The Stealthy Wealthy: How Ordinary Habits Lead To Extraordinary Financial Success

Table of Contents

The Power of Consistent Saving & Budgeting

Building a solid financial foundation requires a robust saving and budgeting strategy. This isn't about deprivation; it's about mindful spending and strategic saving.

Developing a Realistic Budget

Creating a realistic budget is the cornerstone of effective financial planning. This involves tracking your expenses meticulously to understand where your money is going. Once you have a clear picture, identify areas where you can reduce spending without significantly impacting your lifestyle.

- Use budgeting apps: Mint, YNAB (You Need A Budget), and Personal Capital are popular options that simplify expense tracking and budgeting.

- Follow the 50/30/20 rule: Allocate 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment.

- Categorize expenses: Breaking down your spending into categories (housing, transportation, food, entertainment, etc.) provides valuable insights into your spending habits.

By implementing these budgeting strategies and consistently sticking to your saving plan, you'll lay the groundwork for stealth wealth building.

Automating Savings

Automating your savings is a crucial step towards consistent saving without conscious effort. This passive approach ensures that a portion of your income is automatically set aside each month, building your wealth silently.

- Set up automatic transfers: Schedule regular transfers from your checking account to your savings and investment accounts.

- Utilize round-up apps: Apps like Acorns round up your purchases to the nearest dollar and invest the difference, making saving effortless.

These automated savings techniques are key components of passive income strategies and consistent saving habits that fuel long-term financial growth.

Strategic Investing for Long-Term Growth

Saving alone won't build significant wealth; strategic investing is crucial for long-term growth.

Understanding Investment Basics

Investing involves allocating your savings into various assets to generate returns. Different investment vehicles carry varying levels of risk and potential reward.

- Stocks: Represent ownership in a company; higher risk, higher potential return.

- Bonds: Loans to governments or corporations; lower risk, lower potential return.

- Mutual funds: Diversified portfolios of stocks and bonds; moderate risk.

- Real estate: Investing in properties; can provide rental income and appreciation.

Diversification—spreading your investments across different asset classes—is crucial to mitigating risk. A long-term investment horizon allows you to weather market fluctuations and benefit from compounding returns. Consider seeking professional advice from a financial advisor to create a well-diversified investment portfolio.

The Importance of Compound Interest

Compound interest is the magic of exponential growth. It's the interest earned on your initial investment plus the accumulated interest. The earlier you start investing, the more powerful the effect of compounding becomes.

- Example: A small investment made early can grow significantly over decades due to the power of compounding.

- Early investing: Starting early maximizes the benefits of compound interest, leading to substantial long-term wealth creation.

Understanding and leveraging compounding returns is essential for achieving significant financial growth strategies.

Cultivating a Frugal Mindset

While saving and investing are vital, cultivating a frugal mindset is equally important for building wealth silently.

Differentiating Needs vs. Wants

Mindful spending requires distinguishing between needs (essential expenses) and wants (non-essential spending).

- Prioritize needs: Focus your spending on essential items like housing, food, and transportation.

- Mindful spending: Before making a purchase, ask yourself if it's a need or a want, and if it aligns with your financial goals.

- Avoid impulse purchases: Give yourself time to consider larger purchases to avoid regrettable spending.

Avoiding Lifestyle Inflation

Lifestyle inflation—increasing spending as income rises—can significantly hinder wealth accumulation.

- Set financial goals: Clearly defined financial objectives help you prioritize savings over immediate gratification.

- Avoid debt: High-interest debt can quickly derail your financial progress.

- Prioritize savings: Allocate a consistent portion of any income increase towards savings and investments.

Practicing financial discipline and avoiding debt traps are crucial for wealth preservation.

Continuous Learning and Adaptation

The financial landscape constantly evolves; continuous learning and adaptation are crucial for long-term financial success.

Staying Informed About Personal Finance

Enhance your financial literacy through various resources:

- Read books and blogs: Stay updated on financial news and best practices.

- Attend workshops: Gain deeper insights into various investment strategies and financial planning techniques.

- Consult financial advisors: Seek professional guidance when needed.

Reviewing and Adjusting Your Plan

Regularly review and adjust your financial plan based on life changes and market conditions.

- Annual review: Assess your progress, make necessary adjustments, and refine your strategies.

- Adapting to life changes: Significant life events (marriage, children, job loss) necessitate modifications to your financial plan.

