Top 10 Iwi Assets Value Surges To $8.2 Billion: A Growth Report

Table of Contents

Key Drivers of iwi Asset Value Growth

Several interconnected factors have contributed to the remarkable growth in iwi asset values. These can be broadly categorized into successful investment strategies, supportive government policies, and the increasing expertise within iwi organizations.

Successful Investment Strategies

Iwi have demonstrated a keen ability to diversify their investment portfolios and achieve strong returns. This success stems from a combination of shrewd strategies:

- Property Investment: Many iwi have made significant investments in both commercial and residential property, benefiting from rising property values in key locations. This includes large-scale developments and strategic land acquisitions.

- Business Ventures and Commercial Enterprises: Iwi are increasingly engaging in diverse business ventures, ranging from tourism and hospitality to technology and renewable energy. Successful examples include the growth of iwi-owned businesses in aquaculture and forestry.

- Resource Management: Traditional resource management, including forestry, fisheries, and farming, continues to be a significant contributor to iwi wealth. Sustainable management practices are key to long-term profitability.

- Financial Investments: Diversification into financial markets, such as shares and bonds, has provided further avenues for wealth creation and portfolio growth. Sophisticated investment strategies are being employed to maximize returns.

- Examples of Success: While specific financial data for individual iwi investments is often commercially sensitive, case studies highlighting significant gains from specific ventures—such as successful property developments or the expansion of iwi-owned businesses—demonstrate the effectiveness of these strategies. Data from publicly available annual reports, where accessible, could support this analysis further.

Government Policies and Initiatives

Government policies supporting iwi development have played a crucial role in facilitating this asset growth. These include:

- Treaty Settlements and Redress: Settlements resulting from Treaty of Waitangi claims have provided iwi with financial resources to invest in long-term economic development.

- Funding for Economic Development Projects: Government initiatives providing funding for economic development projects have boosted iwi capacity to pursue new ventures and expand existing ones.

- Legislation Promoting Iwi Business Ownership: Legislative changes promoting iwi business ownership and facilitating easier access to capital have created a more favorable environment for iwi investment.

- Specific Examples: The impact of specific government policies can be further examined through case studies analyzing their effects on particular iwi and their investment projects. For example, analyzing the impact of specific funding programs on the development of iwi-owned businesses would provide valuable insight.

Growing Expertise and Capacity within Iwi Organizations

The increasing sophistication of iwi organizations' financial and business management capabilities has been vital to successful investment. This includes:

- Improved Financial Management: Iwi have invested in building stronger financial management teams and systems.

- Enhanced Business Management: Development of strong business management structures and expertise has allowed iwi to effectively manage and expand their business interests.

- Investment Analysis: Improved investment analysis capabilities ensure informed decision-making and optimal portfolio management.

- Strategic Planning: Strong strategic planning is essential for long-term success in managing and growing iwi assets.

- Examples of Leadership: Specific examples of iwi organizations exhibiting exemplary leadership and management can serve as effective case studies and showcase best practices in the sector.

Top 10 iwi and their Asset Portfolios

Determining an exact ranking of the top 10 iwi by asset value requires access to comprehensive and consistently reported financial data from each iwi, which is not always publicly available. However, a representative list could be created based on available information from publicly accessible sources, focusing on notable iwi known for significant asset holdings. This section would benefit from a table summarizing the top 10 iwi, their approximate asset values, and key holdings. For example:

| Rank | Iwi Name | Approximate Asset Value (NZD) | Key Asset Holdings |

|---|---|---|---|

| 1 | Ngāi Tahu | [Estimate] | Land, Property, Tourism, Forestry, Investments |

| 2 | Ngāti Porou | [Estimate] | Forestry, Fisheries, Property, Investments |

| 3 | [Iwi Name] | [Estimate] | [Key Holdings] |

| ... | ... | ... | ... |

| 10 | [Iwi Name] | [Estimate] | [Key Holdings] |

(Note: The above table is a placeholder and requires further research to populate accurately.)

