The Rise Of Disaster Betting: Analyzing The Los Angeles Wildfire Example

Table of Contents

The Mechanics of Disaster Betting

Disaster betting, in its hypothetical form, could function similarly to other prediction markets. Participants would wager on various aspects of a disaster's unfolding. Imagine platforms, perhaps existing within a heavily regulated framework or as part of academic research, allowing users to place bets on:

-

Examples of Hypothetical Platforms: While no widely known public platforms currently specialize in disaster betting, hypothetical models could use existing prediction market technology. These could be tailored for specific disasters. For example, a platform could be designed specifically for hurricane season in the Atlantic or wildfire predictions in California.

-

Setting Odds: Odds would be dynamically adjusted using advanced algorithms incorporating meteorological data, historical patterns of similar disasters, real-time satellite imagery, and other relevant factors. This creates a complex, ever-shifting market reflecting the evolving risk assessment.

-

Types of Bets: A multitude of bets could be offered. These might include: predicting the total acreage burned in a wildfire, the number of structures destroyed, the precise location of maximum damage, the total insured losses, the number of evacuations, or even the ultimate cost of disaster relief.

The Los Angeles Wildfire Case Study

The devastating wildfires that repeatedly plague Los Angeles County provide a stark example of the potential for disaster betting. These fires, often fueled by Santa Ana winds and dry brush, cause widespread destruction, displacing thousands and resulting in substantial economic losses. Analyzing these events through the lens of hypothetical disaster betting reveals crucial ethical considerations.

-

Statistical Data: Recent Los Angeles County wildfires have consumed thousands of acres, destroyed hundreds of homes, and resulted in billions of dollars in damage and displacement of numerous residents. The emotional toll is incalculable.

-

Hypothetical Market Reflection: In a hypothetical disaster betting market, odds on the extent of damage, areas most affected, and the duration of the fires would fluctuate based on weather forecasts, fire department activity, and real-time information.

-

Ethical Considerations: Betting on such events raises profound ethical concerns. Profits generated from correctly predicting the devastation experienced by real people creates a deeply unsettling dynamic. It could easily trivialize human suffering and the significant economic consequences for individuals and communities.

The Ethical and Social Implications of Disaster Betting

The ethical implications of disaster betting are profound and far-reaching. The practice raises serious questions about the commodification of human suffering and the potential for exploitation.

-

Exploitation and Trivialization: Disaster betting risks reducing the tragedy of natural disasters to a mere financial opportunity. This trivializes the suffering of victims and can be deeply offensive to those affected.

-

Psychological Impact: For survivors already struggling with trauma and loss, the knowledge that others are profiting from their misfortune could inflict further psychological damage and erode community trust.

-

Information Manipulation: There is a significant risk of information manipulation to influence betting outcomes, potentially spreading misinformation and undermining efforts in disaster preparedness and response.

The Economic Aspects of Disaster Betting

While potential economic benefits of hypothetical disaster betting markets (e.g., improved risk assessment through aggregated data) exist, the associated costs are substantial.

-

Potential Economic Benefits: Some argue that accurate prediction markets could improve risk assessment and lead to better disaster preparedness and insurance pricing.

-

Economic Costs: The primary cost lies in the ethical and social implications. Furthermore, inaccurate predictions could lead to substantial financial losses for participants, exacerbating existing inequalities.

-

Insurance Company Involvement: Insurance companies, while not directly involved in hypothetical disaster betting markets, could indirectly benefit from the data analysis generated by such markets, potentially leading to more accurate risk assessments and more efficient pricing.

Conclusion

The rise of disaster betting raises serious concerns about the commodification of human suffering. The Los Angeles wildfire example serves as a potent illustration of the problematic nature of such practices, highlighting the ethical dilemmas and potential consequences. Further research and public discourse are crucial to understanding the implications and mitigating the risks associated with this concerning phenomenon. We must critically examine the ethical dimensions of disaster betting and work towards preventing its normalization. Let's prevent the further growth of disaster betting and focus on supporting those affected by natural catastrophes.

Featured Posts

-

Uyi Amma Girl And Nora Fatehis 100 Noras Statement A Reddit Analysis

May 27, 2025

Uyi Amma Girl And Nora Fatehis 100 Noras Statement A Reddit Analysis

May 27, 2025 -

Nora Fatehi And Jason Derulos Snake A Uk British Asian Chart Domination

May 27, 2025

Nora Fatehi And Jason Derulos Snake A Uk British Asian Chart Domination

May 27, 2025 -

Orange Crush 2025 How Organizers Revitalized The Tybee Island Hbcu Spring Break Tradition

May 27, 2025

Orange Crush 2025 How Organizers Revitalized The Tybee Island Hbcu Spring Break Tradition

May 27, 2025 -

American Jewish Congresss Stance On Nyc Mayoral Candidates Cuomo Supported Lander And Mamdani Opposed

May 27, 2025

American Jewish Congresss Stance On Nyc Mayoral Candidates Cuomo Supported Lander And Mamdani Opposed

