The Wall Street Rally: Upending Bear Market Predictions

Table of Contents

Unexpected Economic Resilience

The strength of the recent Wall Street rally is largely attributable to a surprisingly resilient economy. Initial forecasts painted a grim picture, but the reality has been far more positive, fueling investor confidence and contradicting many bear market predictions.

Stronger-than-Expected Economic Data

Recent economic indicators have painted a more optimistic picture than many analysts predicted. This positive data has significantly boosted investor confidence and contributed to the stock market rally.

- Positive GDP growth: Several quarters have shown surprisingly strong GDP growth figures, exceeding initial forecasts and demonstrating the economy's ability to withstand various headwinds.

- Falling unemployment rates: Unemployment figures have remained remarkably low, signaling a healthy labor market and strong consumer spending power.

- Robust consumer spending: Consumer confidence remains relatively high, leading to consistent spending which is a vital engine for economic growth.

- Resilient corporate earnings: Many companies have reported stronger-than-expected earnings, showcasing the enduring strength of the corporate sector. This positive corporate performance directly impacts stock prices and overall market sentiment.

Inflation Cooling More Quickly Than Anticipated

The faster-than-expected cooling of inflation has played a critical role in the Wall Street rally. This has led to a reassessment of the risks associated with a prolonged bear market.

- Decreasing inflation rates: Inflation, a major concern for many investors, has shown signs of slowing down more rapidly than anticipated. This reduction in inflation eases pressure on the Federal Reserve and creates a more favorable environment for the stock market.

- Federal Reserve policy impact: The Federal Reserve's monetary policy adjustments, while still aiming to control inflation, appear to be having a less detrimental effect on economic growth than initially feared.

- Easing supply chain pressures: Easing supply chain disruptions have contributed to lower prices for goods and services, further contributing to the decline in inflation.

Shifting Investor Sentiment

The Wall Street rally is not just driven by economic data; a significant shift in investor sentiment has also played a crucial role.

Increased Risk Appetite

Investors are increasingly moving away from safe-haven assets like government bonds and increasing their investments in equities. This shift reflects a growing optimism about future market performance.

- Investors moving away from safe haven assets: The search for higher yields has driven investors to move away from the perceived safety of government bonds, increasing their risk appetite and driving investment into the stock market.

- Increased investment in equities: Increased investment in equities demonstrates a growing belief in the potential for future growth and profits in the stock market.

- Growing optimism about future market performance: A more optimistic outlook among investors is a crucial driver of the current market rally.

Technological Advancements and Innovation

Positive developments in various technological sectors are boosting investor confidence and contributing to the upward trend.

- Positive developments in AI: Breakthroughs in Artificial Intelligence are driving significant investment and innovation, promising substantial future growth. Companies leading in AI are seeing substantial stock price increases.

- Advancements in renewable energy: The growth of the renewable energy sector is attracting considerable investment, offering both financial returns and environmental benefits.

- Breakthroughs in biotechnology: Advancements in biotechnology are generating significant excitement and driving investments in related companies and sectors, contributing to the overall market strength.

Geopolitical Factors and Their Impact

Geopolitical factors, while always present, have played a surprisingly muted role in recent market movements.

Unexpected Geopolitical Stability

A relative period of calm in certain geopolitical hotspots has contributed to reduced market uncertainty and bolstered investor confidence.

- Easing of certain geopolitical tensions: A reduction in tensions in specific regions has reduced some of the uncertainties that often negatively impact market performance.

- Positive diplomatic developments: Positive developments in international relations have helped to create a more stable global environment.

- Improved international relations: Improved international cooperation and diplomacy have lessened some of the risks associated with geopolitical instability.

Unexpected Resilience in Specific Sectors

Certain sectors have displayed remarkable resilience, contributing significantly to the overall market rally.

- Strong performance in technology: The technology sector has shown impressive growth, fueled by innovation and strong investor demand.

- Strong performance in energy: The energy sector has benefited from geopolitical factors and increased global demand, further contributing to the overall market strength.

- Strong performance in other key sectors: Other key sectors, depending on the overall economic climate, may also show unexpectedly strong performance, supporting the market rally.

Conclusion

The unexpected Wall Street rally presents a complex picture, defying initial bear market predictions. While several factors, including economic resilience, shifting investor sentiment, and geopolitical developments, have contributed to this surge, it's crucial to maintain a balanced perspective. While the rally is encouraging, caution remains warranted. Investors should carefully analyze their portfolios and adjust their investment strategies accordingly, considering the ongoing uncertainties in the global economic landscape. Understanding the forces driving this Wall Street rally is vital for navigating the current market climate and making informed decisions regarding your investments. Continue to monitor the economic indicators and geopolitical landscape to make informed decisions about your Wall Street investment strategy.

