Today's Personal Loan Interest Rates: Compare & Save

Table of Contents

Factors Influencing Today's Personal Loan Interest Rates

Several key factors influence the interest rate a lender offers on a personal loan. Understanding these factors can help you improve your chances of securing a lower rate. Lenders carefully assess these elements to determine your creditworthiness and the risk associated with lending you money.

- Credit Score: Your credit score is the single most important factor. A higher credit score (700 or above) significantly increases your chances of qualifying for a lower interest rate. Lenders view you as a lower risk. Conversely, a poor credit score will result in higher interest rates or even loan rejection.

- Debt-to-Income Ratio (DTI): Your DTI shows the percentage of your monthly income that goes towards debt repayment. A lower DTI indicates you have more disposable income to make loan payments, making you a less risky borrower.

- Loan Amount: Larger loan amounts often come with slightly higher interest rates due to the increased risk for the lender.

- Loan Term: The length of your loan impacts the interest rate. Longer loan terms generally result in lower monthly payments but higher overall interest paid. Shorter terms mean higher monthly payments but less total interest.

- Type of Loan: Secured loans (backed by collateral like a car or savings account) typically have lower interest rates than unsecured loans (not backed by collateral).

- Interest Rate Type: Choose between fixed and variable interest rates. Fixed rates remain constant throughout the loan term, providing predictability. Variable rates fluctuate with market conditions, potentially leading to lower initial payments but increased risk of higher payments later.

