The Rise Of Deutsche Bank's FIC Traders: Excellence In The Global Market

Table of Contents

Strategic Investments and Technological Advancements

Deutsche Bank's commitment to technological innovation has been a crucial driver of its success in the global financial markets. The bank's significant investment in cutting-edge technology provides its FIC traders with a decisive advantage.

- Significant investment in cutting-edge technology: This includes high-frequency trading (HFT) platforms, advanced data analytics tools, and sophisticated algorithmic trading systems. These tools allow for faster execution speeds and more informed decisions.

- Implementation of sophisticated algorithmic trading strategies: These strategies optimize trading efficiency, minimize risk, and allow for the execution of a high volume of trades with precision. Algorithmic trading is a core component of Deutsche Bank's FICC success.

- Development of robust infrastructure: This supports large-scale trading operations and ensures seamless market access, even during periods of high volatility. Reliable infrastructure is critical for maintaining a competitive edge in the fast-paced world of FICC trading.

- Strategic partnerships with leading technology providers: These partnerships ensure access to the latest technological advancements and enhance overall trading capabilities. This collaborative approach keeps Deutsche Bank at the forefront of innovation.

Deutsche Bank's investment in high-frequency trading systems and advanced analytics allows its FIC traders to react swiftly to market changes and execute trades with precision, significantly impacting their performance in the global financial markets.

Exceptional Talent Acquisition and Development

The success of Deutsche Bank's FICC division is intrinsically linked to the expertise of its traders. The bank actively recruits and cultivates exceptional talent, providing ongoing training and mentorship.

- Attracting and retaining top-tier talent: This is achieved through competitive compensation and benefits packages, creating an attractive environment for skilled professionals.

- Investing in comprehensive training programs: These programs develop the skills and knowledge of its FIC traders, ensuring they remain at the cutting edge of financial markets.

- Fostering a culture of mentorship and collaboration: This enhances knowledge sharing and professional growth, creating a collaborative and supportive work environment.

- Prioritizing leadership development: This ensures strong management and strategic direction within the division, fostering long-term growth and stability.

Deutsche Bank's dedication to employee development and retention allows them to maintain a highly skilled and motivated workforce, critical for success in the competitive world of FICC trading.

Risk Management and Regulatory Compliance

In the highly regulated world of financial markets, robust risk management and unwavering compliance are paramount. Deutsche Bank's commitment to these areas ensures the long-term success and stability of its FICC trading division.

- Implementing robust risk management frameworks: These frameworks mitigate potential losses and safeguard the bank's financial stability, crucial in navigating volatile financial markets.

- Maintaining strict adherence to all relevant financial regulations and compliance standards: This is essential for maintaining a strong reputation and avoiding legal repercussions.

- Investing in advanced risk analytics and monitoring tools: These tools proactively detect and manage potential risks, allowing for swift and informed responses to emerging challenges.

- Building a strong compliance culture: This ensures ethical and responsible trading practices are upheld across the entire division.

Deutsche Bank's proactive approach to risk management and regulatory compliance sets a high standard within the industry and contributes to the sustained success of its FIC traders.

Adaptability and Market Expertise in a Dynamic Environment

The global financial market is characterized by constant change. Deutsche Bank's FIC traders have demonstrated a remarkable capacity to adapt to these dynamics, consistently adapting their strategies to capitalize on emerging opportunities while mitigating potential risks.

- Demonstrated ability to adapt to changing market conditions and economic trends: This flexibility is essential for navigating the unpredictable nature of global financial markets.

- Deep understanding of global macroeconomic factors and their impact on financial markets: This knowledge allows for informed decision-making and the development of effective trading strategies.

- Proactive market analysis and forecasting: This enables the identification and capitalization on trading opportunities, leveraging market insights for maximum profitability.

- Strategic planning and agility to respond effectively to unexpected events and market volatility: This ensures resilience and the capacity to navigate periods of uncertainty and market turmoil.

Deutsche Bank's FIC traders' ability to adapt and thrive in a dynamic environment is a key element of their continued success within the global FICC market.

Conclusion

The remarkable rise of Deutsche Bank's FIC traders is a testament to the bank's strategic investments in technology, its commitment to nurturing exceptional talent, its unwavering focus on risk management and regulatory compliance, and its ability to adapt to the ever-changing global financial landscape. Their success underscores the importance of these factors in achieving excellence in the highly competitive world of fixed income, currencies, and commodities trading. To learn more about Deutsche Bank's leading position in FICC trading and its impact on the global market, explore their resources and stay updated on the latest developments in the field of Deutsche Bank’s FIC trading excellence.

