The UK Bottled Water Market: Why Dasani Is Missing

Table of Contents

The Dominance of Existing UK Bottled Water Brands

The UK bottled water market is fiercely competitive, with established brands holding significant market share. These brands, including Highland Spring, Buxton, Volvic, and others, have cultivated strong brand loyalty and extensive distribution networks across the UK, making it a challenging environment for new entrants. The competition in the UK bottled water market is intense, with these established players already dominating the shelves of major supermarkets and convenience stores.

- Strong existing brands: Highland Spring, Buxton, and Volvic, among others, already command a significant portion of the UK bottled water sales. Their established presence creates a significant barrier to entry for any newcomer.

- Extensive distribution channels: These brands have well-established distribution channels that reach every corner of the UK, ensuring widespread availability for consumers. This logistical advantage is hard for a new brand to replicate quickly.

- High barrier to entry: The strong brand loyalty among UK consumers creates a considerable challenge for new brands trying to gain a foothold. Consumers are less likely to switch to an unfamiliar brand when they are satisfied with existing options.

Consumer Preferences and Perceptions in the UK Bottled Water Market

UK consumers have specific preferences when choosing bottled water. They often favour brands perceived as natural, sourced locally, or offering specific health benefits. These preferences heavily influence the UK consumer behaviour related to bottled water purchases. Dasani's branding and positioning might not align with these established preferences, hindering its potential success. The premium bottled water UK market also shows a growing preference for higher-quality, ethically sourced products.

- Prioritization of natural sources: Consumers often prioritize natural spring water sources and ethical sourcing practices, a factor that many established brands actively highlight in their marketing.

- Premiumization trend: The premiumization trend within the UK water market points towards a growing demand for high-quality, naturally sourced products, often at a higher price point.

- Health-conscious consumers: Specific health claims, such as low mineral content or enhanced purity, resonate with a segment of health-conscious UK consumers, a factor Dasani might not have fully capitalized on.

Coca-Cola's Strategic Focus and Other UK Investments

Coca-Cola's significant presence in the UK soft drinks market might lead to strategic resource allocation towards their other successful brands. The absence of Dasani might reflect a deliberate decision to focus on their existing portfolio within the UK beverage market, rather than diverting resources to a new venture in a highly competitive sector. This strategic approach is common for large corporations looking to maximize returns on investment.

- Existing strong portfolio: Coca-Cola already has a strong presence in the UK with its diverse range of popular soft drinks. This dominant position might mean that entering the bottled water market is not seen as a priority.

- Resource allocation: Focusing resources on existing, established brands may be deemed a more efficient strategy than launching a new bottled water brand and competing with already established players.

- High market entry costs: Entering the UK bottled water market would require significant investment in distribution, marketing, and brand building, which might not be deemed worthwhile given Coca-Cola’s existing portfolio strength.

The Challenges of Launching a New Bottled Water Brand in the UK

Launching a new bottled water brand in a saturated market like the UK presents substantial hurdles. Securing distribution channels, building brand awareness among UK consumers, and competing on price and quality with established players require considerable investment and strategic planning. The distribution challenges in the UK alone pose a significant obstacle.

- High marketing costs: High marketing costs are required to build brand awareness and compete against well-established competitors with long-standing brand recognition within the UK.

- Distribution difficulties: Securing shelf space in major retailers is challenging for new entrants, especially against established brands with long-term partnerships and strong negotiating power.

- Consumer loyalty: The strong loyalty of UK consumers to existing brands poses a major challenge for new brands hoping to gain market share quickly.

Conclusion

Dasani's absence from the UK bottled water market is likely a result of a complex interplay of factors. The dominance of established brands, specific UK consumer preferences, and Coca-Cola's strategic focus all contribute to the puzzle. Understanding these dynamics provides valuable insights into the competitive landscape of the UK bottled water market. Further research into the specific strategies of successful UK bottled water brands could offer lessons for future market entrants. To truly understand the complexities of the UK bottled water market and the reasons behind Dasani's absence, continued analysis is key. Are there untapped niches within the UK bottled water market that could offer potential for a new player? Further investigation is warranted.

