The SEC Vs. Ripple: Latest XRP News And Commodity Classification Implications

Table of Contents

The SEC's Case Against Ripple

The SEC filed its lawsuit against Ripple Labs in December 2020, alleging that Ripple conducted an unregistered securities offering of XRP, violating federal securities laws. The SEC's central argument hinges on the assertion that XRP sales constituted investment contracts, meaning investors purchased XRP with the expectation of profit based on Ripple's efforts. This, the SEC argues, meets the Howey Test, the legal standard for determining whether an asset is a security.

Key arguments presented by the SEC include:

- Unregistered securities offering: The SEC claims Ripple sold billions of XRP without registering them with the SEC, depriving investors of crucial information and protections.

- Violation of federal securities laws: The SEC alleges that Ripple violated Section 5 of the Securities Act of 1933, which requires registration of securities offerings.

- Impact on investors: The SEC emphasizes the potential harm to investors who purchased XRP without full disclosure of the risks involved.

Ripple's Defense and Key Arguments

Ripple vehemently denies the SEC's allegations, arguing that XRP is not a security but a decentralized digital asset functioning as a currency and a utility token within the XRP Ledger. Ripple's defense strategy focuses on demonstrating that XRP sales were not investment contracts and did not meet the Howey Test criteria.

Key arguments presented by Ripple's legal team include:

- XRP as a currency/utility token: Ripple contends that XRP is primarily used as a medium of exchange and for facilitating transactions on the XRP Ledger, not as an investment.

- Lack of intent to defraud: Ripple argues it had no intention of defrauding investors and that its sales of XRP were conducted in a transparent manner.

- Focus on programmatic sales: Ripple highlights the programmatic nature of many XRP sales, arguing that these sales lack the essential elements of an investment contract.

Latest Developments and Court Proceedings

The SEC vs. Ripple case has seen several significant developments. Recent court filings have included expert witness testimonies focusing on the technical aspects of XRP and its market functionality. Both sides have presented extensive evidence aiming to support their respective claims about XRP commodity classification. The judge's rulings on motions to dismiss and other procedural matters have shaped the trajectory of the case.

Key aspects of recent developments include:

- Summary of recent court filings: These filings contain crucial information about the evidence presented by both parties, including analyses of XRP’s functionality and market behavior.

- Expert witness testimonies and their significance: Expert opinions on the technical aspects of blockchain technology and digital assets play a crucial role in shaping the court's understanding of XRP.

- Potential outcomes and their timeline: While the exact timeline remains uncertain, the case's outcome will have profound implications for the future of cryptocurrency regulation.

Implications of XRP Commodity Classification

The court's decision on the XRP commodity classification will have far-reaching consequences. A ruling in favor of the SEC could establish a precedent for classifying other cryptocurrencies as securities, potentially chilling innovation in the space. Conversely, a ruling in favor of Ripple could provide clarity and potentially boost investor confidence in XRP and other similar digital assets.

The impact on XRP specifically includes:

- Impact on XRP price volatility: The outcome will significantly influence XRP's price, potentially leading to increased or decreased volatility depending on the ruling.

- Regulatory uncertainty and its effects: Regulatory uncertainty surrounding XRP will likely persist until a final judgment, impacting trading volume and investor sentiment.

- Potential for future regulatory frameworks: The ruling could influence the development of future regulatory frameworks for digital assets, potentially leading to increased clarity or continued ambiguity.

Impact on Other Cryptocurrencies and the Regulatory Landscape

The Ripple case sets a significant precedent for how the SEC approaches the regulation of cryptocurrencies. A ruling against Ripple could lead to increased regulatory scrutiny of other crypto projects, potentially affecting their operations and fundraising activities. This could also prompt other crypto companies to review their token distribution strategies.

This case will likely impact the regulatory landscape in several ways:

- Ripple case as a precedent for other crypto projects: The ruling could serve as a template for future SEC actions against other cryptocurrency projects.

- Increased regulatory scrutiny of cryptocurrencies: The case heightens the focus on how digital assets are classified and regulated, leading to increased scrutiny across the board.

- Potential for clearer regulatory guidelines: Although uncertain, the resolution of the case could potentially pave the way for clearer and more comprehensive regulatory guidelines for the cryptocurrency industry.

Conclusion: Navigating the Future of XRP and Commodity Classification

The SEC vs. Ripple case remains a pivotal moment for the cryptocurrency industry. The uncertainty surrounding the XRP commodity classification continues to impact investor confidence and market sentiment. The court's decision will undoubtedly shape the regulatory landscape for digital assets, influencing both the future of XRP and the broader cryptocurrency ecosystem. Staying informed about the latest developments is crucial for navigating the evolving landscape.

Stay informed about the evolving landscape of XRP and cryptocurrency regulation by following the latest developments in the SEC vs. Ripple case. Understanding the complexities of XRP commodity classification is crucial for navigating the future of digital assets. Further research into legal interpretations of the Howey Test and the SEC's approach to digital asset regulation is recommended for a comprehensive understanding.

Featured Posts

-

Obituary Priscilla Pointer Amy Irvings Mother Dies At 100

May 01, 2025

Obituary Priscilla Pointer Amy Irvings Mother Dies At 100

May 01, 2025 -

Amanda Holden Supports Davina Mc Call Following Brain Tumour News

May 01, 2025

Amanda Holden Supports Davina Mc Call Following Brain Tumour News

May 01, 2025 -

Target And Dei Examining The Change In Stance

May 01, 2025

Target And Dei Examining The Change In Stance

May 01, 2025 -

Ponants 1 500 Flight Credit For Paul Gauguin Cruise Sales A Guide For Agents

May 01, 2025

Ponants 1 500 Flight Credit For Paul Gauguin Cruise Sales A Guide For Agents

May 01, 2025 -

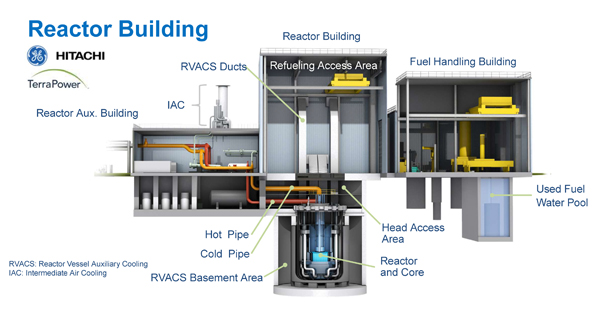

Nrc Reactor Power Uprate Timeline And Key Considerations

May 01, 2025

Nrc Reactor Power Uprate Timeline And Key Considerations

May 01, 2025

Latest Posts

-

Understanding Stock Market Valuations Bof As Take For Investors

May 01, 2025

Understanding Stock Market Valuations Bof As Take For Investors

May 01, 2025 -

High Stock Market Valuations A Bof A Analysis For Investors

May 01, 2025

High Stock Market Valuations A Bof A Analysis For Investors

May 01, 2025 -

Post Election Analysis Examining Pierre Poilievres Loss In Canada

May 01, 2025

Post Election Analysis Examining Pierre Poilievres Loss In Canada

May 01, 2025 -

Russias Black Sea Oil Spill Impacts And 62 Mile Beach Closure

May 01, 2025

Russias Black Sea Oil Spill Impacts And 62 Mile Beach Closure

May 01, 2025 -

Canadas Conservatives After Poilievres Defeat Whats Next

May 01, 2025

Canadas Conservatives After Poilievres Defeat Whats Next

May 01, 2025