The Student Loan Crisis: Economic Ripple Effects And Consequences

Table of Contents

Impact on Individual Borrowers

The weight of student loan debt significantly impacts the lives of millions of borrowers, delaying major life milestones and causing considerable mental health strain. This student loan debt crisis creates a ripple effect that extends far beyond the immediate financial burden.

Delayed Life Milestones

Student loan debt often forces borrowers to postpone significant life decisions. The financial strain makes achieving crucial life goals considerably harder.

- Homeownership: Saving for a down payment becomes exponentially more difficult when a substantial portion of income is dedicated to loan repayments. This contributes to lower homeownership rates among young adults.

- Marriage and Family Planning: Reduced disposable income directly affects the ability to plan for a family, leading many to delay marriage or having children. The financial burden of raising a family, coupled with student loan repayments, can feel insurmountable.

- Career Advancements: The stress and pressure of managing student loan debt can hinder career progression. Borrowers may be less likely to pursue opportunities requiring relocation or further education due to the financial constraints.

A recent study found that 40% of young adults delay marriage due to student loan debt, highlighting the pervasive impact of this student loan crisis on personal life choices.

Mental Health Strain

The overwhelming burden of student loan debt has a profound impact on mental well-being. The constant stress and anxiety associated with repayment can lead to serious mental health issues.

- Increased Risk of Depression and Anxiety: The pressure to repay loans often results in chronic stress, anxiety, and even depression. This can significantly affect overall quality of life and productivity.

- Impact on Overall Well-being: The pervasive nature of student loan debt negatively impacts mental and emotional well-being, affecting relationships, work performance, and overall life satisfaction.

- Decreased Productivity: The mental strain caused by the student loan debt crisis can reduce work productivity and hinder career advancement opportunities.

Resources such as the National Alliance on Mental Illness (NAMI) and the Substance Abuse and Mental Health Services Administration (SAMHSA) offer support and guidance for individuals struggling with the mental health challenges associated with student loan debt.

Broader Economic Consequences

The student loan crisis extends far beyond individual borrowers, creating significant negative consequences for the broader economy. The ripple effect is far-reaching and threatens long-term economic stability.

Reduced Consumer Spending

High levels of student loan debt directly suppress consumer spending, a critical driver of economic growth. The financial strain significantly limits disposable income.

- Less Disposable Income: Borrowers allocate a significant portion of their income to loan repayments, leaving less for discretionary spending on goods and services.

- Decreased Demand: Reduced consumer spending leads to lower demand for goods and services, impacting businesses and slowing economic growth.

- Slower Economic Recovery: The cumulative effect of reduced consumer spending can prolong economic downturns and hinder overall economic recovery.

Numerous economic studies have demonstrated a clear link between high student loan debt and decreased consumer spending, emphasizing the urgent need to address this student loan crisis.

Impact on the Housing Market

The student loan crisis also significantly affects the housing market, particularly for young adults. The burden of student loan debt makes it incredibly challenging to enter the housing market.

- Difficulty Qualifying for Mortgages: High student loan debt can lower credit scores and reduce borrowing capacity, making it harder to qualify for mortgages.

- Reduced Homebuying Power: Even if borrowers qualify for a mortgage, their purchasing power is significantly reduced due to loan repayments.

- Impact on Housing Demand: The reduced homeownership rates among young adults due to the student loan crisis negatively impact overall housing demand.

Data consistently shows a correlation between high student loan debt and lower homeownership rates among millennials and Gen Z, highlighting the significant impact of this student loan crisis on the housing market.

Strain on the Higher Education System

The long-term consequences of the student loan crisis extend to the higher education system itself, potentially impacting future enrollment and tuition costs.

- Reduced Access to Higher Education: The increasing cost of higher education, coupled with the burden of student loan debt, may deter potential students from pursuing further education.

- Pressure to Lower Tuition Costs: The student loan crisis is forcing institutions to consider ways to reduce tuition costs to make higher education more accessible and affordable.

- Government Intervention: The severity of the student loan crisis may necessitate significant government intervention, potentially leading to restructuring of the higher education system.

Potential Solutions and Policy Responses

Addressing the student loan crisis requires a multi-pronged approach involving debt relief measures, improved repayment plans, and long-term systemic changes.

Debt Forgiveness Programs

Debt forgiveness programs are a controversial but widely discussed solution to the student loan crisis. While offering immediate relief, they also present potential drawbacks.

- Potential Benefits: Debt forgiveness can provide immediate relief to borrowers, stimulating the economy by freeing up disposable income.

- Economic Stimulus: Forgiveness programs can inject substantial capital back into the economy, boosting consumer spending and economic growth.

- Potential Drawbacks: Critics argue that forgiveness programs are unfair to taxpayers and may not address the root causes of the problem.

The debate surrounding debt forgiveness programs highlights the complexities and challenges involved in addressing the student loan crisis.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans offer a more sustainable approach to managing student loan debt by linking monthly payments to borrowers' income.

- How IDR Plans Work: These plans adjust monthly payments based on income and family size, making repayments more manageable for borrowers.

- Benefits and Limitations: While IDR plans provide relief, they often result in longer repayment periods and higher total interest paid.

- Potential Improvements: Improving the accessibility and effectiveness of IDR plans is crucial in managing the student loan debt crisis.

Addressing the Root Causes

Long-term solutions require addressing the fundamental issues driving the student loan crisis, such as affordability and accessibility of higher education.

