The Trump Tariffs: Nicolai Tangen's Investment Strategy

Table of Contents

The Impact of Trump Tariffs on Global Markets

The Trump administration's imposition of tariffs, particularly the trade war with China, sent shockwaves through global markets. These tariffs, designed to protect domestic industries, led to a cascade of consequences impacting businesses and consumers worldwide.

- Disruption to global supply chains: Tariffs disrupted established supply chains, forcing companies to re-evaluate sourcing strategies and leading to increased production costs. This impacted everything from manufacturing to technology.

- Increased costs for businesses and consumers: The tariffs directly increased the price of imported goods, leading to higher inflation and reduced consumer purchasing power. Businesses faced higher input costs, squeezing profit margins.

- Uncertainty in international trade relations: The unpredictability of the tariff policies created significant uncertainty for businesses engaged in international trade, hindering investment and economic growth. This uncertainty was a major factor affecting investment decisions globally.

- Impact on specific sectors: Sectors like manufacturing, agriculture, and technology were particularly vulnerable to the tariffs, experiencing varying degrees of disruption depending on their reliance on international trade.

These impacts presented significant risks for investors like Tangen, but also opened up unexpected opportunities for those with the foresight and agility to adapt.

Nicolai Tangen's Response to Tariff Uncertainty

While the exact details of NBIM's internal investment adjustments during the Trump tariff period aren't always publicly available, we can infer Tangen's overall approach from his public statements and the fund's overall investment philosophy. It appears Tangen adopted a balanced strategy, prioritizing risk management and diversification while actively seeking opportunities.

- Analysis of NBIM's investment adjustments: NBIM likely focused on reducing exposure to sectors particularly vulnerable to tariffs, while simultaneously seeking out companies and regions less affected by the trade disputes. This likely involved a careful analysis of the global economic landscape to identify resilience and emerging strength.

- Focus on specific sectors or regions: It's plausible that NBIM increased its investments in sectors less dependent on international trade or those benefiting from increased domestic demand due to tariff protection. Regions less involved in the US-China trade war likely saw increased interest.

- Asset class adjustments: NBIM might have adjusted its exposure to different asset classes. For instance, they may have shifted from US equities heavily reliant on imports to more domestically focused companies or increased allocation to other asset classes less sensitive to trade conflicts.

- Public statements and interviews: Analyzing Tangen's public comments and interviews during this period would shed more light on the specific strategies employed by NBIM in response to the Trump tariffs and global trade uncertainty.

Portfolio Diversification and Risk Management

Tangen's approach to managing the risks associated with the Trump tariffs likely heavily relied on robust portfolio diversification and proactive risk management strategies.

- Geographic diversification: Reducing reliance on any single country or region is a cornerstone of global investment strategy, and this became even more critical during the period of tariff uncertainty. NBIM likely spread its investments across a wide range of countries and regions.

- Asset class diversification: A well-diversified portfolio includes a mix of stocks, bonds, real estate, and other assets. This diversification helps to mitigate risk, as the performance of different asset classes often moves in different directions.

- Currency hedging strategies: Currency fluctuations can significantly impact investment returns. NBIM likely employed currency hedging strategies to protect against losses stemming from exchange rate volatility resulting from trade disputes.

- Sectoral diversification: Avoiding overexposure to any single sector is vital, particularly during periods of economic uncertainty. NBIM likely spread investments across various sectors to limit the impact of tariff-related disruptions.

Identifying Investment Opportunities Amidst the Trade War

The Trump tariffs, while creating challenges, also presented unique investment opportunities for astute investors. Tangen likely capitalized on these opportunities.

- Companies benefiting from increased domestic demand: Tariffs increased demand for domestically produced goods, creating opportunities for companies less reliant on imports and benefiting from protectionist policies.

- Investment in sectors less affected by trade disputes: Sectors less exposed to international trade were less vulnerable to the negative consequences of the trade war and provided a relatively safe haven for investment.

- Opportunities in emerging markets: Emerging markets, less directly involved in the US-China trade war, might have offered attractive investment opportunities during this period. These offered potentially higher returns but also greater risk.

- Potential for undervalued assets: Market corrections often occur during periods of uncertainty, creating opportunities to acquire undervalued assets. Tangen likely took advantage of market volatility to buy undervalued assets.

Conclusion

Nicolai Tangen's approach to managing the investment portfolio of NBIM during the era of Trump tariffs showcases the importance of a well-defined investment strategy that emphasizes diversification, robust risk management, and the ability to identify opportunities in volatile markets. His strategy, while not explicitly detailed in full public record, likely focused on mitigating the negative impacts of trade wars while capitalizing on the opportunities they presented. The ability to navigate the complexities of global economic uncertainty, as demonstrated by Tangen's approach, is vital for informed investment decisions.

Call to Action: Understanding the intricacies of navigating global economic uncertainty, as exemplified by Nicolai Tangen's approach to the Trump tariffs, is crucial for informed investment decisions. Learn more about developing robust investment strategies to manage risks and identify opportunities in today's dynamic market. Research effective investment strategies [link to relevant resource, e.g., investment guide]. Explore the impact of trade policies on your investment portfolio and how to adjust your strategy accordingly to better manage the effects of future trade disputes and mitigate risks associated with global trade wars.

