The Rising National Debt: A Mortgage Borrower's Perspective

Table of Contents

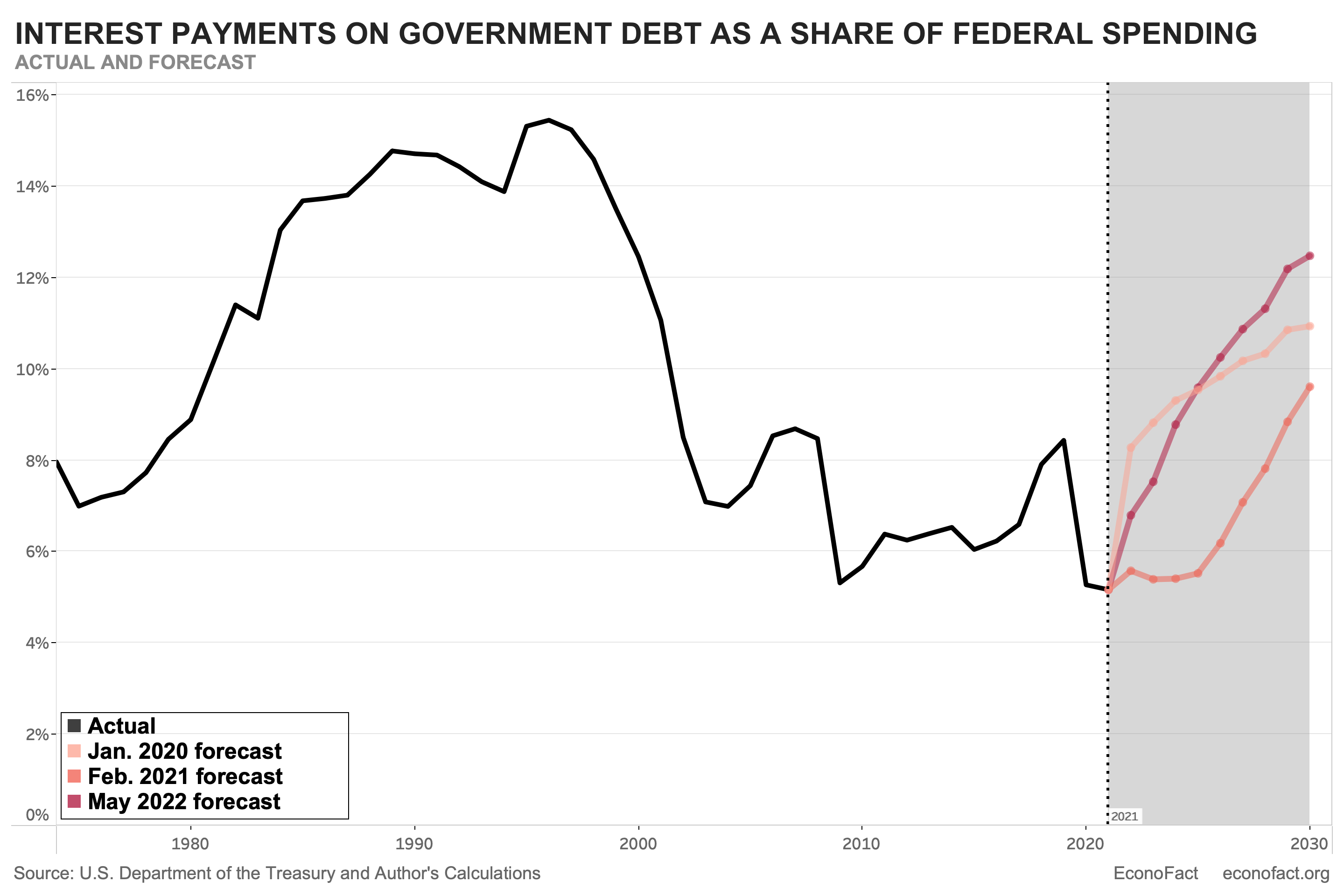

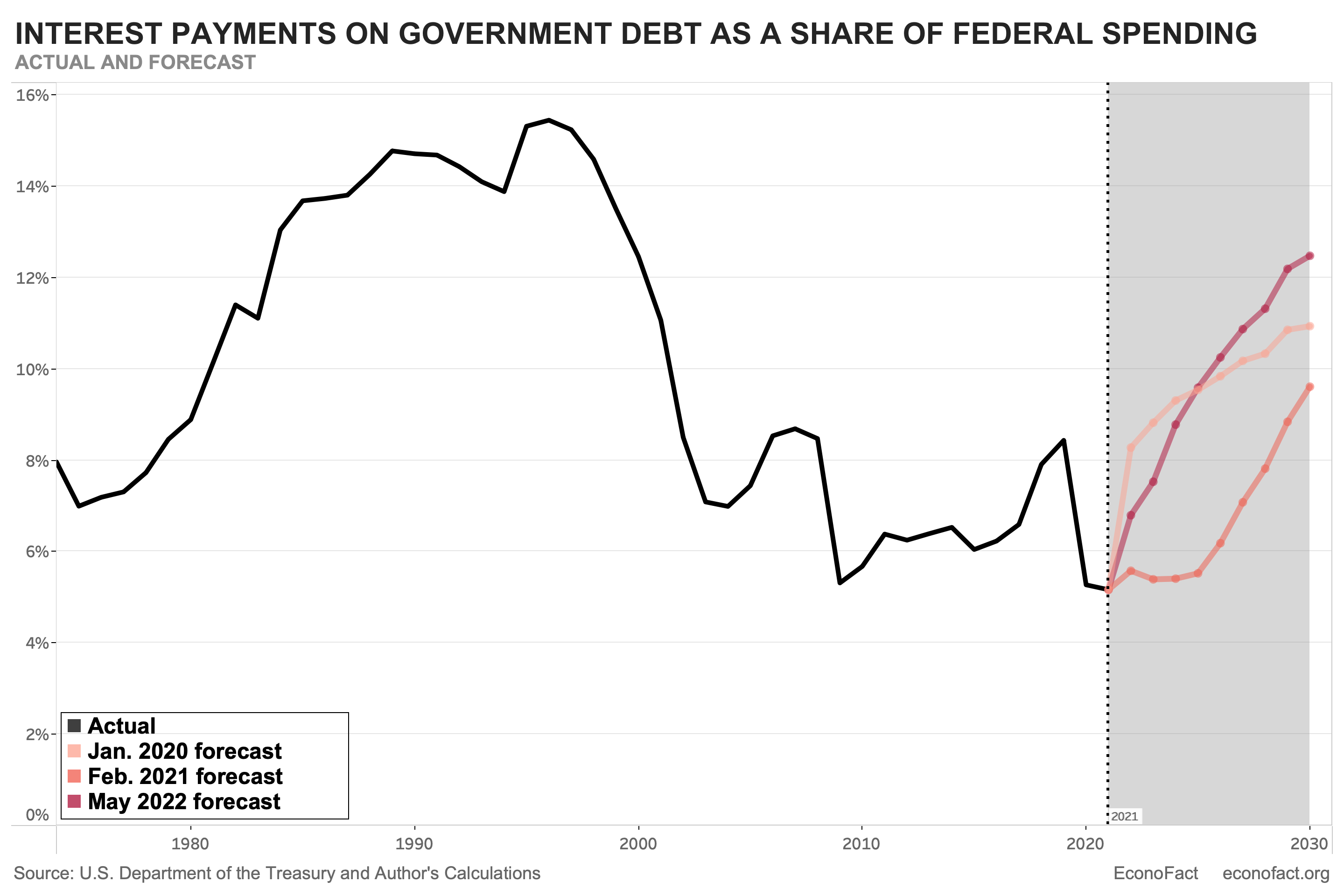

How National Debt Impacts Interest Rates

The relationship between the national debt and interest rates is significant for mortgage borrowers. A higher national debt generally leads to increased government borrowing to finance its obligations. This increased borrowing pushes up the overall demand for loans, including those for mortgages. This increased demand, in a system with a finite supply of loanable funds, drives interest rates higher.

- Increased demand for loans drives up rates: When the government needs to borrow more money, it competes with private borrowers like individuals seeking mortgages. This increased competition increases the price of borrowing – the interest rate.

- The Federal Reserve's response to inflation can also impact rates: To combat inflation, often exacerbated by high national debt, the Federal Reserve may raise interest rates. This further increases the cost of borrowing for mortgages.

- Rising interest rates directly affect mortgage rates: Mortgage rates are intrinsically linked to broader interest rates. Higher interest rates translate directly into higher mortgage payments, making homeownership less affordable.

This impact on mortgage affordability can be substantial. Higher monthly payments can lead to difficulty refinancing, increased financial stress, and even foreclosure in severe cases. Understanding this connection between national debt and interest rates is crucial for responsible financial planning.

Inflation and its Effect on Mortgage Borrowers

A rising national debt can contribute significantly to inflation. When the government prints money to finance the debt, it increases the money supply without a corresponding increase in goods and services. This increase in the money supply dilutes the value of each dollar, leading to inflation.

- Government printing money to finance the debt can dilute the currency's value: This is a fundamental principle of economics; more money chasing the same amount of goods leads to higher prices.

- Increased demand with limited supply fuels inflation: As money becomes less valuable, people tend to spend more, further increasing demand and driving up prices.

- Inflation erodes purchasing power, impacting mortgage borrowers' ability to manage their payments: With inflation, the real value of your income decreases, making it harder to meet your mortgage obligations.

