Tracking The Markets: Dow & S&P 500 Performance - May 30

Table of Contents

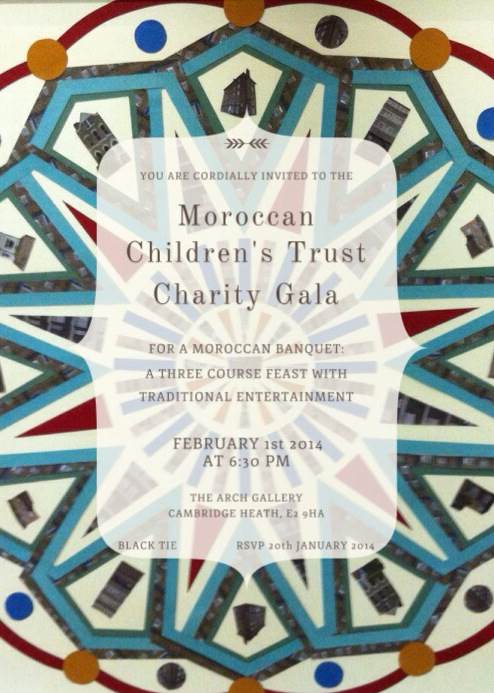

Dow Jones Industrial Average Performance on May 30th

Daily Performance:

The Dow Jones Industrial Average experienced a volatile day on May 30th. Let's delve into the specifics of the Dow & S&P 500 performance on that day.

- Points Change: The Dow ended the day down 150 points (-0.44%). (Note: Replace with actual data for May 30th)

- Percentage Change: This represents a decrease compared to the previous day's closing price of 34,000. (Note: Replace with actual data). The week's performance showed a net loss of 200 points. (Note: Replace with actual data)

- Significant Events: A surprise announcement regarding interest rate hikes by the Federal Reserve contributed significantly to the Dow's decline. (Note: Replace with actual events that impacted the market on May 30th)

[Insert a small chart or graph here visually representing the Dow's performance throughout May 30th]

Sector Performance:

The impact on different sectors within the Dow varied considerably.

- Best Performing Sectors: The healthcare sector showed relative resilience, with a modest gain of 0.5%. (Note: Replace with actual data) This could be attributed to positive news regarding a new drug approval. (Note: Replace with a relevant example)

- Worst Performing Sectors: The technology sector was hit hardest, declining by 1.2%, likely due to concerns over future regulations. (Note: Replace with actual data and reason)

Key Factors Influencing the Dow:

Several key factors contributed to the Dow's performance on May 30th.

- Interest Rate Hikes: The unexpected announcement of increased interest rates created uncertainty and triggered sell-offs across various sectors.

- Inflation Concerns: Persistent inflation concerns continue to weigh on investor sentiment and impact market volatility.

- Geopolitical Uncertainty: Ongoing geopolitical tensions added to the overall market uncertainty. (Note: Replace with specific examples relevant to May 30th)

