Trade War Fears Fuel Gold Price Surge: Is Bullion A Safe Investment?

Table of Contents

Understanding the Impact of Trade Wars on Gold Prices

Global Uncertainty and Safe-Haven Assets

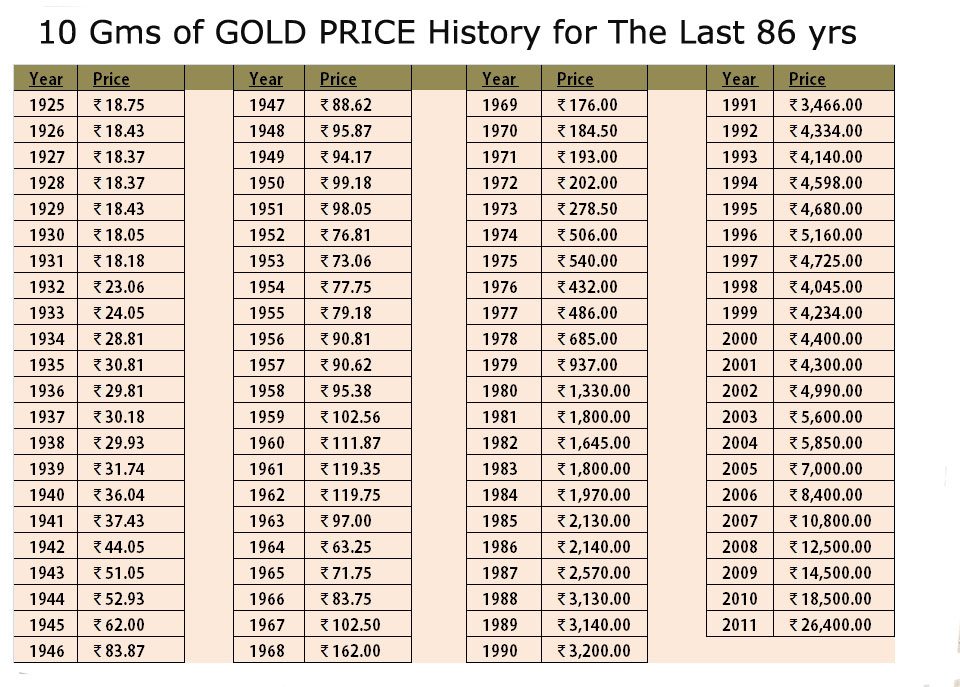

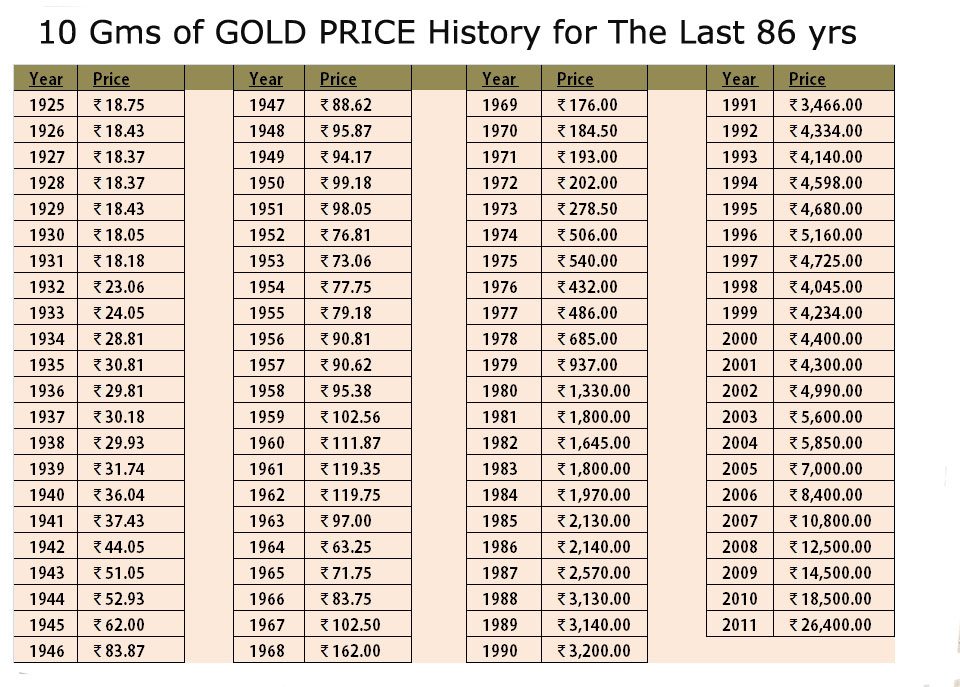

Trade wars inject considerable uncertainty into the global economy. This uncertainty stems from unpredictable tariffs, retaliatory measures, and disruptions to established supply chains. Investors, seeking to protect their capital, naturally gravitate towards safe-haven assets. Gold, with its long history as a store of value, consistently fits this category. Historically, periods of geopolitical instability and economic crisis have witnessed sharp increases in gold prices. For instance, the gold price surged during the 2008 financial crisis and has shown similar strength during other periods of global turmoil. Safe-haven assets are typically characterized by their low correlation to other asset classes and their ability to retain or increase in value even during market downturns. Gold perfectly embodies these characteristics.

- Recent Trade Disputes Impacting Markets: The US-China trade war, trade tensions between the US and Europe, and Brexit all contributed to increased market volatility and subsequently, higher gold prices.

- Definition of Safe-Haven Assets: These are assets that maintain or increase in value during times of economic or political instability, providing a safe place for investors to park their money.

Inflationary Pressures and Gold's Role

Trade wars often exert upward pressure on inflation. Tariffs increase the cost of imported goods, leading to higher consumer prices. This inflationary environment makes gold an attractive hedge. Gold's value tends to rise alongside inflation because it retains its purchasing power even when the value of fiat currencies erodes. Historically, there's a strong correlation between periods of high inflation and significant gold price increases.

- Relationship between Inflation and Gold Prices: When inflation rises, the purchasing power of a currency falls. Gold, being a tangible asset, maintains its intrinsic value, thus becoming more attractive to investors.