May 27, 2025 -

Stav Rubi A Tramp Se Ne E Upushtati U Beskonachne Razgovore Sa Putinom

May 27, 2025

Stav Rubi A Tramp Se Ne E Upushtati U Beskonachne Razgovore Sa Putinom

May 27, 2025

Latest Posts

-

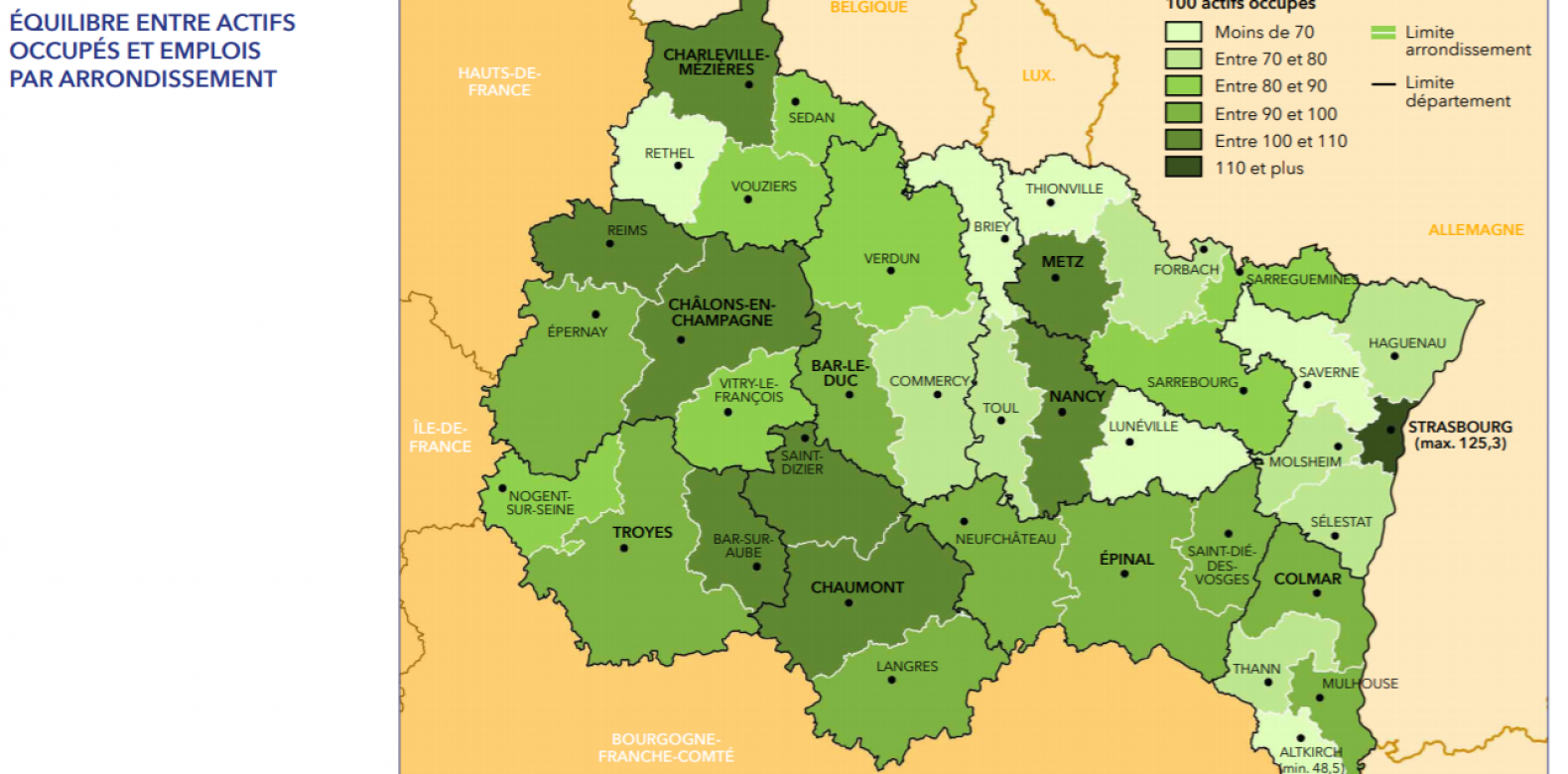

Medine En Concert Le Grand Est Au C Ur D Une Controverse Sur Les Aides Publiques

May 30, 2025

Medine En Concert Le Grand Est Au C Ur D Une Controverse Sur Les Aides Publiques

May 30, 2025 -

Concert De Medine En Grand Est Subventions Regionales Et Reactions Politiques

May 30, 2025

Concert De Medine En Grand Est Subventions Regionales Et Reactions Politiques

May 30, 2025 -

La Condamnation De Marine Le Pen Divisions Et Debats Au Sein De La Classe Politique

May 30, 2025

La Condamnation De Marine Le Pen Divisions Et Debats Au Sein De La Classe Politique

May 30, 2025 -

Grand Est Polemique Autour Des Subventions Pour Un Concert De Medine

May 30, 2025

Grand Est Polemique Autour Des Subventions Pour Un Concert De Medine

May 30, 2025 -

Ineligibilite De Marine Le Pen Analyse De La Decision De Justice Et Ses Consequences

May 30, 2025

Ineligibilite De Marine Le Pen Analyse De La Decision De Justice Et Ses Consequences

May 30, 2025