Three More Rate Cuts Predicted By Desjardins For Bank Of Canada

Table of Contents

Desjardins' Rationale Behind the Prediction

Desjardins' forecast of three additional Bank of Canada rate cuts stems from a careful analysis of several key economic indicators. Their prediction hinges on a confluence of factors pointing towards a potential economic slowdown. This forecast is not made lightly; it's based on a thorough review of current economic data and trends.

-

Weakening Economic Growth in Canada: Desjardins cites slowing GDP growth as a primary concern. Recent economic data reveals a deceleration in several key sectors, suggesting a potential weakening of the overall Canadian economy. This sluggish growth warrants a more accommodative monetary policy.

-

Persistent but Easing Inflation: While inflation remains a concern, Desjardins notes a gradual easing of inflationary pressures. While still above the Bank of Canada's target, the downward trend suggests that aggressive interest rate hikes may no longer be necessary. The easing inflation is a key factor in their prediction for Bank of Canada rate cuts.

-

Potential for a Recession: The risk of a recession in Canada is another significant element in Desjardins' analysis. A proactive approach of lowering interest rates could act as a preventative measure, stimulating economic activity and mitigating the potential severity of a downturn. This is a crucial element of their reasoning for predicting Bank of Canada rate cuts.

-

Comparison to Other Economic Forecasts: It is important to note that Desjardins' forecast isn't made in isolation. While the specifics may vary, many other economic analysts have also projected a slowing Canadian economy, supporting the prediction of further interest rate reductions by the Bank of Canada.

-

Analysis of Current Bank of Canada Statements: Desjardins' prediction also considers recent statements and communications from the Bank of Canada itself. While the Bank hasn't explicitly committed to further cuts, their recent tone suggests a willingness to adjust monetary policy based on incoming economic data. This analysis is crucial to their forecast of future Bank of Canada rate cuts.

The Impact of Three More Rate Cuts on the Canadian Economy

The predicted three interest rate cuts by the Bank of Canada could have far-reaching consequences for the Canadian economy, impacting various sectors differently. Understanding these potential impacts is crucial for both businesses and individuals.

-

Lower Borrowing Costs for Businesses and Consumers: Lower interest rates translate directly into reduced borrowing costs for businesses and consumers. This could stimulate investment, leading to increased economic activity and job creation. Lower borrowing costs are a direct result of Bank of Canada rate cuts.

-

Potential Boost to Consumer Spending and Investment: Lower borrowing costs could encourage consumers to increase spending and businesses to invest more, thereby stimulating economic growth. This increased economic activity is a key benefit of potential Bank of Canada rate cuts.

-

Impact on the Housing Market (Mortgage Rates): A reduction in interest rates will likely lead to lower mortgage rates, potentially boosting the housing market. This could make homeownership more accessible and stimulate activity within the real estate sector, a significant component of the Canadian economy. Lower mortgage rates are directly linked to the anticipated Bank of Canada rate cuts.

-

Effects on the Canadian Dollar Exchange Rate: Lower interest rates might weaken the Canadian dollar relative to other currencies. This could benefit export-oriented industries but could also lead to increased import costs. The impact on the exchange rate is one of the economic side effects of Bank of Canada rate cuts.

-

Risks Associated with Lower Interest Rates (e.g., Inflation Resurgence): While lower interest rates can stimulate the economy, there's a risk of reigniting inflation. This is a key consideration for the Bank of Canada as they weigh the benefits of further rate cuts against the potential for renewed inflationary pressures. This represents a crucial risk assessment for the potential future Bank of Canada rate cuts.

What Should Canadians Do in Response to This Forecast?

The potential for three more Bank of Canada rate cuts necessitates proactive financial planning and adjustments. Canadians should consider the following steps:

-

Review Existing Mortgages and Consider Refinancing Opportunities: Lower interest rates could present an opportunity to refinance existing mortgages at a lower rate, saving significant money over the life of the loan.

-

Re-evaluate Personal Debt Management Strategies: Reduced interest rates can make it easier to manage debt, offering a chance to consolidate high-interest debt or accelerate repayment plans.

-

Adjust Investment Portfolios to Account for Potential Changes in Interest Rates: Lower interest rates typically impact different investment asset classes differently. Adjusting portfolios to align with the anticipated changes can help optimize returns.

-

Consult with a Financial Advisor for Personalized Guidance: Seeking professional financial advice is crucial to developing a personalized strategy that aligns with individual financial goals and risk tolerance in light of the potential Bank of Canada rate cuts.

Conclusion:

Desjardins' prediction of three more Bank of Canada interest rate cuts underscores the importance of understanding the evolving economic landscape and adapting financial strategies accordingly. The rationale behind this forecast centers on weakening economic growth, easing inflation, and recessionary risks. The potential impacts on the Canadian economy are significant, affecting everything from mortgage rates and borrowing costs to consumer spending and investment. Canadians should proactively review their financial plans, consider refinancing opportunities, and seek professional advice to navigate these potential changes effectively. Stay updated on Bank of Canada interest rate announcements and plan your finances effectively based on potential interest rate cuts to manage your financial situation in this changing interest rate environment.