- Key Factors Contributing to Inflation During Trade Wars: Tariffs, supply chain disruptions, and increased uncertainty all contribute to higher prices for goods and services.

Currency Fluctuations and Gold as a Hedge

Trade wars frequently lead to currency fluctuations. As trade tensions rise, investors may lose confidence in a particular currency, leading to devaluation. Gold, unlike fiat currencies, is not tied to a specific government or economy. It acts as a global store of value, holding its value relatively irrespective of currency movements. A weakening currency often makes gold more attractive to international investors, driving up its price.

- How Currency Devaluation Affects Gold Prices: If the US dollar weakens against other currencies, the price of gold denominated in those currencies will increase.

- Examples of Currency Fluctuations During Past Trade Disputes: Many past trade disputes have witnessed significant fluctuations in major currencies like the dollar, euro, and yen, all impacting gold's price in different markets.

Is Gold Bullion a Safe Investment Strategy?

Advantages of Investing in Gold Bullion

Investing in gold bullion during times of trade war uncertainty offers several compelling advantages:

-

Tangible Asset: Unlike many other investments, gold bullion is a physical asset you can hold.

-

Diversification Benefits: Gold provides diversification in a portfolio, reducing overall risk.

-

Hedge Against Inflation: It helps protect your purchasing power during inflationary periods.

-

Portfolio Stability: Gold can act as a ballast in your investment portfolio, providing stability during market volatility.

-

Potential for Capital Appreciation: Gold prices can rise significantly during periods of uncertainty.

-

Pros and Cons of Physical Gold vs. Gold ETFs: Physical gold offers tangible ownership but requires secure storage; Gold ETFs offer liquidity and ease of trading but involve counterparty risk.

Risks Associated with Gold Bullion Investment

While offering significant advantages, investing in gold bullion also presents certain risks:

-

Price Volatility: Gold prices can fluctuate significantly in the short term.

