Today's Stock Market: Dow Futures Point To Positive Week End

Table of Contents

Analyzing Dow Futures: What They Indicate

Dow futures contracts are derivative instruments that track the predicted price movements of the Dow Jones Industrial Average. They act as a powerful indicator of market sentiment, offering a glimpse into the expected direction of the broader stock market before the actual opening bell. Currently, Dow futures contracts show a [Insert Current Dow Futures Price and Percentage Change Here – e.g., price of 34,500, representing a 1.5% increase from the previous day’s close]. This increase suggests a positive outlook for the upcoming trading sessions.

Is this a significant jump? Compared to the previous week's volatility, this is a moderately strong upward trend. However, when viewed in the historical context of major market swings, this increase is not exceptionally dramatic. It is crucial to understand this perspective before making any rash investment decisions.

Here are some key data points to consider:

- Current Dow Futures Price: [Insert Current Price]

- Percentage Change from Previous Day: [Insert Percentage Change]

- Percentage Change from Previous Week: [Insert Percentage Change]

- Trading Volume: [Insert Trading Volume Data]

- Key Resistance Level: [Insert Resistance Level]

- Key Support Level: [Insert Support Level]

Potential Drivers Behind the Positive Outlook

Several factors contribute to this positive outlook reflected in Dow futures. Let's examine the key drivers:

Positive Economic Indicators

Recent economic data has painted a surprisingly optimistic picture. The latest GDP growth figures [Insert GDP Growth Data and Source], coupled with a decline in the unemployment rate to [Insert Unemployment Rate and Source], suggest a robust economy. Furthermore, inflation appears to be cooling, with the CPI at [Insert CPI Data and Source]. This easing inflationary pressure reduces concerns about aggressive interest rate hikes from the Federal Reserve, boosting investor confidence.

Strong Corporate Earnings

Several major companies have recently released strong earnings reports that have exceeded analysts' expectations. [Mention specific companies and their earnings performance – e.g., Company X reported a 15% increase in quarterly profits, exceeding projections by 5%]. This positive performance boosts overall market sentiment and contributes to the upward trend in Dow futures.

Geopolitical Factors

While geopolitical instability remains a concern globally, recent developments [Mention specific geopolitical events and their impact – e.g., the easing of tensions between Country A and Country B] have had a relatively positive impact on market sentiment, at least temporarily. It's important to monitor ongoing events closely.

Investor Sentiment

Investor sentiment, a crucial factor influencing market movements, is currently leaning towards optimism. This positive sentiment is evident in various sentiment indices [Mention specific indices and their current values – e.g., The VIX volatility index has decreased, reflecting reduced market fear].

Cautious Optimism: Potential Risks and Considerations

While Dow futures point to a positive week end, it's essential to maintain a cautious approach. Several factors could potentially reverse this trend:

- Unexpected Inflation Spikes: A sudden resurgence of inflation could trigger another round of aggressive interest rate hikes, negatively impacting the stock market.

- Geopolitical Tensions Escalating: Unforeseen geopolitical events could quickly shift market sentiment, leading to a downturn.

- Changes in Interest Rates: Unexpected changes in interest rate policies by central banks can significantly impact market valuations.

- Disappointing Earnings Reports: If major companies release disappointing earnings reports in the coming days, it could dampen investor optimism.

- Unexpected Economic Slowdown: Signs of a weakening economy could trigger a sell-off.

Diversification and risk management are crucial for mitigating these potential risks. Investors should carefully consider their risk tolerance and diversify their portfolios accordingly.

Conclusion: Dow Futures Point to a Positive Week – But Proceed with Caution

The current increase in Dow futures suggests a potentially positive end to the week for the stock market. Positive economic indicators, strong corporate earnings, and a relatively calmer geopolitical environment are contributing to this optimistic outlook. However, investors must proceed with caution, acknowledging the potential risks outlined above. Thorough research and informed decision-making are paramount before making any investment choices. Stay informed on Dow futures and stock market trends for better investment strategies. Continue monitoring the Dow Jones Industrial Average and other market indicators for timely updates. Consider consulting with a financial advisor before making any investment decisions based on this analysis of Dow futures.

