Today's European Market Update: Stocks And PMI Data

Table of Contents

Today's European market is showing significant movement, influenced by a variety of factors. This update provides a crucial overview of the current state of European stocks and the implications of the latest Purchasing Managers' Index (PMI) data. We'll analyze key economic indicators and their impact on investor sentiment. Understanding these trends is vital for navigating the complexities of the European market.

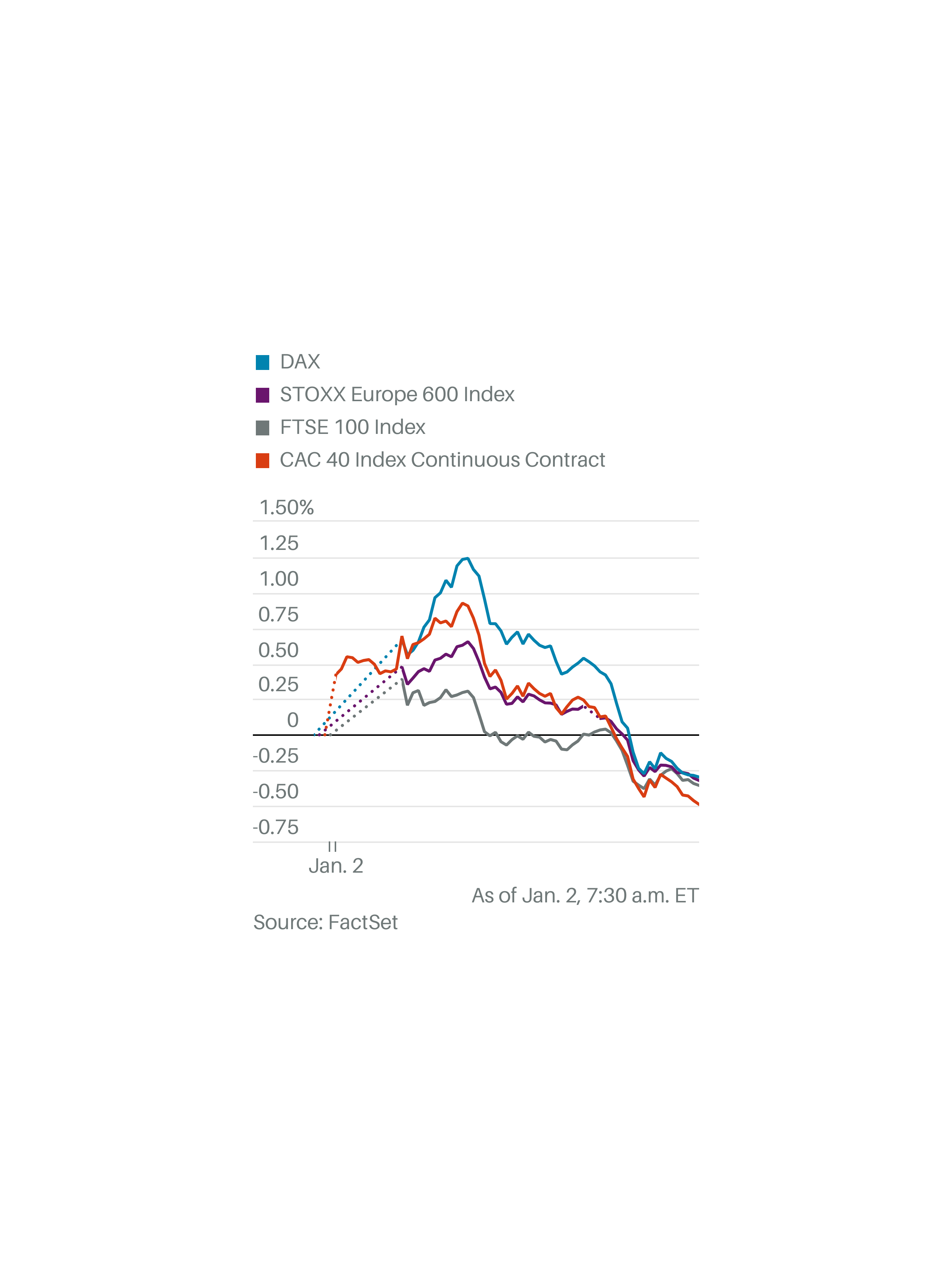

Stock Market Performance Across Major European Indices

Keywords: DAX, FTSE 100, CAC 40, European Stock Indices, Stock Market Volatility

Analyzing the performance of major European stock market indices provides a snapshot of the overall health of the European economy. Let's examine the DAX (Germany), FTSE 100 (UK), and CAC 40 (France) to understand the current market sentiment. Daily percentage changes, coupled with an analysis of contributing factors, offer crucial insights for investors.

-

DAX Performance and Contributing Factors: The DAX, a key indicator of German economic health, has shown [insert current DAX percentage change and direction - e.g., a slight increase of 0.2%]. This movement can be attributed to [insert specific factors affecting the DAX, e.g., positive corporate earnings reports in the automotive sector, concerns about rising inflation, or impacts from global events]. Strong performance in specific sectors, such as technology or manufacturing, can significantly influence the overall index.

-

FTSE 100 Performance and Contributing Factors: The FTSE 100, reflecting the UK's economic performance, is currently showing [insert current FTSE 100 percentage change and direction]. Factors contributing to this movement include [insert specific factors, e.g., the impact of Brexit on trade, fluctuations in the value of the pound, and performance within the banking and energy sectors].

-

CAC 40 Performance and Contributing Factors: The CAC 40, a benchmark for the French economy, exhibits [insert current CAC 40 percentage change and direction]. Key drivers behind this performance are [insert specific factors, e.g., developments within the luxury goods sector, government policies, and global market trends].

-

Comparison of Performance Across Indices: Comparing the performance of these three major indices provides a broader perspective on the European stock market. [Insert comparative analysis, e.g., While the DAX shows modest growth, the FTSE 100 is relatively flat, and the CAC 40 is experiencing a slight decline, indicating a diverse market response to current economic conditions].