-

Lack of Yield: Gold bullion itself doesn't generate income like dividend-paying stocks.

-

Storage Costs: Storing physical gold securely can incur costs.

-

Security Concerns: Securing physical gold against theft is crucial.

-

Factors to Consider Before Investing in Gold Bullion: Your risk tolerance, investment horizon, and overall financial goals.

Diversification and Asset Allocation

Diversification is paramount in any investment strategy, and incorporating gold into a well-diversified portfolio can be a prudent move during times of economic uncertainty. The optimal allocation of gold will vary depending on individual risk tolerance and investment goals, but including a percentage of gold (generally 5-10%) can help reduce portfolio volatility. Other asset classes like real estate, bonds, and stocks should also be considered to create a truly balanced portfolio.

- Guidelines for Diversifying Investments During Times of Economic Uncertainty: Consult a financial advisor to determine the appropriate asset allocation that aligns with your risk profile.

Conclusion: Navigating the Gold Price Surge and Trade War Uncertainty

Trade wars significantly increase global economic uncertainty, pushing investors towards safe-haven assets like gold. Gold serves as an effective hedge against inflation and currency fluctuations, making it an attractive investment option during turbulent times. However, potential investors must carefully weigh the benefits and risks associated with gold bullion investment and integrate it appropriately within a diversified portfolio. The current gold price surge is largely fueled by these trade war fears, underscoring the importance of considering gold as part of a comprehensive investment strategy. To effectively navigate these challenging economic conditions, research thoroughly, consult with a qualified financial advisor, and make informed decisions about incorporating gold bullion into your investment strategy to mitigate trade war risks and effectively manage your investment portfolio during a period of heightened uncertainty. Consider exploring options like investing in gold during a trade war or developing a robust gold bullion investment strategy.

Featured Posts

-

Analyzing Shedeur Sanders Draft Potential An Espn Analysts Perspective

Apr 26, 2025

Analyzing Shedeur Sanders Draft Potential An Espn Analysts Perspective

Apr 26, 2025 -

Trumps Stance On Ukraines Nato Membership A Comprehensive Analysis

Apr 26, 2025

Trumps Stance On Ukraines Nato Membership A Comprehensive Analysis

Apr 26, 2025 -

Wwii Sunken Warship Yields Unexpected Discovery A Car Found Intact

Apr 26, 2025

Wwii Sunken Warship Yields Unexpected Discovery A Car Found Intact

Apr 26, 2025 -

Relax And Unwind A Chat With Karli Kane Hendrickson

Apr 26, 2025

Relax And Unwind A Chat With Karli Kane Hendrickson

Apr 26, 2025 -

Browns Insider Addresses Deion And Shedeur Sanders Concerns

Apr 26, 2025

Browns Insider Addresses Deion And Shedeur Sanders Concerns

Apr 26, 2025

Latest Posts

-

Nbc Chicago Hhs Taps Anti Vaccine Activist To Investigate Autism Vaccine Claims

Apr 27, 2025

Nbc Chicago Hhs Taps Anti Vaccine Activist To Investigate Autism Vaccine Claims

Apr 27, 2025 -

Hhs Appoints Anti Vaccine Activist To Review Autism Vaccine Link Sources

Apr 27, 2025

Hhs Appoints Anti Vaccine Activist To Review Autism Vaccine Link Sources

Apr 27, 2025 -

Nbc Los Angeles Hhs Taps Anti Vaccine Activist To Investigate Discredited Autism Vaccine Link

Apr 27, 2025

Nbc Los Angeles Hhs Taps Anti Vaccine Activist To Investigate Discredited Autism Vaccine Link

Apr 27, 2025 -

Nbc 5 Dallas Fort Worth Reports Hhs Selects Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025

Nbc 5 Dallas Fort Worth Reports Hhs Selects Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025 -

Anti Vaccine Activists Role In Hhs Review Of Autism Vaccine Claims Sparks Outrage

Apr 27, 2025

Anti Vaccine Activists Role In Hhs Review Of Autism Vaccine Claims Sparks Outrage

Apr 27, 2025