Tracking The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist

Table of Contents

Understanding the Amundi MSCI World II UCITS ETF USD Hedged Dist

The Amundi MSCI World II UCITS ETF USD Hedged Dist is an Exchange-Traded Fund that aims to track the performance of the MSCI World Index, a broad market capitalization-weighted index representing large and mid-cap equities from developed markets worldwide. This provides investors with significant global diversification.

- Investment Strategy: The ETF seeks to replicate the MSCI World Index, offering exposure to a wide range of international companies across various sectors.

- MSCI World Index: This benchmark index is widely considered a reliable representation of global equity markets.

- USD Hedged: The "USD Hedged" designation means the ETF employs strategies to mitigate the risk associated with fluctuations between the investor's base currency and the US dollar, in which many of the underlying assets are denominated. This reduces currency risk, providing more stability for investors whose primary currency isn't the USD.

- Key Features & Benefits: Global diversification, currency hedging, low expense ratio, and ease of trading are key benefits.

- Typical Investor Profile: This ETF is suitable for investors seeking broad global market exposure with reduced currency risk, such as long-term investors, retirement savers, and those looking for diversified international equity holdings.

Where to Find the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Accessing reliable and up-to-date NAV data for the Amundi MSCI World II UCITS ETF USD Hedged Dist is straightforward. Several sources provide this crucial information:

- Official Amundi Website: The official Amundi website is a primary source for accurate and timely NAV data. Look for dedicated ETF information sections.

- Major Financial Data Providers: Bloomberg Terminal, Refinitiv Eikon, and other professional financial data platforms offer real-time and historical NAV data.

- Your Brokerage Account Platform: Most brokerage platforms display the current NAV of your held ETFs, often alongside the market price.

- Financial News Websites and ETF Tracking Websites: Many reputable financial news sources and dedicated ETF tracking websites publish NAV data, often with a slight delay.

Data Availability and Potential Delays: While real-time NAV data is available from professional data providers, slight delays might occur on other platforms. Always check the last updated timestamp to ensure you're using the most current information.

Factors Affecting the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Several factors influence the daily NAV fluctuations of the Amundi MSCI World II UCITS ETF USD Hedged Dist:

- MSCI World Index Performance: The primary driver of NAV changes is the performance of the underlying MSCI World Index. Positive market movements generally lead to NAV increases, while negative movements result in decreases.

- Currency Fluctuations: Even with the USD hedging strategy, residual currency risk can still impact the NAV, especially due to movements in the currencies of the underlying assets relative to the USD.

- Expense Ratio and Management Fees: The ETF's expense ratio and management fees gradually reduce the NAV over time. These are deducted from the fund's assets.

- Other Factors: Corporate actions like dividends from underlying companies, stock splits, and mergers and acquisitions can also influence the NAV.

Interpreting and Utilizing NAV Data for Investment Decisions

Understanding how to interpret NAV data is key to making informed investment decisions:

- Monitoring Performance: Tracking the NAV over time allows you to assess the ETF's performance against its benchmark and your investment goals.

- NAV vs. Market Price: Compare the NAV to the ETF's market price. Significant discrepancies might indicate arbitrage opportunities or market inefficiencies.

- Buy/Sell Signals: While not the sole determinant, NAV changes in conjunction with market analysis can inform buy and sell decisions. Consider your investment strategy and risk tolerance.

- Market Context: Always consider the broader economic and market context before making decisions based solely on NAV fluctuations.

Conclusion: Mastering NAV Tracking for the Amundi MSCI World II UCITS ETF USD Hedged Dist

Effectively tracking the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist involves utilizing multiple reliable sources, understanding the factors influencing NAV changes, and integrating this data into a broader investment strategy. Regularly checking the NAV of your Amundi MSCI World II UCITS ETF USD Hedged Dist holdings, combined with thorough market analysis, is crucial for successful investing. Remember to use the information provided in this article to make sound investment choices and proactively manage your portfolio. Start monitoring your Amundi MSCI World II UCITS ETF USD Hedged Dist NAV today!

