This Week's Bitcoin Mining Surge: A Detailed Look

Table of Contents

Increased Difficulty and Miner Profitability

Hash Rate Explained

The hash rate represents the total computational power dedicated to Bitcoin mining across the entire network. It's measured in hashes per second (H/s) and is a crucial indicator of the network's security and health. A higher hash rate means more computational power is securing the blockchain, making it more resistant to attacks like 51% attacks.

- Relationship between hash rate and Bitcoin's security: A higher hash rate makes it exponentially more difficult and expensive for malicious actors to control a majority of the network's hashing power, thereby enhancing the security of the Bitcoin blockchain.

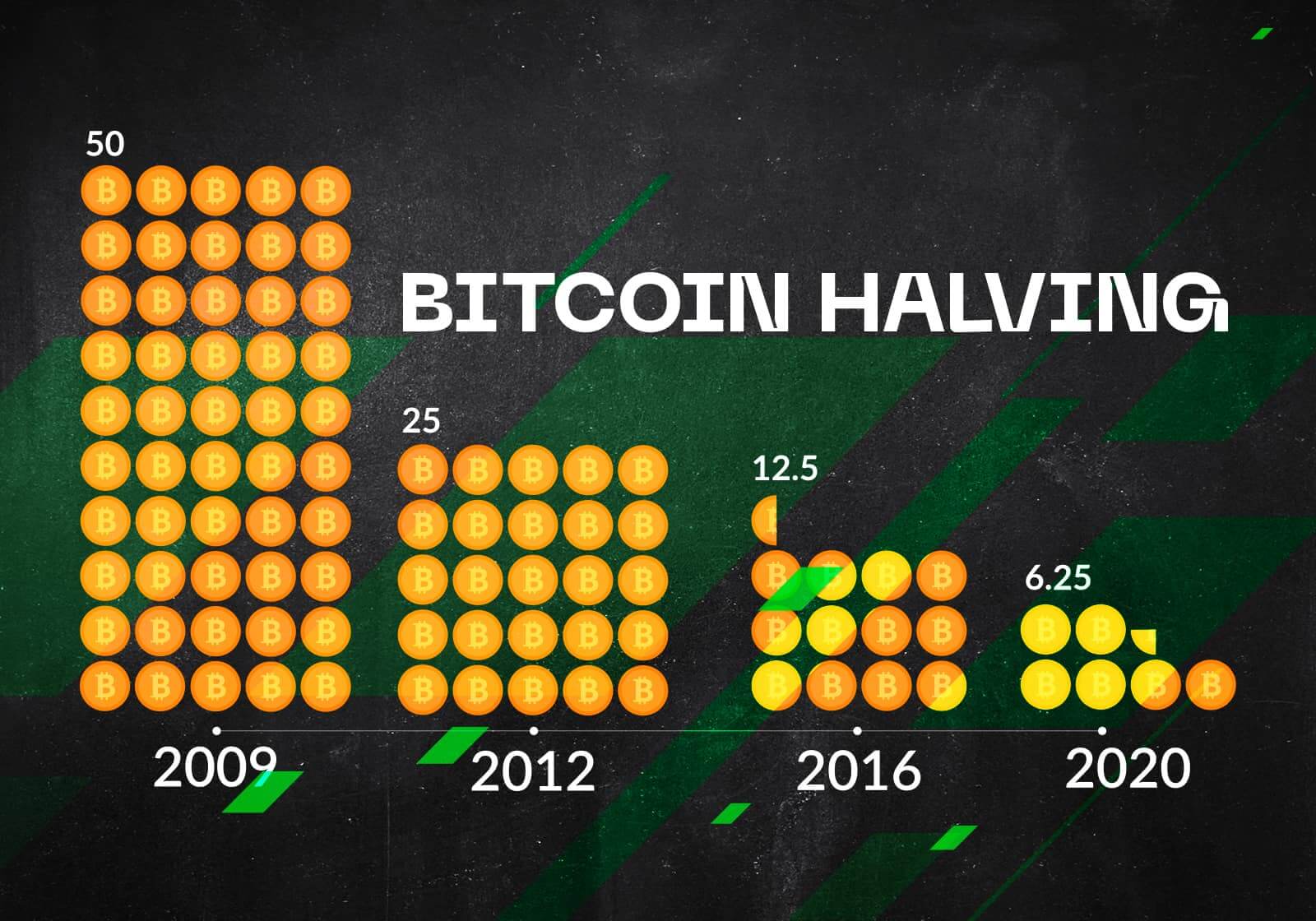

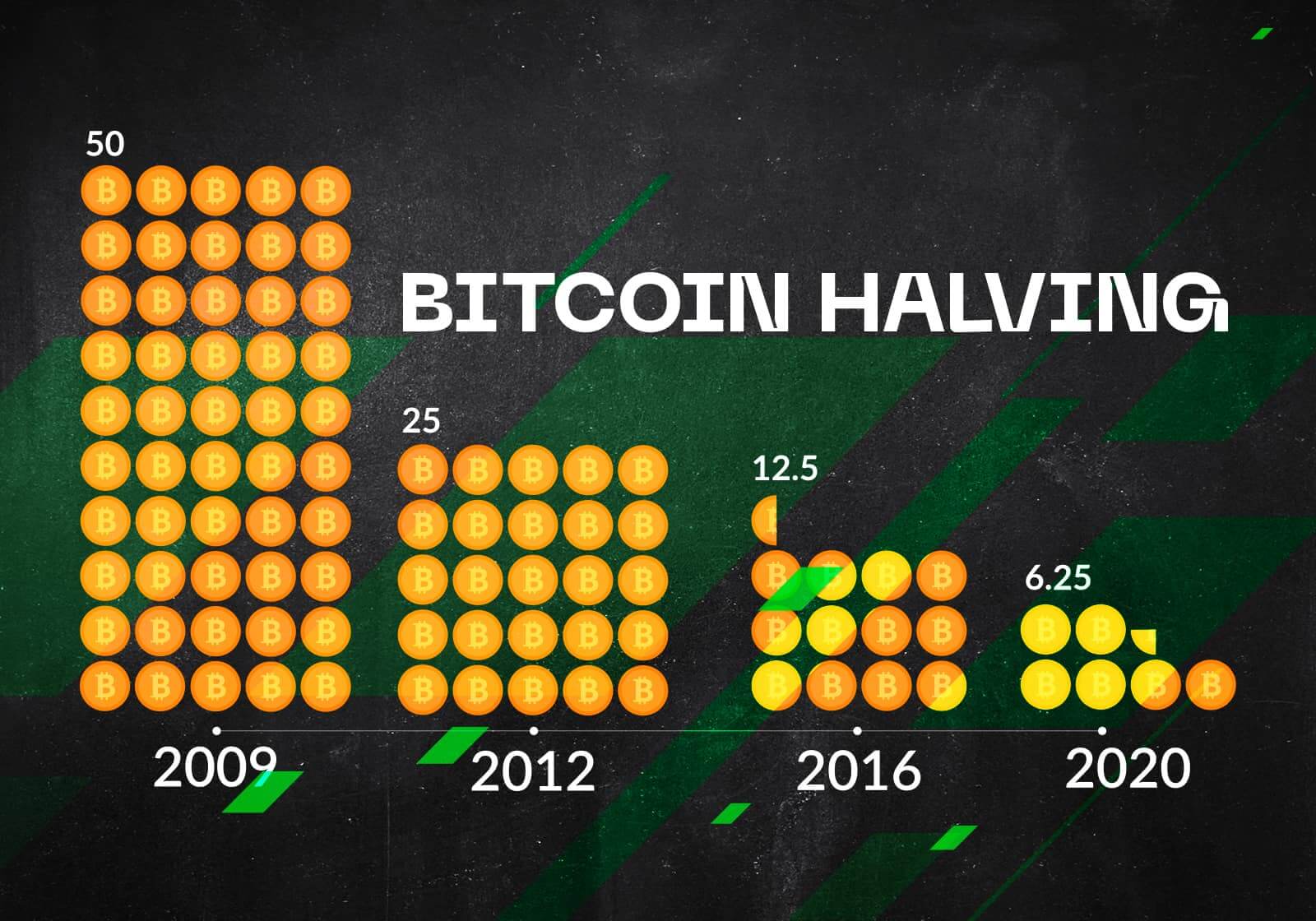

- How difficulty adjustments affect miner profitability: Bitcoin's difficulty adjusts automatically every 2016 blocks (approximately every two weeks) to maintain a consistent block generation time of around 10 minutes. If the hash rate increases, the difficulty increases proportionally, making mining slightly less profitable. Conversely, a decrease in hash rate leads to a difficulty decrease, making mining more profitable.

- Impact of the recent difficulty increase on miners: While the recent Bitcoin mining surge initially led to higher profitability, the subsequent difficulty adjustment partially offset this gain. Miners still likely experienced increased rewards due to the overall rise in hash rate.

- Data points showing the increase in hash rate this week: [Insert chart or graph visually representing the hash rate increase. Source the data from a reputable website like Blockchain.com or similar.]

