Trade War Intensifies: Another Downturn For Dutch Stocks

Table of Contents

Impact of Tariffs on Key Dutch Export Sectors

The Netherlands, a nation heavily reliant on international trade, is particularly vulnerable to the effects of escalating tariffs. Key export sectors, including agriculture and high-tech manufacturing, are feeling the pinch. The impact of trade restrictions and tariffs extends beyond simple price increases; it affects entire supply chains and long-term growth prospects.

-

Agriculture: The Dutch agricultural sector, renowned for its flower exports and dairy products, is facing significant challenges. Tariffs imposed by trading partners are directly impacting export volumes and profitability. For example, increased tariffs on Dutch flowers in certain markets have resulted in a noticeable decrease in export revenue for numerous flower farms. This has, in turn, negatively impacted the share prices of companies involved in this sector.

-

High-Tech Manufacturing: The Netherlands boasts a strong high-tech manufacturing sector, but the trade war is creating uncertainty and impacting export orders. Companies relying on global supply chains are facing disruptions and increased costs, leading to decreased profitability and reduced stock values. Specific examples of companies experiencing setbacks could be cited here (with appropriate sourcing), demonstrating the concrete effects on specific Dutch stocks.

-

Logistics: The Netherlands' crucial role in European logistics is also being affected. Trade disruptions and uncertainties are creating logistical bottlenecks and increasing transportation costs. These increased costs are passed on to businesses, further impacting their bottom line and influencing their stock performance.

-

Government Support: The Dutch government has announced some support measures aimed at mitigating the impact of tariffs on businesses. However, the effectiveness of these measures remains to be seen and their overall impact on the downturn in Dutch stocks is still uncertain. Further analysis of the government's response and its actual effect on affected companies is required to fully assess this aspect.

Weakening Euro and its Effect on Dutch Stock Performance

The weakening Euro adds another layer of complexity to the challenges facing Dutch stocks. As the Euro depreciates against other major currencies, the value of Dutch stocks denominated in Euros decreases for international investors. This makes Dutch companies less attractive to foreign investors, reducing demand and impacting stock prices.

-

Foreign Investment: The decline in the Euro's value makes investing in Dutch companies less appealing to those using other currencies. This reduction in foreign investment further puts downward pressure on Dutch stock prices.

-

International Operations: Dutch companies with significant international operations are particularly vulnerable to currency fluctuations. The weakening Euro can impact their profitability when converting foreign earnings back into Euros. This added pressure is reflected in the stock market valuations of these companies.

-

Hedging Strategies: Investors can utilize hedging strategies to mitigate currency risks. These strategies involve using financial instruments to offset potential losses from currency fluctuations. Further details on available hedging techniques could be provided here to help readers protect their investments.

Investor Sentiment and Market Volatility

The uncertainty surrounding the trade war has significantly dampened investor confidence, leading to increased volatility in the Dutch stock market. Investors are adopting a more cautious approach, leading to a flight to safety and capital outflow from the Dutch stock market.

-

Decline in Confidence: The ongoing trade war creates a climate of uncertainty, making investors hesitant to commit to long-term investments in Dutch stocks. This decrease in investor confidence is directly reflected in the market's performance.

-

Increased Volatility: The Dutch stock market is experiencing heightened volatility, with sharp price swings reflecting the unpredictable nature of the trade war's impact. This volatility makes it challenging for investors to make informed decisions.

-

Capital Outflow: As investors seek safer investment options, capital is flowing out of the Dutch stock market, further exacerbating the downturn. This capital flight is a clear indicator of the negative impact of the trade war on investor sentiment.

-

Market Predictions: While predicting the future of the Dutch stock market is inherently challenging, analysts' forecasts often reflect the prevailing concerns about the trade war's ongoing impact. Mentioning these predictions (with appropriate sourcing) will provide readers with a broader perspective.

Opportunities Amidst the Downturn

While the current situation presents significant challenges, it also creates opportunities for shrewd investors. The downturn may present opportunities for value investing, allowing investors to acquire undervalued stocks with strong long-term potential.

