Trade War Impact: Canadian Aluminum Trader Declares Bankruptcy

Table of Contents

The Bankruptcy Filing – A Detailed Look

The bankruptcy of [Company Name – replace with actual company name if publicly available], a significant player in the Canadian aluminum trade, sent shockwaves through the industry. While the exact details surrounding the filing are still emerging, initial reports paint a grim picture. [Company Name], known for its [brief description of company's activities and history], filed for bankruptcy protection on [Date of filing]. This follows a period of sustained financial difficulty attributed largely to the unpredictable landscape created by ongoing trade disputes and escalating tariffs.

- Date of filing: [Insert Date]

- Estimated debt: [Insert estimated debt amount – if available, include source]

- Number of employees affected: [Insert number of employees affected – if available, include source]

- Reasons cited in bankruptcy filings: Decreased demand due to tariffs imposed by [mention countries imposing tariffs], increased input costs due to import tariffs on raw materials, and intensified competition from subsidized aluminum producers in other countries were all cited as contributing factors in the bankruptcy filings.

- Potential impact on suppliers and clients: The bankruptcy is expected to create significant disruptions within the supply chain, impacting both suppliers and clients who relied on [Company Name] for aluminum procurement and distribution. This could lead to delays, price increases, and potential shortages in the market.

The Role of Trade Wars in the Bankruptcy

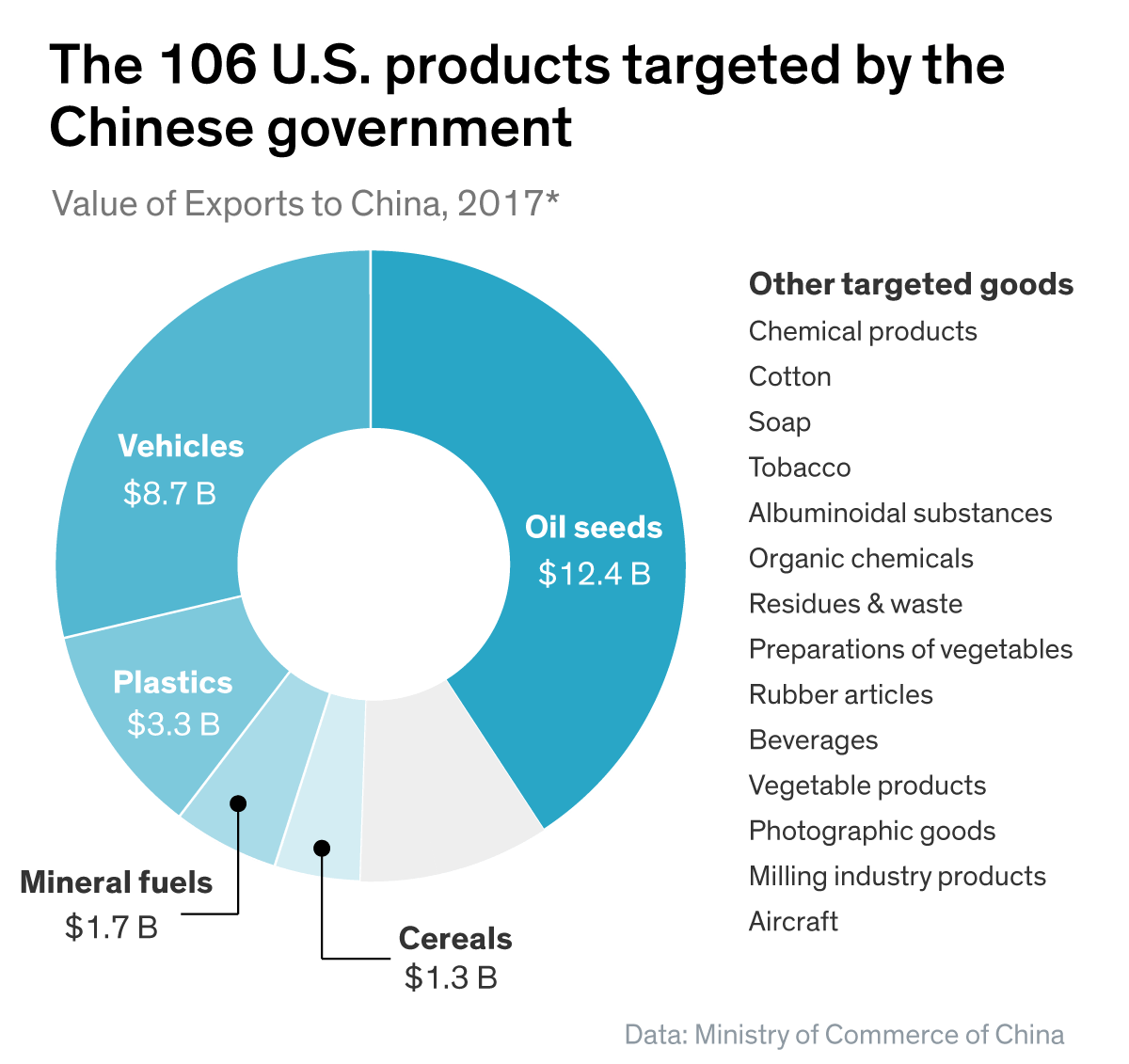

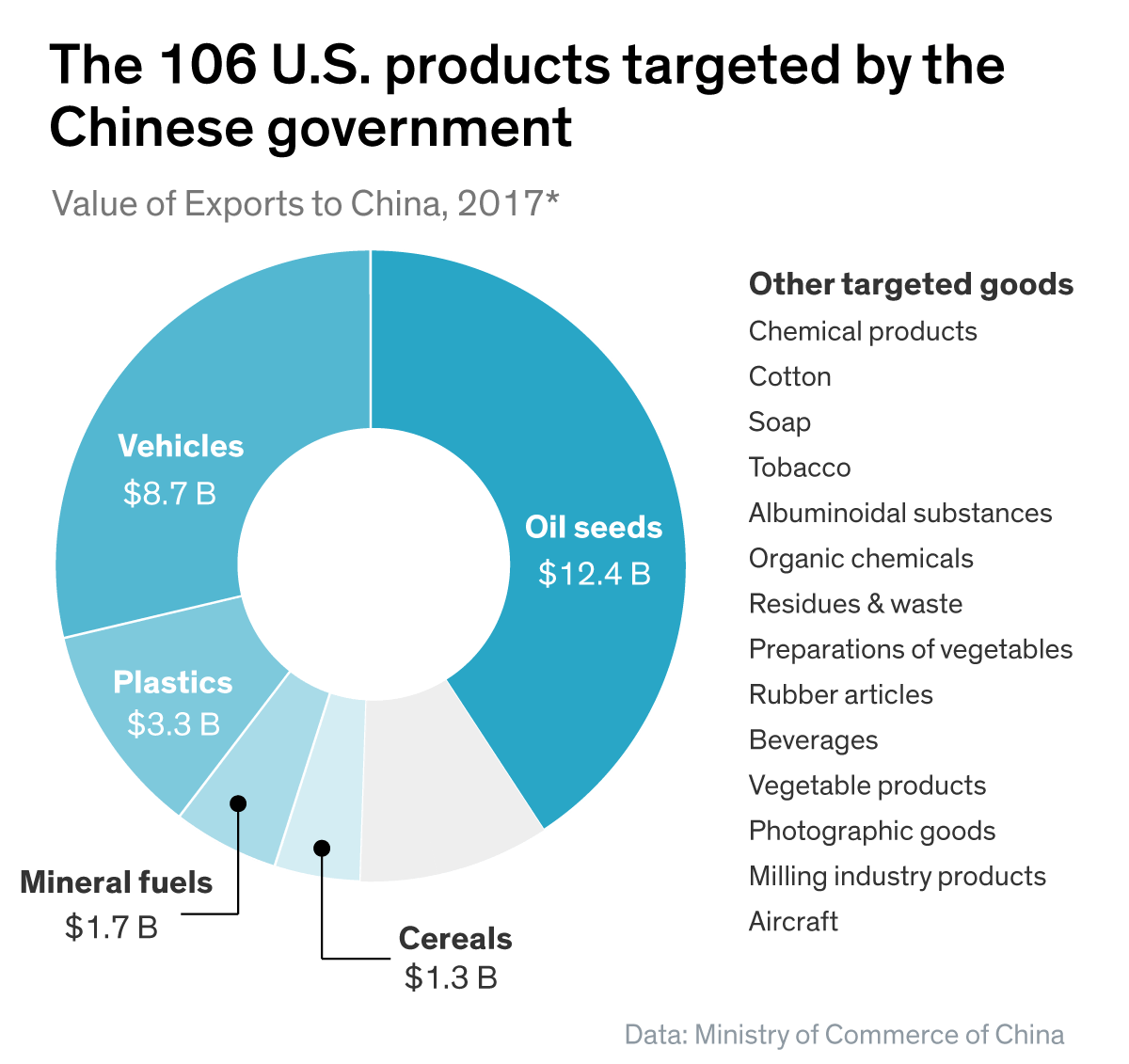

The ongoing trade wars, particularly those involving the aluminum industry, played a pivotal role in [Company Name]'s demise. Increased tariffs on aluminum imports and exports significantly impacted the company's profitability and long-term sustainability. The imposition of tariffs by [mention specific countries and their tariffs] dramatically increased the cost of aluminum imports for Canadian companies, squeezing profit margins. Simultaneously, retaliatory tariffs imposed on Canadian aluminum exports to [mention countries] reduced demand and further exacerbated the company's financial difficulties.

