Thursday's Market Action: Deconstructing CoreWeave (CRWV)'s Significant Price Increase

Table of Contents

CoreWeave's Business Model and Competitive Advantage

CoreWeave's success is built on a foundation of specializing in high-performance cloud computing solutions, perfectly positioned to capitalize on the explosive growth of the Artificial Intelligence (AI) market. This strategic focus allows them to command a significant share of the increasing demand for powerful and scalable cloud infrastructure, differentiating them from more generalized cloud providers.

Focus on AI-Powered Cloud Computing

CoreWeave's primary competitive advantage lies in its dedication to providing the cutting-edge infrastructure crucial for AI development and deployment. This means:

- Leverages advanced GPU infrastructure: CoreWeave utilizes the latest generation of Graphics Processing Units (GPUs), the workhorses of AI model training, enabling faster and more efficient processing of vast datasets.

- Partnerships with leading AI companies: Strategic alliances with key players in the AI industry ensure a steady stream of high-profile clients and provide invaluable market insights. These partnerships solidify CoreWeave's position as a trusted provider within the AI ecosystem.

- Scalable infrastructure: The company's infrastructure is designed for rapid expansion, allowing them to seamlessly accommodate the ever-increasing computational demands of AI projects. This scalability is critical for attracting larger clients with fluctuating needs.

Sustainable and Efficient Infrastructure

Beyond its technological prowess, CoreWeave differentiates itself through its commitment to environmental sustainability. This resonates strongly with environmentally conscious investors and clients, a growing segment of the market.

- Use of renewable energy sources: CoreWeave actively incorporates renewable energy sources into its data center operations, minimizing its carbon footprint and contributing to a greener future.

- Efficient cooling systems: Implementing advanced cooling technologies significantly reduces energy consumption, lowering operational costs and environmental impact.

- ESG (Environmental, Social, and Governance) focus: This commitment to sustainability enhances its brand image, attracting investors increasingly focused on ESG factors and responsible business practices. This strengthens its long-term value proposition.

Recent News and Announcements Impacting CRWV Stock Price

The remarkable price increase in CRWV stock can be directly linked to a combination of positive media coverage, market speculation fueled by AI's popularity, and strategic company developments.

Positive Investor Sentiment & Market Speculation

The recent surge in investor interest in AI-related stocks has undoubtedly contributed to the positive sentiment surrounding CoreWeave.

- Positive media coverage: Analyze recent news articles and press releases focusing on CoreWeave's technological advancements and market successes. These stories reinforce positive investor sentiment.

- Key partnerships and contracts: Announcements of new strategic partnerships and substantial contracts signal increased market confidence and growth potential, attracting further investment.

- Overall AI sector sentiment: The broader positive outlook for the AI sector directly impacts the perception and valuation of companies like CoreWeave, which are central players in this growth.

Strategic Partnerships and Growth Prospects

CoreWeave's growth trajectory has been propelled by strategic partnerships and ambitious expansion plans.

- Revenue stream diversification: New collaborations introduce diverse revenue streams and reduce reliance on a single client base, improving the overall stability of the business.

- Market expansion: Expansion into new geographical markets or specialized segments within the AI industry increases market reach and potential for growth.

- Long-term growth potential: The successful implementation of these strategies underscores CoreWeave's significant long-term growth potential, attracting long-term investors.

Market Analysis and Future Outlook for CoreWeave (CRWV)

Understanding CoreWeave's position within the broader market requires a comprehensive evaluation of its valuation, performance, and potential risks.

Market Valuation and Stock Performance

Analyzing CoreWeave's valuation against its competitors is crucial for a well-rounded assessment.

- Stock performance relative to market indices: Comparing CRWV's performance to relevant indices (like the NASDAQ) provides context for its growth and volatility.

- Key financial metrics: Examining metrics such as the Price-to-Earnings ratio (P/E) and other key financial indicators helps determine if the current valuation is justified.

- Potential for appreciation or correction: Considering the current market conditions and CoreWeave's trajectory, analysts can project future price movements.

Risks and Challenges Facing CoreWeave

While the outlook for CoreWeave is promising, several factors could impact its future performance.

- Competitive landscape: The cloud computing market is highly competitive, with established giants constantly vying for market share. CoreWeave needs to maintain its innovative edge.

- Technological advancements: The rapid pace of technological change necessitates constant innovation to stay ahead of the curve. Falling behind could severely impact its competitiveness.

- Macroeconomic factors: Broader economic conditions (e.g., recessions, inflation) can significantly influence investor sentiment and overall demand for cloud computing services.

Conclusion

CoreWeave (CRWV)'s substantial price increase on Thursday reflects a combination of factors: its strategic focus on the high-growth AI cloud computing market, positive investor sentiment driven by recent news, and promising future growth prospects. While challenges exist, its strong position in the burgeoning AI sector suggests potential for continued success. However, thorough due diligence and a careful assessment of market risks are essential before investing in CoreWeave or any other stock. For a deeper dive into CoreWeave (CRWV) and its market performance, further research into the AI cloud computing sector is recommended. Continue your research into CoreWeave stock and make informed investment decisions.