- Increased Funding for Higher Education: Increased government funding for higher education can help control tuition costs and make education more affordable.

- Affordable Tuition: Exploring tuition-free college options and implementing measures to control tuition increases are essential.

- Improved Career Counseling: Investing in comprehensive career counseling services can help students make informed decisions about their education and career paths.

Conclusion: Understanding and Addressing the Student Loan Crisis

The student loan crisis presents a complex and multifaceted challenge with far-reaching economic consequences. From the individual struggles of borrowers facing delayed life milestones and mental health strain to the broader impacts on consumer spending, the housing market, and the higher education system, the ramifications are profound. Addressing this student loan debt crisis requires a comprehensive strategy that encompasses debt forgiveness, improved repayment plans, and long-term solutions that focus on affordability and accessibility of higher education. The severity of the student loan problem demands immediate and decisive action.

We urge you to learn more about the student loan crisis and engage in constructive dialogue to find effective solutions. Contact your elected officials and advocate for policies that address the student debt crisis and alleviate the burdens faced by millions of Americans struggling under the weight of student loan debt. Let's work together to tackle this critical issue and create a more equitable and sustainable future for higher education and the economy.

Featured Posts

-

Akp Djauhari Kasatlantas Baru Polresta Balikpapan Imam Sholat Subuh

May 28, 2025

Akp Djauhari Kasatlantas Baru Polresta Balikpapan Imam Sholat Subuh

May 28, 2025 -

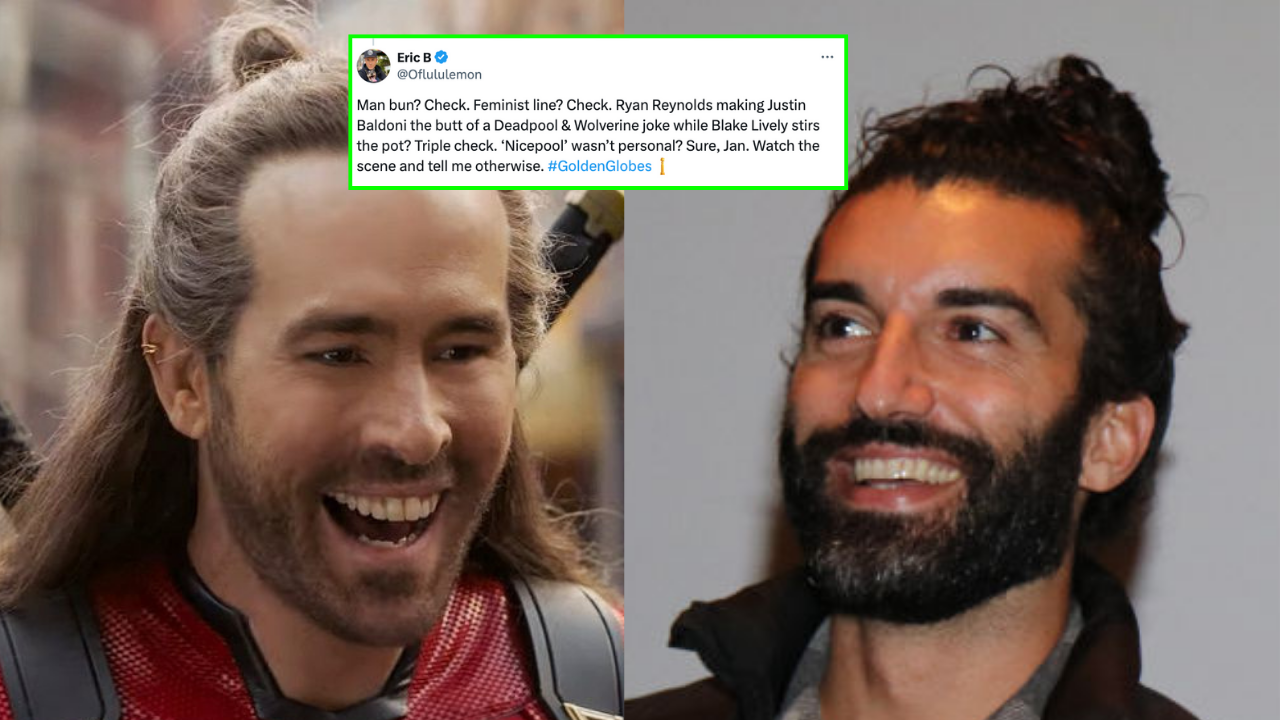

Did Ryan Reynolds Sabotage Justin Baldoni A Lawyer Weighs In

May 28, 2025

Did Ryan Reynolds Sabotage Justin Baldoni A Lawyer Weighs In

May 28, 2025 -

Tyrese Haliburtons Current Injury Status Nets Vs Pacers Game

May 28, 2025

Tyrese Haliburtons Current Injury Status Nets Vs Pacers Game

May 28, 2025 -

O Kosmos Toy Goyes Anterson Zontaneyei Se Ekthesi Sto Londino

May 28, 2025

O Kosmos Toy Goyes Anterson Zontaneyei Se Ekthesi Sto Londino

May 28, 2025 -

Liverpools Summer Transfer Strategy Wingers And The Salah Contract Situation

May 28, 2025

Liverpools Summer Transfer Strategy Wingers And The Salah Contract Situation

May 28, 2025