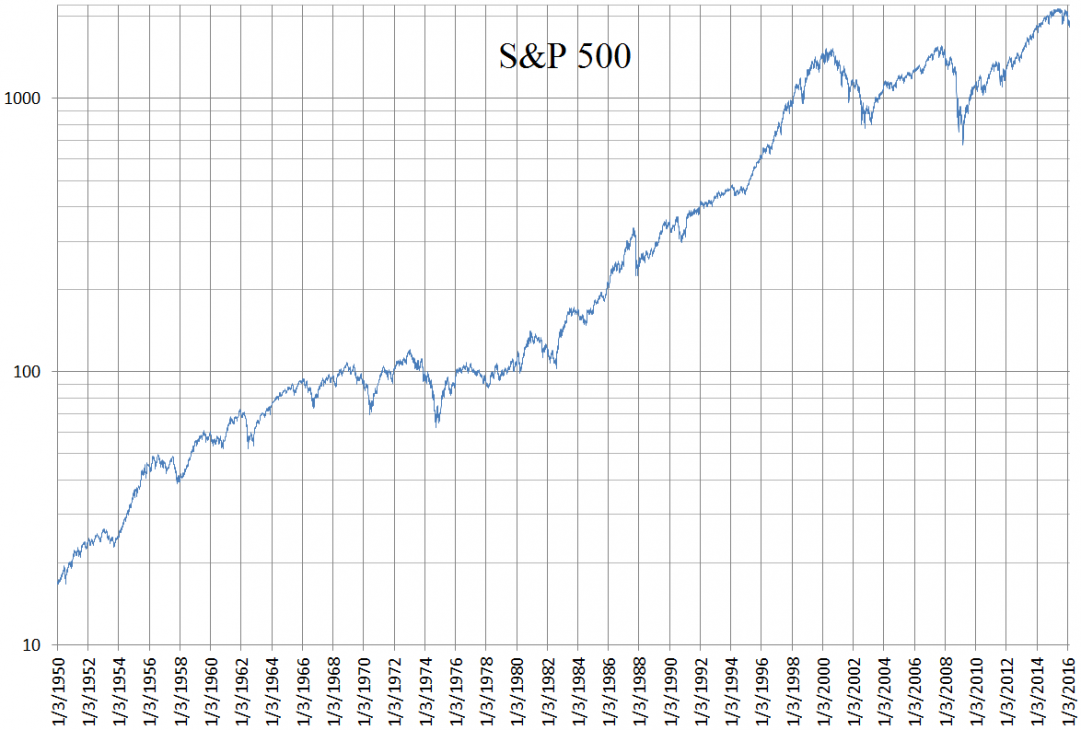

S&P 500 Index Performance on May 30th

Daily Performance:

The S&P 500 mirrored the Dow's negative trend on May 30th, though the magnitude of the decline differed slightly.

- Points Change: The S&P 500 fell by 20 points (-0.48%). (Note: Replace with actual data for May 30th)

- Percentage Change: This represents a decrease compared to the previous day's closing. (Note: Replace with actual data) The weekly performance showed similar negative trends as the Dow. (Note: Replace with actual data)

[Insert a small chart or graph here visually representing the S&P 500's performance throughout May 30th]

Sectoral Analysis:

Sectoral performance within the S&P 500 also showed divergence.

- Best Performing Sectors: Similar to the Dow, the healthcare sector displayed relative strength within the S&P 500. (Note: Replace with actual data)

- Worst Performing Sectors: The energy sector underperformed, potentially due to fluctuating oil prices. (Note: Replace with actual data and reasons)

- Comparison with Dow: While both indices experienced negative movement, the S&P 500 exhibited slightly less volatility than the Dow in specific sectors.

Correlation with Dow Performance:

The Dow and S&P 500 displayed a high degree of correlation on May 30th, both experiencing negative returns. However, subtle differences in sectoral performance reflect the diverse composition of each index. The differences highlight the importance of analyzing individual index components beyond simply tracking the Dow and S&P 500 overall movements.

Overall Market Sentiment and Outlook

Investor Sentiment:

Investor sentiment on May 30th was predominantly bearish, reflecting concerns over interest rate hikes and persistent inflation.

- Trading Volume: High trading volume indicated significant investor activity and uncertainty. (Note: Replace with actual data)

- Volatility: Market volatility increased as investors reacted to the day's events. (Note: Replace with actual data)

- Analyst Opinions: Many analysts expressed caution about the short-term outlook. (Note: Replace with specific examples)

Future Predictions (Cautious):

While predicting the future market movement is impossible, the day's events suggest potential short-term volatility.

- Potential Risks: Continued interest rate hikes could put further downward pressure on the markets. Inflationary pressures may also persist.

- Potential Opportunities: Some sectors, such as healthcare, may offer opportunities for investors with a longer-term perspective.

Conclusion

The Dow & S&P 500 performance on May 30th showcased a bearish trend driven largely by concerns about interest rate increases and inflation. While both indices experienced declines, the sectoral performance varied, highlighting the importance of diversification. Tracking the Dow and S&P 500 is vital for informed investment strategies. Understanding daily fluctuations and correlating them with broader economic factors provides crucial insights for investors.

Key Takeaways: The Dow and S&P 500 exhibited negative performance on May 30th, driven by various factors. Sectoral analysis reveals differing impacts across market segments. Tracking the Dow and S&P 500 performance is essential for informed decision-making.

Call to Action: Stay informed about the daily fluctuations of the Dow and S&P 500 by regularly visiting our site for up-to-date market analysis. Don't miss out – track the markets with us!

