Travel Tech Giant Navan Targets US IPO: Exclusive Report On Investment Banking Strategy

Table of Contents

Navan's Market Position and Growth Trajectory

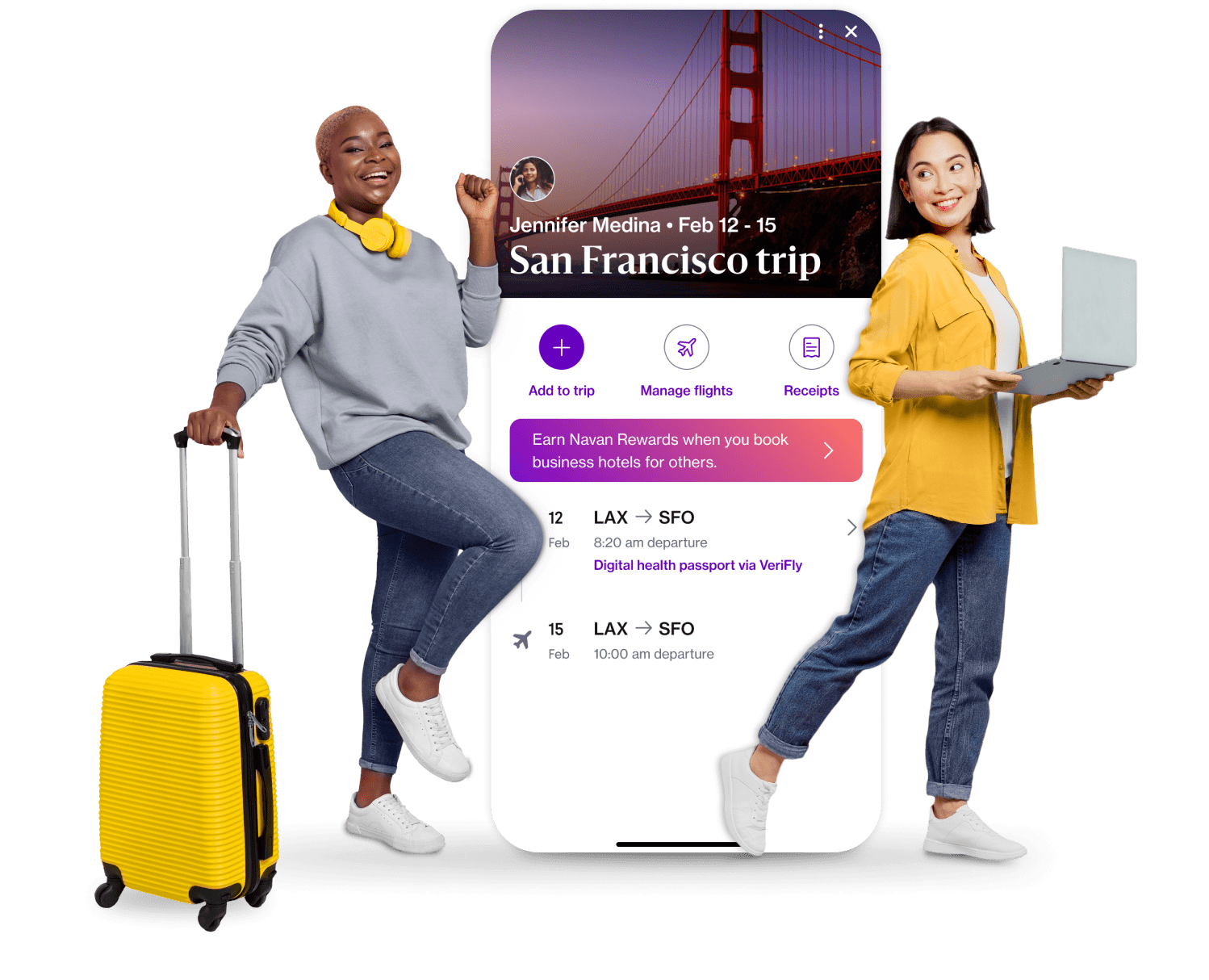

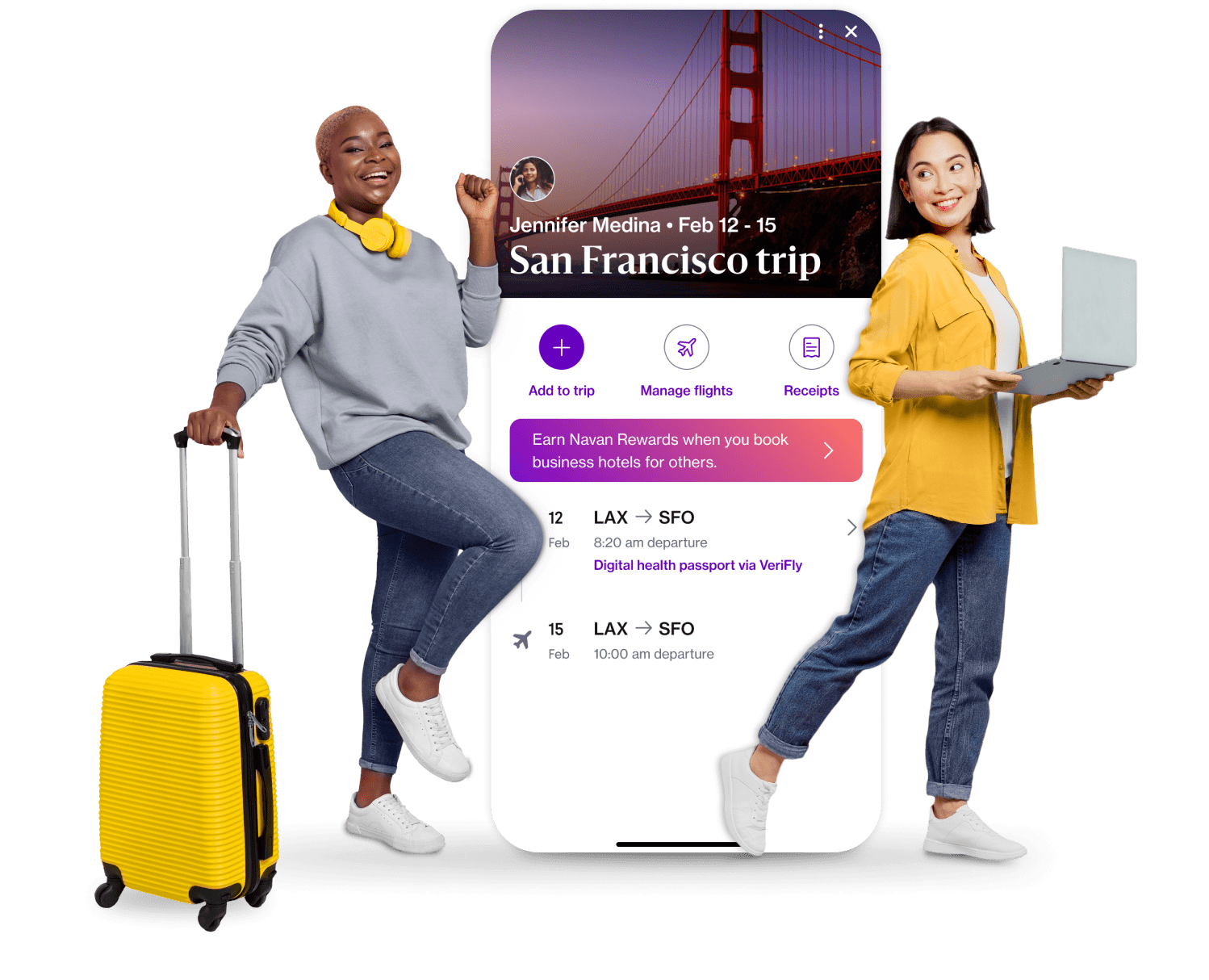

Navan's strong market position in the corporate travel management sector is a key driver of its IPO. The company has demonstrated impressive revenue growth and profitability, fueled by its innovative travel management software and a robust customer base. This success is built on several key competitive advantages:

-

Cutting-edge Technology: Navan's platform leverages advanced technology to streamline the corporate travel booking process, offering features such as AI-powered recommendations, real-time data analytics, and seamless integration with existing corporate systems. This superior technology provides a significant advantage over competitors.

-

Extensive Customer Base: Navan boasts a large and diverse portfolio of corporate clients, spanning various industries and sizes. This established client base provides a strong foundation for future growth and revenue generation. This broad reach underscores the value proposition to investors.

-

Data-Driven Decision Making: Navan leverages data analytics to optimize travel programs and provide clients with actionable insights, improving efficiency and cost savings. This value-added service enhances customer loyalty and attracts new clients.

Key Statistics: While specific figures may be confidential before the official IPO filing, publicly available information often reveals significant year-over-year revenue growth and a positive trajectory in market share within the corporate travel software segment. These statistics, once released, will be crucial in determining the Navan IPO valuation.

Selection of Investment Banks and Underwriters

The selection of investment banks is a critical aspect of any successful IPO. Navan's choice of financial advisors will significantly influence the IPO's outcome. The banks involved will play crucial roles in pricing the offering, managing the process, and attracting investors. The rationale behind choosing specific banks often involves several factors, including:

-

Expertise in Tech IPOs: Selecting banks with proven experience in guiding technology companies through the IPO process is essential. This expertise ensures a smoother and more efficient process.

-

Global Market Reach: The chosen banks should possess a wide network of investors to maximize market reach and ensure a successful IPO. This broad network increases the likelihood of attracting diverse and substantial investments.

-

Strong Reputation and Track Record: Working with reputable investment banks is crucial for building investor confidence and attracting the best possible valuation. A strong track record of successfully managing IPOs provides reassurance and trust.