Inflation also affects housing prices, further impacting mortgage borrowers. Rising construction costs and increased demand for housing due to inflation can drive up home values, potentially making it more difficult for borrowers to manage their mortgages and refinance. Inflation significantly affects budgeting and financial planning, requiring careful monitoring and adjustments.

Government Policies and their Influence on the Housing Market

Government policies designed to address the national debt can have a ripple effect on the housing market and mortgage borrowers. These policies often involve measures like tax increases and spending cuts.

- Tax changes can impact homeownership affordability: Increased taxes can reduce disposable income, making it harder for people to afford a mortgage or maintain their current home.

- Government spending cuts could affect housing subsidies or programs: Reductions in government spending might lead to cuts in programs that support affordable housing or provide assistance to struggling homeowners.

- Economic uncertainty due to high national debt can decrease housing demand: Fear of economic instability caused by a high national debt can decrease consumer confidence and lead to reduced demand in the housing market, potentially impacting home values.

Depending on the specific policies implemented, we could see scenarios with varied effects on mortgage rates, home values, and borrower stability. Understanding these potential scenarios is critical for navigating economic uncertainty.

Strategies for Mortgage Borrowers in Times of High National Debt

Facing a rising national debt and potential economic instability requires proactive financial management. Mortgage holders should implement the following strategies:

- Create a robust budget and track expenses: Knowing where your money goes is the first step to effective financial management. A detailed budget helps identify areas for savings.

- Explore options for refinancing to lower interest rates: If interest rates fall, refinancing your mortgage can significantly reduce your monthly payments.

- Build an emergency fund to cushion against unexpected financial shocks: An emergency fund provides a safety net to cover unexpected expenses without resorting to high-interest debt.

- Diversify investments to mitigate risk: Don't put all your eggs in one basket. Diversification helps reduce the impact of economic downturns.

Financial literacy is paramount during these times. Seeking professional financial advice can provide personalized guidance and strategies to navigate the complexities of managing your mortgage in a challenging economic climate.

Conclusion

The rising national debt presents significant challenges for mortgage borrowers, impacting interest rates, inflation, and the overall housing market. Understanding these connections is crucial for making informed financial decisions. Stay informed about the national debt and its potential impact on your mortgage. Proactive financial planning and a strong understanding of your financial situation are essential tools in navigating these economic uncertainties. Learn more about managing your finances during times of high national debt and take control of your financial future.

Featured Posts

-

Steczkowska W Eurowizji Reakcja Fanow I Ostateczny Werdykt

May 19, 2025

Steczkowska W Eurowizji Reakcja Fanow I Ostateczny Werdykt

May 19, 2025 -

Luchtvaartsector 2025 Toename Passagiers Daling Maastricht

May 19, 2025

Luchtvaartsector 2025 Toename Passagiers Daling Maastricht

May 19, 2025 -

Uber One Kenya Your Guide To Savings On Rides And Deliveries

May 19, 2025

Uber One Kenya Your Guide To Savings On Rides And Deliveries

May 19, 2025 -

Collier County Mothers Plea For Safer School Buses After Near Miss

May 19, 2025

Collier County Mothers Plea For Safer School Buses After Near Miss

May 19, 2025 -

Paige Bueckers Injecting Energy Into The Dallas Wings And The Wnba

May 19, 2025

Paige Bueckers Injecting Energy Into The Dallas Wings And The Wnba

May 19, 2025

Latest Posts

-

I Anastasi Toy Lazaroy Gegonota Mnimeia Kai Pneymatiki Klironomia Sta Ierosolyma

May 19, 2025

I Anastasi Toy Lazaroy Gegonota Mnimeia Kai Pneymatiki Klironomia Sta Ierosolyma

May 19, 2025 -

Pasxalines Kai Protomagiotikes Giortes Stin Kastoria Ena Taksidi Stin Paradosi

May 19, 2025

Pasxalines Kai Protomagiotikes Giortes Stin Kastoria Ena Taksidi Stin Paradosi

May 19, 2025 -

To Patriarxiko Sylleitoyrgo Sto Frikto Golgotha Leptomereies Kai Simasia

May 19, 2025

To Patriarxiko Sylleitoyrgo Sto Frikto Golgotha Leptomereies Kai Simasia

May 19, 2025 -

I Anastasi Toy Lazaroy Sta Ierosolyma Mia T Heologiki Kai Istoriki Proseggisi

May 19, 2025

I Anastasi Toy Lazaroy Sta Ierosolyma Mia T Heologiki Kai Istoriki Proseggisi

May 19, 2025 -

Kastoria Paradosiakes Eortes Toy Maioy

May 19, 2025

Kastoria Paradosiakes Eortes Toy Maioy

May 19, 2025