The Ripple Effect: Trump Tariffs And The Delayed Affirm (AFRM) IPO

Table of Contents

Affirm, a prominent buy-now-pay-later (BNPL) company, was poised to make a significant entrance into the public markets. The anticipation surrounding its IPO was immense, given the explosive growth of the BNPL sector. However, the timeline was unexpectedly altered. This article aims to unravel how the ripple effects of Trump's tariffs contributed to this delay.

The Global Supply Chain Disruptions Caused by Tariffs

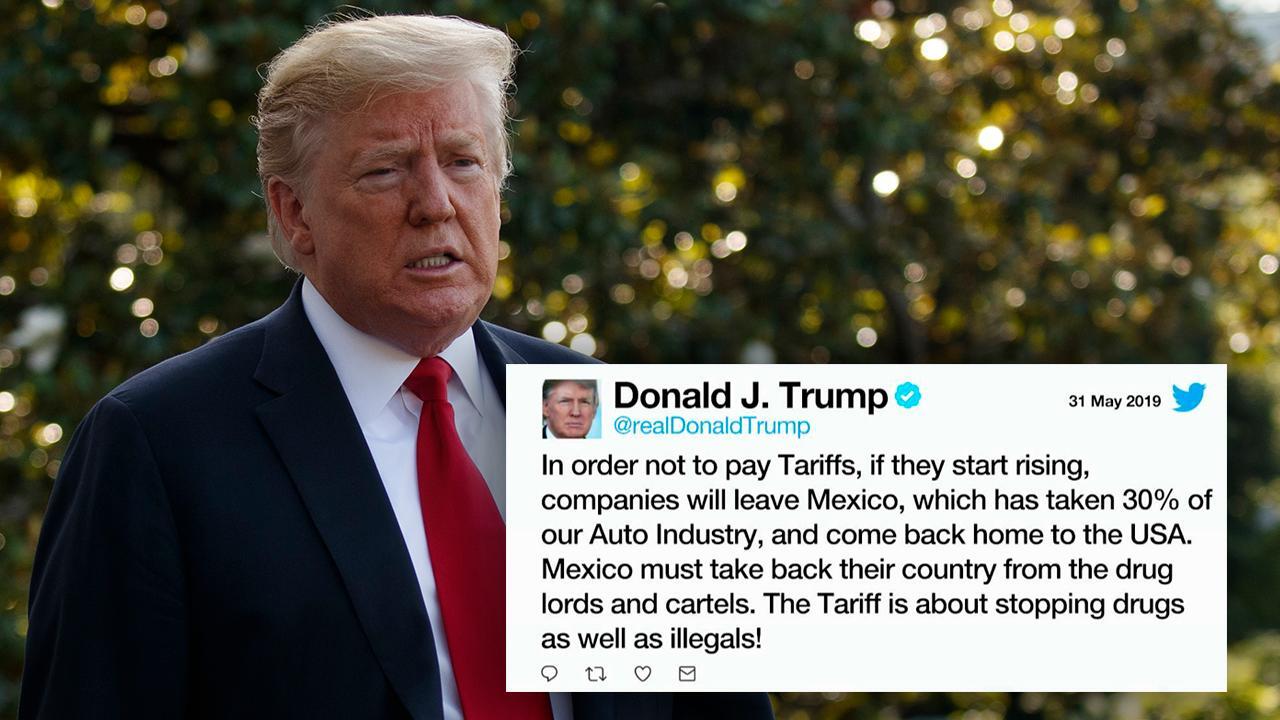

Trump's tariffs, implemented as part of his trade protectionist policies, significantly disrupted global supply chains. These disruptions had a cascading effect, impacting businesses worldwide, including those indirectly connected to Affirm's operations.

Increased Costs and Production Delays

Tariffs on imported goods, particularly from China, increased manufacturing costs across numerous sectors. This increase wasn't limited to the directly targeted goods; it rippled through the entire supply chain. Production delays became commonplace as businesses struggled to source materials and navigate the new trade landscape.

- Affected Industries: Electronics manufacturing, apparel, and automotive industries experienced significant delays and cost increases. These delays trickled down to other businesses reliant on these sectors.

- Impact on Businesses: Many technology companies, including those that might have been Affirm's potential merchant partners, faced challenges in meeting production targets and fulfilling orders, leading to reduced revenues and potential instability.

Impact on Affirm's Merchant Partners

Affirm's business model relies heavily on partnerships with merchants. These merchants offer Affirm's BNPL services to their customers at the point of sale. The tariff-related disruptions significantly affected the financial health and growth trajectory of many of these partners.

- Affected Merchant Partners: Retailers selling imported goods or relying on components manufactured overseas faced increased costs and supply chain issues, impacting their profitability.

- Impact on Affirm's Performance: The financial difficulties experienced by these merchant partners could have impacted Affirm's revenue projections and overall business stability, potentially influencing the decision to delay the IPO.

Investor Sentiment and Market Volatility

The trade wars and resulting economic uncertainty generated by the tariffs significantly impacted investor sentiment and market volatility. This climate of uncertainty had a notable impact on IPO activity.

Economic Uncertainty and its Reflection on IPOs

Trade wars and the resulting uncertainty created a risk-averse environment. Investors became hesitant to commit capital to new ventures in a climate characterized by unpredictability. This hesitancy led to a noticeable decline in IPO activity.

