The "Sell America" Narrative: Analyzing The 5% 30-Year Treasury Yield

Table of Contents

Understanding the 5% 30-Year Treasury Yield

What does it mean?

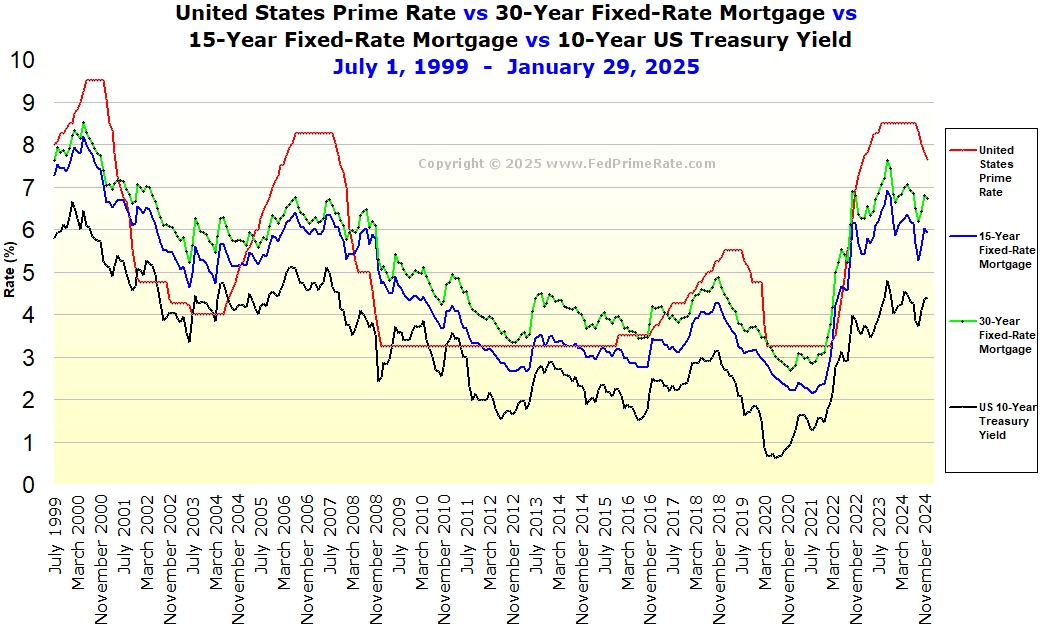

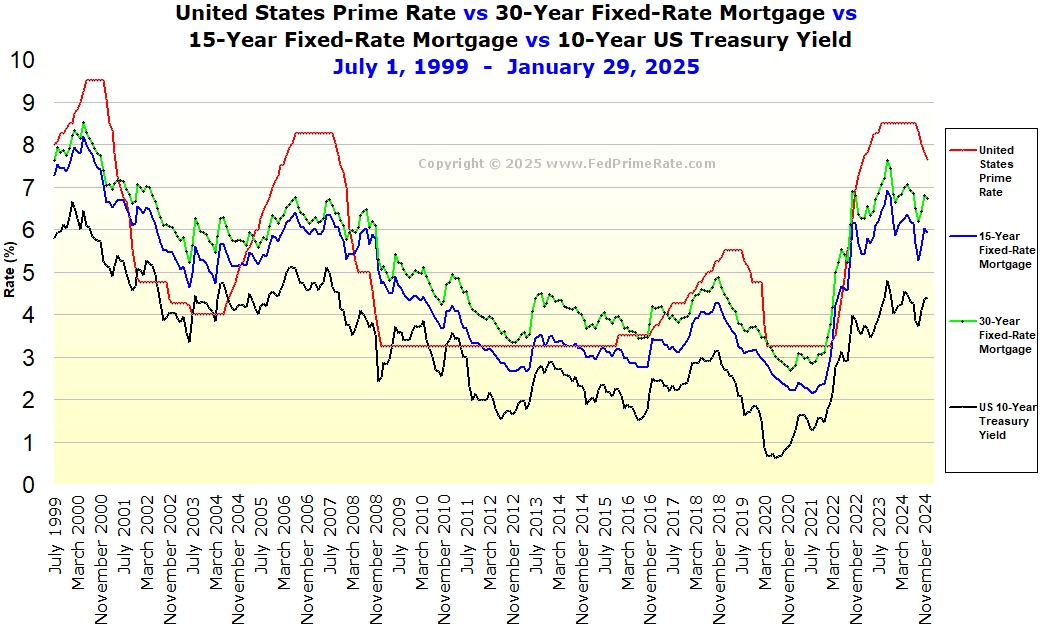

The 30-year Treasury yield represents the return investors receive for lending money to the US government for three decades. A 5% yield signifies that investors are demanding a 5% annual return for this long-term loan. Reaching this level is significant, especially considering its historical context.

- Mechanics of Treasury Yields: Treasury yields are inversely related to bond prices. When demand for Treasury bonds falls, prices drop, and yields rise. Conversely, increased demand pushes prices up and yields down. This relationship is crucial to understanding the current market dynamics.

- Historical Context: Comparing the current 5% yield to historical levels provides valuable perspective. Analyzing past periods of similar yields helps determine whether the current level is exceptionally high or within a normal range of fluctuation. Charting historical 30-year Treasury yields against significant economic events will provide better context.

- Impact on Long-Term Borrowing Costs: A high 30-year yield translates to increased borrowing costs for the government and corporations issuing long-term debt. This can affect government spending, infrastructure projects, and corporate investment strategies.

Factors Driving the Yield Increase

Several interconnected factors contribute to the recent rise in the 30-year Treasury yield:

- Inflation Expectations: Persistent inflation erodes the purchasing power of future payments, prompting investors to demand higher yields to compensate for this risk. High inflation rates directly correlate with higher treasury yields.

- Federal Reserve Policy: The Federal Reserve's monetary policy significantly influences interest rates. Aggressive interest rate hikes aimed at curbing inflation can lead to higher Treasury yields across the maturity spectrum. Analyzing the Fed's recent announcements and their impact on the bond market is crucial.

- Global Economic Uncertainty: Geopolitical instability and economic slowdowns in other parts of the world can drive investors towards the perceived safety of US Treasury bonds, increasing demand and potentially pushing yields higher (though this is often countered by other factors, like a stronger dollar).