Featured Posts

-

Apakah Mtel Dan Mbma Layak Dibeli Setelah Masuk Msci Small Cap

May 24, 2025

Apakah Mtel Dan Mbma Layak Dibeli Setelah Masuk Msci Small Cap

May 24, 2025 -

April 18 2025 Nyt Mini Crossword Complete Answers And Hints

May 24, 2025

April 18 2025 Nyt Mini Crossword Complete Answers And Hints

May 24, 2025 -

Bailed Teen Rearrested Shop Owners Fatal Stabbing

May 24, 2025

Bailed Teen Rearrested Shop Owners Fatal Stabbing

May 24, 2025 -

Escape To The Country Tips For A Smooth Transition To Rural Life

May 24, 2025

Escape To The Country Tips For A Smooth Transition To Rural Life

May 24, 2025 -

Erfolgsgeschichte Golz Und Brumme Als Essener Leistungstraeger

May 24, 2025

Erfolgsgeschichte Golz Und Brumme Als Essener Leistungstraeger

May 24, 2025

Latest Posts

-

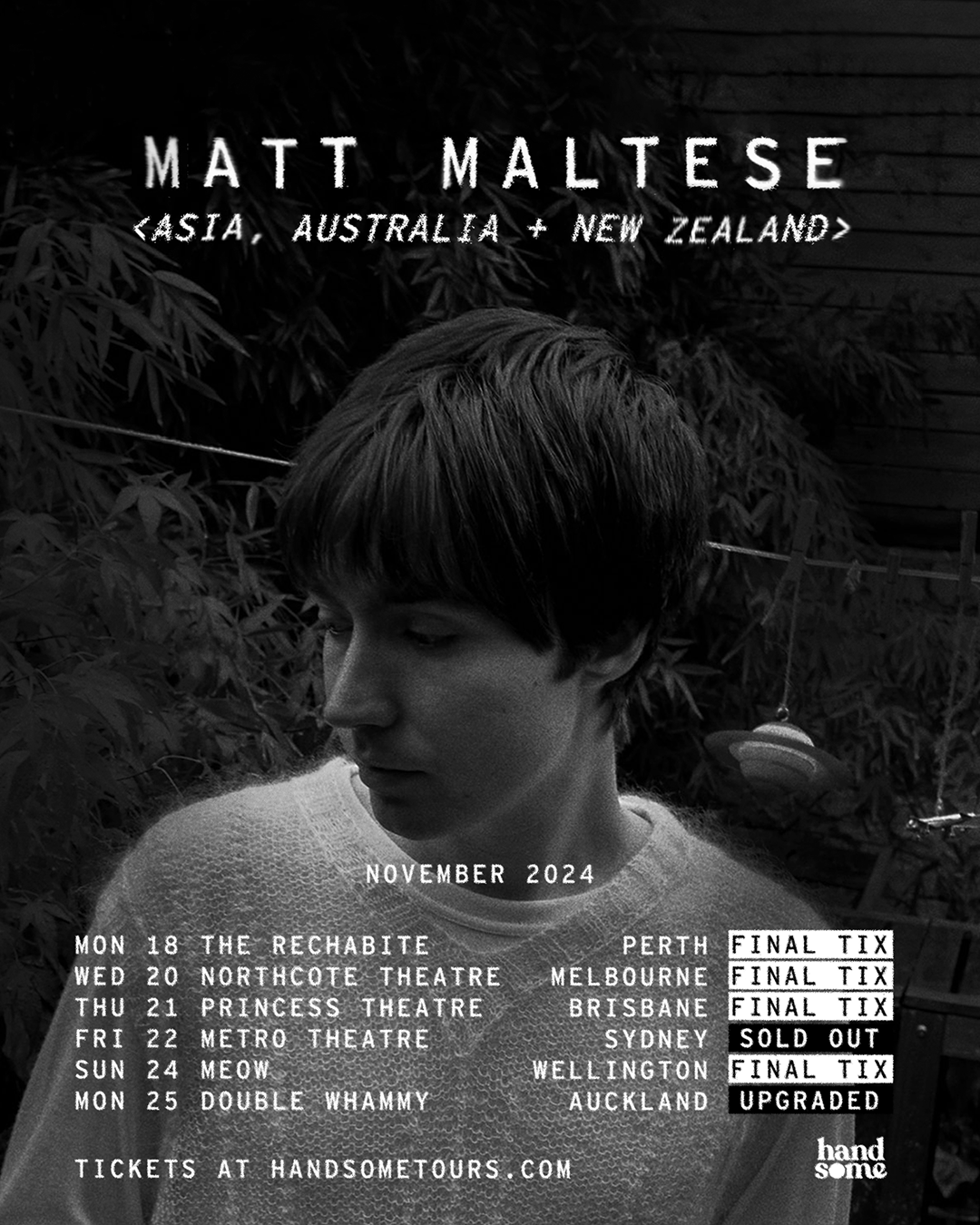

New Album Her In Deep Matt Maltese Talks Intimacy And Personal Growth

May 24, 2025

New Album Her In Deep Matt Maltese Talks Intimacy And Personal Growth

May 24, 2025 -

Matt Maltese Discusses Intimacy And Growth In His Forthcoming Album

May 24, 2025

Matt Maltese Discusses Intimacy And Growth In His Forthcoming Album

May 24, 2025 -

Matt Maltese On Her In Deep Intimacy Growth And The Creative Process

May 24, 2025

Matt Maltese On Her In Deep Intimacy Growth And The Creative Process

May 24, 2025 -

Matt Maltese Intimacy Growth And His New Album Her In Deep

May 24, 2025

Matt Maltese Intimacy Growth And His New Album Her In Deep

May 24, 2025 -

Bbc Radio 1 Big Weekend The Ultimate Ticket Guide

May 24, 2025

Bbc Radio 1 Big Weekend The Ultimate Ticket Guide

May 24, 2025