Featured Posts

-

Cassidy Hutchinsons Memoir A Jan 6 Witness Account

May 24, 2025

Cassidy Hutchinsons Memoir A Jan 6 Witness Account

May 24, 2025 -

Open Ai And Jony Ive The Potential For A Strategic Partnership In Ai Hardware

May 24, 2025

Open Ai And Jony Ive The Potential For A Strategic Partnership In Ai Hardware

May 24, 2025 -

Escape To The Country Choosing The Right Rural Property

May 24, 2025

Escape To The Country Choosing The Right Rural Property

May 24, 2025 -

Universals Epic 7 Billion Theme Park A New Era In The Disney Universal Rivalry

May 24, 2025

Universals Epic 7 Billion Theme Park A New Era In The Disney Universal Rivalry

May 24, 2025 -

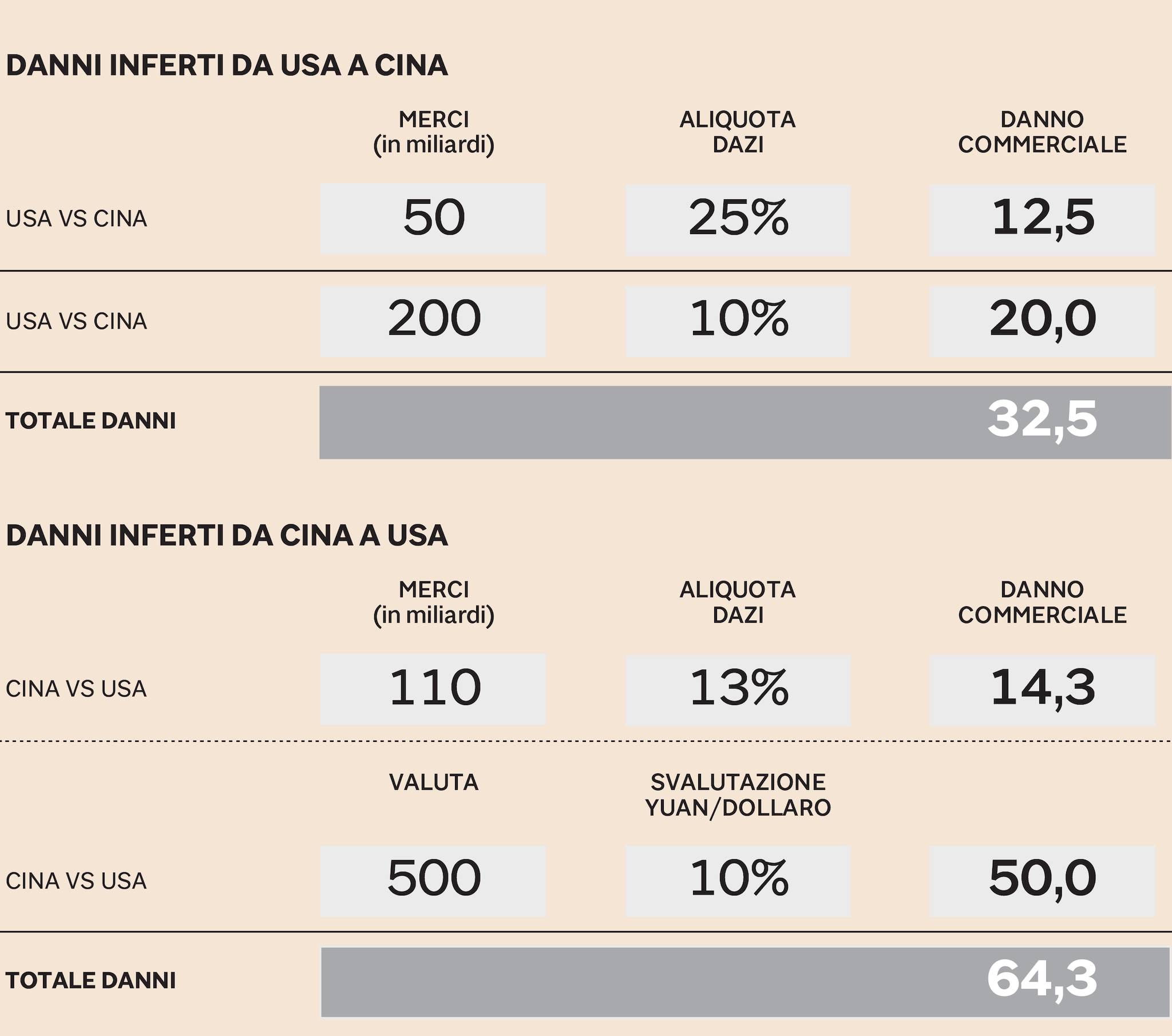

Guerra Dei Dazi Le Borse Crollano La Ue Risponde

May 24, 2025

Guerra Dei Dazi Le Borse Crollano La Ue Risponde

May 24, 2025

Latest Posts

-

The Last Rodeo Neal Mc Donoughs Standout Role

May 24, 2025

The Last Rodeo Neal Mc Donoughs Standout Role

May 24, 2025 -

Neal Mc Donough Rides Tall A Look At The Last Rodeo

May 24, 2025

Neal Mc Donough Rides Tall A Look At The Last Rodeo

May 24, 2025 -

Memorial Day 2025 Your Guide To Unbeatable Sales And Deals

May 24, 2025

Memorial Day 2025 Your Guide To Unbeatable Sales And Deals

May 24, 2025 -

Best Memorial Day Sales 2025 A Shopping Experts Selection

May 24, 2025

Best Memorial Day Sales 2025 A Shopping Experts Selection

May 24, 2025 -

2025 Memorial Day Sales Find The Best Deals Now

May 24, 2025

2025 Memorial Day Sales Find The Best Deals Now

May 24, 2025