The Unexpected Heir: A Canadian Billionaire's Path To Potential Warren Buffett Succession

Table of Contents

The Unlikely Rise of Robert MacMillan: From Humble Beginnings to Billionaire Status

Keywords: Humble Beginnings, Entrepreneurial Journey, Business Success, Canadian Entrepreneur, Self-Made Billionaire

Robert MacMillan's journey is a testament to the power of perseverance and innovative thinking within the Canadian entrepreneurial landscape. Born in a small rural town in Nova Scotia, his early life was far from luxurious. His entrepreneurial spirit blossomed early; he started his first business – a small lawn-mowing service – at the age of 12, reinvesting his earnings into expanding his operations.

- Early Life and Career: MacMillan's early experiences instilled in him a strong work ethic and a keen understanding of the value of a dollar. This foundation proved invaluable as he navigated the complexities of the business world.

- Key Moments and Decisions: A pivotal moment came when he took a significant risk and invested his savings in a fledgling tech company. This gamble paid off immensely, laying the groundwork for his future success. He consistently demonstrated an ability to identify undervalued opportunities and capitalize on them.

- Entrepreneurial Spirit and Innovation: MacMillan's success isn't solely attributable to luck. He consistently demonstrated a unique entrepreneurial spirit, adapting to market changes and embracing innovative business models. His willingness to take calculated risks set him apart from his peers.

- Successful Business Ventures: His portfolio includes successful ventures in technology, renewable energy, and real estate, each showcasing his diverse business acumen and strategic investment prowess within the Canadian business context. He masterfully navigated the challenges inherent in building a self-made billionaire empire in Canada.

Investment Strategies Mirroring the Oracle of Omaha: A Comparative Analysis

Keywords: Warren Buffett Investment Strategy, Value Investing, Long-Term Investments, Canadian Investment Strategy, Portfolio Diversification

MacMillan's investment philosophy shares striking similarities with Warren Buffett's approach, emphasizing long-term value and avoiding short-term market fluctuations. Both prioritize fundamental analysis and a deep understanding of a company's intrinsic worth before investing.

- Comparison with Buffett's Strategy: Like Buffett, MacMillan focuses on value investing, seeking out undervalued companies with strong fundamentals and long-term growth potential. He avoids speculative investments and prefers companies with proven track records and stable cash flows.

- Examples of Mirroring Investments: His investment in [Specific example of a company mirroring Buffett's style] exemplifies this long-term, value-oriented approach, demonstrating a clear parallel to Buffett's investment strategy.

- Risk Tolerance and Long-Term Strategies: MacMillan's investment decisions reflect a patient, long-term perspective, mirroring Buffett's aversion to short-term market volatility. He maintains a diversified portfolio to mitigate risk.

- Role of Value Investing: Value investing is the cornerstone of MacMillan's success. By meticulously researching and identifying undervalued assets, he has consistently generated significant returns over the long term. His approach effectively showcases the power of value investing within the Canadian investment landscape.

Succession Planning: Challenges and Opportunities for the Next Generation

Keywords: Business Succession Planning, Wealth Transfer, Family Business, Next Generation Leadership, Succession Strategies

The successful transition of MacMillan's business empire to the next generation presents both significant challenges and opportunities. Effective succession planning is crucial to maintain the company's legacy and continued growth.

- Challenges of Wealth Transfer: Transferring both wealth and the mantle of leadership within a family business requires careful consideration of tax implications, family dynamics, and the next generation's preparedness to assume responsibility.

- Strategies for Smooth Transition: Mentorship programs, phased transitions of responsibility, and clear communication within the family are crucial components of a successful succession plan. Professional advice from wealth management experts is also essential.

- Impact of Next Generation Involvement: The level of involvement and preparedness of the next generation will significantly impact the success of the transition. Providing them with sufficient training and experience is crucial.