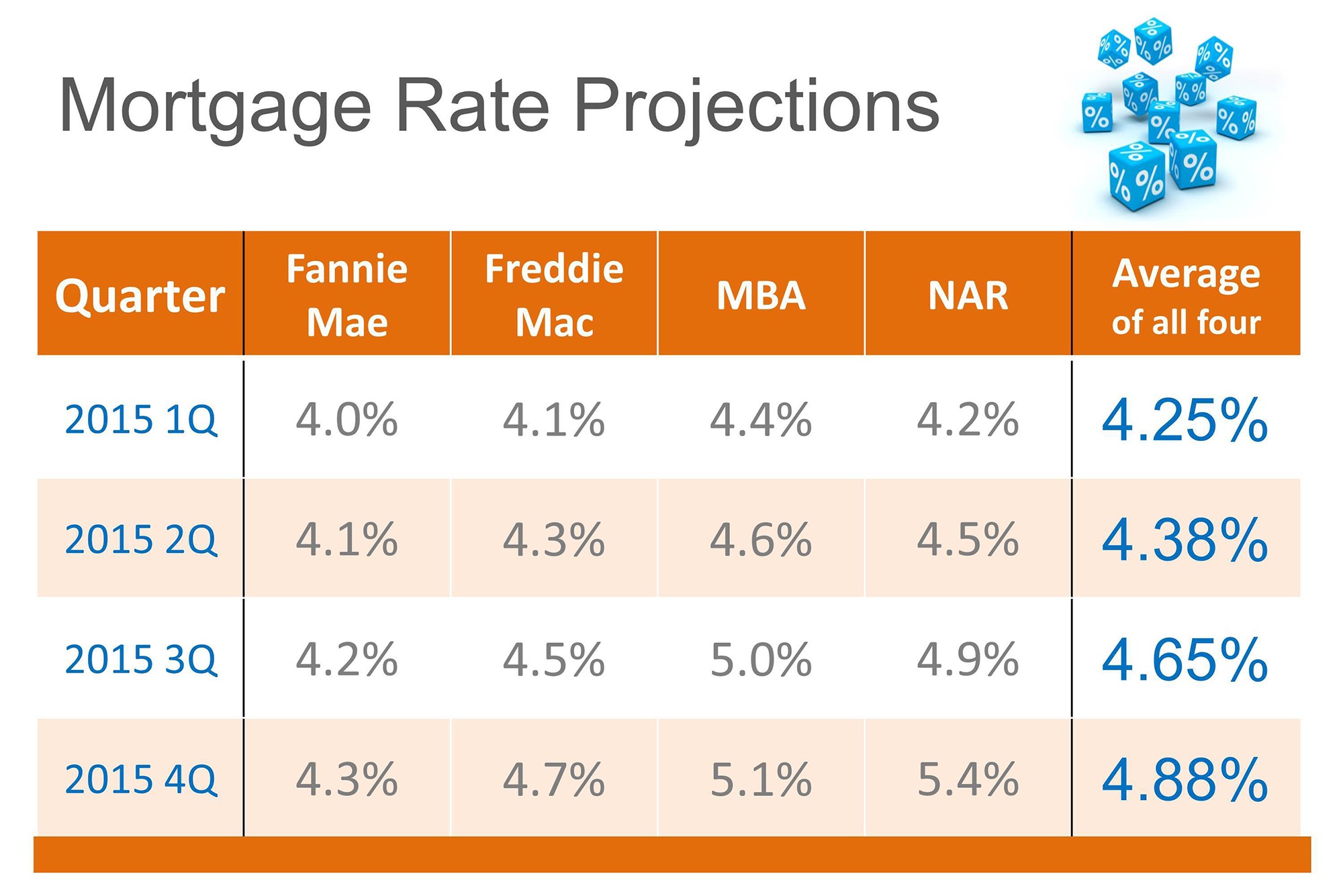

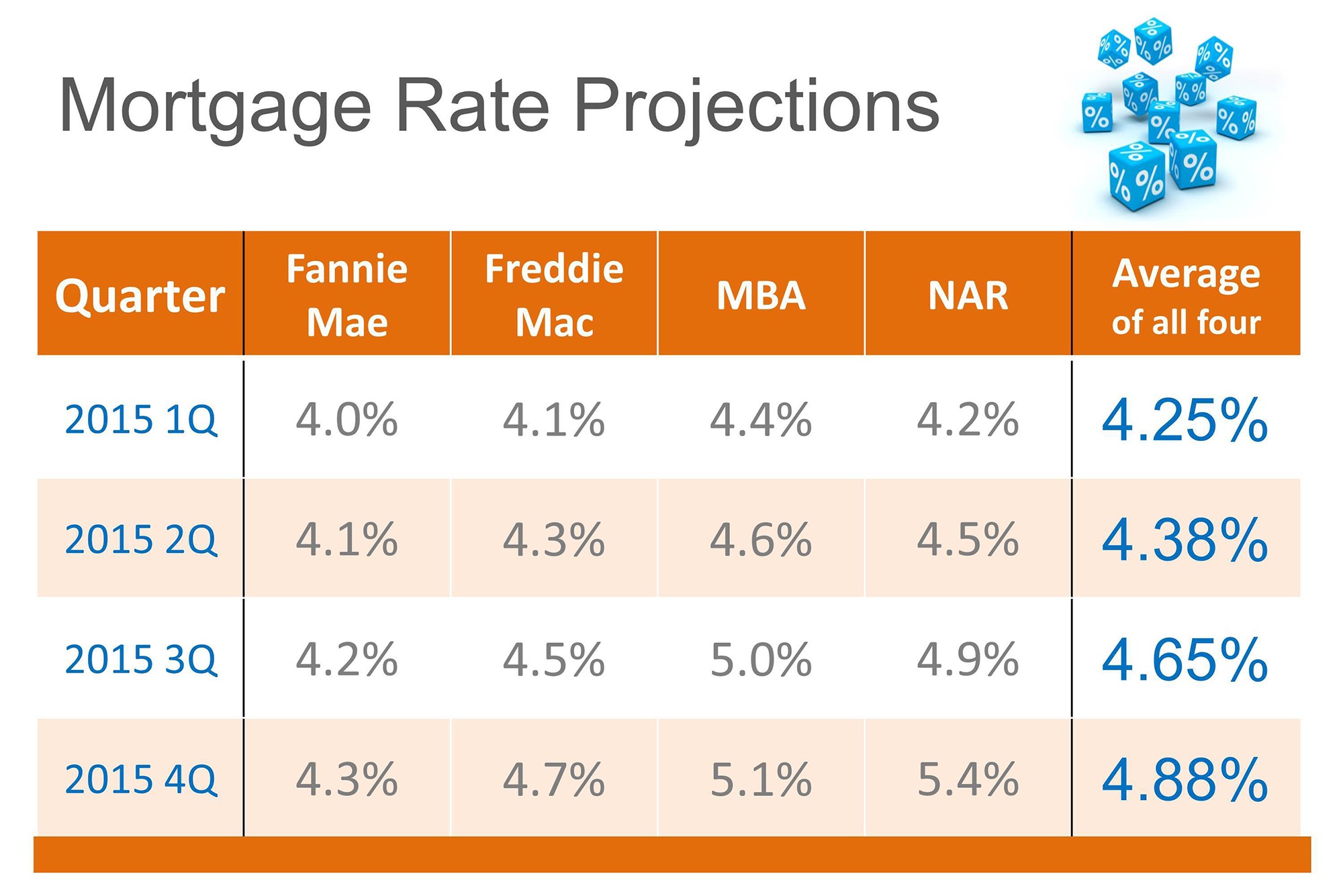

| Credit Score Range | Typical Interest Rate Range (%) |

|---|---|

| 750+ (Excellent) | 6-10 |

| 700-749 (Good) | 8-14 |

| 650-699 (Fair) | 12-18 |

| Below 650 (Poor) | 18%+ or loan rejection |

Note: These ranges are estimates and can vary depending on the lender and other factors.

