The Significance Of U.S.-China Tariff Rollbacks: An Economic Analysis

Table of Contents

Impact on Consumer Prices

Tariff rollbacks would have a direct and significant impact on consumer prices. The imposition of tariffs previously led to increased costs for imported goods, reducing consumer purchasing power. A reversal of this policy could lead to substantial benefits.

Reduced Costs for Consumers:

- Examples: Rollbacks would likely lower prices for a wide range of imported goods, including electronics (smartphones, laptops), clothing and apparel, and furniture. Consumers could see immediate savings on everyday purchases.

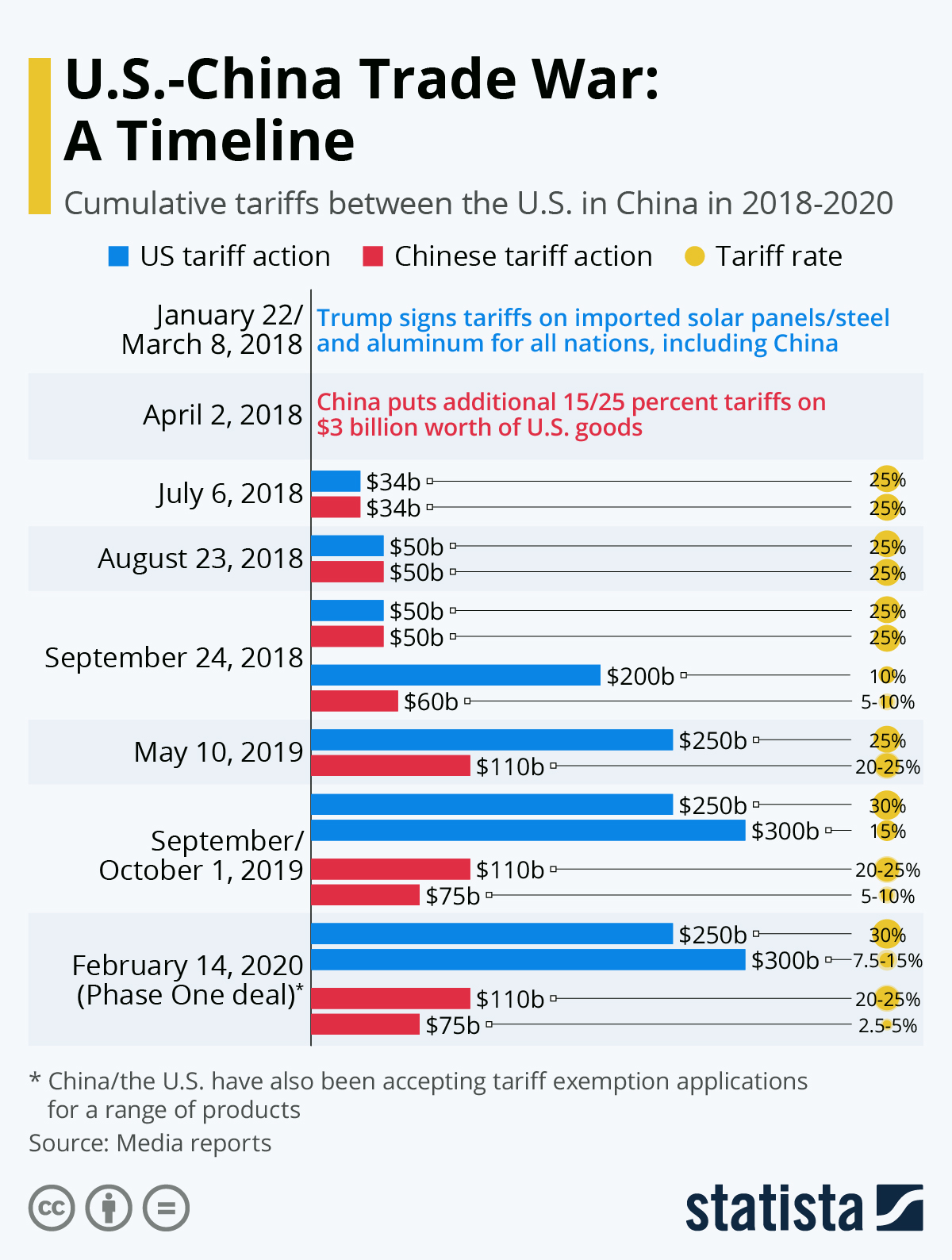

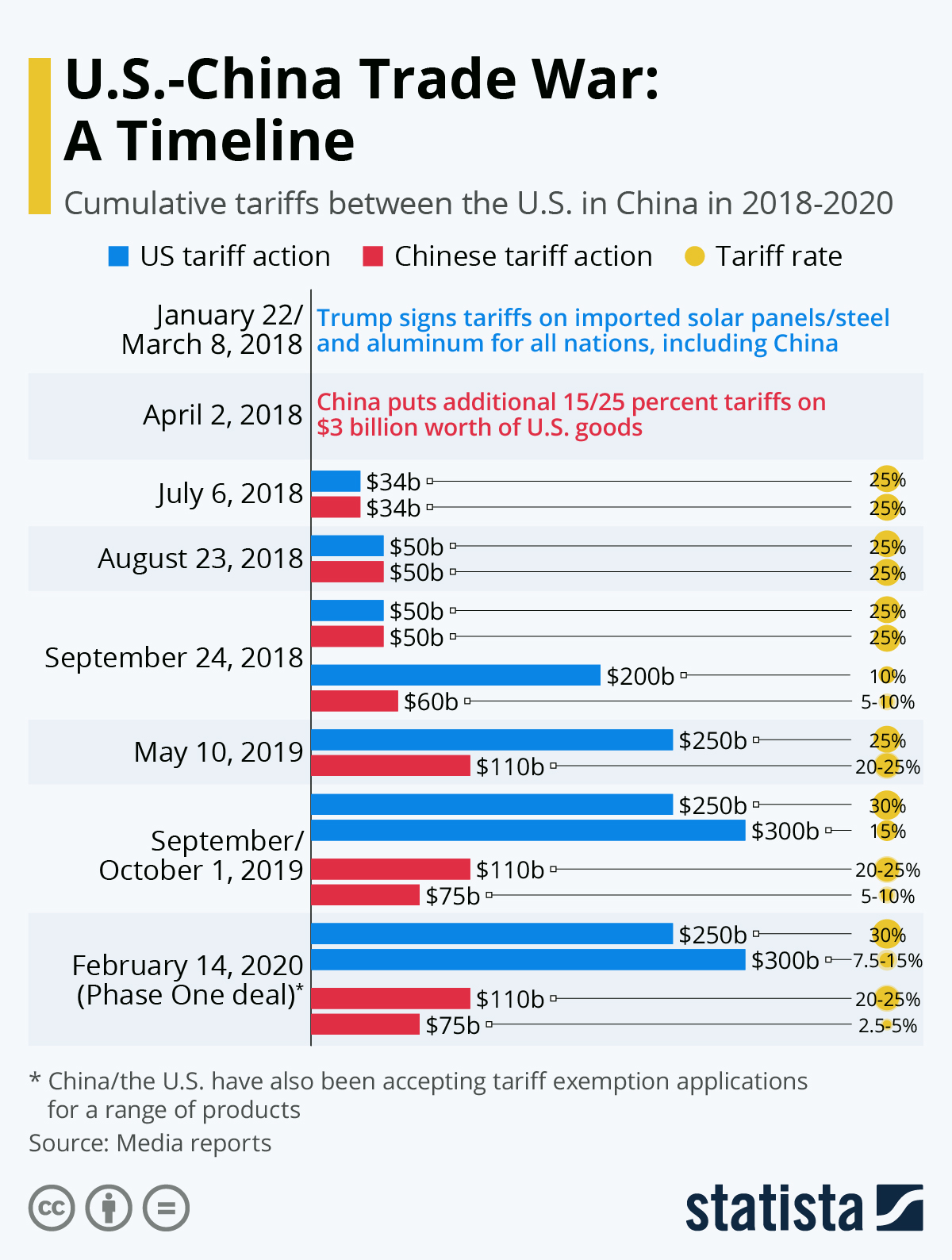

- Data Points: Studies have shown that tariffs imposed between 2018 and 2020 led to a noticeable increase in the price of various consumer goods, ranging from 10% to 25% depending on the product category. These increases disproportionately affected lower-income households.

- Increased Spending and Growth: Lower prices would boost consumer purchasing power, potentially leading to increased consumer spending and stimulating economic growth. This increased demand could also benefit domestic businesses.

