Trump Greenlights Nippon-U.S. Steel Merger: A New Chapter In Steel Trade

Table of Contents

Economic Implications of the Nippon-U.S. Steel Merger

Increased Market Share and Competition

The merger of Nippon Steel and U.S. Steel creates a steel behemoth with a significantly increased market share, both domestically and internationally. This consolidation will undoubtedly impact competition within the industry. The combined entity will control a substantial portion of the global steel market, potentially influencing steel prices for consumers and businesses.

- Increased production capacity: The combined resources of Nippon Steel and U.S. Steel will lead to a significant boost in production capacity.

- Potential for price reductions (or increases): Depending on market dynamics, this increased capacity could lead to lower prices for consumers, or conversely, if the combined entity exercises market power, it could result in price increases.

- Impact on smaller steel producers: Smaller steel producers could face intensified competition and reduced market share, potentially leading to consolidation or even bankruptcies within the industry.

Job Creation and Economic Growth

Proponents of the merger argue it will spur significant job creation in the U.S. through increased production and investment in infrastructure projects. The combined company's enhanced efficiency and competitiveness could lead to new contracts and expansion, boosting related industries. However, it's crucial to acknowledge the possibility of job losses in competing steel companies.

- New jobs in manufacturing: The merger could lead to increased demand for skilled labor in U.S. manufacturing plants.

- Potential for investment in infrastructure projects: A larger, more competitive steel producer could attract more investment in large-scale infrastructure projects.

- Impact on local economies: The economic impact will vary depending on the location of the merged entity's operations and the resulting job creation or displacement.

Impact on U.S. Trade Policy

The Nippon-U.S. Steel merger will inevitably influence U.S. trade negotiations and policies regarding steel imports. The combined entity's increased market power could shift the dynamics of international trade relationships. This could potentially lead to trade disputes or retaliatory measures from other steel-producing nations.

- Changes to tariffs: The merger might influence the U.S. government's stance on steel tariffs and other trade barriers.

- Impact on bilateral trade agreements: The merger could impact existing trade agreements and negotiations with other countries.

- Potential for trade wars: The merger's impact on global steel prices and market share could potentially trigger trade disputes and retaliatory measures.

Strategic Advantages and Synergies of the Merger

Technological Advancements and Innovation

The merger promises significant advancements in steel production technology and innovation. The combined resources and expertise of Nippon Steel and U.S. Steel will likely accelerate R&D efforts, leading to improved efficiency, product quality, and sustainable production methods.

- R&D collaborations: Joint research initiatives will foster the development of new steel alloys and production techniques.

- Improved manufacturing processes: The merger can streamline production, reducing waste and improving overall efficiency.

- Development of new steel products: The combined entity can develop innovative steel products to meet the demands of emerging industries.

Global Market Positioning

The merged entity will have an unparalleled global market position, enabling it to better compete with other major steel producers. This enhanced competitiveness will likely lead to increased market share, stronger negotiating power, and expansion into new markets.

- Increased global market share: The combined company will control a larger share of the global steel market.

- Stronger negotiating power: The larger entity will have greater leverage in negotiating contracts with suppliers and customers.

- Expansion into new markets: The merger facilitates entry into new markets and geographic regions.

Potential Challenges and Concerns Regarding the Nippon-U.S. Steel Merger

Antitrust Concerns and Regulatory Scrutiny

The merger faced intense antitrust scrutiny and regulatory review. Government agencies needed to ensure fair competition and prevent the creation of a steel monopoly. The approval process likely involved conditions to mitigate anti-competitive effects.

- Antitrust investigations: Thorough investigations were conducted to assess the merger's potential impact on competition.

- Regulatory approvals: The merger required approvals from relevant regulatory bodies in various countries.

- Potential divestitures: To address antitrust concerns, the companies might have been required to divest certain assets or operations.

Impact on Workers and Communities

While the merger promises job growth in some areas, it also raises concerns about potential job losses and plant closures in other regions. Mitigation strategies are essential to support affected workers and communities.

- Job displacement: Some workers might lose their jobs due to plant closures or operational changes.

- Retraining programs: Government and company-sponsored retraining programs are crucial to help displaced workers transition to new jobs.

- Community support initiatives: Support for affected communities is necessary to mitigate the negative economic consequences.

Conclusion

The Nippon-U.S. Steel merger presents a complex picture with significant potential benefits and challenges. While the combined entity could boost economic growth, create jobs, and drive technological innovation, concerns regarding antitrust issues, job displacement, and the impact on trade policy remain. President Trump's approval marks a pivotal moment for the U.S. steel industry, and its long-term effects, both positive and negative, will unfold over time. Stay informed about the developments in the Nippon-U.S. Steel merger and its effects on the global steel market. Further research into U.S. trade policy and the global steel industry will provide valuable insights into the long-term implications of this combined steel giant.

Featured Posts

-

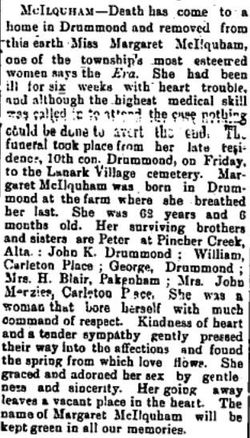

Hells Angels Craig Mc Ilquham Sunday Memorial Service Details

May 26, 2025

Hells Angels Craig Mc Ilquham Sunday Memorial Service Details

May 26, 2025 -

Kak Vyglyadyat Deti Naomi Kempbell Syn I Doch

May 26, 2025

Kak Vyglyadyat Deti Naomi Kempbell Syn I Doch

May 26, 2025 -

Rtbf Liege Le Futur Du Site Du Palais Des Congres

May 26, 2025

Rtbf Liege Le Futur Du Site Du Palais Des Congres

May 26, 2025 -

Pogacars Tour Of Flanders Triumph A Masterclass In Solo Riding

May 26, 2025

Pogacars Tour Of Flanders Triumph A Masterclass In Solo Riding

May 26, 2025 -

L Affaire Ardisson Baffie Sexisme Accusations Et Consequences

May 26, 2025

L Affaire Ardisson Baffie Sexisme Accusations Et Consequences

May 26, 2025