The Saudi ABS Market: How A Key Rule Change Will Drive Exponential Growth

Table of Contents

The Key Regulatory Change and its Impact

The Saudi Arabian Monetary Authority (SAMA), the kingdom's central bank, recently implemented a pivotal regulatory change designed to stimulate growth in the Saudi ABS market. This change, specifically a [Insert Specific Detail of Rule Change Here, e.g., relaxation of capital requirements for securitization transactions or the introduction of a new, more flexible securitization framework], has significantly altered the market dynamics.

SAMA's rationale behind this change is multifaceted. Historically, stringent regulations and a lack of standardized frameworks hampered the growth of the ABS market. This reform aims to:

- Increase investor confidence by providing greater transparency and reducing perceived risk.

- Simplify the securitization process, making it more accessible to a wider range of businesses.

- Attract foreign investment by aligning Saudi regulations with international best practices.

The direct and indirect positive impacts of this change are numerous:

- Increased investor confidence: The clarified regulatory environment reduces uncertainty and encourages greater participation from both domestic and international investors.

- Lower borrowing costs for originators: By facilitating access to capital markets, the rule change allows businesses to borrow at more competitive interest rates.

- Greater access to capital for businesses: This leads to increased investment in projects, expansion, and job creation.

- Stimulation of economic activity: The enhanced availability of capital fuels broader economic growth within Saudi Arabia.

Increased Investment Opportunities in the Saudi ABS Market

The Saudi ABS market presents compelling investment opportunities for both domestic and international players. The ongoing diversification of the Saudi economy, coupled with the government's Vision 2030 initiatives, creates a fertile ground for growth in various sectors. Potential investment sectors include:

- Real Estate: Securitization of mortgages and other real estate-related assets.

- Auto Loans: Offering investors exposure to the growing automotive sector in Saudi Arabia.

- Consumer Credit: Providing opportunities for diversification within the consumer finance landscape.

Expected returns vary depending on the specific investment strategy and the underlying asset class. While higher yields are possible compared to traditional fixed-income instruments, investors should carefully consider the risk profiles associated with each investment. Government initiatives, such as [mention specific government initiatives supporting ABS market development, if any], further enhance the attractiveness of this market.

Investment opportunities include:

- High-yield potential: The Saudi ABS market offers the potential for higher returns compared to some other asset classes.

- Diversification benefits: ABS provides a means to diversify investment portfolios beyond traditional equities and bonds.

- Growing market size: The market's expansion offers substantial potential for capital appreciation.

- Support from the Saudi government: Government initiatives signal a commitment to fostering the growth of the ABS market.

Challenges and Opportunities for Market Participants

While the prospects are bright, market participants face certain challenges:

- Developing robust risk management frameworks: Effective risk management is critical to ensuring the stability and long-term sustainability of the market.

- Building investor awareness and education: Educating investors about the intricacies of ABS is essential for attracting broader participation.

- Ensuring transparency and standardization: Maintaining high levels of transparency and adopting standardized practices are vital for building investor confidence.

However, these challenges also present opportunities:

- Developing innovative ABS products: The market offers room for innovation in product design, catering to the evolving needs of both originators and investors.

- Expanding into new sectors: Untapped sectors present opportunities for market participants to establish a first-mover advantage.

- Building strategic partnerships: Collaborations between market players can accelerate growth and foster greater efficiency.

In summary:

- Challenges: Risk management, investor education, transparency.

- Opportunities: Product innovation, sector expansion, strategic partnerships.

Future Outlook and Predictions for the Saudi ABS Market

The recent regulatory changes are expected to propel the Saudi ABS market to significant growth in the coming years. We project [Insert specific growth prediction with supporting data or reasoning, e.g., a doubling of the market size within the next five years]. The market is well-positioned to become a regional leader in ABS, attracting investors from across the Middle East and beyond.

Future developments might include:

- Further regulatory refinements to enhance efficiency and transparency.

- The emergence of new product offerings tailored to specific market segments.

- Increased participation from international investors seeking diversification opportunities.