- Increasing US National Debt: The ever-growing US national debt increases the supply of Treasury bonds, potentially putting downward pressure on prices and upward pressure on yields, particularly if investor confidence weakens. Analyzing the national debt-to-GDP ratio adds context to this factor.

The "Sell America" Narrative: Assessing the Validity

Arguments for a "Sell America" Interpretation

Some argue that the high 30-year Treasury yield signals a loss of confidence in the US economy:

- Concerns about Fiscal Policy: Critics point to unsustainable levels of government spending and a lack of fiscal discipline as potential reasons for declining investor confidence.

- Debt Sustainability: The rising national debt raises concerns about the US government's ability to repay its obligations, potentially leading investors to demand higher yields as compensation for increased risk.

- Geopolitical Risks: Global uncertainties and geopolitical tensions contribute to risk aversion, making US Treasuries less attractive relative to other assets, and increasing the required yield.

Counterarguments and Alternative Explanations

However, not all analysts believe the high yield reflects a "Sell America" sentiment:

- Global Market Factors: Global bond market dynamics, such as changes in global interest rates or shifts in investor preferences, can influence US Treasury yields independent of domestic economic conditions.

- Increased Demand for Safe-Haven Assets: During times of economic uncertainty, US Treasuries are often viewed as a safe-haven asset, increasing demand and potentially counteracting the impact of rising national debt.

- Market Correction: The increase in the 30-year yield could simply reflect a market correction after a period of unusually low yields, rather than a fundamental shift in investor sentiment towards the US economy.

Implications for Investors and the Economy

Impact on Investment Strategies

The high 30-year Treasury yield has significant implications for various investment strategies:

- Bond Portfolios: Investors with long-term bond portfolios need to reassess their risk exposure and consider diversifying into other asset classes or shorter-term bonds to mitigate the impact of rising yields.

