The Rising Costs Of Offshore Wind Energy: A Shifting Investment Landscape

Table of Contents

Increased Material and Manufacturing Costs

The escalating costs of raw materials and manufacturing are significantly impacting offshore wind project budgets. A perfect storm of global factors is at play.

- Rising steel prices: The surge in global steel demand, coupled with supply chain disruptions caused by geopolitical events and increased transportation costs, has driven up steel prices dramatically. Steel is a critical component in the construction of offshore wind turbine foundations and support structures.

- Increased costs of specialized wind turbine components: The specialized components of modern wind turbines, such as blades, generators, and gearboxes, have also seen significant price increases. The complex manufacturing processes and the high demand for these components contribute to this cost escalation.

- Inflationary pressures on manufacturing and transportation: Broad inflationary pressures impacting the entire manufacturing and transportation sectors are further exacerbating the cost increases for offshore wind projects. These pressures ripple through the entire supply chain, impacting everything from raw material sourcing to final assembly.

These increased costs directly affect project feasibility and profitability. Developers are facing tighter margins, necessitating careful cost management and potentially delaying or even canceling projects deemed no longer financially viable.

Escalating Installation and Operational Expenses

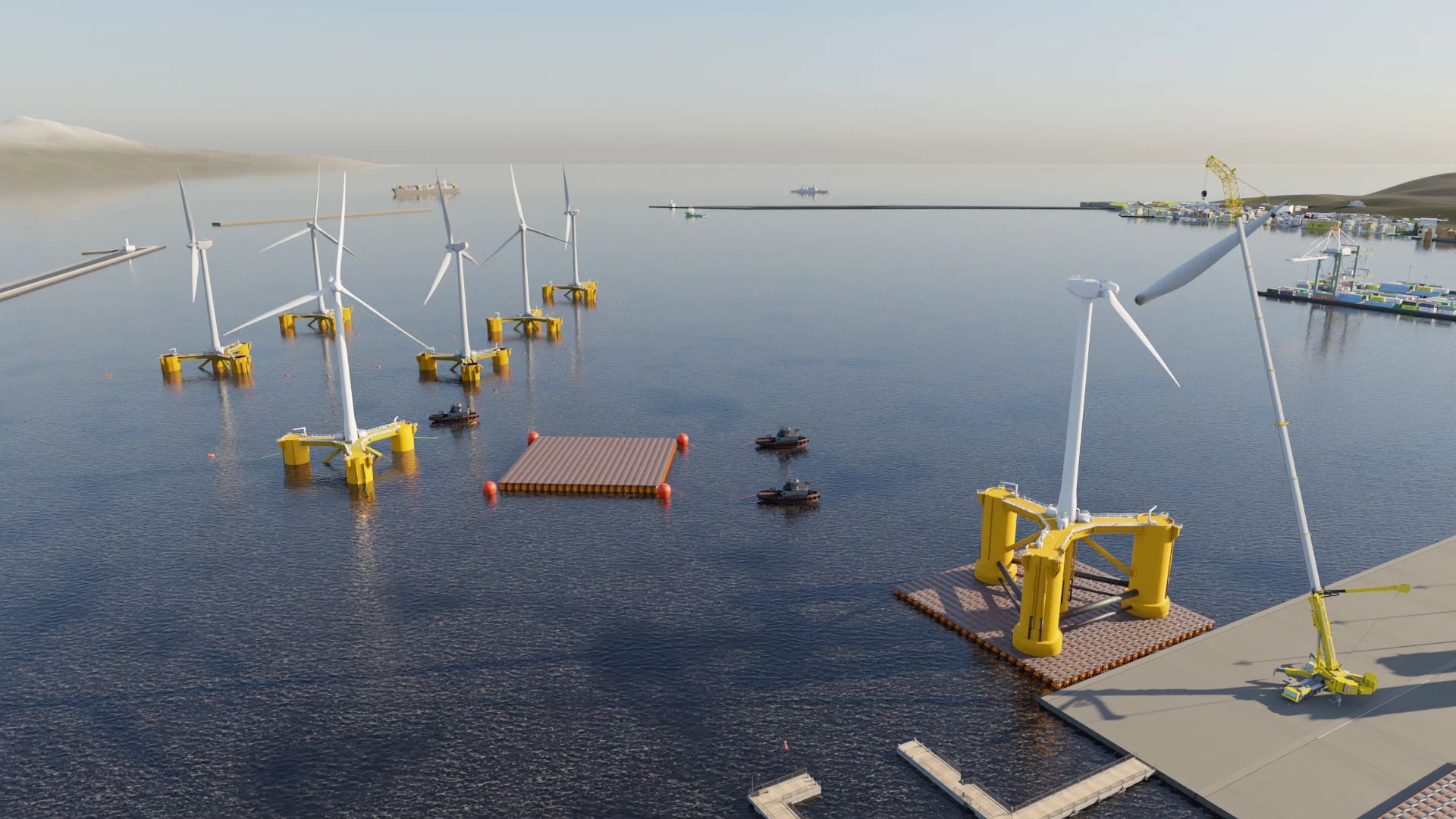

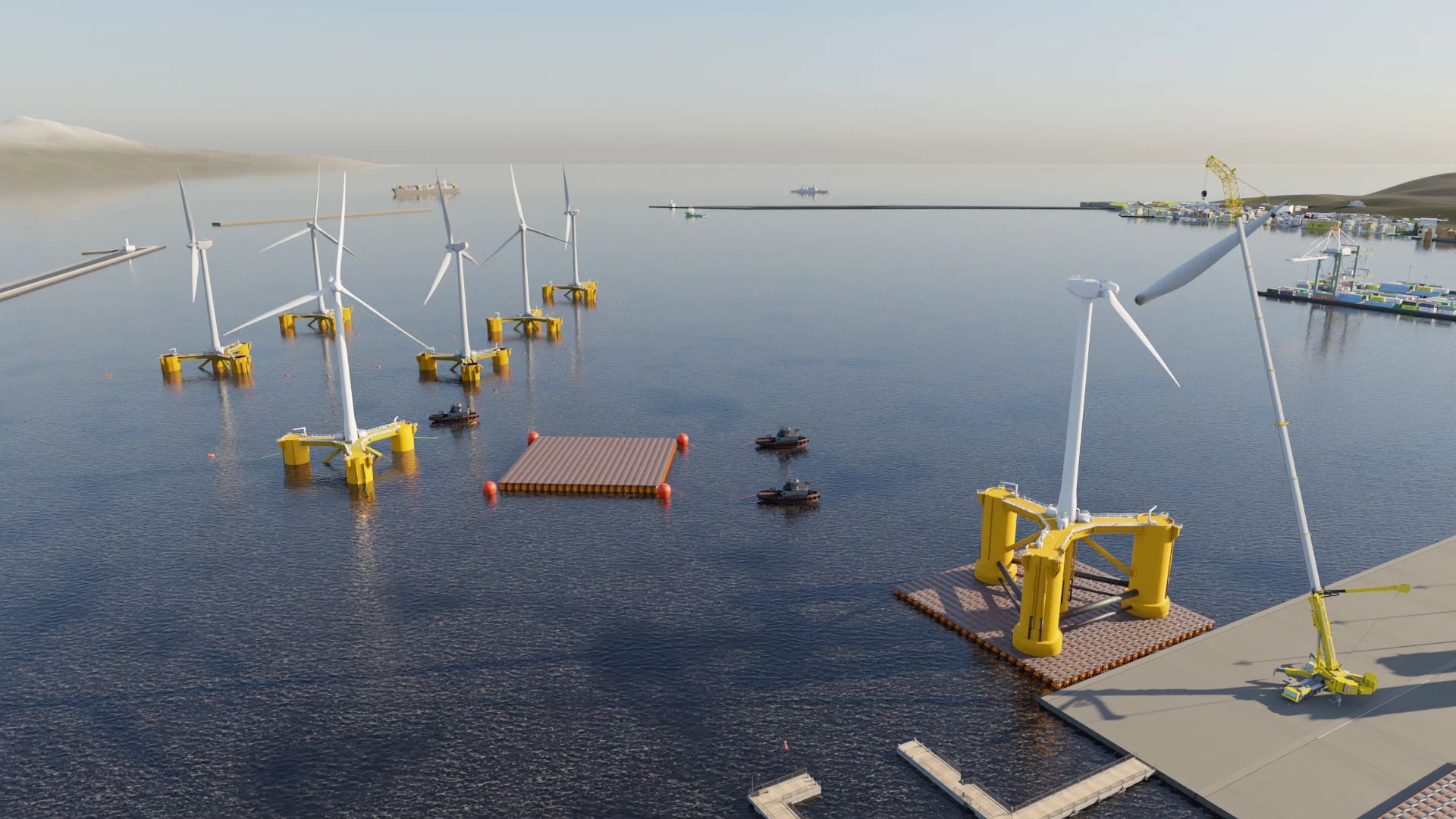

Installing an offshore wind farm is a complex and expensive undertaking. This complexity contributes significantly to the overall cost of offshore wind energy.

- High costs of specialized vessels and skilled labor: Specialized vessels, such as jack-up barges and heavy-lift cranes, are essential for the installation of offshore wind turbines. The costs associated with chartering these vessels, along with the highly skilled labor required to operate them, are substantial.

