Trump And Powell's White House Meeting: Implications For The US Economy

Table of Contents

The Context of the Meeting

Trump's Criticism of the Fed's Monetary Policy

Former President Trump consistently criticized Powell's interest rate hikes, viewing them as detrimental to economic growth. He frequently expressed his belief that the Fed was acting too aggressively, hindering his administration's economic agenda.

- Examples of Trump's public statements: Trump frequently used Twitter and public appearances to voice his displeasure with the Fed's actions, often labeling Powell's policies as "crazy" or "ridiculous."

- Desire for lower interest rates: Trump consistently advocated for lower interest rates to stimulate economic activity, believing they would boost job creation and accelerate GDP growth.

- Concerns about a potential recession: Trump often expressed concerns that the Fed's policies risked pushing the US economy into a recession. He publicly warned of negative economic consequences resulting from higher interest rates.

The State of the US Economy Pre-Meeting

The US economy leading up to these meetings presented a complex picture. While unemployment remained relatively low, inflation was a growing concern.

- Relevant economic indicators: Inflation was rising, exceeding the Federal Reserve's target rate. GDP growth, while positive, showed signs of slowing.

- Concerns about inflation: The increasing inflation rate sparked debates about the Fed's appropriate response and the potential for a wage-price spiral.

- Existing economic debates: Economists were divided on the optimal policy response, with some advocating for more aggressive interest rate hikes to combat inflation and others warning of the potential for a recession.

The Meeting Itself and its Immediate Aftermath

Key Discussion Points (If known)

The specifics of the conversations between Trump and Powell were often kept private, resulting in much speculation. However, it's widely believed that interest rate policy, inflation targets, and the overall economic outlook dominated the discussions.

- Possible topics of discussion: The potential for a recession, the effectiveness of current monetary policy tools, and the appropriate response to rising inflation were likely key points of contention.

- The lack of transparency: The limited public information surrounding the meetings fueled speculation and uncertainty in financial markets.

Market Reactions

News of the Trump-Powell meetings and any subsequent statements often sent shockwaves through financial markets.

- Specific examples of market fluctuations: Stock market indices frequently experienced significant volatility following reports or statements related to these meetings. Bond yields also reacted, reflecting changing expectations about future interest rates.

- Analysis of investor sentiment: Investor confidence was often shaken by the perceived political interference in the Federal Reserve's decision-making process, leading to uncertainty and market fluctuations.

Long-Term Implications for the US Economy

Impact on Interest Rate Policy

The meetings and their aftermath did not appear to significantly alter the Federal Reserve's long-term approach to interest rate policy.

- Analysis of subsequent interest rate decisions: The Fed continued to make independent decisions based on economic data, although the pressure from the White House was undeniable.

- Potential long-term effects on borrowing costs: While the meetings didn't directly change the trajectory of interest rates, the uncertainty they created impacted borrowing costs indirectly, especially for businesses and consumers.

Effect on Economic Growth and Inflation

The long-term effects on economic growth and inflation are complex and subject to ongoing debate.

- Data supporting the analysis of growth and inflation: While some economists argue that the meetings had a negligible impact, others point to increased uncertainty as a potential factor influencing economic performance.

- Unexpected economic outcomes: The potential impact of these events on long-term economic trends requires further analysis and research.

Damage to the Fed's Independence?

The meetings raised serious concerns about potential political interference in the Federal Reserve's decision-making process.

- Arguments for and against potential damage to the Fed's independence: Some argued that the President's actions undermined the Fed's autonomy, while others claimed that the Fed maintained its independence despite the political pressure.

- Discussion of the importance of central bank autonomy: The importance of an independent central bank free from political influence is crucial for maintaining price stability and fostering long-term economic growth.

Conclusion

The meetings between Trump and Powell underscored the complex interplay between political pressure and monetary policy. While the short-term market reactions were significant, the long-term economic consequences remain a subject of ongoing discussion and research. The events highlighted the potential for political interference to impact interest rate policy, economic growth, inflation, and ultimately, the independence of the Federal Reserve. Understanding the impact of these meetings is crucial for navigating the complexities of US economic policy.

Call to Action: Understanding the impact of the Trump and Powell White House meetings remains crucial for comprehending the complexities of US economic policy. Continue your research into the intricacies of the Federal Reserve and its influence on the US economy by exploring further resources [link to relevant resources]. Stay informed about the ongoing effects of these pivotal meetings on your financial future and the overall health of the US economy.