Featured Posts

-

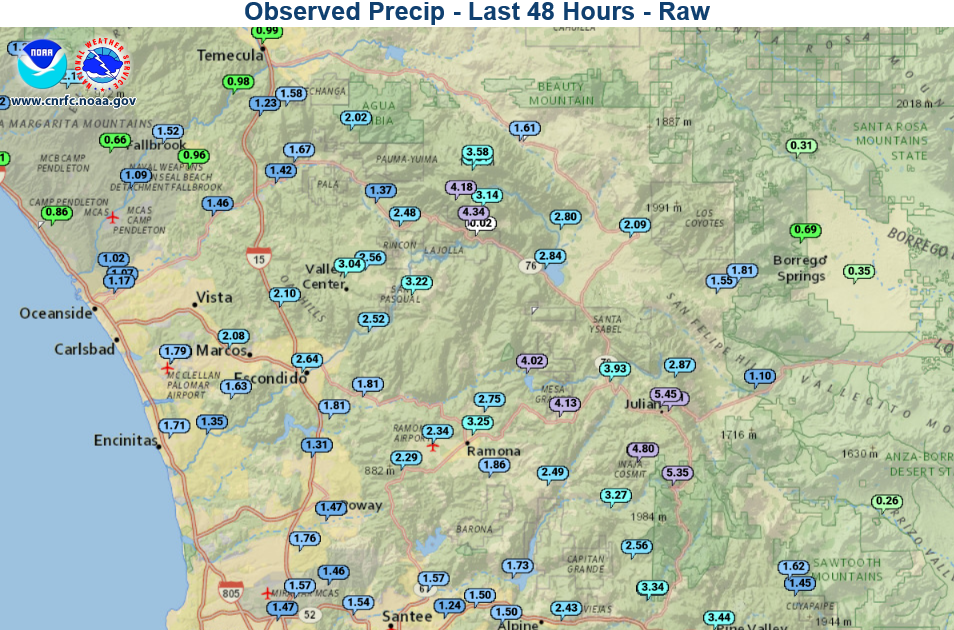

San Diego Rain Totals Cbs 8 Coms Latest Update

May 30, 2025

San Diego Rain Totals Cbs 8 Coms Latest Update

May 30, 2025 -

3 Olympia Theatre Olly Alexanders Performance In Pictures

May 30, 2025

3 Olympia Theatre Olly Alexanders Performance In Pictures

May 30, 2025 -

French Open Ruuds Knee Trouble Leads To Borges Victory

May 30, 2025

French Open Ruuds Knee Trouble Leads To Borges Victory

May 30, 2025 -

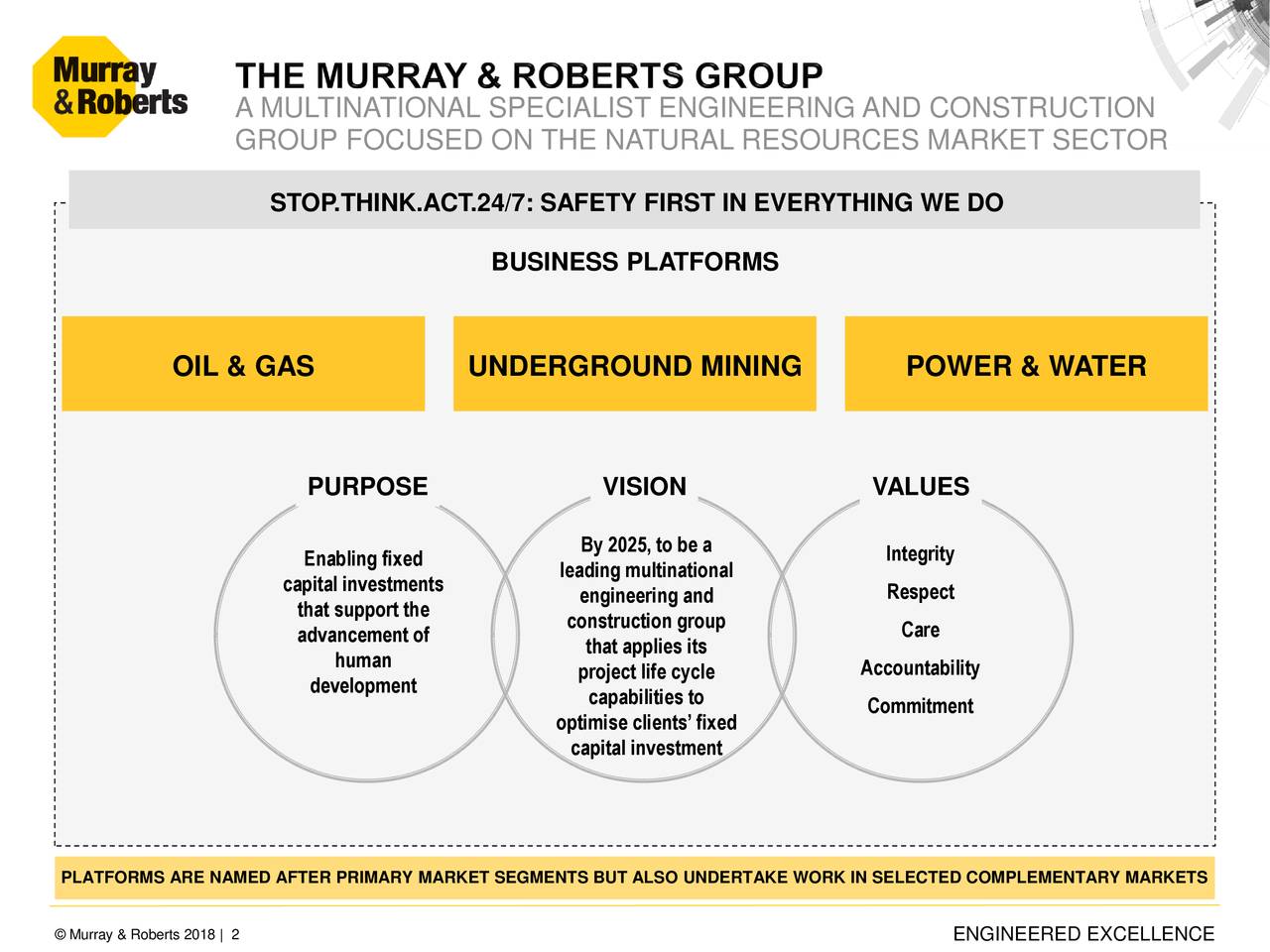

International Companies To Present At Deutsche Bank Depositary Receipts Virtual Investor Conference May 15 2025

May 30, 2025

International Companies To Present At Deutsche Bank Depositary Receipts Virtual Investor Conference May 15 2025

May 30, 2025 -

Ticketmaster Warning Fake Ticket Sellers Costing Punters Thousands

May 30, 2025

Ticketmaster Warning Fake Ticket Sellers Costing Punters Thousands

May 30, 2025