- Challenges posed by weather conditions and remote locations: Offshore wind farms are typically located in challenging marine environments, subject to harsh weather conditions. These conditions can lead to delays, increased safety measures, and higher installation costs. Remote locations also add to logistical complexities and transportation costs.

- Rising insurance premiums: The inherent risks associated with offshore wind farm installations, including potential damage from storms and equipment malfunctions, lead to higher insurance premiums, further increasing project costs.

Operational expenses, including maintenance, repair, and grid connection costs, also represent a significant portion of the overall lifecycle cost of an offshore wind farm, adding to the financial burden on developers and investors.

Supply Chain Bottlenecks and Delays

Global supply chain disruptions are significantly impacting the timely delivery of components and materials, leading to project delays and cost overruns.

- Shortages of crucial components: Shortages of critical components, such as specialized castings, electronics, and rare earth minerals, are causing delays in the construction of offshore wind turbines. This scarcity often drives up prices significantly.

- Increased transportation costs: Logistical challenges, port congestion, and the increased cost of shipping are adding to the overall project costs. These delays can have a cascading effect on the entire project schedule.

- Impact of geopolitical factors: Geopolitical instability and trade tensions can disrupt material sourcing and significantly impact project timelines and budgets. The reliance on specific regions for certain components makes offshore wind projects vulnerable to global events.

These bottlenecks underscore the importance of robust supply chain management and diversification strategies to mitigate risks and ensure timely project completion.

Permitting and Regulatory Hurdles

The permitting and regulatory process for offshore wind projects is notoriously complex and lengthy, adding considerable time and expense to the development timeline.

- Environmental impact assessments and consultations: Extensive environmental impact assessments and consultations with various stakeholders are required before project approval, leading to significant delays.

- Navigating local, regional, and national regulations: Offshore wind projects often require navigating a complex web of local, regional, and national regulations, further complicating the permitting process.

- Potential delays due to legal challenges and appeals: Legal challenges and appeals from environmental groups or competing interests can lead to significant delays and increased legal costs.

The financial implications of prolonged permitting processes are substantial, as developers incur ongoing costs while projects remain stalled. Streamlining the regulatory framework is crucial to accelerate project development and reduce costs.

Evolving Investment Strategies and Mitigation Tactics

In response to the rising costs, investors are adapting their strategies to mitigate risks and ensure project viability.

- Increased focus on project risk management and cost control: Investors are placing a greater emphasis on robust project risk management strategies and rigorous cost control measures to minimize potential overruns.

- Exploration of innovative financing mechanisms: The use of innovative financing mechanisms, such as green bonds and project finance, is gaining traction to attract capital and reduce reliance on traditional equity financing.

- Collaboration and partnerships to share risks and reduce costs: Collaboration and strategic partnerships are becoming increasingly important to share risks, pool resources, and negotiate better terms with suppliers and contractors.

Technological advancements, such as the development of larger and more efficient turbines, improved installation methods, and more robust foundation designs, offer the potential to reduce future costs and increase the competitiveness of offshore wind energy.

Conclusion

The rising costs of offshore wind energy present significant challenges for investors, but they do not diminish the vital role offshore wind plays in the global transition to cleaner energy sources. The factors discussed above – increased material and manufacturing costs, escalating installation and operational expenses, supply chain bottlenecks, and regulatory hurdles – all contribute to a complex and evolving investment landscape. However, innovative financing mechanisms, improved risk management, technological advancements, and strategic collaborations offer pathways to mitigate these challenges and ensure the long-term viability of this crucial renewable energy source. To fully understand the implications of the rising costs of offshore wind energy, further exploration of current cost drivers and the ongoing development of cost-reduction strategies is crucial. We encourage readers to explore resources dedicated to in-depth analysis of offshore wind investment and cost management to contribute to the sustainable growth of this essential technology.

Featured Posts

-

Investissement Energetique Majeur Eneco Inaugure Un Parc De Batteries A Au Roeulx

May 04, 2025

Investissement Energetique Majeur Eneco Inaugure Un Parc De Batteries A Au Roeulx

May 04, 2025 -

Eurovision Song Contest 2024 Wer Vertritt Deutschland Beim Esc 2025

May 04, 2025

Eurovision Song Contest 2024 Wer Vertritt Deutschland Beim Esc 2025

May 04, 2025 -

Ufc 313 Preview And Predictions A Fight By Fight Breakdown

May 04, 2025

Ufc 313 Preview And Predictions A Fight By Fight Breakdown

May 04, 2025 -

From Contender To Question Mark Tracing Kevin Hollands Ufc Journey

May 04, 2025

From Contender To Question Mark Tracing Kevin Hollands Ufc Journey

May 04, 2025 -

Bakole Clash Ajagbas Strong Statements

May 04, 2025

Bakole Clash Ajagbas Strong Statements

May 04, 2025