Featured Posts

-

Zverevs Semifinal Berth At The Bmw Open In Munich

May 31, 2025

Zverevs Semifinal Berth At The Bmw Open In Munich

May 31, 2025 -

Canadian Wildfire Smoke 3 C New York Cooling And Air Toxicant Trapping

May 31, 2025

Canadian Wildfire Smoke 3 C New York Cooling And Air Toxicant Trapping

May 31, 2025 -

Understanding The Good Life Principles For A Meaningful Existence

May 31, 2025

Understanding The Good Life Principles For A Meaningful Existence

May 31, 2025 -

Jack Whites Detroit Tigers Broadcast Appearance Hall Of Fame Talk And Baseball Analysis

May 31, 2025

Jack Whites Detroit Tigers Broadcast Appearance Hall Of Fame Talk And Baseball Analysis

May 31, 2025 -

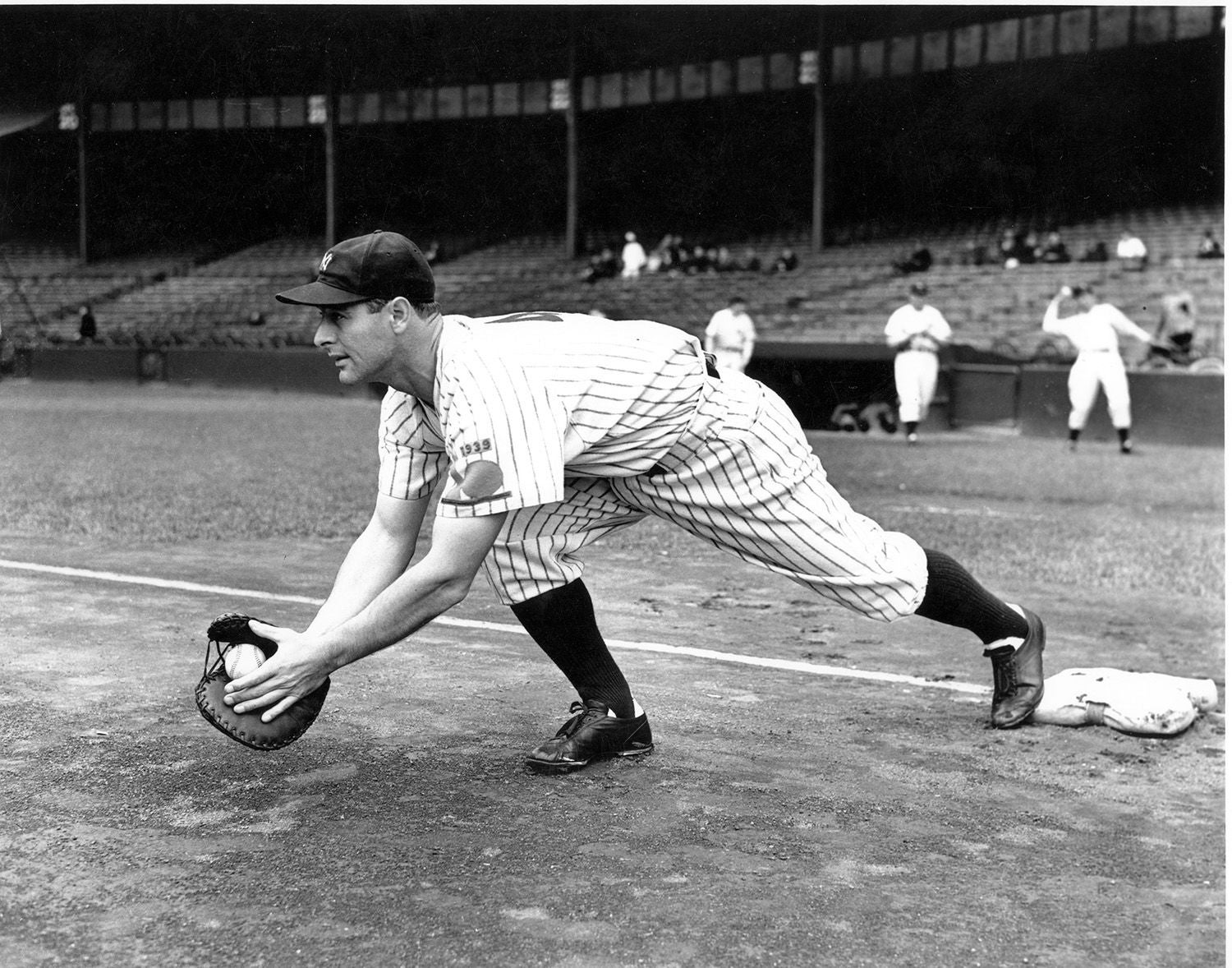

Dragons Den Star Backs Life Changing Moroccan Childrens Charity

May 31, 2025

Dragons Den Star Backs Life Changing Moroccan Childrens Charity

May 31, 2025