The Simplest Dividend Strategy: The Most Profitable Approach

Table of Contents

H2: Understanding Dividend Investing Basics

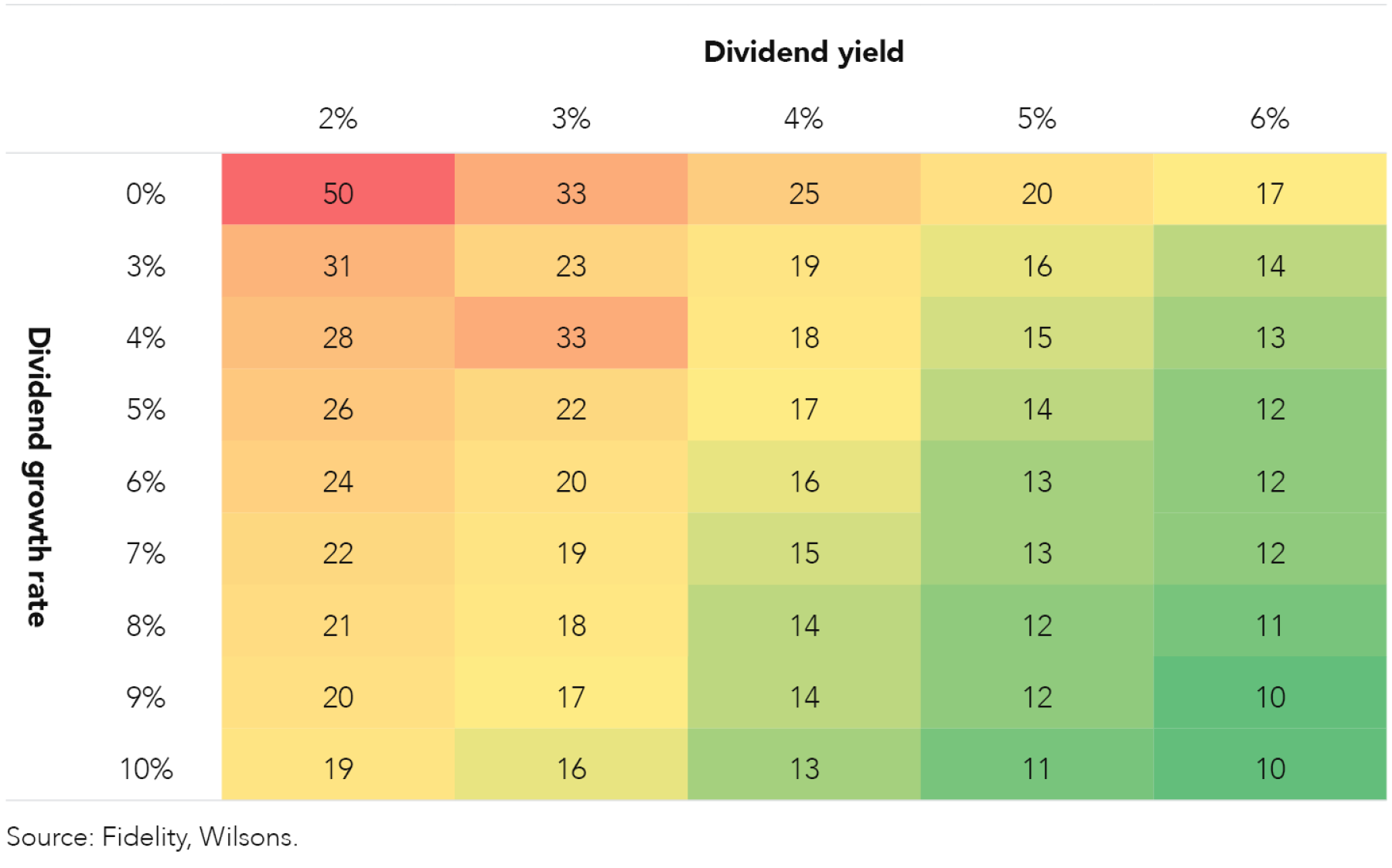

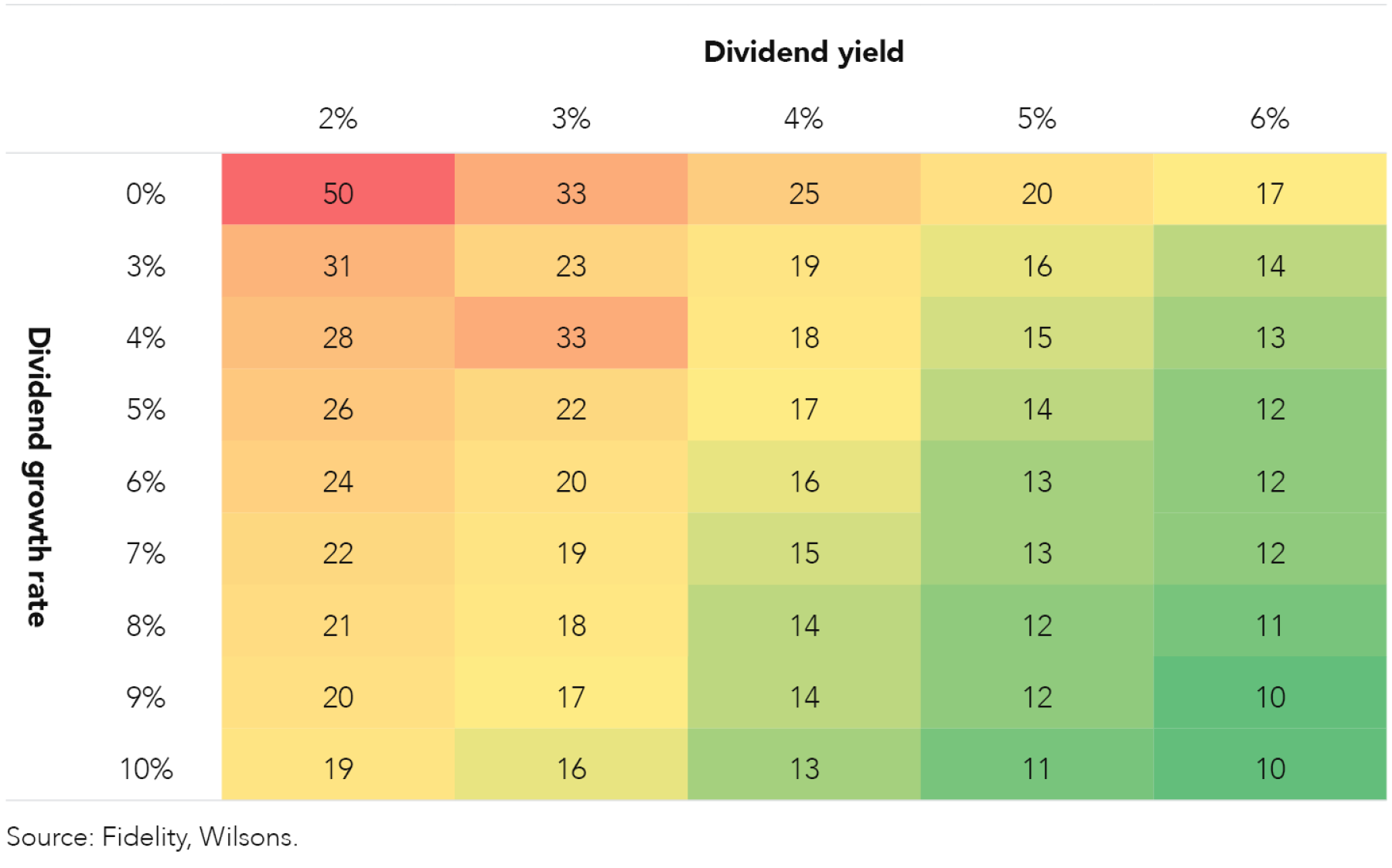

Dividend investing is a strategy focused on generating passive income and long-term growth by purchasing stocks in companies that regularly pay out a portion of their profits to shareholders as dividends. This passive income stream can supplement your income and provide a sense of financial security. The key is to find dividend stocks with a history of consistent dividend growth, delivering a healthy dividend yield. Understanding "dividend yield" (the annual dividend payment relative to the stock price) and "dividend growth" (the rate at which dividends increase over time) is crucial.

H3: Identifying High-Yield Dividend Stocks:

Finding high-yield dividend stocks requires careful screening. You need to look beyond just the dividend yield itself; consider the overall health and stability of the company. Here's how:

- Use online stock screeners and financial websites: Resources like Yahoo Finance, Google Finance, and dedicated stock screeners allow you to filter stocks based on criteria like dividend yield, payout ratio, and market capitalization.

- Consider dividend history and consistency: Look for companies with a long history of paying dividends and a consistent track record of increasing those payments over time. This indicates a commitment to returning value to shareholders.

- Analyze the company's financial statements: Scrutinize key financial metrics like the dividend payout ratio (the percentage of earnings paid out as dividends), free cash flow, and debt levels to assess the sustainability of the dividend.

