The Scale Of The Bond Crisis: Understanding The Risks And Opportunities

Table of Contents

The Extent of the Current Bond Market Vulnerability

The current bond market vulnerability is multifaceted, stemming from a confluence of interconnected factors. Understanding the interplay of these factors is crucial for assessing the potential impact and developing appropriate strategies.

Rising Interest Rates and Their Impact

Rising interest rates directly impact bond prices. Existing bonds become less attractive when new bonds offer higher yields. This inverse relationship is a fundamental principle of bond investing.

- Increased borrowing costs for governments and corporations: Higher interest rates increase the cost of borrowing for governments and corporations, potentially impacting their ability to service their debt.

- Potential for defaults on high-yield bonds: High-yield (junk) bonds, which carry higher risk, are particularly vulnerable to rising interest rates, increasing the likelihood of defaults.

- The effect of quantitative tightening (QT) by central banks: Central banks' reduction of their bond holdings (QT) further puts downward pressure on bond prices and increases yields. This policy aims to curb inflation but can exacerbate market volatility.

Inflation's Erosive Power on Bond Returns

High inflation diminishes the real return on fixed-income investments. Inflation erodes the purchasing power of future interest payments and principal repayments, impacting the overall attractiveness of bonds.

- Real yields (yield adjusted for inflation) are falling: While nominal yields may be rising, real yields – the return after accounting for inflation – are often falling, making bonds less attractive to investors seeking to preserve their purchasing power.

- The challenges of predicting future inflation rates and their impact on bond valuations: Accurately forecasting inflation is notoriously difficult, adding to the uncertainty surrounding bond valuations. Unexpected inflation can significantly impact bond returns.

- Strategies for inflation hedging within bond portfolios: Investors can use strategies like investing in inflation-protected securities (TIPS) or incorporating commodities or real estate into their portfolios to mitigate inflation risk.

Geopolitical Uncertainty and its Ripple Effect

Global events like war and political instability significantly impact bond markets, introducing an element of uncertainty that can be difficult to quantify.

- Flight to safety: During times of geopolitical uncertainty, investors often flock to perceived "safe haven" assets, such as U.S. Treasury bonds, driving up their prices and lowering yields.

- Increased risk aversion leading to lower bond prices: Increased uncertainty leads to higher risk aversion among investors, causing them to sell riskier bonds and drive down prices.

- The influence of sanctions and geopolitical tensions on sovereign debt: Geopolitical tensions and sanctions can significantly impact the creditworthiness of sovereign debt, leading to increased borrowing costs and potentially defaults.

Identifying Key Risks Associated with the Bond Crisis

Navigating the current bond market requires a thorough understanding of the key risks involved. Effective risk management is paramount to preserving capital and achieving investment goals.

Credit Risk and Default

The increased probability of defaults on corporate and even sovereign bonds is a significant risk in the current environment. Rising interest rates and economic slowdowns can strain borrowers’ ability to meet their obligations.

- Identifying high-risk bonds and strategies for mitigation: Careful due diligence, including examining credit ratings and financial statements, is essential to identifying high-risk bonds. Diversification is a key mitigation strategy.

- The role of credit rating agencies in assessing risk: While not perfect, credit rating agencies provide valuable insights into the creditworthiness of issuers. However, investors should not solely rely on ratings.

- Diversification strategies to minimize credit risk exposure: Diversifying across different issuers, sectors, and geographies helps to mitigate the risk of defaults.

Interest Rate Risk and Duration Management

Understanding the sensitivity of bond prices to interest rate fluctuations is critical. Interest rate risk is the risk that bond prices will fall as interest rates rise.

- Importance of duration matching and hedging strategies: Duration matching involves aligning the duration of a bond portfolio with an investor's investment horizon. Hedging strategies, such as using derivatives, can help mitigate interest rate risk.

- Using derivatives to manage interest rate risk: Interest rate swaps and futures can be used to hedge against interest rate movements.

- Assessing the impact of interest rate hikes on bond portfolios: Investors should regularly assess the potential impact of interest rate changes on their bond portfolios and adjust their holdings accordingly.

Liquidity Risk and Market Volatility

Liquidity risk is the risk that a bond cannot be sold quickly without significant price concessions. Market volatility can exacerbate liquidity risk, especially during times of stress.

- The importance of liquidity analysis in portfolio construction: Investors need to carefully assess the liquidity of the bonds they hold and ensure that they can access cash when needed.