- IPO Activity Statistics: Studies show a marked decrease in the number of IPOs and a reduction in the average deal size during periods of heightened economic uncertainty, similar to the period of Trump's tariffs.

- Impact on Market Confidence: The general uncertainty surrounding global trade made investors cautious, preferring to wait for greater clarity before investing in new ventures.

Risk Assessment and its Impact on Affirm's IPO Timing

Increased market volatility amplified the perceived risk associated with Affirm's IPO. Investors became more discerning, demanding greater assurances of stability and profitability before committing capital.

- Key Factors in IPO Risk Assessment: Revenue projections, market share, regulatory compliance, and overall economic stability are key factors considered in risk assessment.

- Influence on Affirm's Decision: Given the economic uncertainty, Affirm's leadership might have deemed it prudent to delay the IPO until market conditions stabilized and investor confidence improved, minimizing potential risks.

Regulatory Scrutiny and Compliance Considerations

The turbulent economic climate created by the tariffs also increased regulatory scrutiny of businesses, including those considering an IPO. This added layer of complexity might have played a role in Affirm's decision to delay its public offering.

Increased Regulatory Complexity in a Turbulent Economic Climate

Periods of economic uncertainty often lead to increased regulatory scrutiny as policymakers try to safeguard the stability of the financial system. This increased scrutiny often translates to a more complex and demanding regulatory environment for businesses.

- Relevant Regulations and Compliance Requirements: Businesses considering an IPO face stringent regulatory requirements, particularly concerning financial disclosures, investor protection, and compliance with securities laws.

- Impact on IPO Timing: Navigating this intensified regulatory landscape could have added time and complexity to Affirm's IPO preparations.

The Delay as a Strategic Response to Regulatory Pressures

Affirm's delay might have been a strategic decision to address potential regulatory concerns thoroughly before going public. A delay allowed for more time to ensure full compliance, minimizing potential risks and future complications.

- Potential Regulatory Hurdles: Issues related to data privacy, consumer protection, and compliance with evolving financial regulations could have necessitated a more thorough review.

- Impact on Timeline: Addressing these concerns meticulously would have inevitably extended the IPO timeline, ensuring a smoother and less risky public debut.

Conclusion: Understanding the Long-Term Effects of Trump Tariffs and the Delayed Affirm (AFRM) IPO

In conclusion, the seemingly disparate events of Trump's tariffs and Affirm's delayed IPO are connected through a complex web of cause and effect. The tariffs created supply chain disruptions, increased costs, and fueled economic uncertainty, all impacting investor sentiment and increasing the perceived risk of IPOs. This environment likely contributed to Affirm's decision to delay its public offering, highlighting the indirect but significant influence of geopolitical events on the financial markets and specific companies.

Key Takeaways: This analysis underscores the far-reaching consequences of protectionist trade policies. The impact extends beyond the directly targeted industries, affecting the overall economic climate and the decisions of businesses, even those seemingly removed from the immediate effects of tariffs. Understanding these ripple effects is crucial for navigating the complexities of global trade.

Call to Action: We encourage further research into the relationship between Trump Tariffs and the Delayed Affirm (AFRM) IPO, delving deeper into the complexities of global supply chain management and the dynamics of the IPO market during periods of economic uncertainty. This exploration will provide valuable insights into how seemingly unrelated geopolitical events can have profound and lasting effects on the business world. Further reading on topics like supply chain resilience, the impact of trade wars on financial markets, and the intricacies of IPO risk assessment is strongly recommended.

Featured Posts

-

The Voice Season 27 Episode 3 Recap Adam Levines Performance Highlights

May 14, 2025

The Voice Season 27 Episode 3 Recap Adam Levines Performance Highlights

May 14, 2025 -

Ohtanis 3 Run Homer Leads Dodgers To 14 11 Victory

May 14, 2025

Ohtanis 3 Run Homer Leads Dodgers To 14 11 Victory

May 14, 2025 -

Wegmans Recalls Braised Beef Important Information For Consumers

May 14, 2025

Wegmans Recalls Braised Beef Important Information For Consumers

May 14, 2025 -

Klarnas Us Ipo Filing 24 Revenue Surge Revealed

May 14, 2025

Klarnas Us Ipo Filing 24 Revenue Surge Revealed

May 14, 2025 -

Sevilla Miercoles 7 De Mayo Tu Plan Perfecto Para Hoy

May 14, 2025

Sevilla Miercoles 7 De Mayo Tu Plan Perfecto Para Hoy

May 14, 2025

Latest Posts

-

Kupovina Novakovikh Patika Vodich Kroz Modele Od 1 500 Evra

May 14, 2025

Kupovina Novakovikh Patika Vodich Kroz Modele Od 1 500 Evra

May 14, 2025 -

Discover Staten Islands Hidden Gems Traditional Nonna Restaurants

May 14, 2025

Discover Staten Islands Hidden Gems Traditional Nonna Restaurants

May 14, 2025 -

The Enduring Power Of Chanel As Demonstrated By Tyla

May 14, 2025

The Enduring Power Of Chanel As Demonstrated By Tyla

May 14, 2025 -

Understanding Enoteca Maria Nonnas Story And The Restaurants Success

May 14, 2025

Understanding Enoteca Maria Nonnas Story And The Restaurants Success

May 14, 2025 -

Experience Chocolate Paradise Lindts Latest London Store Opens

May 14, 2025

Experience Chocolate Paradise Lindts Latest London Store Opens

May 14, 2025