Featured Posts

-

Juergen Klopp Geri Doenueyor Gelecegin Futbol Takimi

May 22, 2025

Juergen Klopp Geri Doenueyor Gelecegin Futbol Takimi

May 22, 2025 -

Nato Nun Tuerkiye Ve Italya Ya Verdigi Ortak Goerev

May 22, 2025

Nato Nun Tuerkiye Ve Italya Ya Verdigi Ortak Goerev

May 22, 2025 -

Colorado Gray Wolf Dies After Reintroduction To Wyoming A Report

May 22, 2025

Colorado Gray Wolf Dies After Reintroduction To Wyoming A Report

May 22, 2025 -

Tuerkiye Nato Nun Gelecegini Sekillendiriyor

May 22, 2025

Tuerkiye Nato Nun Gelecegini Sekillendiriyor

May 22, 2025 -

Noumatrouff Mulhouse Echo Du Hellfest

May 22, 2025

Noumatrouff Mulhouse Echo Du Hellfest

May 22, 2025

Latest Posts

-

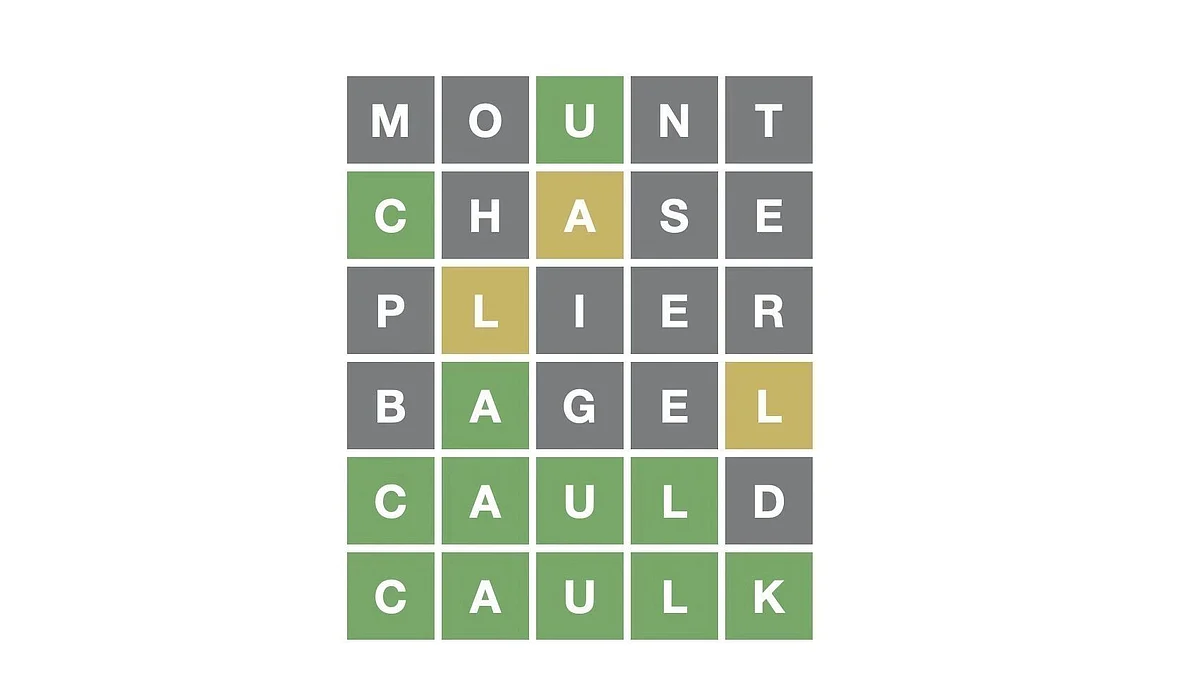

Wordle Game 370 March 20 Hints Clues And Solution

May 22, 2025

Wordle Game 370 March 20 Hints Clues And Solution

May 22, 2025 -

Solve Wordle April 26 2025 Hints And Solution For Puzzle 1407

May 22, 2025

Solve Wordle April 26 2025 Hints And Solution For Puzzle 1407

May 22, 2025 -

Wordle 370 Solution Clues And Answer For March 20th

May 22, 2025

Wordle 370 Solution Clues And Answer For March 20th

May 22, 2025 -

Wordle Today 370 March 20 Hints Clues And The Answer

May 22, 2025

Wordle Today 370 March 20 Hints Clues And The Answer

May 22, 2025 -

Todays Wordle Puzzle March 26 Nyt Wordle Solution

May 22, 2025

Todays Wordle Puzzle March 26 Nyt Wordle Solution

May 22, 2025