- Risks and Opportunities: Potential risks include family disputes and disagreements over leadership. However, a well-planned succession can also unlock new opportunities for growth and innovation, leveraging the fresh perspectives and expertise of the next generation.

The Future of Robert MacMillan's Empire: Maintaining Legacy and Continued Growth

Keywords: Business Legacy, Long-Term Growth, Future of Business, Sustainable Business Practices, Corporate Social Responsibility

MacMillan's long-term vision extends beyond personal wealth accumulation. His commitment to sustainability and corporate social responsibility plays a vital role in shaping the future direction of his business empire.

- Long-Term Vision and Future Direction: The company's commitment to sustainable practices and technological innovation is essential for ensuring long-term viability and growth.

- Initiatives for Sustainable Growth: Investments in renewable energy and environmentally friendly technologies are integral parts of the company's long-term strategy.

- Commitment to Corporate Social Responsibility: Philanthropic activities and initiatives focused on community development demonstrate a commitment to giving back and building a positive social legacy.

- Impact of Global Economic Trends: The ability to adapt and respond to global economic shifts and technological advancements will be key to maintaining competitiveness and long-term success.

Conclusion

This article has examined the remarkable journey of Robert MacMillan, tracing his unlikely rise to billionaire status and his adoption of investment strategies reminiscent of Warren Buffett. We've also explored the complexities of his potential succession plan, highlighting both the challenges and opportunities facing his heirs. The path to becoming the next Warren Buffett is never easy, but MacMillan's story provides a compelling example of entrepreneurial spirit, strategic investment, and the enduring legacy of a Canadian business giant.

Call to Action: Learn more about the fascinating world of Canadian billionaires and the intricacies of successful business succession planning. Discover more stories of unexpected heirs and their impact on the global economy by visiting [link to a relevant resource]. Explore the potential for your own business succession planning with our expert advice on [link to related services].