-

Value Investing: The current market volatility might create situations where fundamentally strong companies are temporarily undervalued. Value investors can capitalize on these opportunities to acquire stocks at discounted prices.

-

Less Susceptible Sectors: Some sectors of the Dutch economy may be less susceptible to the direct impacts of the trade war. Identifying these sectors can provide opportunities for strategic investment.

-

Long-Term Investment: A long-term investment strategy is crucial during times of market uncertainty. Investors with a long-term horizon can ride out short-term volatility and benefit from potential future growth.

Conclusion

The intensifying global trade war presents significant challenges for the Dutch stock market. Tariffs, currency fluctuations, and decreased investor confidence are creating a volatile and uncertain environment for Dutch stocks. However, by understanding these challenges and employing informed investment strategies, investors can navigate this period. Stay informed about the evolving global trade situation and its impact on Dutch stocks. Conduct thorough research before making investment decisions and consider consulting a financial advisor to create a robust investment strategy for mitigating risks related to the ongoing trade war and the potential for further downturns in Dutch stocks.

Featured Posts

-

Assessing The Success Of Le Pens National Rally Demonstration In France

May 24, 2025

Assessing The Success Of Le Pens National Rally Demonstration In France

May 24, 2025 -

16 Nisan 2025 Avrupa Piyasa Raporu Stoxx Europe 600 Ve Dax 40 Taki Gerileme

May 24, 2025

16 Nisan 2025 Avrupa Piyasa Raporu Stoxx Europe 600 Ve Dax 40 Taki Gerileme

May 24, 2025 -

Nanari Upplysingar Um Nyja Porsche Macan Ev

May 24, 2025

Nanari Upplysingar Um Nyja Porsche Macan Ev

May 24, 2025 -

Planning Your Country Escape Tips For A Smooth Transition

May 24, 2025

Planning Your Country Escape Tips For A Smooth Transition

May 24, 2025 -

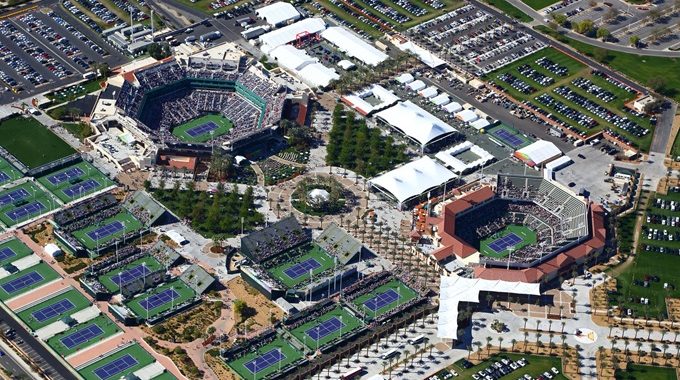

Draper Claims Maiden Atp Masters 1000 Crown In Indian Wells

May 24, 2025

Draper Claims Maiden Atp Masters 1000 Crown In Indian Wells

May 24, 2025

Latest Posts

-

A Controversial Plan Analyzing Newark Airports Air Traffic Control Failures

May 24, 2025

A Controversial Plan Analyzing Newark Airports Air Traffic Control Failures

May 24, 2025 -

Reduced Budgets Reduced Accessibility The State Of Gaming

May 24, 2025

Reduced Budgets Reduced Accessibility The State Of Gaming

May 24, 2025 -

How Safe Is Flying Visualizing Airplane Accidents And Near Misses

May 24, 2025

How Safe Is Flying Visualizing Airplane Accidents And Near Misses

May 24, 2025 -

Trump Memecoin Dinner Who Attended And Why

May 24, 2025

Trump Memecoin Dinner Who Attended And Why

May 24, 2025 -

The Legal Status Of Character Ai Chatbot Conversations

May 24, 2025

The Legal Status Of Character Ai Chatbot Conversations

May 24, 2025