The Trump Presidency And Oil Prices: A Study In Contradictions

Table of Contents

Increased Domestic Oil Production: A Double-Edged Sword

The Trump administration's approach to domestic energy production significantly impacted oil prices. Its emphasis on deregulation unleashed a boom in US oil production, creating a double-edged sword with both benefits and drawbacks.

Deregulation and Fracking Boom

The Trump administration's commitment to deregulation significantly boosted domestic oil production, primarily through increased fracking activity. This strategy aimed to achieve energy independence and reduce reliance on foreign oil.

- Reduced environmental regulations: Easing environmental restrictions accelerated drilling and exploration, leading to a rapid expansion of oil production. This included streamlining the permitting process for new wells and pipelines.

- Easing permitting processes: The administration expedited the approval process for oil and gas projects, reducing bureaucratic hurdles and enabling faster development of new oil fields.

- Surge in US crude oil output: The combination of deregulation and streamlined permitting led to a substantial surge in US crude oil output, transforming the US into a major global oil producer. This dramatically impacted global supply and, consequently, prices.

Impact on Global Oil Markets

This dramatic increase in US oil production initially put downward pressure on global oil prices. While benefiting American consumers through lower gasoline prices, it presented challenges for other oil-producing nations.

- Oversupply in the market: The increased US production led to a global oversupply of oil, creating price volatility and impacting the profitability of oil producers worldwide.

- OPEC's response: OPEC, the Organization of the Petroleum Exporting Countries, responded to the increased US production by adjusting its output strategy, attempting to manage the supply and stabilize prices. This led to a period of fluctuating cooperation and tension between the US and OPEC.

- Geopolitical factors and demand: The impact of increased US production on oil prices varied considerably, influenced by global economic growth, geopolitical events (like conflicts in the Middle East), and changes in global demand.

The Iran Sanctions Conundrum

The Trump administration's re-imposition of sanctions on Iran significantly impacted the global oil market, creating a complex and ultimately contradictory situation regarding oil prices.

Restricting Iranian Oil Exports

The sanctions aimed to drastically curtail Iran's oil exports, significantly reducing its role as a major global oil supplier. This action was intended to pressure Iran on various geopolitical issues.

- Significant reduction in Iranian oil supply: The sanctions led to a considerable decrease in Iranian oil exports, creating a supply deficit in the global market.

- Expected price increase: Logically, this reduction in supply should have driven oil prices higher. However, reality proved more complex.

- Offset by increased US production: The substantial increase in US oil production partially offset the impact of the reduced Iranian supply, limiting the upward pressure on global oil prices.

Unintended Consequences

While intending to pressure Iran, the sanctions also created uncertainty and volatility in the global oil market, impacting energy security and potentially exacerbating geopolitical tensions.

- Higher oil prices for consumers: In many parts of the world, the sanctions resulted in higher oil prices for consumers, increasing the cost of living and impacting various sectors of the economy.

- Search for alternative oil sources: The sanctions spurred a global search for alternative oil sources, diversifying supply chains but also potentially creating new geopolitical challenges.

- Geopolitical implications: The strategic impact of the sanctions on Iran's economy and regional stability was significant, leading to complex and potentially destabilizing consequences.

The Role of International Relations and Geopolitical Events

The Trump administration's approach to international relations and its handling of geopolitical events significantly influenced the dynamics of oil prices.

Trade Wars and Global Uncertainty

The Trump administration's trade policies, including the initiation of trade wars with several countries, contributed to global economic uncertainty. This uncertainty directly affected energy demand and, consequently, oil prices.

- Increased market volatility: Trade tensions created volatility in global markets, making it more challenging to predict and manage commodity pricing, including oil.

- Impact on oil demand forecasts: Uncertainty about future economic growth directly influenced the forecasts for global oil demand, affecting investment decisions in the oil industry.

- Global economic slowdown: A potential global economic slowdown resulting from trade disputes could curb oil demand, leading to depressed prices.

Relationships with OPEC and Other Oil-Producing Nations

The Trump administration's approach to OPEC and other oil-producing nations was inconsistent, further contributing to market volatility. At times, the administration sought cooperation to stabilize prices, while at other times, its actions seemed to contradict that goal.

- Negotiations with OPEC: The administration engaged in negotiations with OPEC, aiming to influence global oil supply and stabilize prices. The success of these negotiations varied greatly.

- Unpredictable effects on prices: The administration's actions often had unpredictable and lasting effects on oil prices, making it difficult for market participants to anticipate future trends.

- Changing international dynamics: Shifting dynamics in international relations frequently affected global energy markets, highlighting the interconnectedness of politics and economics in determining oil prices.

Conclusion

The Trump presidency's impact on oil prices was undeniably complex and multifaceted. While policies aimed at boosting domestic production through deregulation and sanctions on Iran had significant effects, these were often counteracted by global events and the unpredictable nature of international relations. Increased domestic oil production initially lowered prices, while sanctions aimed at Iran created volatility. Analyzing "Trump oil prices" requires understanding the interwoven impact of domestic policies, international relations, and global economic trends. Further research into the long-term consequences of these policies is crucial to understanding the future trajectory of global oil markets. To deepen your understanding of the intricate relationship between presidential policy and energy prices, continue exploring the multifaceted impact of the Trump oil prices phenomenon.

Featured Posts

-

Putin I Dzhonson Obsuzhdenie Rossiyskikh Atomnykh Podlodok

May 12, 2025

Putin I Dzhonson Obsuzhdenie Rossiyskikh Atomnykh Podlodok

May 12, 2025 -

The Unexpected Role Of Adam Sandler In Modern America

May 12, 2025

The Unexpected Role Of Adam Sandler In Modern America

May 12, 2025 -

Hanouna Sur M6 Un Animateur Star Reagit

May 12, 2025

Hanouna Sur M6 Un Animateur Star Reagit

May 12, 2025 -

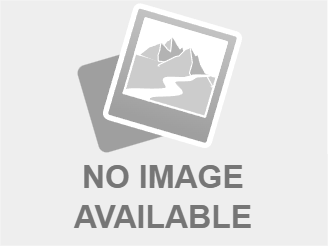

Lily Collinss Postpartum Journey An Honest Look At Motherhood

May 12, 2025

Lily Collinss Postpartum Journey An Honest Look At Motherhood

May 12, 2025 -

Bochum Und Holstein Kiel Abgestiegen Leipzig Verpasst Champions League

May 12, 2025

Bochum Und Holstein Kiel Abgestiegen Leipzig Verpasst Champions League

May 12, 2025

Latest Posts

-

Navi Mumbai News Nmmcs Aala Unhala Niyam Pala Summer Heatwave Advisory

May 13, 2025

Navi Mumbai News Nmmcs Aala Unhala Niyam Pala Summer Heatwave Advisory

May 13, 2025 -

Heatwave Advisory For Delhi Government Urges Precautions Against Heatstroke

May 13, 2025

Heatwave Advisory For Delhi Government Urges Precautions Against Heatstroke

May 13, 2025 -

Delhi Issues Heatstroke Warning Amidst Rising Mercury Levels

May 13, 2025

Delhi Issues Heatstroke Warning Amidst Rising Mercury Levels

May 13, 2025 -

Heatwave Alert Ghaziabad Issues Safety Guidelines For Outdoor Workers

May 13, 2025

Heatwave Alert Ghaziabad Issues Safety Guidelines For Outdoor Workers

May 13, 2025 -

Soaring Temperatures In Delhi Government Advisory On Heatstroke Prevention

May 13, 2025

Soaring Temperatures In Delhi Government Advisory On Heatstroke Prevention

May 13, 2025