Thursday's CoreWeave (CRWV) Stock Dip: Factors Contributing To The Decline

Table of Contents

Broader Market Downturn and Tech Sector Weakness

The CoreWeave (CRWV) stock dip didn't occur in isolation. A general market correction or negative investor sentiment significantly impacted tech stocks, especially those in the high-growth segment like CRWV. Thursday saw a downturn across major market indices, with the Nasdaq, a bellwether for technology companies, experiencing a notable decline. This broader market weakness created a negative environment for even fundamentally strong companies, influencing CRWV's share price negatively.

- Overall market volatility influenced CRWV's price. The interconnected nature of the global financial markets means that a downturn in one sector can easily impact others.

- Negative sentiment towards high-growth tech stocks. Investors often become more risk-averse during market corrections, leading to selling pressure on companies perceived as riskier, even if their fundamentals remain strong.

- Increased risk aversion among investors. Uncertainty in the broader economic climate often pushes investors towards safer investments, leading to capital outflow from high-growth, albeit volatile, stocks.

- Correlation with broader tech index performance. CRWV's performance is intrinsically linked to the overall performance of the technology sector and relevant indices.

Profit-Taking and Speculative Trading

The sharp rise in CRWV stock price prior to Thursday's dip likely led to profit-taking by some investors. After significant gains, some investors chose to secure their profits, resulting in selling pressure. Furthermore, speculative trading, characterized by short-term trading based on price fluctuations rather than fundamental analysis, can amplify short-term price volatility. Increased trading volume on Thursday might indicate a significant amount of profit-taking activity.

- Investors cashing out after CRWV's initial price surge. This is a natural market reaction following a period of rapid growth.

- Short-term speculative trading driving price volatility. Speculative traders often contribute to amplified price swings, regardless of underlying company performance.

- Increased trading volume indicative of profit-taking. High trading volume coupled with a price drop suggests significant selling activity.

- Potential for short-selling influencing the decline. Short-selling, where investors borrow and sell shares hoping to buy them back at a lower price, can exacerbate downward price movements.

Concerns Regarding Future Growth and Competition

While CoreWeave operates in a rapidly expanding market, concerns about its future growth trajectory and increasing competition likely played a role in Thursday's stock dip. The cloud computing and AI infrastructure market is becoming increasingly crowded, with established players and new entrants vying for market share. This competitive landscape poses challenges for all companies in the sector, including CoreWeave.

- Increased competition in the cloud computing and AI infrastructure market. Established players and new entrants are constantly innovating and expanding their offerings.

- Concerns about sustaining high growth rates. Maintaining rapid growth in a competitive market is a significant challenge for any company.

- Analysis of competitor strategies and market share. Investors constantly assess the competitive landscape and potential market share shifts.

- Potential impact of new technological advancements on CRWV. Rapid technological advancements can quickly render existing technologies obsolete, posing a risk to companies unable to adapt quickly.

Lack of Catalyzing News or Positive Developments

The absence of positive news or announcements from CoreWeave on Thursday further contributed to the negative sentiment. Without positive catalysts—such as new partnerships, significant contract wins, or positive earnings reports—investor confidence can wane, leading to selling pressure. The lack of bullish analyst ratings or price target upgrades also likely impacted investor sentiment.

- No significant positive announcements from the company. A lack of positive news creates a vacuum that negative speculation can fill.

- Absence of bullish analyst ratings or price target upgrades. Analyst opinions significantly influence investor decisions.

- Lack of major partnerships or contract wins. Strategic partnerships and large contracts are crucial for growth in this sector.

- Potential for negative news affecting investor sentiment (even in the absence of explicit news). Market rumors and speculation can negatively influence investor sentiment even without confirmed negative news.

Conclusion

The CoreWeave (CRWV) stock dip on Thursday was likely a confluence of factors. Broader market conditions, profit-taking, concerns about future growth and competition, and a lack of positive news all contributed to the decline. Understanding these dynamics is crucial for investors to make informed decisions. To stay updated on CoreWeave (CRWV) stock performance and future prospects, continue monitoring financial news and market trends. Remember to conduct thorough research and consider consulting a financial advisor before making any investment decisions related to CoreWeave (CRWV) or any other stock. Careful analysis of the CoreWeave (CRWV) stock dip and its underlying causes will be key to navigating the volatility of this dynamic market.

Featured Posts

-

Wtt Announces Groundbreaking Competitive Model At Press Conference

May 22, 2025

Wtt Announces Groundbreaking Competitive Model At Press Conference

May 22, 2025 -

Vstup Ukrayini Do Nato Golovna Nebezpeka Za Slovami Yevrokomisara

May 22, 2025

Vstup Ukrayini Do Nato Golovna Nebezpeka Za Slovami Yevrokomisara

May 22, 2025 -

Is Googles Ai Strategy Winning Over Investors

May 22, 2025

Is Googles Ai Strategy Winning Over Investors

May 22, 2025 -

Succession Planning For High Net Worth Individuals Challenges And Strategies

May 22, 2025

Succession Planning For High Net Worth Individuals Challenges And Strategies

May 22, 2025 -

Teroerizm Ve Deniz Guevenligi Antalya Da Nato Parlamenter Asamblesi Nin Guendemi

May 22, 2025

Teroerizm Ve Deniz Guevenligi Antalya Da Nato Parlamenter Asamblesi Nin Guendemi

May 22, 2025

Latest Posts

-

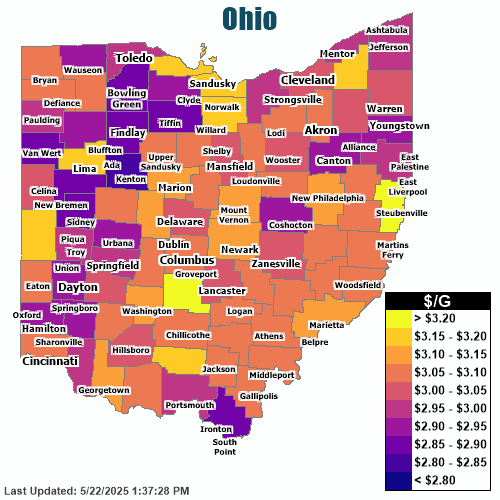

Wide Gas Price Range In Columbus 2 83 3 31 Gallon

May 22, 2025

Wide Gas Price Range In Columbus 2 83 3 31 Gallon

May 22, 2025 -

Solve Nyt Wordle 1368 March 18 Hints And The Answer

May 22, 2025

Solve Nyt Wordle 1368 March 18 Hints And The Answer

May 22, 2025 -

Columbus Gas Station Prices Vary By 48 Cents

May 22, 2025

Columbus Gas Station Prices Vary By 48 Cents

May 22, 2025 -

Wordle 367 March 17th Hints Clues And Answer

May 22, 2025

Wordle 367 March 17th Hints Clues And Answer

May 22, 2025 -

Columbus Gas Prices 2 83 To 3 31 Per Gallon

May 22, 2025

Columbus Gas Prices 2 83 To 3 31 Per Gallon

May 22, 2025