Featured Posts

-

Tonights Nhl Game Maple Leafs Vs Blue Jackets Predictions Betting Odds And Analysis

May 15, 2025

Tonights Nhl Game Maple Leafs Vs Blue Jackets Predictions Betting Odds And Analysis

May 15, 2025 -

How Ind As 117 Is Reshaping The Indian Insurance Industry

May 15, 2025

How Ind As 117 Is Reshaping The Indian Insurance Industry

May 15, 2025 -

Cassies Wedding Dress And Mystery Husband Unveiled In Euphoria Season 3 Set Photos

May 15, 2025

Cassies Wedding Dress And Mystery Husband Unveiled In Euphoria Season 3 Set Photos

May 15, 2025 -

Almeria Vs Eldense En Vivo Y En Directo Por La Liga Hyper Motion

May 15, 2025

Almeria Vs Eldense En Vivo Y En Directo Por La Liga Hyper Motion

May 15, 2025 -

Knicks Playoff Hopes Dented By Jalen Brunsons Injury

May 15, 2025

Knicks Playoff Hopes Dented By Jalen Brunsons Injury

May 15, 2025

Latest Posts

-

Stock Market Valuation Concerns A Bof A Analysis For Investors

May 16, 2025

Stock Market Valuation Concerns A Bof A Analysis For Investors

May 16, 2025 -

The Bof A Perspective Understanding Elevated Stock Market Valuations

May 16, 2025

The Bof A Perspective Understanding Elevated Stock Market Valuations

May 16, 2025 -

Addressing High Stock Market Valuations Bof As Analysis For Investors

May 16, 2025

Addressing High Stock Market Valuations Bof As Analysis For Investors

May 16, 2025 -

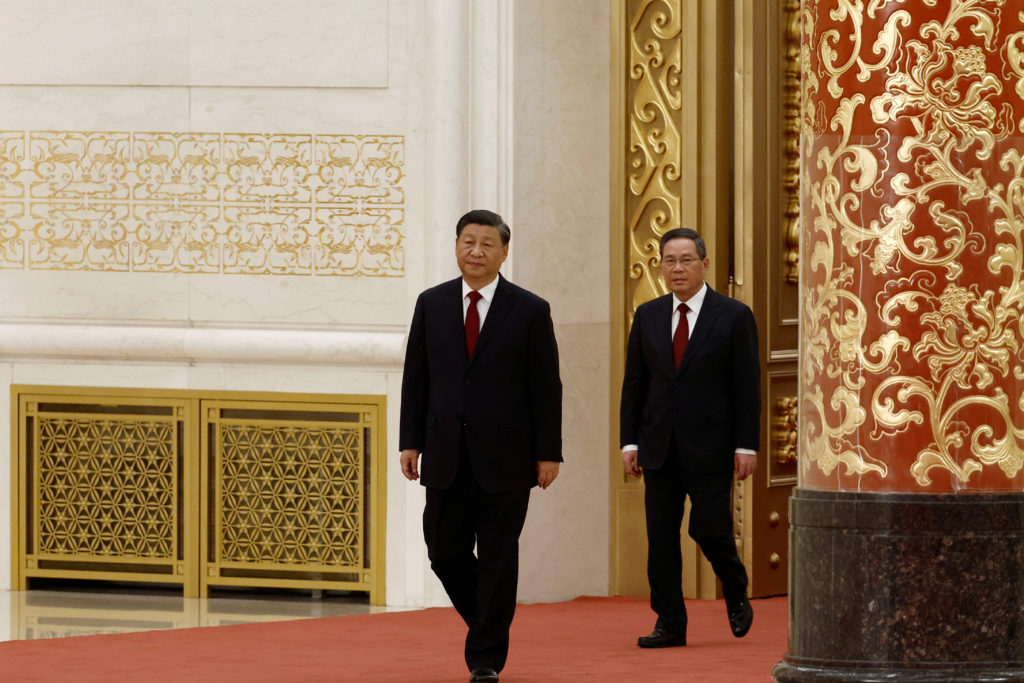

Negotiating Power Xi Jinpings Elite Team Secures Us Deal For China

May 16, 2025

Negotiating Power Xi Jinpings Elite Team Secures Us Deal For China

May 16, 2025 -

China Secures Us Deal The Role Of Xis Experienced Advisors

May 16, 2025

China Secures Us Deal The Role Of Xis Experienced Advisors

May 16, 2025