Specific names of the investment banks involved will likely be disclosed in the official SEC filings, along with a detailed breakdown of their respective roles (lead underwriter, co-managers, etc.) within the Navan IPO process.

IPO Valuation and Pricing Strategy

Determining the Navan IPO valuation is a complex process that considers several factors:

-

Market Conditions: The overall state of the stock market, investor sentiment, and prevailing interest rates all play a crucial role in valuation.

-

Growth Prospects: Navan's projected future revenue growth and profitability are essential in estimating its long-term value.

-

Comparable Companies: Analyzing the valuations of similar companies in the travel technology sector provides a benchmark for Navan's pricing.

The pricing strategy employed will aim to attract investors while ensuring a fair valuation for Navan’s shareholders. The expected price range will likely be revealed closer to the IPO date, subject to market dynamics and investor demand. The final share price will be determined through the bookbuilding process, balancing supply and demand to optimize the Navan IPO’s success.

Regulatory Compliance and SEC Filings

Navigating the regulatory landscape is a critical element of the Navan IPO. Compliance with SEC regulations is paramount for a successful offering. This involves a meticulous process:

-

Preparing the Registration Statement (S-1): This document provides comprehensive information about Navan’s business, financials, and risks to potential investors. Accuracy and transparency are critical.

-

Responding to SEC Comments: The SEC reviews the S-1 and may request additional information or clarifications. Timely and effective responses are vital for a timely IPO process.

-

Due Diligence: Thorough due diligence is crucial to identify and address any potential regulatory hurdles or legal challenges. Addressing these proactively will ensure the success of the Navan IPO.

Meeting these regulatory requirements is essential for maintaining investor confidence and ensuring a successful Navan IPO. Any failure to comply could delay or even jeopardize the entire process.

Investor Relations and Marketing Strategy

A robust investor relations and marketing strategy is vital for attracting investors to the Navan IPO. This includes:

-

Pre-IPO Roadshows: Presentations to potential investors to showcase Navan’s business model, growth strategy, and investment opportunity.

-

Investor Presentations: Creating compelling presentations that effectively communicate Navan’s value proposition and highlight its competitive advantages.

-

Media Outreach: Engaging with financial media to build awareness and generate positive coverage of the Navan IPO.

Effective communication is key to building investor confidence and attracting significant investment for the Navan IPO. The success of this strategy will be crucial in achieving the desired results.

Conclusion

The Navan IPO represents a significant milestone for the company and the broader corporate travel technology industry. This analysis highlights the intricate investment banking strategy employed by Navan, encompassing market positioning, bank selection, valuation, regulatory compliance, and investor relations. The potential success of the Navan IPO hinges on several key factors, including favorable market conditions, effective execution of the offering, and continued growth momentum. Stay tuned for further updates on the Navan IPO and learn more about the evolving landscape of the corporate travel tech industry.

Featured Posts

-

Short Lived Coaching Partnership For Raducanu

May 14, 2025

Short Lived Coaching Partnership For Raducanu

May 14, 2025 -

Find Captain America Brave New World Your Guide To Pvod Streaming

May 14, 2025

Find Captain America Brave New World Your Guide To Pvod Streaming

May 14, 2025 -

Barry Bonds Takes A Shot At Shohei Ohtani Analyzing The Criticism

May 14, 2025

Barry Bonds Takes A Shot At Shohei Ohtani Analyzing The Criticism

May 14, 2025 -

El Sevilla Fc Confirma La Llegada De Joaquin Caparros Y La Salida De Garcia Pimienta

May 14, 2025

El Sevilla Fc Confirma La Llegada De Joaquin Caparros Y La Salida De Garcia Pimienta

May 14, 2025 -

Global Tech Ipo Slowdown The Tariff Uncertainty Factor

May 14, 2025

Global Tech Ipo Slowdown The Tariff Uncertainty Factor

May 14, 2025

Latest Posts

-

Wynonna And Ashley Judds Docuseries Uncovering Family Truths

May 14, 2025

Wynonna And Ashley Judds Docuseries Uncovering Family Truths

May 14, 2025 -

Wynonna And Ashley Judd Open Up About Family Life In New Docuseries

May 14, 2025

Wynonna And Ashley Judd Open Up About Family Life In New Docuseries

May 14, 2025 -

The Judd Sisters A Docuseries Exploring Family History And Heartache

May 14, 2025

The Judd Sisters A Docuseries Exploring Family History And Heartache

May 14, 2025 -

Judd Family Docuseries Wynonna And Ashley Reveal All

May 14, 2025

Judd Family Docuseries Wynonna And Ashley Reveal All

May 14, 2025 -

The Judd Sisters Wynonna And Ashley Share Their Familys Untold History In New Docuseries

May 14, 2025

The Judd Sisters Wynonna And Ashley Share Their Familys Untold History In New Docuseries

May 14, 2025