Featured Posts

-

Vozvraschenie Stivena Kinga V X Oskorblenie Ilona Maska

May 10, 2025

Vozvraschenie Stivena Kinga V X Oskorblenie Ilona Maska

May 10, 2025 -

Celebrity Antiques Road Trip A Guide To The Show And Its Treasures

May 10, 2025

Celebrity Antiques Road Trip A Guide To The Show And Its Treasures

May 10, 2025 -

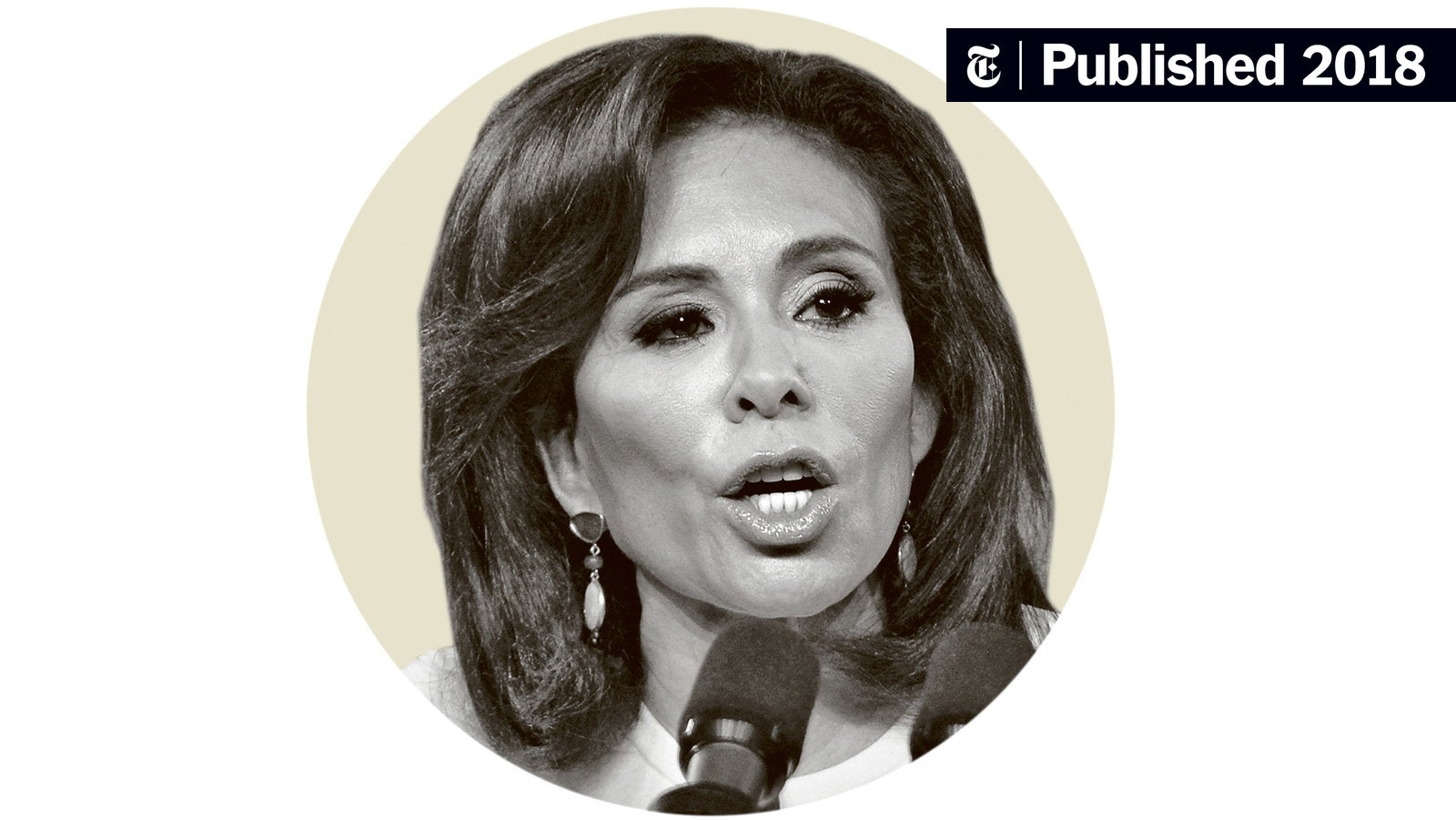

Jeanine Pirros Controversial Stance On Due Process And El Salvador Deportations

May 10, 2025

Jeanine Pirros Controversial Stance On Due Process And El Salvador Deportations

May 10, 2025 -

Ovechkins Record 9 Players With The Potential To Break It

May 10, 2025

Ovechkins Record 9 Players With The Potential To Break It

May 10, 2025 -

Letartoztattak Floridaban Egy Transznemu Not A Noi Mosdo Hasznalataert

May 10, 2025

Letartoztattak Floridaban Egy Transznemu Not A Noi Mosdo Hasznalataert

May 10, 2025