Remember to include relevant keywords for each iwi (e.g., Ngāti Porou assets, Ngāi Tahu investments etc.).

Implications of the iwi Asset Growth

The surge in iwi asset values has profound implications for Māori communities and the broader New Zealand economy.

Economic Impact on Māori Communities

The increased wealth generated from iwi assets is having a positive impact on Māori communities:

- Job Creation: Investment in iwi-owned businesses creates employment opportunities within Māori communities.

- Improved Infrastructure: Increased wealth allows iwi to invest in essential infrastructure, benefiting local communities.

- Increased Social Services: Iwi can use their assets to support social services, improving the well-being of their members.

- Enhanced Self-Determination: Greater economic control empowers Māori communities and strengthens their self-determination.

Future Outlook for iwi Assets

The future holds significant potential for further growth, but also presents challenges:

- Emerging Investment Opportunities: New opportunities in areas such as renewable energy, technology, and sustainable tourism present exciting possibilities.

- Risks and Uncertainties in the Market: Economic fluctuations and global market uncertainties pose potential risks to iwi investments.

- Sustainability and Environmental Considerations: Sustainable investment practices are crucial for long-term wealth creation and environmental protection.

- Potential for Further Growth: Based on current trends and strategic planning, iwi assets have the potential for continued substantial growth.

Conclusion: The Future of iwi Asset Growth and its Significance

The $8.2 billion surge in iwi asset value represents a remarkable achievement, driven by effective investment strategies, supportive government policies, and growing expertise within iwi organizations. This growth has significant positive implications for Māori communities, leading to job creation, improved infrastructure, enhanced social services, and strengthened self-determination. While challenges remain, the future potential for iwi asset growth is considerable. Learn more about successful iwi asset management strategies and how they are shaping the future of the Māori economy.