The interplay between mining difficulty and profitability is a dynamic equilibrium. A higher hash rate generally leads to increased network security, although individual miner profitability might fluctuate depending on the interplay of these factors and electricity costs.

Influx of New Mining Hardware and Capacity

Advanced Mining Equipment

The Bitcoin mining industry is constantly evolving, with advancements in Application-Specific Integrated Circuit (ASIC) technology playing a significant role in boosting the hash rate. New, more efficient ASIC miners are consistently being released, allowing miners to process transactions more quickly and efficiently.

- Specific new hardware releases and their impact: [Mention specific examples of recently released ASIC miners and their reported hash rates. Link to manufacturer websites for verification.]

- Impact of improved mining efficiency on profitability: More efficient miners lower the cost per hash, improving profitability even with difficulty adjustments. This encourages further investment in new hardware and contributes to the overall Bitcoin mining surge.

- Potential for future hardware upgrades to further increase hash rate: Ongoing technological advancements promise even more powerful and energy-efficient ASIC miners in the future, potentially leading to even greater increases in hash rate.

The continuous development and deployment of advanced mining equipment significantly influence the overall hash rate, fueling the competitive landscape of Bitcoin mining.

Price Volatility and Miner Behavior

Bitcoin Price Influence

Bitcoin's price is intrinsically linked to miner profitability. Higher Bitcoin prices translate to higher rewards for successfully mined blocks, incentivizing more miners to participate and increasing the hash rate.

- Correlation between Bitcoin price and hash rate: Historically, there's a strong positive correlation between Bitcoin's price and its hash rate. As the price rises, so does the incentive to mine, leading to an increased hash rate.

- Impact of recent price fluctuations on the mining surge: [Analyze recent Bitcoin price movements and their correlation with the observed hash rate increase. Were there any significant price jumps preceding or coinciding with the surge?]

- Significant price predictions and their potential effects: While predicting Bitcoin's price is speculative, positive price forecasts can influence miner behavior, encouraging investment in new hardware and leading to a higher hash rate.

Miner behavior is heavily influenced by Bitcoin's price. Price volatility creates periods of both increased and decreased activity, directly impacting the overall hash rate.

Regulatory Changes and Geopolitical Factors

Regulatory Landscape

Regulatory changes concerning Bitcoin mining in different regions can significantly impact the global hash rate distribution.

- How new regulations might drive miners to different jurisdictions: Stricter regulations in one region (e.g., increased energy costs, outright bans) can cause miners to relocate to regions with more favorable policies, potentially shifting the global hash rate distribution.

- Impact of energy policies on Bitcoin mining activity: Energy costs are a major factor for miners. Regions with cheap and abundant energy sources attract more mining operations, potentially contributing to a global hash rate increase.

- Geopolitical events that might have influenced the recent surge: [Discuss any significant geopolitical events that might have indirectly influenced the Bitcoin mining surge, such as changes in energy prices in specific regions, or shifts in political stability impacting mining operations.]

The interplay between regulatory frameworks and geopolitical events adds another layer of complexity to understanding fluctuations in the Bitcoin mining landscape.

Conclusion

This week's Bitcoin mining surge is a multifaceted event resulting from several interconnected factors. The increase in hash rate, driven by increased miner profitability, new mining hardware, price fluctuations, and potentially regulatory changes, underscores the dynamic nature of the Bitcoin network. Understanding these contributing factors is critical for predicting future trends in Bitcoin mining and its overall impact on the cryptocurrency's security and value. To stay informed about future fluctuations and understand the implications of the ongoing Bitcoin mining surge, continue to monitor industry news and analysis.

Featured Posts

-

Obyavlenie Aeroport Permi Zakryt Do 4 00 Iz Za Snegopada

May 09, 2025

Obyavlenie Aeroport Permi Zakryt Do 4 00 Iz Za Snegopada

May 09, 2025 -

Trumps Houthi Truce Shippers Remain Skeptical

May 09, 2025

Trumps Houthi Truce Shippers Remain Skeptical

May 09, 2025 -

Tatum Praises Curry An Honest Take Following The Nba All Star Game

May 09, 2025

Tatum Praises Curry An Honest Take Following The Nba All Star Game

May 09, 2025 -

Is A Trillion Dollar Palantir Stock Realistic By 2030

May 09, 2025

Is A Trillion Dollar Palantir Stock Realistic By 2030

May 09, 2025 -

Abc Series Actors Reunite In High Potential Finale Episode

May 09, 2025

Abc Series Actors Reunite In High Potential Finale Episode

May 09, 2025