-

Analysis of Sector-Specific Performance: Analyzing sector-specific performance within these indices reveals valuable information. For example, [insert specific sector examples and performance, e.g., the technology sector is outperforming other sectors across all three indices, suggesting positive investor sentiment towards tech stocks; while energy sector performance remains volatile due to geopolitical factors]. This granular view is crucial for identifying investment opportunities and managing risk.

Decoding the Latest PMI Data: Manufacturing and Services

Keywords: PMI, Purchasing Managers' Index, Manufacturing PMI, Services PMI, Economic Growth, Eurozone Economy

The Purchasing Managers' Index (PMI) provides valuable insights into the health of the Eurozone economy. We'll examine the latest PMI data for both the manufacturing and services sectors to gauge the overall economic outlook. Comparing current data with previous periods allows us to identify trends and predict future economic performance.

-

Eurozone Manufacturing PMI: The Eurozone Manufacturing PMI currently stands at [insert current value]. This [insert interpretation - e.g., indicates a contraction in manufacturing activity, suggesting a slowdown in the industrial sector]. Compared to last month's reading of [insert previous month's value], this represents [insert percentage change and direction]. Factors contributing to this include [insert potential contributing factors e.g., supply chain disruptions, energy price increases, and weakening global demand].

-

Eurozone Services PMI: The Eurozone Services PMI stands at [insert current value], indicating [insert interpretation - e.g., a modest expansion in the services sector]. This is [insert percentage change and direction] compared to last month's reading of [insert previous month's value]. The services sector seems more resilient, but [insert possible caveats and factors affecting the services sector, e.g., high inflation is beginning to impact consumer spending].

-

Analysis of the Relationship Between PMI Data and Stock Market Performance: The relationship between PMI data and stock market performance is often closely correlated. Strong PMI readings generally indicate economic growth, which positively affects investor sentiment and stock prices. Conversely, weak PMI data suggests economic contraction, potentially leading to lower stock prices and increased market volatility. [Insert specific observations related to the current relationship between PMI data and European stock market performance].

