The Trump Tax Cut Bill: A Breakdown Of The House Republican Proposal

Table of Contents

The Trump Tax Cut Bill, officially known as the Tax Cuts and Jobs Act of 2017, significantly altered the U.S. tax code. This legislation, a cornerstone of the Republican agenda, implemented sweeping changes impacting individuals, businesses, and the national economy. This article provides a detailed breakdown of the key provisions within the House Republican proposal, examining its effects and lasting consequences. Understanding this landmark legislation is crucial for anyone navigating the complexities of current tax laws.

<h2>Individual Tax Changes Under the Trump Tax Cut Bill</h2>

The Trump Tax Cut Bill brought substantial changes to individual income taxes, affecting millions of Americans. Understanding these changes is critical for assessing their personal financial impact.

<h3>Reduced Income Tax Rates</h3>

The bill significantly reduced income tax rates across most brackets. This simplification aimed to provide tax relief to many individuals.

- Lowered rates for most income brackets: The number of tax brackets was reduced, and the rates within those brackets were lowered.

- Simplified tax brackets: The fewer brackets simplified tax calculations for many taxpayers.

- Potential impact on tax liability: While many saw a reduction in their tax liability, the impact varied significantly depending on individual income, deductions, and credits. High-income earners generally saw the largest percentage decrease.

For example, a taxpayer in the 35% bracket might have seen their rate drop to 32%, resulting in substantial savings. However, the elimination of certain deductions (discussed below) could offset some of these savings for some individuals.

<h3>Changes to Standard Deduction and Itemized Deductions</h3>

The Trump Tax Cut Bill made significant changes to both the standard deduction and itemized deductions.

- Increased standard deduction amounts: The standard deduction was substantially increased, benefiting many taxpayers by making it more advantageous to take the standard deduction rather than itemize.

- Limitation or elimination of SALT deductions: The bill significantly limited or eliminated the deduction for state and local taxes (SALT), impacting taxpayers in high-tax states disproportionately. This change often offset some of the benefits from the increased standard deduction for higher-income individuals in those states.

- Impact on taxpayers' choice between standard deduction and itemized deductions: Many taxpayers who previously itemized found it more beneficial to utilize the increased standard deduction.

This shift towards the standard deduction simplified tax filing for many, but it also resulted in higher tax burdens for some taxpayers, particularly those in high-tax states who previously relied heavily on itemized deductions.

<h3>Child Tax Credit Modifications</h3>

The bill also modified the Child Tax Credit (CTC), providing further tax relief to families with children.

- Increased Child Tax Credit amount: The maximum amount of the CTC was increased, providing more financial assistance to families.

- Expanded eligibility criteria: The changes also broadened the eligibility criteria for the CTC, allowing more families to benefit.

- Impact on low- and middle-income families: The modifications to the CTC had a particularly significant impact on low- and middle-income families, providing them with considerable tax savings.

These adjustments aimed to provide more financial support to families, but the actual benefit varied depending on the family's income and other tax circumstances.

<h2>Corporate Tax Changes Under the Trump Tax Cut Bill</h2>

The Trump Tax Cut Bill also implemented significant changes to corporate taxation, profoundly impacting businesses across the country.

<h3>Reduction in Corporate Tax Rate</h3>

The most significant change for corporations was the dramatic reduction in the corporate tax rate.

- Reduction from 35% to 21%: This substantial cut was intended to boost business investment and stimulate economic growth.

- Impact on corporate profitability and investment: The lower rate increased corporate profitability, theoretically freeing up more capital for investment and expansion.

- Potential effects on job creation and economic growth: Proponents argued that the lower rate would lead to increased job creation and overall economic growth.

However, the actual impact on job creation and investment remains a subject of ongoing debate and economic analysis.

<h3>International Tax Provisions</h3>

The bill also included substantial changes to international taxation.

- Shift to a territorial tax system: The move towards a territorial tax system aimed to make American companies more competitive globally by taxing only domestic income.