Inflationary Pressures:

- Offsetting Inflation: Reduced import costs from tariff rollbacks could help offset other inflationary pressures in the economy, such as rising energy prices or supply chain bottlenecks. This could lead to a more stable price environment.

- Data Points: Comparing inflation rates before and after the implementation of tariffs reveals a clear correlation between higher tariffs and increased inflation. Rollback could reverse this trend.

- Monetary Policy: The reduction in inflationary pressures could influence the Federal Reserve's monetary policy decisions, potentially allowing for more moderate interest rate increases or even a pause in tightening.

Effects on Businesses and Supply Chains

Businesses, particularly those reliant on imported goods or components, would experience significant benefits from U.S.-China tariff rollbacks.

Reduced Production Costs:

- Industries Affected: Manufacturing, agriculture, and technology are among the sectors that would see a substantial reduction in production costs due to lower input costs. This is particularly true for businesses relying heavily on imports from China.

- Data Points: Analysis suggests that tariffs led to a decrease in business investment and hindered job creation in several sectors. Rollback could help reverse these trends, leading to increased hiring and investment.

- Increased Efficiency and Reduced Uncertainty: Lower input costs would lead to increased efficiency and profitability. The reduced uncertainty associated with stable trade relations would also encourage long-term investment planning.

Restructuring Global Supply Chains:

- Diversification: Tariff rollbacks could influence businesses to reconsider their reliance on China for sourcing, leading to a greater diversification of supply chains. This diversification could improve resilience against future trade disruptions.

- Data Points: Statistics on trade volumes indicate a shift in sourcing away from China in certain industries due to the tariffs. Rollbacks could moderate this shift, but diversification efforts might persist.

- Impact on Relocated Production: Companies that relocated production due to tariffs might reassess their decisions, potentially leading to a partial return of manufacturing to locations closer to their main markets.

Geopolitical Implications of U.S.-China Tariff Rollbacks

The potential rollbacks have significant geopolitical implications extending far beyond pure economics.

Improved U.S.-China Relations:

- De-escalation: Tariff rollbacks could signal a de-escalation of trade tensions and potentially improve overall bilateral relations between the U.S. and China. This could create a more stable and predictable trading environment.

- Increased Cooperation: Improved relations could lead to increased cooperation on other global issues, including climate change, pandemics, and global security.

Impact on Global Trade:

- Ripple Effects: Rollbacks could have positive ripple effects on other countries' economies, as they would benefit from increased trade with both the U.S. and China. This could contribute to global economic growth.

- Data Points: Studies show a strong correlation between U.S.-China trade relations and global trade growth. Improved relations generally lead to increased global trade activity.

- International Organizations: The rollbacks could strengthen the role of international organizations like the WTO in regulating global trade and promoting fairer trade practices.

Conclusion:

U.S.-China tariff rollbacks would have profound and multifaceted economic impacts. They would likely lead to lower consumer prices, reduced inflationary pressures, increased business profitability, and a restructuring of global supply chains. Moreover, these rollbacks would likely contribute to improved U.S.-China relations and a more stable global trading environment. Understanding the full significance of U.S.-China tariff rollbacks requires continued monitoring and analysis. Stay informed about future developments in this crucial area of global trade, paying close attention to specific industry impacts and the long-term economic consequences. Further research into the sector-specific effects of tariff adjustments will be crucial to fully grasp the implications of these changes.

Featured Posts

-

Beyond Radhe And Antim Exploring Salman Khans Underperforming Films

May 13, 2025

Beyond Radhe And Antim Exploring Salman Khans Underperforming Films

May 13, 2025 -

Decoding Tory Lanezs Alone At Prom Understanding The New Album Alone At Prom

May 13, 2025

Decoding Tory Lanezs Alone At Prom Understanding The New Album Alone At Prom

May 13, 2025 -

Exploring Dan Browns The Da Vinci Code Symbols History And Controversy

May 13, 2025

Exploring Dan Browns The Da Vinci Code Symbols History And Controversy

May 13, 2025 -

Nba Draft 2025 Teams Most Likely To Land Cooper Flagg

May 13, 2025

Nba Draft 2025 Teams Most Likely To Land Cooper Flagg

May 13, 2025 -

Elsbeth Season 2 Finale Returning Characters Confirmed

May 13, 2025

Elsbeth Season 2 Finale Returning Characters Confirmed

May 13, 2025