Featured Posts

-

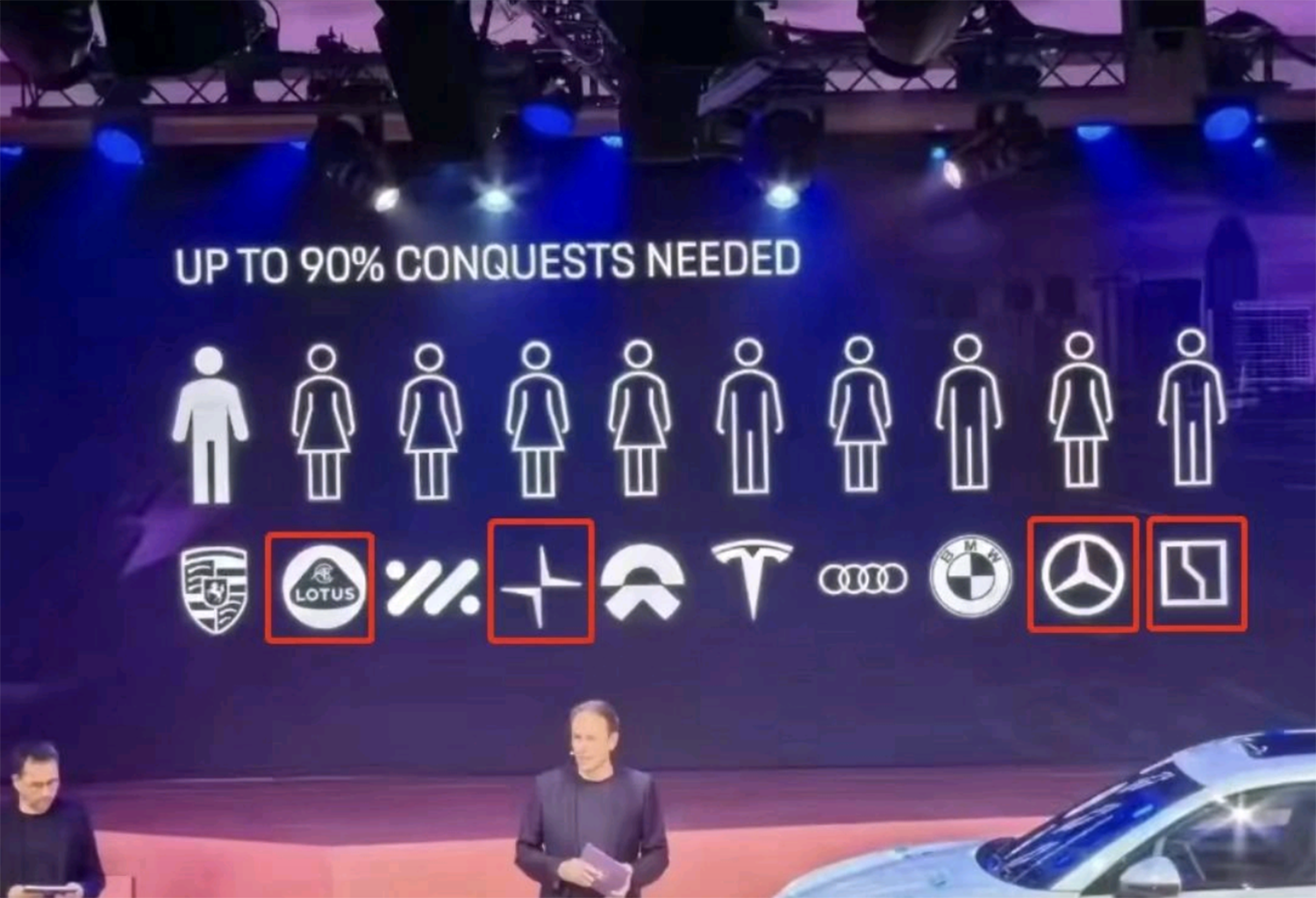

Navigating The Chinese Market The Struggles Of Bmw Porsche And Competitors

May 04, 2025

Navigating The Chinese Market The Struggles Of Bmw Porsche And Competitors

May 04, 2025 -

Ufc 314 Fan Favorite Knockout Artists Bout Cancelled Major Blow To The Card

May 04, 2025

Ufc 314 Fan Favorite Knockout Artists Bout Cancelled Major Blow To The Card

May 04, 2025 -

Der Deutsche Esc Vorentscheid 2025 Alles Zur Ersten Show

May 04, 2025

Der Deutsche Esc Vorentscheid 2025 Alles Zur Ersten Show

May 04, 2025 -

Ufc 314 Main Event Volkanovski Vs Lopes Opening Odds Analysis

May 04, 2025

Ufc 314 Main Event Volkanovski Vs Lopes Opening Odds Analysis

May 04, 2025 -

Sydney Sweeneys Wedding To Jonathan Davino Reportedly Off

May 04, 2025

Sydney Sweeneys Wedding To Jonathan Davino Reportedly Off

May 04, 2025