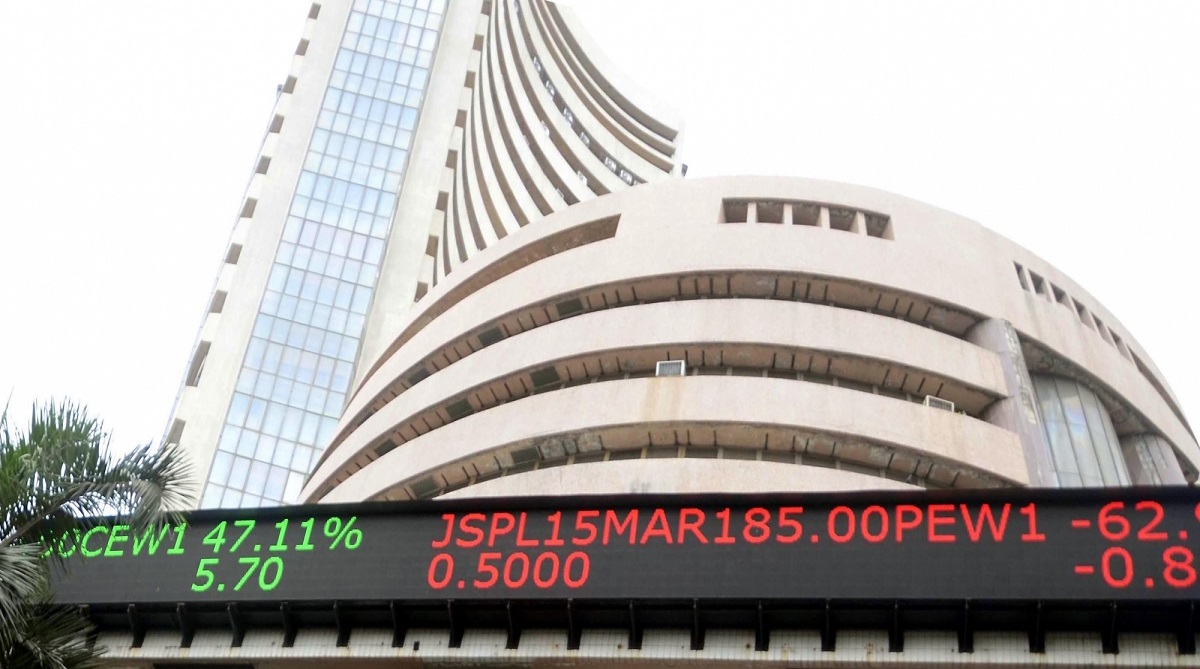

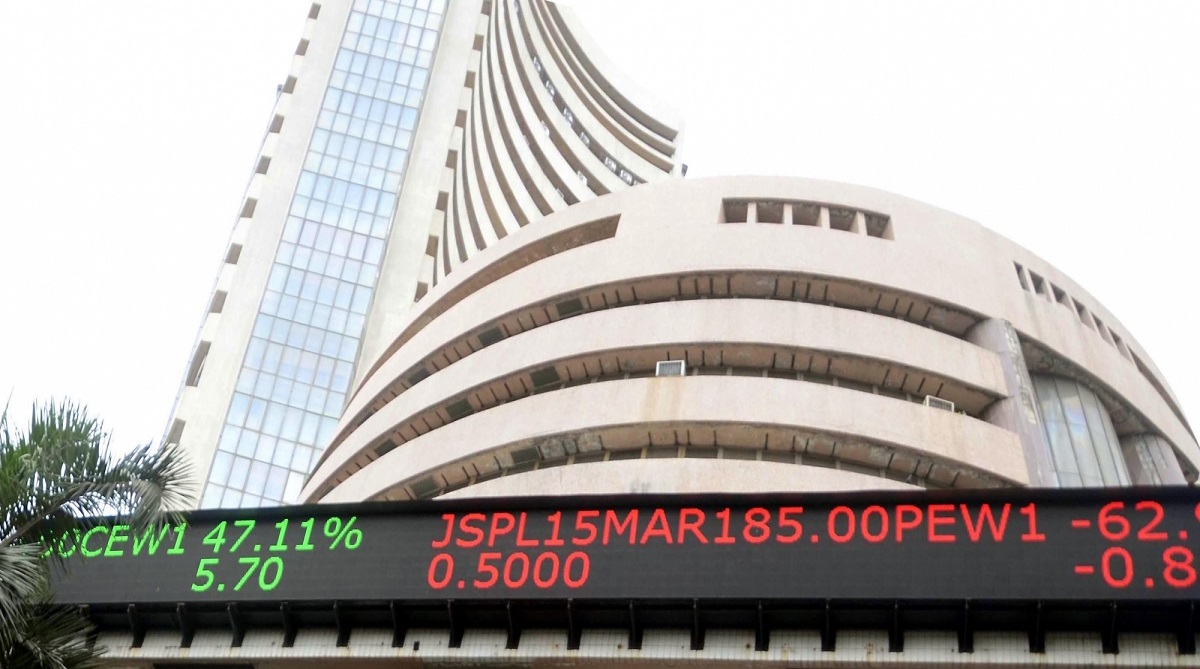

Today's Stock Market Update: Significant Gains For Sensex And Nifty

Table of Contents

Sensex's Stellar Performance

Percentage Gain and Closing Figures

The Sensex closed today with a spectacular gain of X%, reaching a final closing value of Y points. This represents a significant jump from yesterday's closing.

