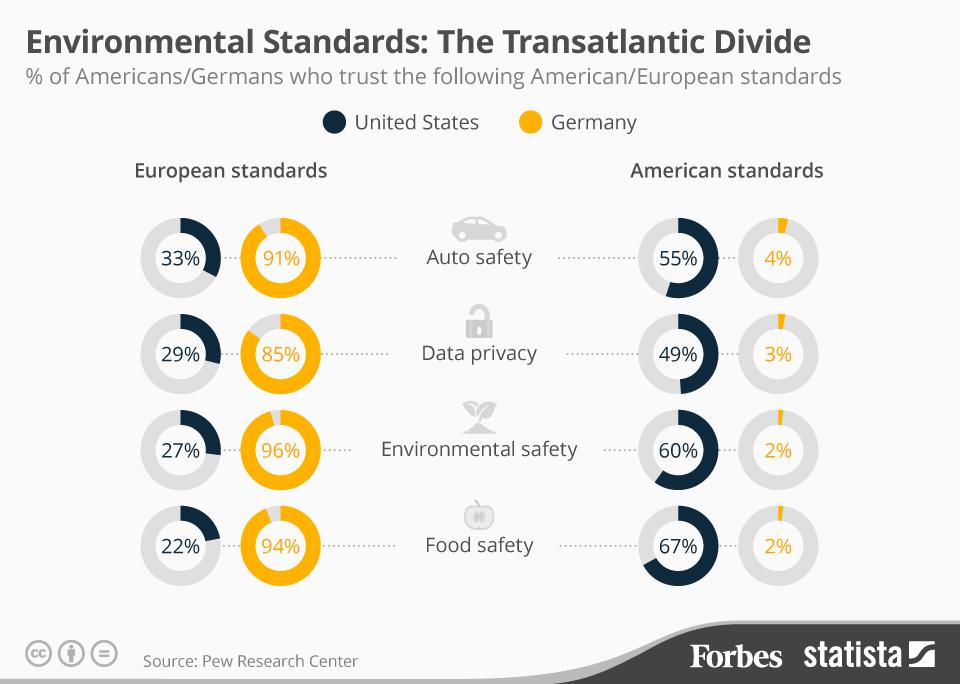

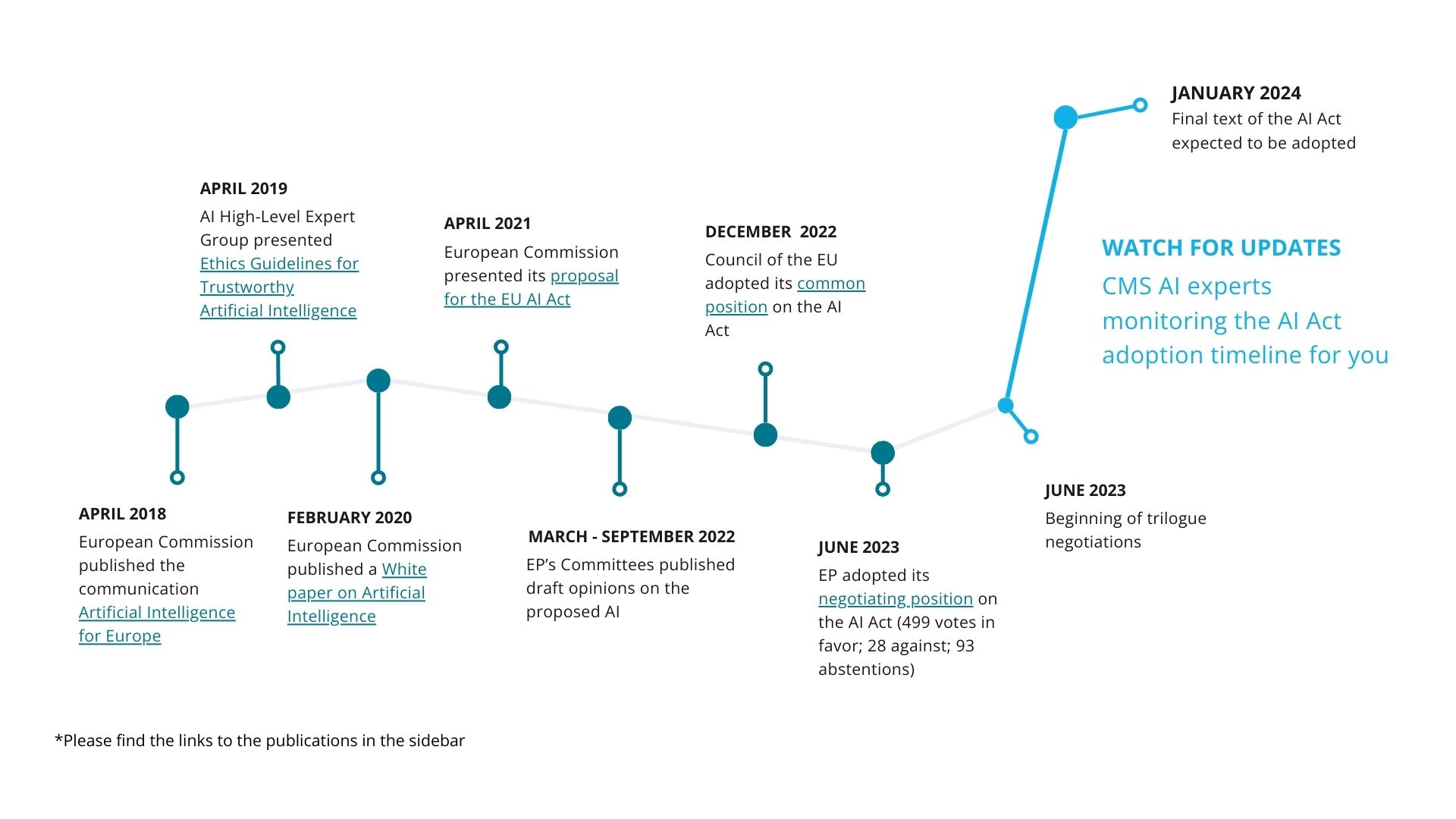

Navigating The Transatlantic Divide Trumps Impact On European Ai Rulemaking

Apr 26, 2025

Navigating The Transatlantic Divide Trumps Impact On European Ai Rulemaking

Apr 26, 2025 -

The Trump Administrations Influence On European Ai Policy A Critical Analysis

Apr 26, 2025

The Trump Administrations Influence On European Ai Policy A Critical Analysis

Apr 26, 2025 -

Europe Rejects Ai Rulebook Amidst Trump Administration Pressure

Apr 26, 2025

Europe Rejects Ai Rulebook Amidst Trump Administration Pressure

Apr 26, 2025 -

Trump Administrations Pressure Campaign Against Europes Ai Regulations

Apr 26, 2025

Trump Administrations Pressure Campaign Against Europes Ai Regulations

Apr 26, 2025 -

Escape Disney 7 Must Try Orlando Restaurants For 2025

Apr 26, 2025

Escape Disney 7 Must Try Orlando Restaurants For 2025

Apr 26, 2025