Featured Posts

-

Manchester United Eyeing Jobe Bellingham Transfer

May 14, 2025

Manchester United Eyeing Jobe Bellingham Transfer

May 14, 2025 -

Yevrobachennya 2025 Novatorskiy Pidkhid Opera V Sauni

May 14, 2025

Yevrobachennya 2025 Novatorskiy Pidkhid Opera V Sauni

May 14, 2025 -

Snow White Box Office Bomb The Impact Of A Divisive Remake

May 14, 2025

Snow White Box Office Bomb The Impact Of A Divisive Remake

May 14, 2025 -

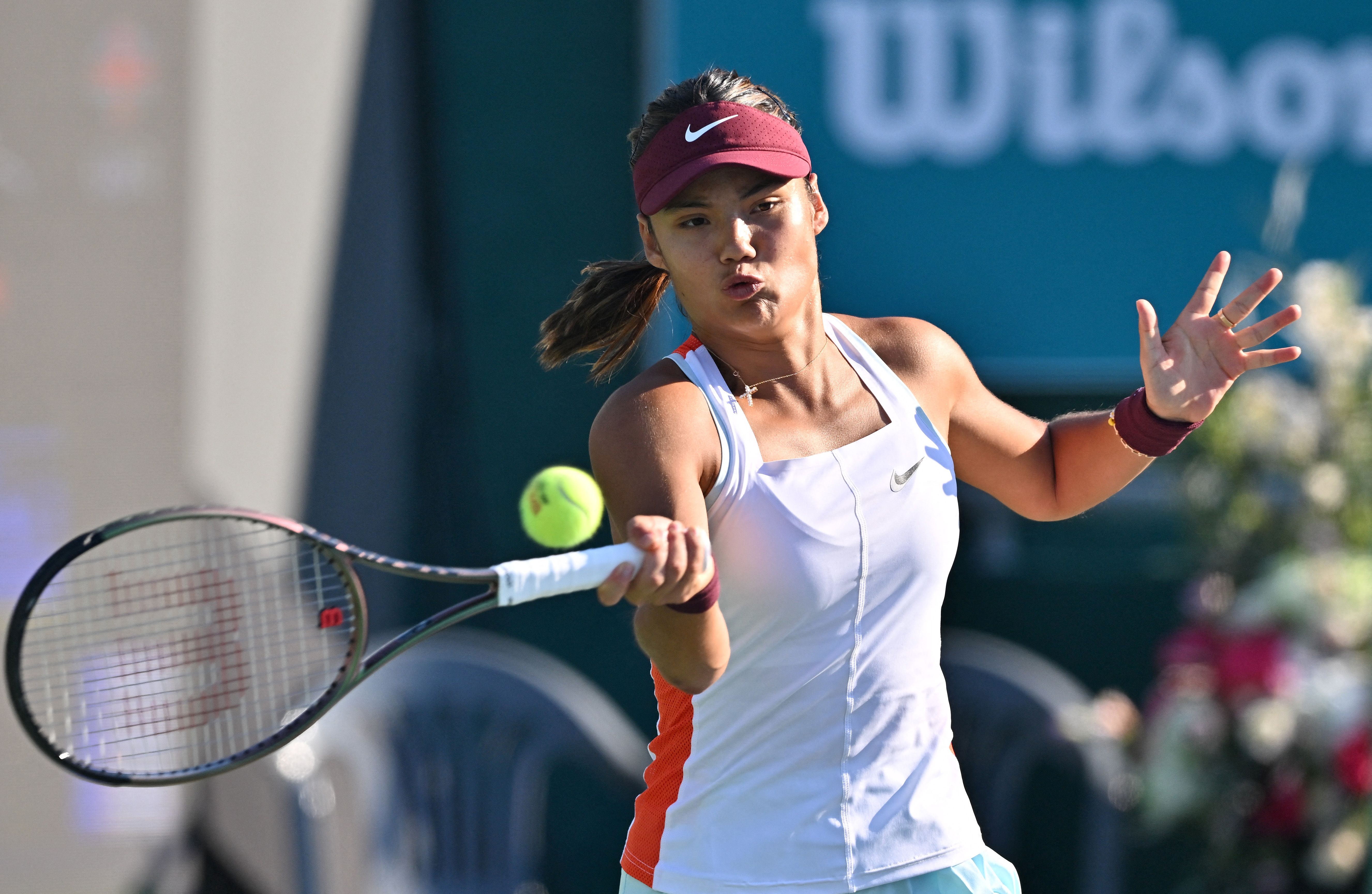

Raducanu Falls To Muchova In Dubai Tennis Championships

May 14, 2025

Raducanu Falls To Muchova In Dubai Tennis Championships

May 14, 2025 -

El Sevilla Apuesta Por La Experiencia Caparros Sustituye A Garcia Pimienta

May 14, 2025

El Sevilla Apuesta Por La Experiencia Caparros Sustituye A Garcia Pimienta

May 14, 2025

Latest Posts

-

Mirka I Rodzer Federer Cetiri Blizanca Porodicna Fotografija

May 14, 2025

Mirka I Rodzer Federer Cetiri Blizanca Porodicna Fotografija

May 14, 2025 -

Rodzer Federer Slike Njegovih Blizanaca

May 14, 2025

Rodzer Federer Slike Njegovih Blizanaca

May 14, 2025 -

Koliko Je Dokovic Daleko Od Svih Federerove Rekorde

May 14, 2025

Koliko Je Dokovic Daleko Od Svih Federerove Rekorde

May 14, 2025 -

Deca Rodzera I Mirke Federer Retki Uvid U Porodicu

May 14, 2025

Deca Rodzera I Mirke Federer Retki Uvid U Porodicu

May 14, 2025 -

Analiza Dokovicevih Rekorda U Poredenju Sa Federerom

May 14, 2025

Analiza Dokovicevih Rekorda U Poredenju Sa Federerom

May 14, 2025