The Ripple Effect: Oil Supply Disruptions And Airline Ticket Prices

Table of Contents

The Direct Impact of Jet Fuel on Airline Costs

Jet fuel is a significant operating expense for airlines, typically second only to labor costs. Fluctuations in jet fuel prices directly impact an airline's profitability and, consequently, their pricing strategies. Understanding this relationship is crucial for both airlines and travelers.

- Significant Expense: Jet fuel typically accounts for 20-30% of an airline's total operating costs, a figure that can fluctuate wildly depending on market conditions.

- Fuel Hedging Strategies: Many airlines utilize fuel hedging strategies, purchasing fuel contracts at predetermined prices to mitigate the risk of price volatility. However, these strategies aren't foolproof and can't completely eliminate the impact of sudden price spikes.

- Aircraft Fuel Efficiency: The fuel efficiency of different aircraft models significantly impacts operating costs. Newer, more fuel-efficient planes can help airlines reduce their fuel consumption and lessen the impact of price increases, while older fleets are more vulnerable.

How Oil Supply Disruptions Affect Jet Fuel Prices

The global jet fuel market is intrinsically linked to crude oil prices. Crude oil is the primary feedstock for jet fuel production; therefore, any disruption to the global oil supply chain directly affects jet fuel availability and price.

- Geopolitical Instability: Conflicts, political unrest, and sanctions in oil-producing regions can severely restrict supply, leading to price surges. The war in Ukraine, for example, has significantly impacted global oil markets.

- Natural Disasters: Hurricanes, earthquakes, and other natural disasters affecting oil production or transportation infrastructure can cause temporary shortages and price spikes.

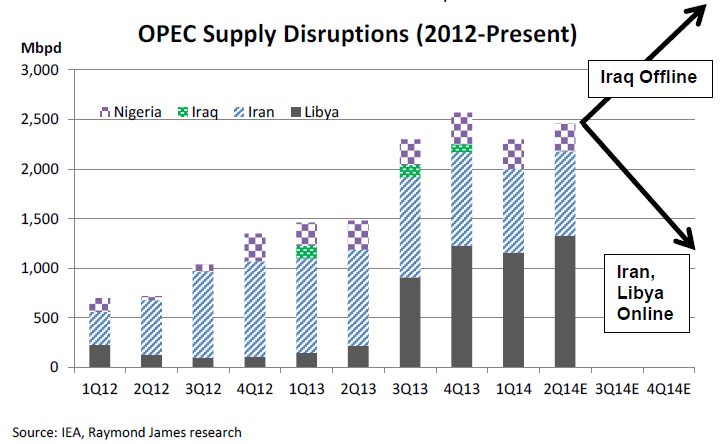

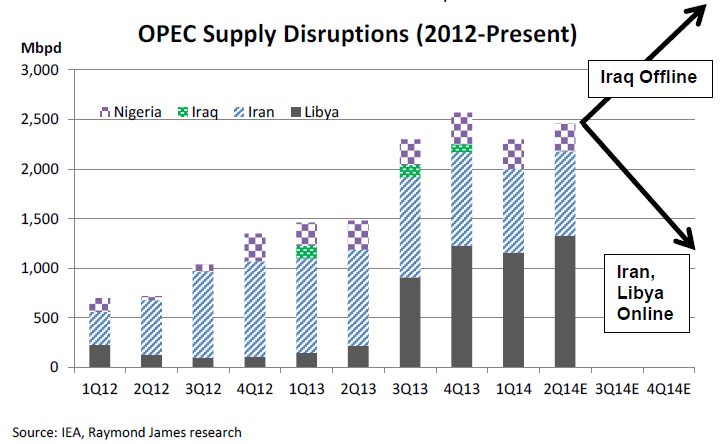

- OPEC Decisions: The Organization of the Petroleum Exporting Countries (OPEC) plays a significant role in influencing global oil supply and prices through production quotas and agreements. Changes in OPEC policy can have dramatic effects on jet fuel costs.

- Supply and Demand: Basic economic principles of supply and demand are at play. When supply is constrained and demand remains high, jet fuel prices inevitably rise.

- Market Speculation: Speculation and market manipulation can further exacerbate price volatility, pushing prices up beyond what might be justified by underlying supply and demand factors.

The Pass-Through Effect: Airlines and Ticket Pricing

Increased jet fuel costs are largely passed onto consumers in the form of higher airline ticket prices. While airlines absorb some of the increased costs, they ultimately need to recoup their expenses to remain profitable.

- Airline Pricing Strategies: Airlines employ various pricing strategies, including dynamic pricing, which adjusts ticket prices based on demand, time of year, and other factors. Fuel costs are a key input in these dynamic pricing models.

- Ancillary Revenue: Airlines generate additional revenue through ancillary services like baggage fees, seat selection, and in-flight meals. This revenue can help offset some of the impact of higher fuel costs, but it doesn't fully compensate for substantial price increases.

- Low-Cost vs. Full-Service Airlines: Low-cost carriers generally have thinner margins and are more directly impacted by fuel price fluctuations, potentially passing on higher fuel costs more aggressively to consumers compared to full-service airlines which may have more financial resilience.

Mitigation Strategies for Travelers

While you can't control global oil prices, you can take steps to mitigate the impact of high airfares on your travel budget.

- Book in Advance: Booking flights well in advance often yields lower prices.

- Be Flexible with Dates: Traveling during off-peak seasons or on weekdays can significantly reduce airfare.

- Use Flight Comparison Websites: Utilize websites like Google Flights, Skyscanner, or Kayak to compare prices across different airlines and dates.

- Pack Light: Avoid checked baggage fees by packing efficiently.

- Consider Budget Airlines: Opting for budget airlines can significantly reduce costs, but weigh the trade-offs in terms of comfort and services.

- Be Flexible with Your Destination: Consider alternative airports or destinations that may offer lower airfares.

Conclusion

The relationship between oil supply disruptions, jet fuel prices, and airline ticket prices is undeniable. Fluctuations in global oil markets significantly impact the cost of air travel. Understanding this dynamic allows travelers to make informed decisions and utilize strategies to find the best deals on airfare. Stay informed about global oil market trends and use the tips provided to navigate the complexities of oil supply disruptions and airline ticket prices and secure affordable flights for your next trip. Plan ahead and be flexible to find the best airfare deals, even during periods of high fuel costs.

Featured Posts

-

Tioga Downs Gears Up For The 2025 Racing Season

May 04, 2025

Tioga Downs Gears Up For The 2025 Racing Season

May 04, 2025 -

How Fleetwood Mac Achieved A Top Charting Album Without Releasing New Music

May 04, 2025

How Fleetwood Mac Achieved A Top Charting Album Without Releasing New Music

May 04, 2025 -

Kanye Wests Control Over Bianca Censori A Growing Concern

May 04, 2025

Kanye Wests Control Over Bianca Censori A Growing Concern

May 04, 2025 -

Paddy Pimblett Vs Dustin Poirier Retirement Debate Sparks Controversy

May 04, 2025

Paddy Pimblett Vs Dustin Poirier Retirement Debate Sparks Controversy

May 04, 2025 -

Deutschland Praesentiert Die Sonderedition Chefsache Esc 2025

May 04, 2025

Deutschland Praesentiert Die Sonderedition Chefsache Esc 2025

May 04, 2025