The long-term sustainability and resilience of the Saudi ABS market depend on continued regulatory support, the development of robust infrastructure, and the successful management of risk. Key future trends include:

- Continued market expansion: Driven by the regulatory changes and strong economic growth.

- Increased product diversification: Catering to the diverse needs of investors and originators.

- Regional leadership: Saudi Arabia becoming a major hub for ABS activity in the Middle East.

Conclusion: Seizing the Opportunities in the Expanding Saudi ABS Market

The recent regulatory change in Saudi Arabia has unlocked significant potential within the Saudi ABS market. The resulting increase in investor confidence, lower borrowing costs, and greater access to capital are expected to drive exponential growth. The market presents attractive investment opportunities, offering both high-yield potential and diversification benefits. By carefully navigating the challenges while capitalizing on the emerging opportunities, investors and market participants can play a crucial role in shaping the future of this dynamic market.

Learn more about how to capitalize on the burgeoning Saudi ABS market and its exciting growth potential. [Insert links to relevant resources here, e.g., SAMA website, financial news articles, investment platforms]

Featured Posts

-

Joseph Tf 1 Immersion Dans L Univers De La Creme De La Crim

May 03, 2025

Joseph Tf 1 Immersion Dans L Univers De La Creme De La Crim

May 03, 2025 -

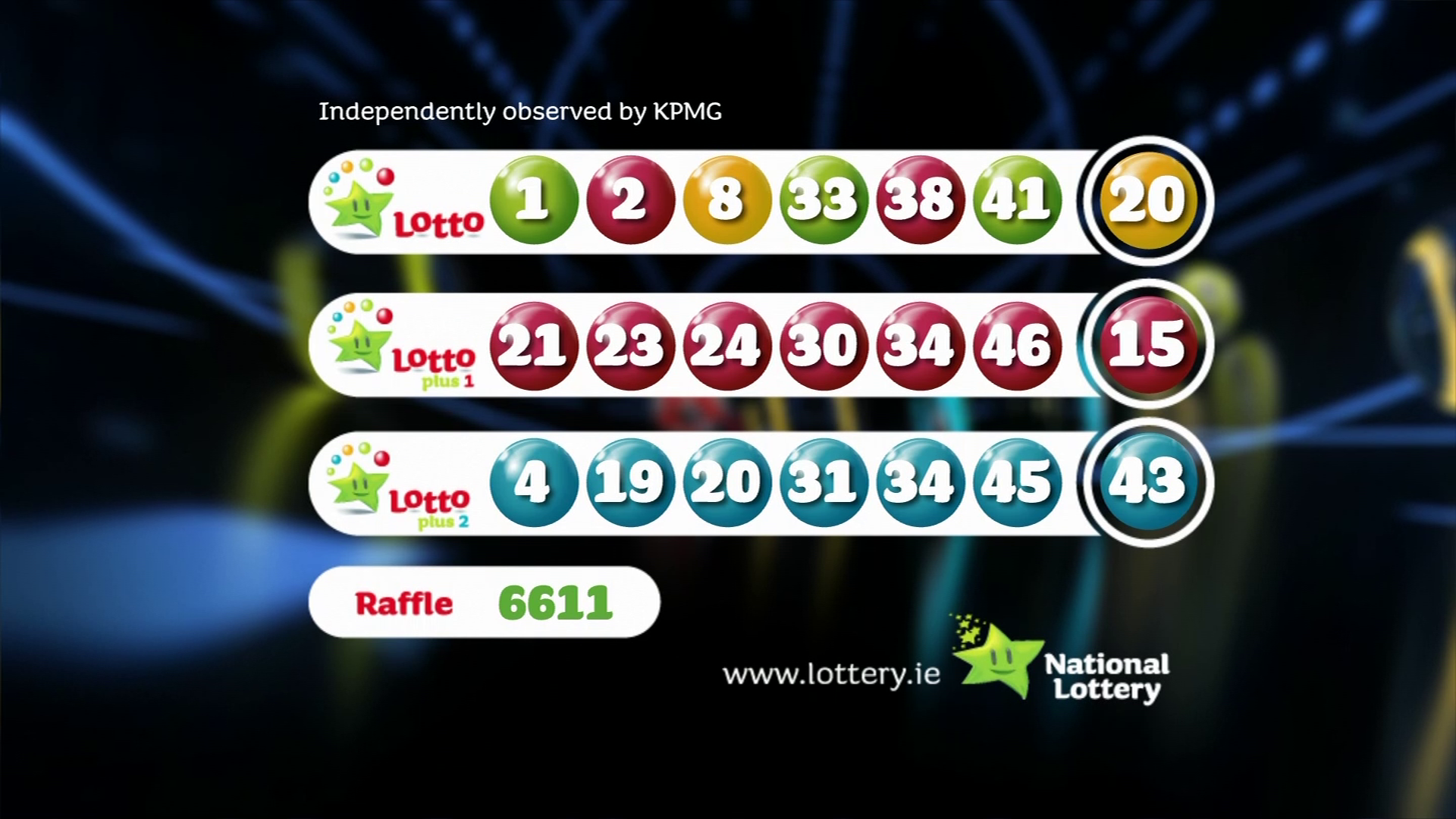

Check Your Numbers Lotto Results For Wednesday April 30 2025

May 03, 2025

Check Your Numbers Lotto Results For Wednesday April 30 2025

May 03, 2025 -

Australian Government Responds To Growing Number Of Chinese Ships Near Sydney

May 03, 2025

Australian Government Responds To Growing Number Of Chinese Ships Near Sydney

May 03, 2025 -

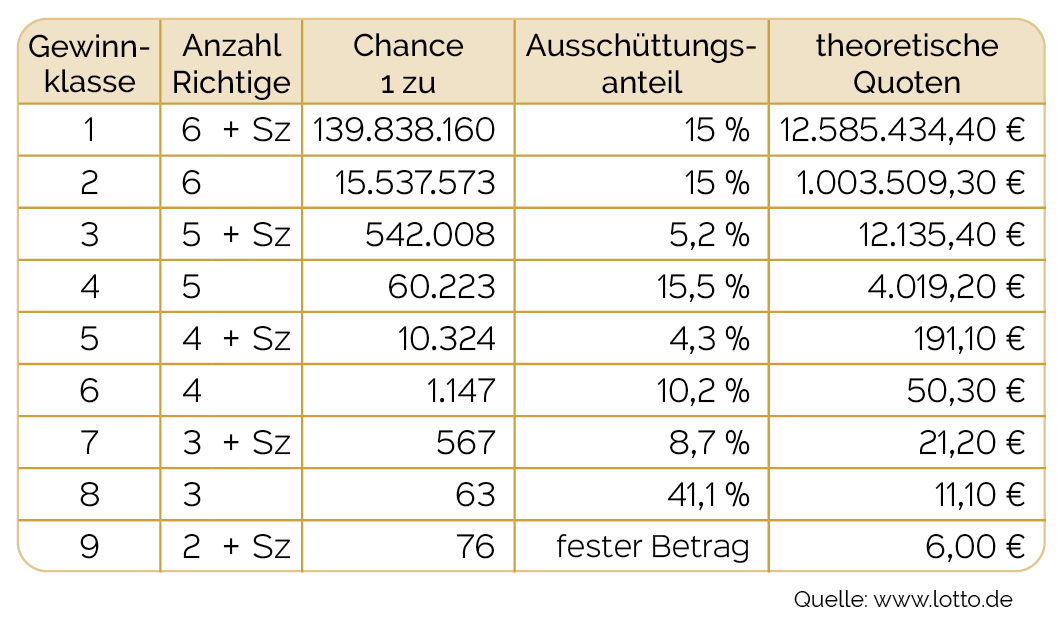

6aus49 Lottoziehung Vom 19 April 2025 Alle Wichtigen Infos

May 03, 2025

6aus49 Lottoziehung Vom 19 April 2025 Alle Wichtigen Infos

May 03, 2025 -

Official Lotto Results Wednesday 16th April 2025

May 03, 2025

Official Lotto Results Wednesday 16th April 2025

May 03, 2025