- Stock Investments: Higher yields can affect stock valuations, as investors may shift funds from stocks to bonds in search of higher returns and perceived safety.

- Real Estate: Higher borrowing costs due to increased interest rates can impact real estate markets, potentially reducing demand and slowing price growth.

Broader Economic Consequences

The high yield has significant broader economic consequences:

- Government Borrowing Costs: Higher yields make it more expensive for the government to borrow money, potentially limiting its ability to fund essential programs and infrastructure projects.

- Business Investment: Increased borrowing costs can also dampen business investment and economic growth, affecting job creation and overall economic activity.

- Consumer Spending: Higher interest rates may lead to reduced consumer spending as borrowing becomes more expensive, impacting overall economic demand.

- Potential for Inflationary Pressures: While the Fed aims to curb inflation, the effect of higher yields on borrowing costs could inadvertently fuel inflation, creating a challenging policy dilemma.

Conclusion

The 5% 30-year Treasury yield has sparked considerable debate, with the "Sell America" narrative gaining traction among some analysts. However, a nuanced understanding reveals a complex interplay of factors, including inflation expectations, Federal Reserve policy, global economic uncertainty, and the increasing US national debt. While concerns about the sustainability of US debt are valid, attributing the yield increase solely to a "Sell America" sentiment may be an oversimplification. The implications for investors are substantial, necessitating careful consideration of portfolio diversification and risk management strategies. The broader economic consequences warrant close monitoring and potentially proactive policy responses.

Call to Action: Stay informed about the evolving situation with the 30-year Treasury yield and its impact on the US economy. Conduct further research into 5% 30-Year Treasury Yield analysis and consult with financial professionals before making any investment decisions based on this analysis of the "Sell America" narrative surrounding the 30-year Treasury yield.

Featured Posts

-

Flavio Cobolli Claims First Atp Championship In Bucharest

May 20, 2025

Flavio Cobolli Claims First Atp Championship In Bucharest

May 20, 2025 -

Agatha Christies Influence On M Night Shyamalans The Village

May 20, 2025

Agatha Christies Influence On M Night Shyamalans The Village

May 20, 2025 -

Important Restrictions Des 2 Et 3 Roues Sur Le Boulevard Fhb A Compter Du 15 Avril

May 20, 2025

Important Restrictions Des 2 Et 3 Roues Sur Le Boulevard Fhb A Compter Du 15 Avril

May 20, 2025 -

Exploring Agatha Christies Poirot His Cases Techniques And Enduring Legacy

May 20, 2025

Exploring Agatha Christies Poirot His Cases Techniques And Enduring Legacy

May 20, 2025 -

L Integrale Agatha Christie Biographie Et Analyse De Ses Romans

May 20, 2025

L Integrale Agatha Christie Biographie Et Analyse De Ses Romans

May 20, 2025

Latest Posts

-

Wayne Gretzky And Donald Trump A Loyalty Questioned

May 20, 2025

Wayne Gretzky And Donald Trump A Loyalty Questioned

May 20, 2025 -

Gretzkys Loyalty Examining The Legacy Amidst Trump Ties

May 20, 2025

Gretzkys Loyalty Examining The Legacy Amidst Trump Ties

May 20, 2025 -

The Gretzky Loyalty Debate Trumps Tariffs And Statehood Comments Spark Controversy In Canada

May 20, 2025

The Gretzky Loyalty Debate Trumps Tariffs And Statehood Comments Spark Controversy In Canada

May 20, 2025 -

Wayne Gretzkys Canadian Patriotism Questioned Amidst Trump Tariff And Statehood Controversy

May 20, 2025

Wayne Gretzkys Canadian Patriotism Questioned Amidst Trump Tariff And Statehood Controversy

May 20, 2025 -

Trump Tariffs Gretzky Loyalty And Canadas Statehood Debate A Complex Issue

May 20, 2025

Trump Tariffs Gretzky Loyalty And Canadas Statehood Debate A Complex Issue

May 20, 2025