Featured Posts

-

Tulsa Remote A Cost Benefit Analysis Of The Program

May 31, 2025

Tulsa Remote A Cost Benefit Analysis Of The Program

May 31, 2025 -

Saskatchewan Faces Increased Wildfire Risk Amidst Hotter Summer Forecast

May 31, 2025

Saskatchewan Faces Increased Wildfire Risk Amidst Hotter Summer Forecast

May 31, 2025 -

Office Lunch Etiquette 6 Rules For Professional Success

May 31, 2025

Office Lunch Etiquette 6 Rules For Professional Success

May 31, 2025 -

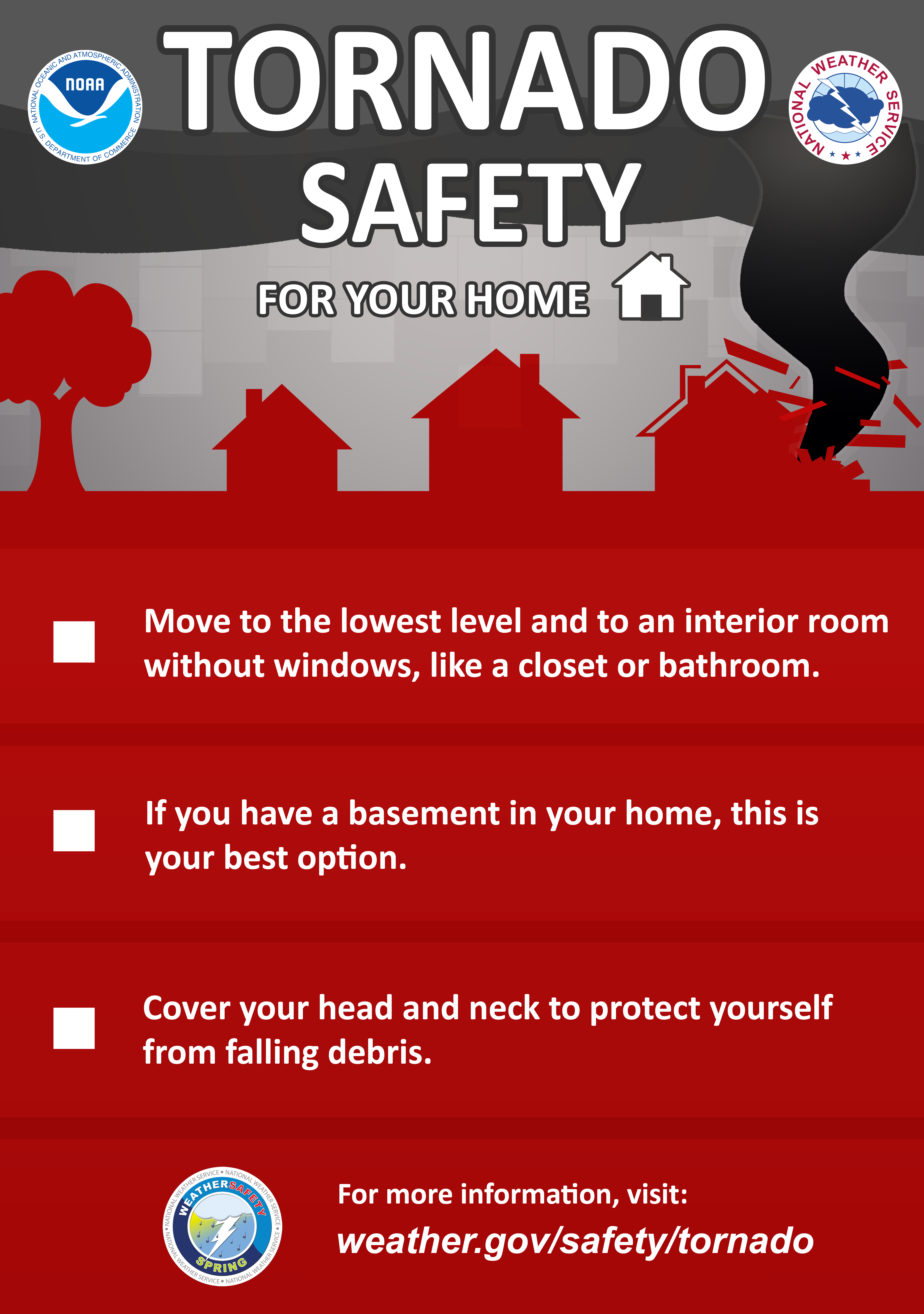

Severe Weather Preparedness In The Carolinas Understanding Alert Systems

May 31, 2025

Severe Weather Preparedness In The Carolinas Understanding Alert Systems

May 31, 2025 -

Who New Covid 19 Variant Fueling Case Increases Globally

May 31, 2025

Who New Covid 19 Variant Fueling Case Increases Globally

May 31, 2025