Featured Posts

-

Dakota Johnsons Career Path Exploring The Influence Of Chris Martin

May 10, 2025

Dakota Johnsons Career Path Exploring The Influence Of Chris Martin

May 10, 2025 -

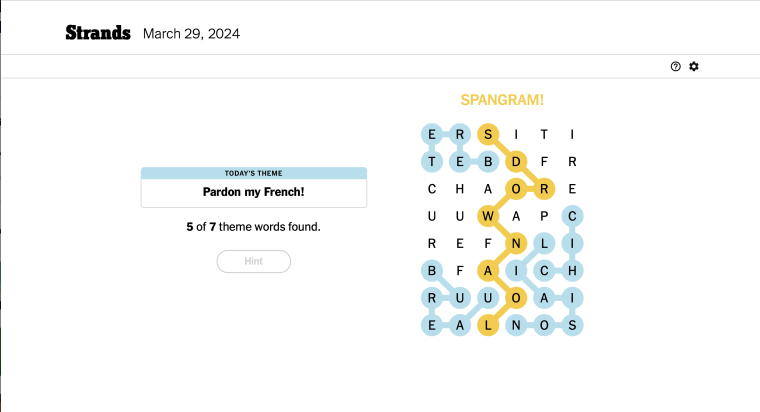

Nyt Strands Puzzle Solutions Tuesday March 4th Game 366

May 10, 2025

Nyt Strands Puzzle Solutions Tuesday March 4th Game 366

May 10, 2025 -

Sensex And Nifty Climb Daily Stock Market Report And Analysis

May 10, 2025

Sensex And Nifty Climb Daily Stock Market Report And Analysis

May 10, 2025 -

The Nottingham Tragedy Survivors Recount Their Experiences

May 10, 2025

The Nottingham Tragedy Survivors Recount Their Experiences

May 10, 2025 -

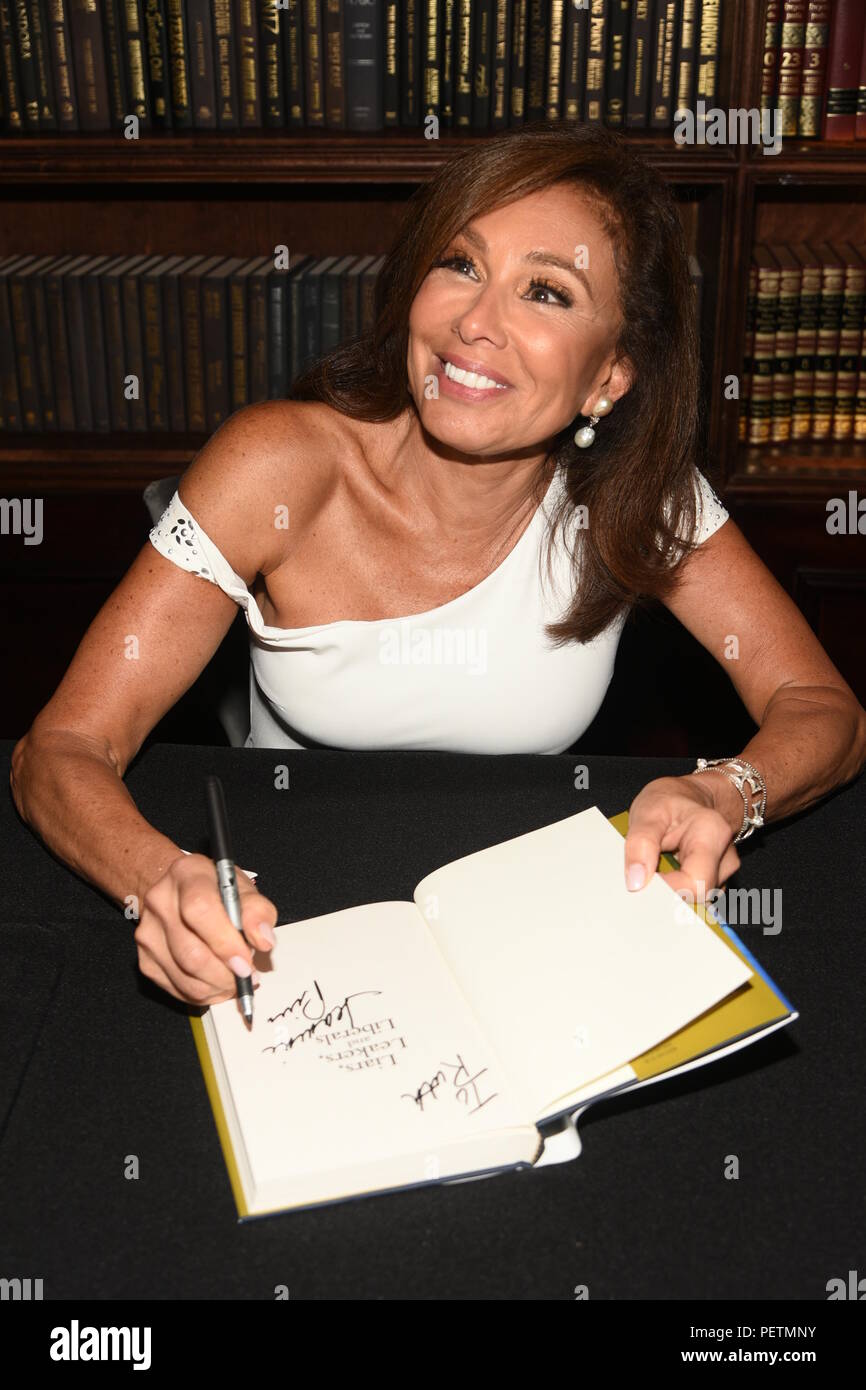

Judge Jeanine Pirro Behind The Gavel A Revealing Interview

May 10, 2025

Judge Jeanine Pirro Behind The Gavel A Revealing Interview

May 10, 2025