Top India Fund Manager DSP Sounds Warning On Stocks

Table of Contents

DSP's Concerns Regarding Current Market Valuation

DSP expresses serious concerns over the high valuations of certain sectors within the Indian stock market. This investment warning highlights a potential overvaluation, suggesting a possible stock market bubble. Several key factors contribute to this assessment:

-

Inflated Price-to-Earnings (PE) Ratios: DSP points to significantly elevated PE ratios in several key sectors compared to both historical averages and global market peers. This indicates that investors are paying a premium for earnings, increasing the risk of a sharp correction. A high PE ratio suggests that the market is anticipating significant future earnings growth; however, if this growth fails to materialize, the stock price could fall dramatically.

-

Overvalued Sectors: Specific sectors, such as technology and consumer discretionary, are flagged as exhibiting signs of significant overvaluation. Rapid growth in these sectors has driven up stock prices, potentially beyond what is justified by underlying fundamentals. This market valuation discrepancy presents a considerable risk.

-

Vulnerability to Corrections: The sustained high valuations make the Indian stock market vulnerable to significant corrections. Any negative news or shift in market sentiment could trigger a sharp decline in prices, impacting investor portfolios substantially. Understanding this vulnerability is key to effective portfolio management.

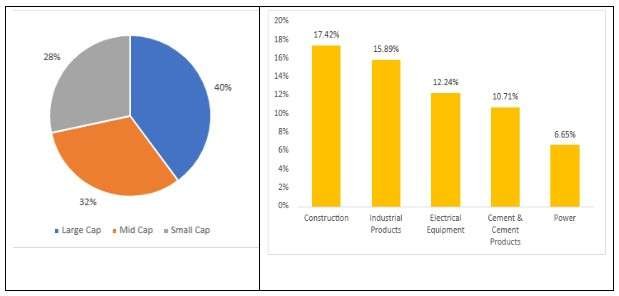

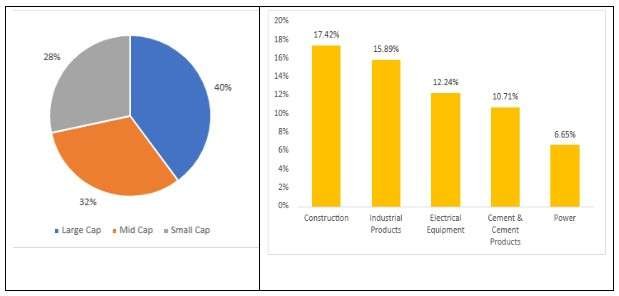

(Include a relevant chart or graph here illustrating the PE ratios of identified sectors compared to historical averages and global peers.)

Potential Triggers for Market Correction According to DSP

DSP identifies several potential triggers that could precipitate a market correction in India:

-

Interest Rate Hikes: The Reserve Bank of India (RBI) might increase interest rates to combat persistent inflation. Higher interest rates make borrowing more expensive, potentially slowing economic growth and impacting corporate earnings, negatively affecting stock prices.

-

Persistent Inflation: High inflation erodes purchasing power and can lead to decreased consumer spending, negatively impacting corporate profitability and market sentiment. This inflationary pressure is a significant factor in DSP's stock market warning.

-

Global Economic Slowdown: A global economic slowdown could significantly impact India's export-oriented sectors and reduce foreign investment flows into the Indian market, creating downward pressure on stock prices. Global geopolitical risks also play a role.

-

Geopolitical Risks: Geopolitical uncertainties, both regionally and globally, can increase market volatility and negatively affect investor confidence, leading to capital flight and market corrections. These risks add to the overall uncertainty highlighted in the investment warning.

-

Specific Events: DSP may have cited specific upcoming events or announcements (e.g., policy changes, earnings reports) as potential catalysts for a market correction. (Specify these events if available from the original DSP statement).

DSP's Recommendations for Investors

In light of these concerns, DSP offers several recommendations for investors:

-

Portfolio Diversification: DSP stresses the importance of diversifying portfolios across different asset classes (e.g., equities, bonds, real estate) and sectors to mitigate risk. This diversification reduces the impact of any single sector's underperformance.

-

Shift to Defensive Stocks: The firm recommends considering a shift towards more defensive stocks—those less sensitive to economic downturns—to protect capital during a potential correction.

-

Adjust Asset Allocation: Investors should review their asset allocation strategies and adjust them based on their individual risk tolerance and investment goals. A more conservative approach might be warranted in the current climate.

-

Long-Term Investment Strategy: Despite the current concerns, DSP emphasizes the importance of sticking to a long-term investment strategy and avoiding panic selling. Long-term investors should focus on the bigger picture rather than reacting to short-term market fluctuations.

Importance of Seeking Professional Financial Advice

Navigating the complexities of the Indian stock market requires careful consideration. The information provided here should not be considered financial advice. Instead, it's crucial to:

-

Consult a Financial Advisor: Before making any significant investment decisions, it is vital to consult with a qualified financial advisor. A personalized investment plan, tailored to your specific needs and risk tolerance, is invaluable.

-

Personalized Financial Planning: A financial advisor can help you create a robust investment strategy that aligns with your long-term financial goals while mitigating risk effectively. This personalized approach is far superior to general advice.

-

Portfolio Optimization: A financial advisor can optimize your existing portfolio to ensure it is well-diversified and adequately protected against market volatility. This optimization is critical for managing your Indian stock investments effectively.

(Provide links to resources for finding qualified financial advisors in India.)

Conclusion:

DSP's warning regarding the Indian stock market underscores the need for caution and vigilance among investors. The concerns raised regarding valuations, potential triggers for a correction, and the importance of robust risk management strategies are crucial considerations in the current climate. This stock market warning from a reputable source should not be ignored. Don’t ignore this crucial stock market warning and take proactive steps to protect your portfolio. Review your investment strategy and consider seeking professional financial advice for guidance in navigating the complexities of the Indian stock market. Learn more about managing risk in your Indian stock portfolio today.

Featured Posts

-

Will Pete Rose Receive A Posthumous Pardon From Trump

Apr 29, 2025

Will Pete Rose Receive A Posthumous Pardon From Trump

Apr 29, 2025 -

Upcoming 2026 Porsche Cayenne Ev Insights From Recent Spy Photos

Apr 29, 2025

Upcoming 2026 Porsche Cayenne Ev Insights From Recent Spy Photos

Apr 29, 2025 -

Senate Majority Leader Schumer Staying Put Dismissing Calls For Leadership Change

Apr 29, 2025

Senate Majority Leader Schumer Staying Put Dismissing Calls For Leadership Change

Apr 29, 2025 -

Move Over Quinoa The Next Big Superfood

Apr 29, 2025

Move Over Quinoa The Next Big Superfood

Apr 29, 2025 -

Nyt Strands Solutions Hints And Answers For February 27 2025

Apr 29, 2025

Nyt Strands Solutions Hints And Answers For February 27 2025

Apr 29, 2025