Featured Posts

-

Cam Newton Picks His Top 2025 Qb Where Should Shedeur Sanders Play

Apr 26, 2025

Cam Newton Picks His Top 2025 Qb Where Should Shedeur Sanders Play

Apr 26, 2025 -

Chinas Impact On Bmw And Porsche Market Share And Future Outlook

Apr 26, 2025

Chinas Impact On Bmw And Porsche Market Share And Future Outlook

Apr 26, 2025 -

Chelsea Handler Reveals Surprise Whistler Trip Companion

Apr 26, 2025

Chelsea Handler Reveals Surprise Whistler Trip Companion

Apr 26, 2025 -

Nyt Spelling Bee February 5th 339 Hints Answers And Solutions

Apr 26, 2025

Nyt Spelling Bee February 5th 339 Hints Answers And Solutions

Apr 26, 2025 -

Mission Impossible 7 Tom Cruises Perilous Stunt Takes Center Stage

Apr 26, 2025

Mission Impossible 7 Tom Cruises Perilous Stunt Takes Center Stage

Apr 26, 2025

Latest Posts

-

The Unlikely Path Of Ahmed Hassanein Could He Be The First Egyptian In The Nfl

Apr 26, 2025

The Unlikely Path Of Ahmed Hassanein Could He Be The First Egyptian In The Nfl

Apr 26, 2025 -

Ahmed Hassanein An Egyptians Path To The Nfl Draft

Apr 26, 2025

Ahmed Hassanein An Egyptians Path To The Nfl Draft

Apr 26, 2025 -

Is Ahmed Hassanein Egypts Next Nfl Star A Look At His Draft Prospects

Apr 26, 2025

Is Ahmed Hassanein Egypts Next Nfl Star A Look At His Draft Prospects

Apr 26, 2025 -

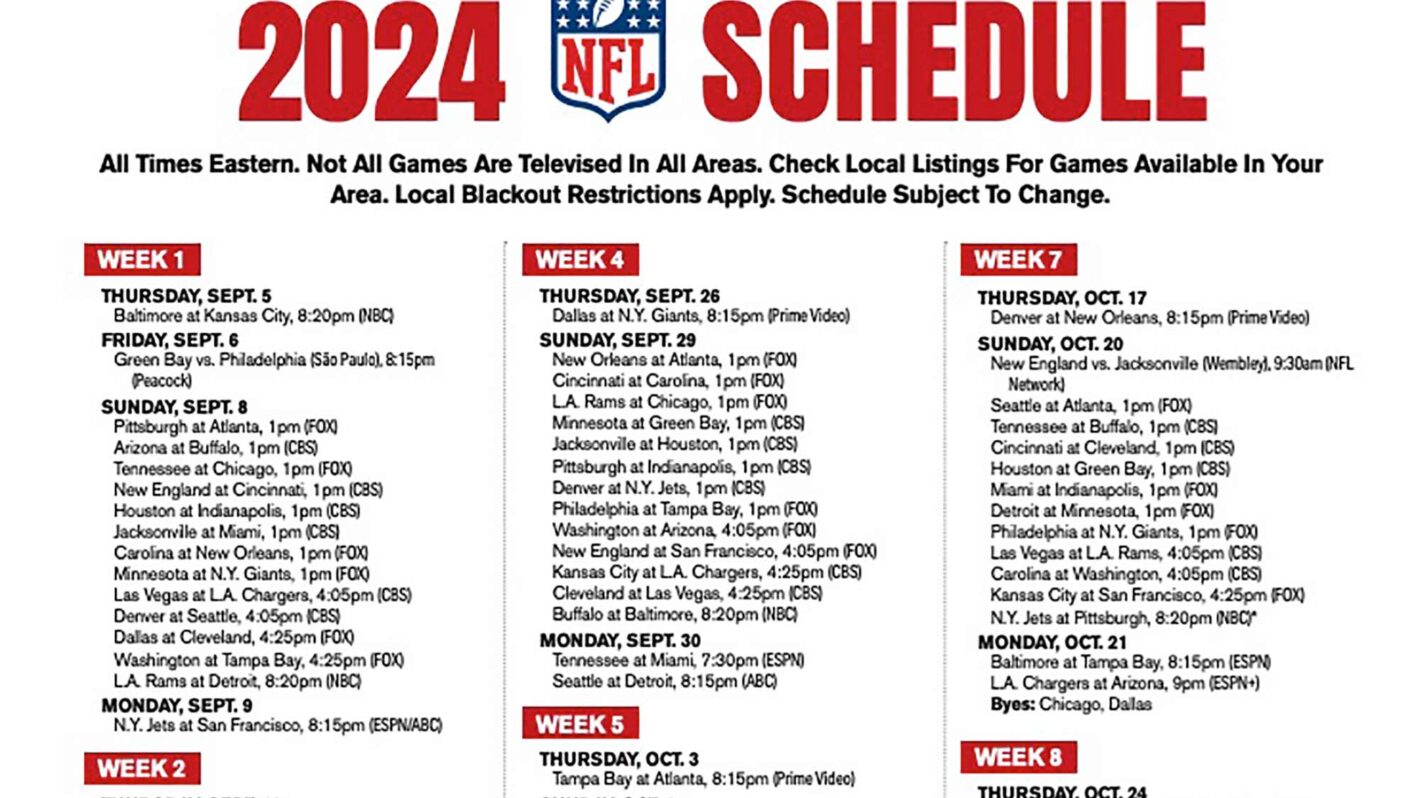

Thursday Night Football Nfl Drafts First Round Begins In Green Bay

Apr 26, 2025

Thursday Night Football Nfl Drafts First Round Begins In Green Bay

Apr 26, 2025 -

Will Ahmed Hassanein Break Barriers As Egypts First Nfl Draft Selection

Apr 26, 2025

Will Ahmed Hassanein Break Barriers As Egypts First Nfl Draft Selection

Apr 26, 2025