-

Potential Impact on Future Interest Rate Decisions by the European Central Bank (ECB): The ECB carefully monitors PMI data when making interest rate decisions. Weak PMI data might lead the ECB to maintain or even lower interest rates to stimulate economic activity. Strong PMI data, on the other hand, could indicate that interest rate hikes are necessary to control inflation.

Impact of Geopolitical Factors on European Markets

Keywords: Geopolitical Risk, European Union, Inflation, Energy Prices, Russia-Ukraine Conflict

Geopolitical events significantly impact European markets. The ongoing Russia-Ukraine conflict, the energy crisis, and persistent inflation are creating considerable uncertainty.

-

The Ongoing Impact of the Russia-Ukraine Conflict on the European Economy: The war continues to disrupt supply chains, increase energy prices, and fuel inflationary pressures across the Eurozone. This instability directly impacts investor confidence and market volatility.

-

The Influence of Energy Prices on Manufacturing and Service Sectors: Soaring energy prices are a major concern for European businesses, increasing production costs and impacting profitability across various sectors. This has a ripple effect, potentially hindering economic growth.

-

The Effect of Inflation on Consumer Spending and Business Investment: High inflation erodes consumer purchasing power, impacting demand for goods and services. Businesses face increased costs, potentially leading to reduced investment and hiring.

-

Assessment of Geopolitical Risk and its Impact on Market Sentiment: Geopolitical uncertainty creates volatility in the European market. Investors become cautious, potentially leading to capital flight and decreased investment in riskier assets.

Conclusion

This European market update reveals a dynamic situation influenced by a complex interplay of stock market performance, PMI data, and geopolitical factors. Understanding the current trends in European stocks and economic indicators is critical for informed investment decisions. The latest PMI figures offer insights into the health of the Eurozone economy, while geopolitical risks continue to shape market volatility.

Call to Action: Stay informed on the ever-changing landscape of the European market. Regularly check back for updated analyses on European stocks and PMI data to make well-informed investment choices. Understanding the intricacies of the European market is key to successful investing.

Featured Posts

-

Grand Ole Oprys Centennial Celebration A Star Studded London Show

May 23, 2025

Grand Ole Oprys Centennial Celebration A Star Studded London Show

May 23, 2025 -

Johnson Matthey Catalyst Unit Honeywells Hon Bid And Future Prospects

May 23, 2025

Johnson Matthey Catalyst Unit Honeywells Hon Bid And Future Prospects

May 23, 2025 -

Netflix Sirens Everything We Know About The Limited Series

May 23, 2025

Netflix Sirens Everything We Know About The Limited Series

May 23, 2025 -

Liga Natiunilor Rezultat Clar In Georgia Armenia 6 1

May 23, 2025

Liga Natiunilor Rezultat Clar In Georgia Armenia 6 1

May 23, 2025 -

Showrunner Explains How Netflixs Cobra Kai Connects To The Karate Kid

May 23, 2025

Showrunner Explains How Netflixs Cobra Kai Connects To The Karate Kid

May 23, 2025

Latest Posts

-

Problemi Ta Rishennya Pid Chas Remontu Pivdennogo Mostu

May 23, 2025

Problemi Ta Rishennya Pid Chas Remontu Pivdennogo Mostu

May 23, 2025 -

Pivdenniy Mist Kontrol Za Khodom Remontnikh Robit

May 23, 2025

Pivdenniy Mist Kontrol Za Khodom Remontnikh Robit

May 23, 2025 -

Analiz Vitrat Na Remont Pivdennogo Mostu

May 23, 2025

Analiz Vitrat Na Remont Pivdennogo Mostu

May 23, 2025 -

Pivdenniy Mist Aktualniy Stan Remontu Ta Maybutni Plani

May 23, 2025

Pivdenniy Mist Aktualniy Stan Remontu Ta Maybutni Plani

May 23, 2025 -

Reactiile La Revenirea Lui Andrew Tate In Dubai Controverse Si Perspective

May 23, 2025

Reactiile La Revenirea Lui Andrew Tate In Dubai Controverse Si Perspective

May 23, 2025