- Seek professional advice: Don't hesitate to consult financial advisors for guidance on complex financial matters.

Adaptable financial strategies are key to navigating life's changes and achieving long-term financial success.

Conclusion

Becoming "Stealthy Wealthy" isn't about sudden windfalls; it's about consistently practicing ordinary yet powerful financial habits. By combining consistent saving and budgeting, strategic investing, a frugal mindset, and continuous learning, you can build significant wealth silently. Embrace the Stealthy Wealthy approach—start your journey to Stealthy Wealth today by taking a small step, such as creating a budget or automating your savings. Discover the secrets of Stealthy Wealth and unlock your financial potential.

Featured Posts

-

Interdisciplinary And Transdisciplinary Approaches Benefits And Challenges

May 19, 2025

Interdisciplinary And Transdisciplinary Approaches Benefits And Challenges

May 19, 2025 -

5 Time Grammy Nominee Announces Retirement Due To Age And Memory Issues Final Show In May

May 19, 2025

5 Time Grammy Nominee Announces Retirement Due To Age And Memory Issues Final Show In May

May 19, 2025 -

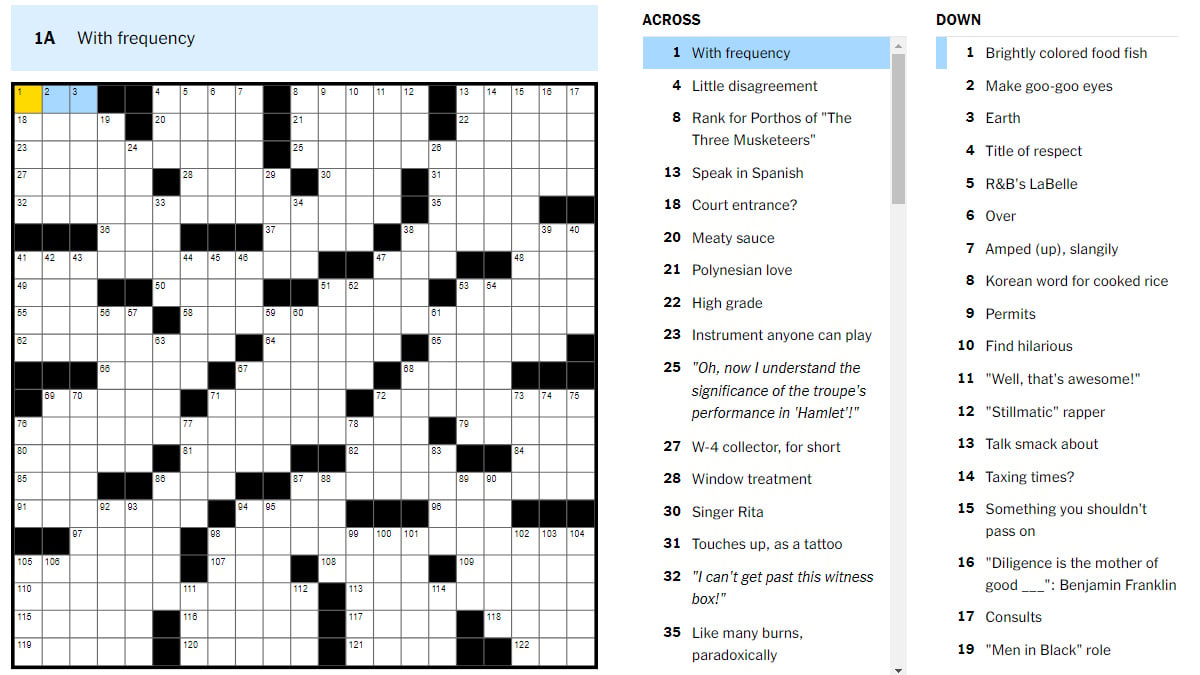

Nyt Mini Crossword Answers March 16 2025 Helpful Hints And Solutions

May 19, 2025

Nyt Mini Crossword Answers March 16 2025 Helpful Hints And Solutions

May 19, 2025 -

Everything You Need To Know About Eurovision Voting

May 19, 2025

Everything You Need To Know About Eurovision Voting

May 19, 2025 -

La Suerte Del Campeon De Miami Mensik Y El Almuerzo Del Supervisor

May 19, 2025

La Suerte Del Campeon De Miami Mensik Y El Almuerzo Del Supervisor

May 19, 2025