The Real Safe Bet: Diversification Strategies For Risk-Averse Investors

Table of Contents

Understanding Your Risk Tolerance

Before diving into specific diversification strategies, understanding your risk tolerance is paramount. Your investment approach should directly reflect your comfort level with potential losses.

Assessing Your Investment Goals

Your investment goals—whether short-term (like saving for a down payment) or long-term (like retirement)—significantly influence your risk tolerance. Short-term goals generally necessitate a more conservative approach with low-risk investments, prioritizing capital preservation. Long-term goals allow for a potentially more aggressive strategy, as time provides a cushion to recover from market downturns.

Defining Your Risk Profile

Investors typically fall into three main risk profiles:

- Conservative: These investors prioritize capital preservation and stability over high returns. They're comfortable with minimal risk and often favor safe investments.

- Moderate: These investors seek a balance between risk and return. They're willing to accept some risk for the potential of higher returns but still prioritize capital protection.

- Aggressive: These investors are comfortable with higher risk in pursuit of potentially higher returns. They’re more willing to tolerate market fluctuations.

Identifying your risk profile requires honest self-assessment.

- Utilize online risk tolerance questionnaires to gauge your comfort level.

- Consider seeking advice from a qualified financial advisor for personalized guidance.

- Understand your emotional response to market fluctuations. How do you react to news of market downturns? This emotional response is a key indicator of your true risk tolerance.