Where to Find Today's Personal Loan Interest Rates

Finding the best personal loan requires diligent comparison shopping. Don't settle for the first offer you receive! Explore these sources for accurate and up-to-date information on today's personal loan interest rates:

- Online Lenders: Companies like LendingClub, SoFi, and Upstart offer competitive rates and convenient online applications.

- Banks and Credit Unions: Traditional banks and credit unions also provide personal loans, often with slightly different rates and terms. Credit unions usually offer better rates to their members.

- Comparison Websites: Websites like NerdWallet and Bankrate allow you to compare offers from multiple lenders simultaneously, saving you time and effort.

- Directly Contacting Lenders: Don't hesitate to contact lenders directly to inquire about their current rates and specific loan options.

Remember to check multiple sources and compare the offers side-by-side to ensure you get the most accurate picture of today's personal loan interest rates.

How to Compare Personal Loan Interest Rates Effectively

Comparing interest rates requires a keen eye for detail. Don't just focus on the stated interest rate; pay close attention to the APR (Annual Percentage Rate).

- APR vs. Interest Rate: The APR includes the interest rate plus other fees, giving a more complete picture of the loan's total cost.

- Additional Fees: Be aware of origination fees, prepayment penalties, and late payment fees, as these can significantly increase the overall cost of the loan.

To effectively compare loan offers:

- Create a Spreadsheet: Organize key features (APR, loan amount, loan term, monthly payment, total interest paid, and fees) in a spreadsheet for easy comparison.

- Focus on Total Cost: Don't solely focus on the monthly payment. Calculate the total amount you'll repay over the life of the loan.

- Consider the Loan Term: A longer loan term means lower monthly payments but higher total interest paid.

Tips for Getting the Best Personal Loan Interest Rates

Improving your chances of securing a favorable interest rate requires proactive steps:

- Improve Your Credit Score: Pay your bills on time, keep your credit utilization low, and monitor your credit report for errors.

- Shop Around: Compare offers from multiple lenders to find the most competitive rates.

- Negotiate: Don't be afraid to negotiate with lenders. They may be willing to lower the interest rate if you have a strong credit score and a compelling reason for the loan.

- Consider Secured Loans: If possible, consider a secured loan to potentially secure a lower interest rate.

- Maintain a Healthy DTI: Keep your debt-to-income ratio as low as possible to demonstrate financial responsibility.

Conclusion: Secure the Best Today's Personal Loan Interest Rates

Understanding today's personal loan interest rates is paramount to securing the best financial deal. By carefully considering the factors that influence rates, diligently comparing offers from various sources, and taking steps to improve your creditworthiness, you can significantly reduce the overall cost of your loan. Remember to focus on the APR, include all fees in your calculations, and don't hesitate to negotiate. Start comparing today's personal loan interest rates and find the best deal for your financial needs! Use our comparison tool [link to comparison tool if applicable] to begin your search now.

Featured Posts

-

Paul Skenes Pittsburgh Pirates Opening Day Starter

May 28, 2025

Paul Skenes Pittsburgh Pirates Opening Day Starter

May 28, 2025 -

Free Online Streaming Of The 2025 American Music Awards

May 28, 2025

Free Online Streaming Of The 2025 American Music Awards

May 28, 2025 -

Ipswich Town Weekly Report Mc Kenna Shines Phillips And Cajuste Face Challenges

May 28, 2025

Ipswich Town Weekly Report Mc Kenna Shines Phillips And Cajuste Face Challenges

May 28, 2025 -

Kyle Stowers Walk Off Grand Slam Leads Marlins To Win Against Athletics

May 28, 2025

Kyle Stowers Walk Off Grand Slam Leads Marlins To Win Against Athletics

May 28, 2025 -

Blue Origin Rocket Launch Abruptly Cancelled Subsystem Malfunction

May 28, 2025

Blue Origin Rocket Launch Abruptly Cancelled Subsystem Malfunction

May 28, 2025

Latest Posts

-

Odigos Tileorasis Gia Tin Kyriaki 11 5

May 30, 2025

Odigos Tileorasis Gia Tin Kyriaki 11 5

May 30, 2025 -

Tileoptiko Programma Savvatoy 10 Maioy Ti Na Deite

May 30, 2025

Tileoptiko Programma Savvatoy 10 Maioy Ti Na Deite

May 30, 2025 -

Programma Tileorasis Savvatoy 10 5 Odigos Metadoseon

May 30, 2025

Programma Tileorasis Savvatoy 10 5 Odigos Metadoseon

May 30, 2025 -

Programma Tileoptikon Metadoseon Kyriakis 11 5

May 30, 2025

Programma Tileoptikon Metadoseon Kyriakis 11 5

May 30, 2025 -

Savvato 15 3 Olokliromenos Odigos Tileoptikon Metadoseon

May 30, 2025

Savvato 15 3 Olokliromenos Odigos Tileoptikon Metadoseon

May 30, 2025