- Diversify your portfolio across various sectors: Don't put all your eggs in one basket. Diversification mitigates risk by investing in companies from different industries, reducing the impact of any single company's underperformance.

H3: Assessing Dividend Sustainability:

A high dividend yield is attractive, but it's meaningless if the company can't sustain those payments. Analyze these factors:

- Check the company's payout ratio: A high payout ratio (above 70-80%) might signal a company stretching its resources to pay dividends, potentially making future increases unlikely or even leading to dividend cuts.

- Look at its free cash flow: Free cash flow represents the cash a company has left after covering its operating expenses and capital expenditures. A strong free cash flow is crucial to support consistent dividend payments.

- Consider the company's debt levels: High debt can strain a company's finances, making it difficult to maintain dividend payments, especially during economic downturns.

- Analyze future growth prospects: Companies with strong growth prospects are better positioned to increase dividends in the future.

H2: The Simplest Dividend Strategy: Buy and Hold

The simplest and often most effective dividend strategy is the buy-and-hold approach. This involves selecting high-quality dividend stocks and holding them for the long term, allowing your investments to grow through both dividend payments and potential capital appreciation.

H3: The Power of Reinvestment:

Reinvesting your dividends is a powerful tool for accelerating growth through the magic of compounding.

- Increased returns over time: Reinvesting your dividends buys more shares, generating even more dividends in the future, creating a snowball effect.

- Automatic portfolio growth: Dividend reinvestment plans (DRIPs) often automate this process, making it effortless to grow your portfolio.

- Reduced transaction costs: Regularly buying additional shares manually incurs transaction fees. DRIPs eliminate this cost.

H3: Selecting Your Investment Vehicles:

You have several options for implementing this strategy:

- Individual stocks: Offer the potential for higher returns but require more research and carry more risk.

- ETFs (Exchange-Traded Funds): Offer instant diversification across many dividend-paying companies with lower management fees than mutual funds.

- Mutual funds: Similar to ETFs but often have higher management fees. Look for funds specifically focused on dividend-paying companies.

H2: Managing Risk in Your Dividend Portfolio

Even the simplest strategies require risk management.

H3: Diversification Across Sectors and Companies:

Diversification is paramount.

- Spread your investments across various sectors: Don't concentrate your investments in a single sector, as a downturn in that sector could significantly impact your portfolio.

- Invest in companies with different levels of risk: Balance high-yield, potentially riskier stocks with more stable, lower-yield options.

- Don't over-concentrate in one specific stock: Even a seemingly strong company can encounter unforeseen challenges.

H3: Monitoring Your Portfolio Regularly:

Regular monitoring helps ensure your strategy remains on track.

- Review financial statements: Keep abreast of the financial health of your holdings.

- Track dividend payments and payouts: Ensure dividends are paid as expected and that the payout ratio remains sustainable.

- Rebalance your portfolio as needed: Periodically adjust your holdings to maintain your desired asset allocation and risk profile.

3. Conclusion:

This guide outlined the simplest dividend strategy – focusing on identifying sustainable high-yield dividend stocks and employing a long-term buy-and-hold approach with dividend reinvestment. Remember to diversify and regularly monitor your portfolio for optimal results. Start building your passive income today with the simplest dividend strategy! Begin your journey to a more financially secure future by learning more about high-yield dividend stocks and implementing this profitable approach to dividend investing.

Featured Posts

-

Rozmova Putina Ta Trampa Reaktsiya Borisa Dzhonsona Vin Smiyetsya Nad Nami

May 11, 2025

Rozmova Putina Ta Trampa Reaktsiya Borisa Dzhonsona Vin Smiyetsya Nad Nami

May 11, 2025 -

Understanding Manon Fiorot Her Journey In The Ufc

May 11, 2025

Understanding Manon Fiorot Her Journey In The Ufc

May 11, 2025 -

Payton Pritchards Sixth Man Award A Va Hero Moment

May 11, 2025

Payton Pritchards Sixth Man Award A Va Hero Moment

May 11, 2025 -

Unlock Bet365 Bonus Code Nypbet Your Guide To Knicks Vs Pistons Betting

May 11, 2025

Unlock Bet365 Bonus Code Nypbet Your Guide To Knicks Vs Pistons Betting

May 11, 2025 -

Holstein Kiels Fight Against Relegation A Draw Against Mainz Keeps Champions League Hopes Alive

May 11, 2025

Holstein Kiels Fight Against Relegation A Draw Against Mainz Keeps Champions League Hopes Alive

May 11, 2025