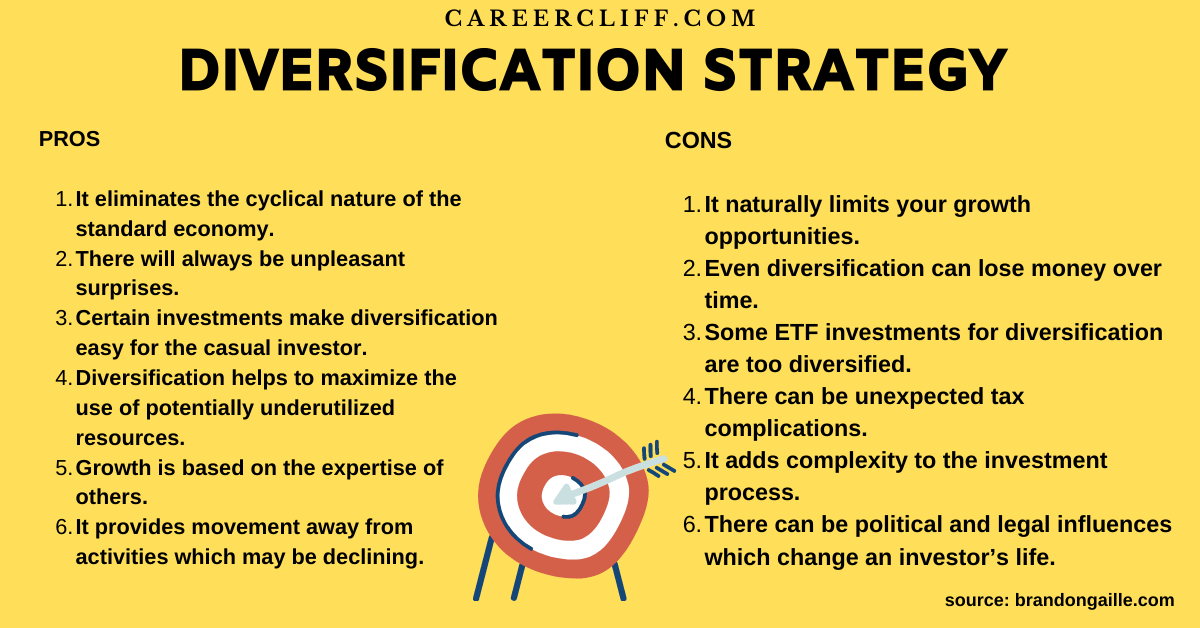

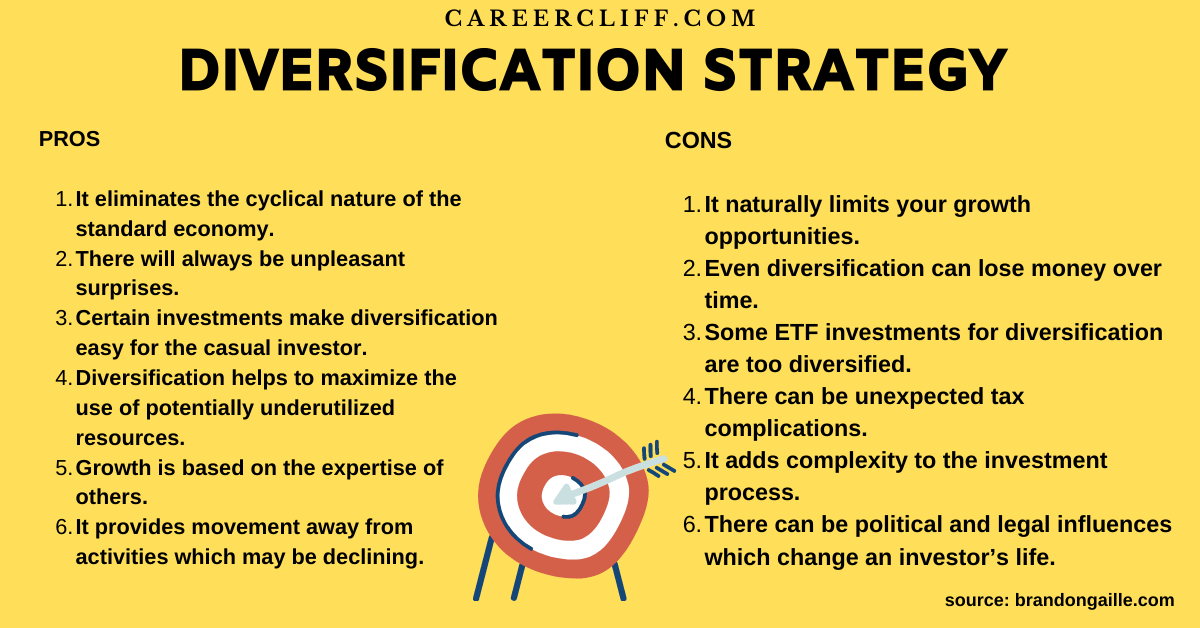

Core Diversification Strategies for Risk-Averse Investors

Effective diversification strategies involve spreading your investments across various asset classes, sectors, and geographies to reduce your overall portfolio risk.

Asset Class Diversification

This is the cornerstone of any effective investment strategy. It involves allocating your capital across different asset classes, each with unique characteristics and risk profiles:

-

Stocks: Offer higher growth potential but also carry higher risk.

-

Bonds: Generally considered lower risk than stocks, providing a steady income stream. Allocate a larger portion to lower-risk assets like bonds and government securities if you're risk-averse.

-

Real Estate: Can provide diversification and potential for long-term appreciation, but it’s less liquid than stocks or bonds.

-

Cash: Offers safety and liquidity, acting as a buffer during market downturns.

-

Consider diversification across global markets to further reduce risk.

-

Understanding correlation is vital. Assets with low correlation tend to move independently, reducing overall portfolio volatility.

Sector Diversification

Within the stock market, sector diversification involves spreading your investments across various industries (technology, healthcare, consumer staples, etc.). This minimizes the impact of industry-specific downturns.

- Utilize index funds or ETFs for broad market exposure and easy sector diversification.

- Research individual stocks carefully if investing directly, paying close attention to each company's financial health and market position.

- Sector rotation—adjusting your portfolio's sector allocation based on market conditions—can be a valuable strategy, but requires careful market analysis.

Geographic Diversification

Investing in assets from different countries helps mitigate country-specific risks, such as political instability or economic downturns.

- Invest in international mutual funds or ETFs for easy access to global markets.

- Consider emerging markets with caution and thorough research due to their higher risk profiles.

- Be aware of currency risk (fluctuations in exchange rates) and strategies to mitigate it, such as hedging.

Low-Risk Investment Options for Risk-Averse Investors

Several low-risk investment options provide a solid foundation for a conservative portfolio:

High-Yield Savings Accounts & Money Market Accounts

These accounts offer FDIC insurance (in the US) and easy access to your funds, making them ideal for emergency funds and short-term savings. However, their returns are typically modest.

Certificates of Deposit (CDs)

CDs offer fixed interest rates for a specified period, providing predictable returns. The longer the term, the higher the interest rate, but your money is less accessible.

Government Bonds

Government bonds (Treasury bonds in the US) are considered among the safest investments, backed by the full faith and credit of the government. They offer relatively stable returns, although these can vary based on interest rate changes.

Dividend-Paying Stocks

While stocks carry inherent risk, dividend-paying stocks can provide a steady income stream, making them suitable for conservative portfolios. However, dividend payments are not guaranteed and can be reduced or eliminated by the company.

Conclusion

Building a secure financial future requires understanding your risk tolerance and employing effective diversification strategies. This involves carefully allocating your investments across various asset classes, sectors, and geographies to mitigate risk. Explore low-risk investments like high-yield savings accounts, CDs, and government bonds to form a solid base for your portfolio. Remember, a well-diversified portfolio is the real safe bet for long-term financial success. Don't let fear of risk paralyze your financial future. Start building your secure portfolio today by implementing the diversification strategies discussed above. Remember, seeking advice from a qualified financial advisor can provide personalized guidance to help you build a robust investment portfolio that aligns with your individual financial goals and risk tolerance.

Featured Posts

-

Cologne Climbs Above Hamburg In Bundesliga 2 Matchday 27

May 09, 2025

Cologne Climbs Above Hamburg In Bundesliga 2 Matchday 27

May 09, 2025 -

Golden Knights Vs Wild Game 4 Barbashevs Ot Winner Evens Stanley Cup Playoffs Series

May 09, 2025

Golden Knights Vs Wild Game 4 Barbashevs Ot Winner Evens Stanley Cup Playoffs Series

May 09, 2025 -

Hertls Hat Trick Leads Golden Knights Past Red Wings

May 09, 2025

Hertls Hat Trick Leads Golden Knights Past Red Wings

May 09, 2025 -

Pley Off Vegas Golden Nayts Vyigryvayut U Minnesoty V Overtayme

May 09, 2025

Pley Off Vegas Golden Nayts Vyigryvayut U Minnesoty V Overtayme

May 09, 2025 -

New Anchorage Establishments Candle Studio Alaska Airlines Lounge Korean Bbq And Eye Tooth Restaurant

May 09, 2025

New Anchorage Establishments Candle Studio Alaska Airlines Lounge Korean Bbq And Eye Tooth Restaurant

May 09, 2025