Tracking The Net Asset Value Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

How to Find the Amundi Dow Jones Industrial Average UCITS ETF NAV

Knowing where to find the Amundi Dow Jones Industrial Average UCITS ETF NAV is the first step to effective tracking. Several reliable sources provide this crucial information, updated regularly.

-

Official ETF Provider Website: The most accurate and authoritative source is usually the official website of Amundi, the ETF provider. Look for sections dedicated to investor resources or ETF details. They will typically display the daily NAV along with other key performance indicators.

-

Financial News Websites: Reputable financial news sources like Bloomberg and Yahoo Finance provide real-time or end-of-day NAV data for many ETFs, including the Amundi Dow Jones Industrial Average UCITS ETF. Simply search for the ETF's ticker symbol (usually found on your brokerage statement) to find its current NAV.

-

Brokerage Platforms: Most online brokerage platforms display the NAV of your holdings directly within your account dashboard. This is a convenient way to track the NAV of the Amundi Dow Jones Industrial Average UCITS ETF alongside your other investments.

Where to Find the Data:

- Official Amundi Website: [Insert Amundi Website Link Here - replace with actual link]

- Bloomberg Terminal: (Subscription required)

- Yahoo Finance: [Insert Yahoo Finance Search Link Example - replace with an example search link, e.g., https://finance.yahoo.com/quote/XXXX.XX ] (replace XXXX.XX with the correct ticker symbol)

- Your Brokerage Account: (Check your specific platform's help section for instructions)

NAV updates typically occur daily, usually at the close of the market. However, always check the specific timing on your chosen data source.

Factors Affecting the Amundi Dow Jones Industrial Average UCITS ETF NAV

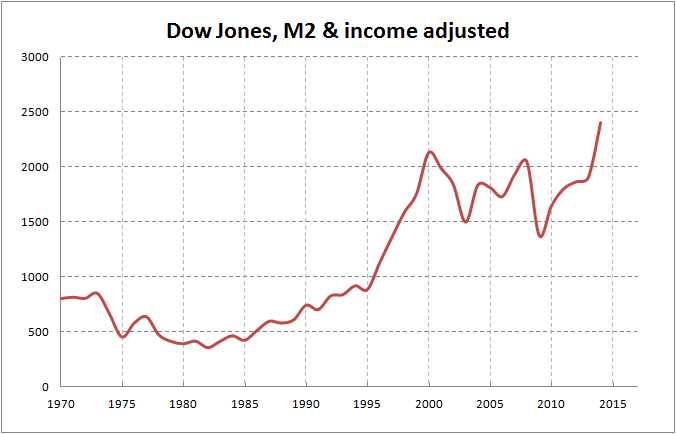

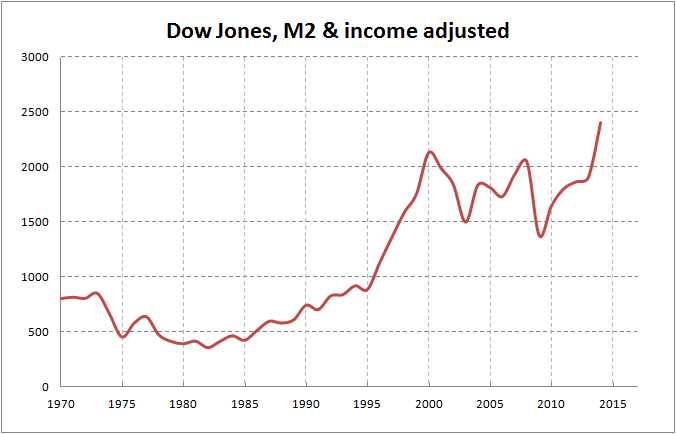

The Amundi Dow Jones Industrial Average UCITS ETF's NAV is primarily driven by the performance of its underlying index: the Dow Jones Industrial Average (DJIA). Understanding the factors that influence the DJIA is key to interpreting NAV changes.

-

Dow Jones Industrial Average Performance: The DJIA's daily movements directly impact the ETF's NAV. Positive movements in the DJIA generally lead to a higher NAV, and vice versa. Significant market events, economic news, and individual company performance all contribute to the DJIA's fluctuations.

-

Currency Exchange Rates (if applicable): Since this is a UCITS ETF, currency fluctuations between the Euro (or other currency the ETF is denominated in) and the US dollar could influence the NAV, particularly for investors holding the ETF in a different currency.

-

Management Fees & Expenses: The ETF's management fees and operating expenses are deducted from the assets under management, impacting the NAV, albeit usually slightly.

-

Dividend Distributions: When the underlying companies in the DJIA pay dividends, the ETF will distribute a portion of those dividends to its shareholders. This distribution will result in a slight decrease in the NAV on the ex-dividend date.