- Managing liquidity risk in times of market stress: Maintaining sufficient cash reserves and diversifying across liquid bonds can help mitigate liquidity risk during market stress.

- Strategies for navigating illiquid bond markets: In illiquid markets, investors may need to accept lower prices to sell their bonds quickly. A long-term investment horizon is often necessary in illiquid markets.

Uncovering Opportunities Amidst the Bond Crisis Volatility

While the bond crisis presents significant risks, it also offers potential opportunities for savvy investors. Careful analysis and strategic decision-making can lead to attractive returns.

Value Investing in Distressed Bonds

Identifying undervalued bonds with potential for significant price appreciation can be a rewarding strategy, but it requires careful analysis and risk assessment.

- Thorough due diligence and risk assessment: Investing in distressed bonds requires extensive due diligence to assess the underlying risks and potential for recovery.

- Seeking opportunities in sectors experiencing temporary distress: Certain sectors may experience temporary distress, presenting opportunities for value investors to acquire bonds at attractive prices.

- The potential for high returns but also high risks: While distressed bonds offer the potential for high returns, they also carry significantly higher risks, including the possibility of complete loss of principal.

Strategic Bond Allocation and Diversification

Building a resilient bond portfolio involves diversifying across different sectors, maturities, and geographies. This helps to reduce overall portfolio risk and improve the chances of achieving investment goals.

- The importance of a well-defined investment strategy: A clear investment strategy, outlining investment objectives, risk tolerance, and time horizon, is crucial for success in the bond market.

- Utilizing different bond types to achieve specific investment goals: Different types of bonds, such as corporate bonds, government bonds, and municipal bonds, offer different risk-return profiles and can be used to achieve specific investment goals.

- Professional advice and portfolio management: Seeking professional advice from a qualified financial advisor can be invaluable in developing a robust bond investment strategy.

Alternative Fixed-Income Strategies

Exploring options such as inflation-protected securities (TIPS) or floating-rate notes can provide additional diversification and risk mitigation.

- Examining alternative strategies to mitigate interest rate risk and inflation: TIPS offer protection against inflation, while floating-rate notes adjust their interest payments based on prevailing interest rates.

- Understanding the risks and potential rewards of alternative fixed-income investments: Each alternative investment strategy comes with its own set of risks and potential rewards. Careful consideration is required.

- Assessing the suitability of alternative strategies for different investor profiles: The suitability of different strategies depends on an investor's individual risk tolerance, investment horizon, and financial goals.

Conclusion

The scale of the potential bond crisis is significant, presenting both considerable risks and compelling opportunities. Understanding the interplay of rising interest rates, inflation, and geopolitical uncertainty is crucial for navigating this volatile environment. By carefully assessing credit risk, managing interest rate risk, and strategically allocating assets across diversified bond types, investors can mitigate potential losses and potentially capitalize on the opportunities arising from this market disruption. Don't miss out – proactively manage your exposure to the bond crisis and adapt your investment strategy to secure your financial future. Seek professional advice to develop a robust bond investment strategy tailored to your individual needs and risk tolerance.