- Impact on repatriation of foreign earnings: The changes encouraged the repatriation of foreign earnings, potentially boosting domestic investment.

- Effects on US competitiveness globally: The aim was to enhance U.S. competitiveness in the global marketplace by reducing the tax burden on multinational corporations.

These changes had complex consequences, impacting both domestic and international businesses.

<h2>Long-Term Economic Impacts of the Trump Tax Cut Bill</h2>

The long-term economic effects of the Trump Tax Cut Bill remain a subject of intense debate and analysis.

<h3>Projected Budget Deficit Implications</h3>

The tax cuts resulted in a significant increase in the national debt.

- Increased national debt projections: The reduced tax revenues led to projections of a larger national debt.

- Debate over the long-term economic consequences: Economists hold differing views on the long-term economic consequences of this increased debt.

- Potential impact on government spending and social programs: The increased national debt could lead to limitations on future government spending and social programs.

<h3>Impact on Economic Growth and Investment</h3>

The bill's effect on economic growth and investment remains a subject of ongoing discussion.

- Potential short-term economic boost: Some economists observed a short-term boost in economic activity following the passage of the bill.

- Debate over long-term sustainability of economic growth: The long-term sustainability of this growth remains uncertain, with arguments on both sides.

- Impact on investment in different sectors: The impact on investment varied across different sectors, with some experiencing greater growth than others.

<h2>Conclusion</h2>

The Trump Tax Cut Bill fundamentally reshaped the U.S. tax system. Understanding its impact, from reduced individual income tax rates and changes to deductions to the lower corporate tax rate and international tax provisions, is crucial for navigating the current economic landscape. While the bill aimed to stimulate economic growth, its long-term consequences for the national debt and overall economic stability are still being debated and analyzed. To gain a deeper understanding of this complex legislation and its implications for your specific circumstances, explore additional resources and consider consulting with a tax professional. Proper planning based on your understanding of the Trump Tax Cut Bill is vital for managing your financial future.

Featured Posts

-

Gibraltars Forza Launch Coinsilium Groups Official Event Highlights

May 13, 2025

Gibraltars Forza Launch Coinsilium Groups Official Event Highlights

May 13, 2025 -

Remembering Sue Crane A Life Of Public Service In Portola Valley

May 13, 2025

Remembering Sue Crane A Life Of Public Service In Portola Valley

May 13, 2025 -

Asap Rockys Entanglement A Deeper Look At The Cases Involving 50 Cent And Tory Lanez

May 13, 2025

Asap Rockys Entanglement A Deeper Look At The Cases Involving 50 Cent And Tory Lanez

May 13, 2025 -

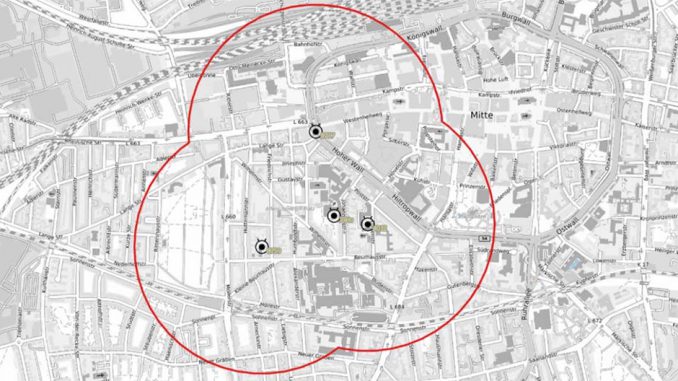

Evakuierung Braunschweiger Schule Aktuelle Informationen Zum Alarm

May 13, 2025

Evakuierung Braunschweiger Schule Aktuelle Informationen Zum Alarm

May 13, 2025 -

Aryna Sabalenkas Miami Open Championship A 19th Career Win

May 13, 2025

Aryna Sabalenkas Miami Open Championship A 19th Career Win

May 13, 2025