- Contributing Sectors: The IT sector led the charge, followed by strong performances from Banking and FMCG sectors.

- Intraday Performance: The Sensex reached a high of Z points and a low of A points during the trading session.

- Trading Volume: A high volume of B shares were traded today, indicating significant investor activity.

Key Drivers Behind Sensex's Rise

Several factors contributed to the Sensex's impressive rise.

- Positive Global Cues: Positive developments in global markets, particularly in the US and European markets, boosted investor sentiment.

- Strong Domestic Economic Data: Recent positive economic indicators, such as robust industrial production and improved consumer confidence, fueled market optimism.

- Improved Investor Sentiment: Overall, a generally positive investor sentiment played a crucial role in driving up the Sensex.

- Strong Company Performances: Positive quarterly earnings announcements from several blue-chip companies also boosted market confidence. Experts attribute this to improved consumer spending. One market analyst stated, "The strong earnings season has clearly injected confidence into the market."

Nifty's Impressive Growth

Percentage Gain and Closing Figures

The Nifty 50 index mirrored the Sensex's upward trajectory, closing with a remarkable gain of X%, reaching Y points.

- Top Performers: Leading the Nifty 50 were companies like [mention top 3-5 performing companies], showcasing robust performance across various sectors.

- Intraday Performance: The Nifty reached a high of Z points and a low of A points throughout the day's trading.

- Trading Volume: Similar to the Sensex, high trading volumes in the Nifty index indicated strong investor participation.

Factors Influencing Nifty's Performance

Nifty's growth was driven by similar factors to the Sensex, with some notable nuances.

- Foreign Institutional Investor (FII) Investment: Significant inflows from FIIs injected substantial liquidity into the market, pushing up indices.

- Domestic Institutional Investor (DII) Activity: Domestic institutional investors also played a considerable role, further supporting the market's upward momentum.

- Impact of Global Events: Positive global developments, particularly reduced geopolitical tensions, contributed significantly to the positive market sentiment.

- "The consistent inflow of FII investment is a key indicator of confidence in the Indian economy," noted a leading market expert.

Sector-Wise Analysis

Top Performing Sectors

The IT, Banking, and FMCG sectors were the star performers today, contributing significantly to the overall market gains.

- IT Sector: Strong quarterly earnings and positive global technology trends fuelled this sector's growth.

- Banking Sector: Improved credit growth and positive regulatory developments boosted investor confidence in the banking sector.

- FMCG Sector: Resilient consumer demand and strong sales figures contributed to the robust performance of this sector.

[Include a simple bar chart visualizing the performance of these sectors].

Underperforming Sectors

While most sectors performed well, the [mention underperforming sectors, e.g., Pharma and Energy] sectors showed relatively weaker performances.

- Reasons for Underperformance: This underperformance could be attributed to [mention specific reasons, e.g., specific company-related news, global headwinds affecting commodity prices].

Expert Opinions and Future Outlook

Market Analyst Predictions

Market analysts remain cautiously optimistic about the short-term outlook for both the Sensex and Nifty.

- Positive Predictions: Many experts anticipate continued growth, driven by sustained FII inflows and positive economic data.

- "We expect the positive momentum to continue in the coming weeks," said a leading market strategist.

Potential Risks and Challenges

Despite the positive outlook, certain risks could impact future market performance.

- Global Economic Uncertainties: Global economic slowdown or geopolitical instability could influence investor sentiment.

- Inflationary Pressures: Persistent inflationary pressures could potentially dampen market enthusiasm.

- Geopolitical Risks: Ongoing geopolitical tensions could create volatility in the market.

Conclusion: Wrapping Up Today's Stock Market Update: Sensex and Nifty Gains

Today's stock market update showcases remarkable gains for both the Sensex and Nifty, driven by positive global cues, strong domestic economic data, and robust investor sentiment. The IT, Banking, and FMCG sectors were the key contributors to this impressive market rally. While experts maintain cautious optimism, potential risks such as global uncertainties and inflation need to be considered. Stay tuned for tomorrow's stock market update on Sensex and Nifty performance! Follow us for continuous updates on Sensex and Nifty performance and insightful market analysis.

Featured Posts

-

Solve The Nyt Strands Crossword April 6 2025 Answers And Strategies

May 09, 2025

Solve The Nyt Strands Crossword April 6 2025 Answers And Strategies

May 09, 2025 -

Leading Nhl Goal Scorer Leon Draisaitl Injured Oilers React

May 09, 2025

Leading Nhl Goal Scorer Leon Draisaitl Injured Oilers React

May 09, 2025 -

Ferdinand Predicts Champions League Winner Ahead Of Arsenal Vs Psg

May 09, 2025

Ferdinand Predicts Champions League Winner Ahead Of Arsenal Vs Psg

May 09, 2025 -

The Trump Tariff Debate A Fox News Hosts Financial Counterpoint

May 09, 2025

The Trump Tariff Debate A Fox News Hosts Financial Counterpoint

May 09, 2025 -

Manchester Castle Hosts Massive Music Festival Featuring Olly Murs

May 09, 2025

Manchester Castle Hosts Massive Music Festival Featuring Olly Murs

May 09, 2025