Interpreting the Amundi Dow Jones Industrial Average UCITS ETF NAV Data

Using NAV data effectively requires understanding how to interpret and utilize the information.

-

Performance Tracking (comparing NAV over time): By tracking the NAV over time, you can assess the ETF's historical performance. This allows you to evaluate the investment's growth or decline.

-

NAV vs. Market Price Comparison: The ETF's market price can sometimes differ slightly from its NAV. This difference might present arbitrage opportunities for sophisticated investors, but it's usually very small and temporary for well-traded ETFs like this one.

-

Understanding Total Returns: To get a complete picture, consider the total return, which includes capital appreciation (changes in NAV) and dividend distributions.

-

Considering Other Key Performance Indicators (KPIs): While NAV is crucial, don't rely solely on it. Consider other KPIs like expense ratio, turnover rate, and tracking error (how closely the ETF follows its benchmark index) for a comprehensive evaluation.

Utilizing NAV for Investment Decisions with the Amundi Dow Jones Industrial Average UCITS ETF

Monitoring the Amundi Dow Jones Industrial Average UCITS ETF's NAV can support, but not dictate, your investment decisions.

-

Informative Buy/Sell Signals (within a broader investment strategy): Significant changes in the NAV, within the context of your overall investment goals and market analysis, may suggest buying or selling opportunities. However, this should be part of a larger strategy and not the sole decision-making factor.

-

Risk Management and Investment Goals: Your risk tolerance and investment time horizon should strongly influence your trading decisions. A long-term investor might be less concerned about short-term NAV fluctuations than a short-term trader.

-

Diversification Considerations: The Amundi Dow Jones Industrial Average UCITS ETF should be part of a diversified portfolio, reducing reliance on any single investment's performance.

-

Long-Term vs. Short-Term Investing: The NAV's relevance varies depending on your investment strategy. Long-term investors may focus less on daily NAV changes and more on long-term growth.

Conclusion: Mastering Amundi Dow Jones Industrial Average UCITS ETF NAV Tracking

Tracking the Net Asset Value of the Amundi Dow Jones Industrial Average UCITS ETF is vital for informed investment decisions. By understanding how to find, interpret, and utilize NAV data alongside other performance metrics and your investment goals, you can make more strategic choices. Remember that NAV is just one piece of the puzzle; consider a holistic approach incorporating market analysis and risk assessment. Start tracking your Amundi Dow Jones Industrial Average UCITS ETF NAV today and make informed investment decisions! For further resources on ETF investing and NAV analysis, consider exploring reputable financial education websites and consulting with a qualified financial advisor.

Featured Posts

-

Mamma Mia The Hottest New Ferrari Hot Wheels Cars

May 25, 2025

Mamma Mia The Hottest New Ferrari Hot Wheels Cars

May 25, 2025 -

Herstel Op Beurzen Aex Fondsen Klimmen Na Trump Uitstel

May 25, 2025

Herstel Op Beurzen Aex Fondsen Klimmen Na Trump Uitstel

May 25, 2025 -

Daxs Rise A Wall Street Recovery Could Change Everything

May 25, 2025

Daxs Rise A Wall Street Recovery Could Change Everything

May 25, 2025 -

Relx Trotseert Economische Tegenwind Dankzij Ai Sterke Groei Voorspeld Tot 2025

May 25, 2025

Relx Trotseert Economische Tegenwind Dankzij Ai Sterke Groei Voorspeld Tot 2025

May 25, 2025 -

West Hams Pursuit Of Kyle Walker Peters Latest Transfer News

May 25, 2025

West Hams Pursuit Of Kyle Walker Peters Latest Transfer News

May 25, 2025

Latest Posts

-

Brest Urban Trail Les Visages De L Evenement

May 25, 2025

Brest Urban Trail Les Visages De L Evenement

May 25, 2025 -

Camunda Con 2025 Amsterdam Ai Automation And Orchestration A Winning Combination

May 25, 2025

Camunda Con 2025 Amsterdam Ai Automation And Orchestration A Winning Combination

May 25, 2025 -

Amsterdam 2025 How Orchestration At Camunda Con Will Boost Your Ai Automation Investments

May 25, 2025

Amsterdam 2025 How Orchestration At Camunda Con Will Boost Your Ai Automation Investments

May 25, 2025 -

Camunda Con 2025 Unlocking The Power Of Orchestration With Ai And Automation In Amsterdam

May 25, 2025

Camunda Con 2025 Unlocking The Power Of Orchestration With Ai And Automation In Amsterdam

May 25, 2025 -

Camunda Con 2025 Amsterdam Orchestration For Maximizing Ai And Automation Roi

May 25, 2025

Camunda Con 2025 Amsterdam Orchestration For Maximizing Ai And Automation Roi

May 25, 2025