- Specific tariffs impacting the company's operations: [Insert details on specific tariffs – ideally with links to official government documentation] For instance, the [mention specific tariff, e.g., 25% tariff on Canadian aluminum imports to the US] severely reduced competitiveness.

- Analysis of the impact of tariffs on pricing and demand: The increased tariffs resulted in higher prices for aluminum, impacting demand both domestically and internationally. This reduced sales volume and ultimately contributed to the company’s financial instability.

- Competition from other countries/regions: [Company Name] also faced stiff competition from aluminum producers in countries with lower production costs and government subsidies, further weakening its market position.

- Impact of retaliatory tariffs: Retaliatory tariffs imposed by other countries significantly reduced export opportunities for Canadian aluminum producers, further limiting revenue streams for [Company Name] and other Canadian aluminum businesses.

Wider Implications for the Canadian Aluminum Industry

The bankruptcy of [Company Name] is not an isolated incident. It serves as a stark warning of the potential ripple effect on the broader Canadian aluminum industry. The failure of a significant player like [Company Name] could trigger a domino effect, potentially leading to further bankruptcies and widespread job losses within the sector.

- Potential for further bankruptcies within the industry: The current economic climate, characterized by trade uncertainty and volatile aluminum prices, increases the risk of further bankruptcies within the Canadian aluminum industry. Smaller companies, particularly those lacking the financial reserves of [Company Name], are particularly vulnerable.

- Impact on employment in related sectors: The bankruptcy will likely lead to significant job losses, not only within [Company Name] itself but also in related industries such as transportation, logistics, and manufacturing.

- Government response and potential support measures: The Canadian government may need to implement support measures, such as financial aid or trade diversification programs, to mitigate the negative impact on the Canadian aluminum industry and prevent further economic damage.

- Long-term implications for Canada’s trade relationships: This bankruptcy highlights the importance of stable and predictable trade relationships for the Canadian economy. The long-term impact on Canada's trade relationships, particularly with major aluminum importing countries, will require careful consideration and strategic adjustments.

Global Aluminum Market Impacts

The bankruptcy of a major Canadian aluminum trader will undoubtedly have significant ramifications for the global aluminum market. The reduced supply of aluminum from Canada could lead to price increases and supply chain disruptions worldwide. This event will also likely influence the strategic decisions of other aluminum producers and buyers globally.

- Potential price changes in the aluminum market: The decreased supply from Canada could lead to higher aluminum prices globally, affecting various industries that rely on aluminum as a raw material.

- Impact on global supply chains: The bankruptcy will disrupt established supply chains, forcing companies to seek alternative suppliers and potentially leading to delays and increased costs.

- Reactions from other countries or international organizations: The bankruptcy could trigger reactions from other countries or international organizations, potentially leading to renewed discussions on trade policies and the need for greater stability in the global aluminum market.

Conclusion

The bankruptcy of this Canadian aluminum trader serves as a cautionary tale of the real-world consequences of trade wars. The company's downfall highlights the vulnerability of businesses operating in a volatile global market, especially those heavily reliant on international trade. The wider implications for the Canadian aluminum industry and global aluminum markets are significant and deserve close monitoring.

Call to Action: Understanding the impact of trade wars on industries like aluminum is critical. Stay informed about the latest developments in global trade and the potential risks and opportunities within the Canadian aluminum market. Learn more about the effects of trade wars and how they impact businesses by [link to relevant resource/further reading]. Continue to follow updates on the evolving situation surrounding Canadian aluminum and the ongoing effects of trade disputes.

Featured Posts

-

The Rising Stars Latin Women Dominating Music In 2025

May 29, 2025

The Rising Stars Latin Women Dominating Music In 2025

May 29, 2025 -

Characters Who Might Not Return In Stranger Things Season 5

May 29, 2025

Characters Who Might Not Return In Stranger Things Season 5

May 29, 2025 -

Joshlin Smith Trial Why Charges Were Dropped

May 29, 2025

Joshlin Smith Trial Why Charges Were Dropped

May 29, 2025 -

Draga Ritkasagok A Vateran Szazezreket Ero Aukcios Leuetesek

May 29, 2025

Draga Ritkasagok A Vateran Szazezreket Ero Aukcios Leuetesek

May 29, 2025 -

Live Nation Entertainment Lyv Investor Sentiment And Stock Outlook

May 29, 2025

Live Nation Entertainment Lyv Investor Sentiment And Stock Outlook

May 29, 2025