Featured Posts

-

Relocation Regret My Experience Leaving The Us For Germany

May 28, 2025

Relocation Regret My Experience Leaving The Us For Germany

May 28, 2025 -

Menteri Hanif Faisol Bali Sebagai Model Pengelolaan Sampah Nasional

May 28, 2025

Menteri Hanif Faisol Bali Sebagai Model Pengelolaan Sampah Nasional

May 28, 2025 -

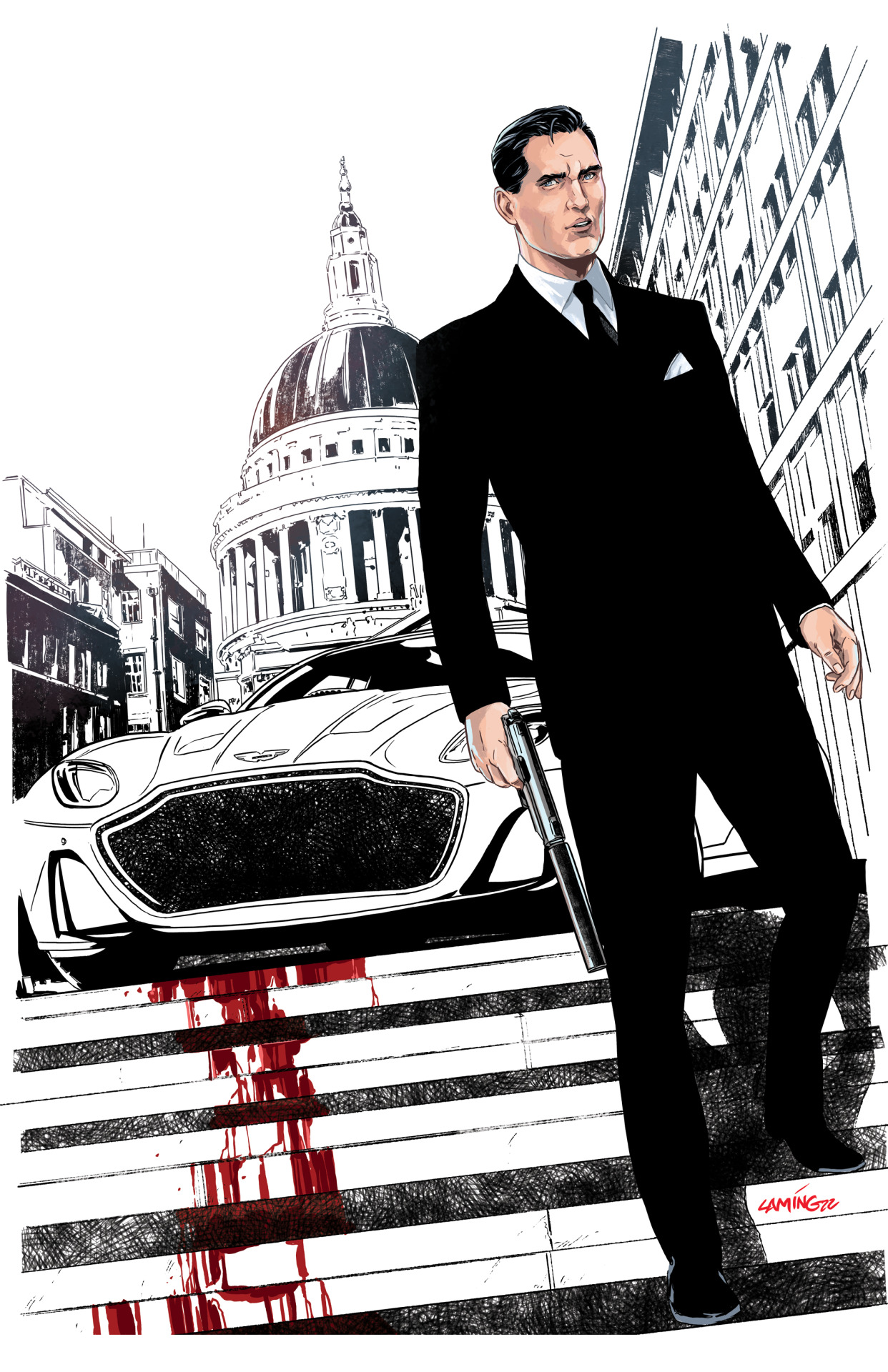

New Twist In Blake Lively Justin Baldoni Lawsuit A List Celebrity Involved

May 28, 2025

New Twist In Blake Lively Justin Baldoni Lawsuit A List Celebrity Involved

May 28, 2025 -

Understanding The 2024 South Korean Presidential Election Candidates And Platforms

May 28, 2025

Understanding The 2024 South Korean Presidential Election Candidates And Platforms

May 28, 2025 -

American Music Awards Host Revealed Jennifer Lopez For May Show

May 28, 2025

American Music Awards Host Revealed Jennifer Lopez For May Show

May 28, 2025

Latest Posts

-

Tuis First Adults Only Cruise A New Era In Cruising

May 29, 2025

Tuis First Adults Only Cruise A New Era In Cruising

May 29, 2025 -

Starboard Group Mein Schiff Relax To Feature Expanded Retail Offering

May 29, 2025

Starboard Group Mein Schiff Relax To Feature Expanded Retail Offering

May 29, 2025 -

Celebrity Loved The Most Affordable Nike Sneakers

May 29, 2025

Celebrity Loved The Most Affordable Nike Sneakers

May 29, 2025 -

Tui Cruises And Starboard Group Mein Schiff Relax Gets New Retail Partner

May 29, 2025

Tui Cruises And Starboard Group Mein Schiff Relax Gets New Retail Partner

May 29, 2025 -

Optimal Probopass Ex Deck Strategies For Pokemon Tcg Pocket

May 29, 2025

Optimal Probopass Ex Deck Strategies For Pokemon Tcg Pocket

May 29, 2025