The Promise Of Driverless Cars: Exploring Uber And Related ETFs

Table of Contents

Uber's Position in the Autonomous Vehicle Market

Uber, a name synonymous with ride-sharing, is heavily invested in the autonomous vehicle market. Its commitment to self-driving technology is shaping its future and presents both exciting possibilities and significant challenges.

Uber's Autonomous Driving Initiatives

Uber's journey into autonomous driving has been marked by both significant strides and setbacks. Its Advanced Technologies Group (ATG) spearheads this effort, focusing on developing and deploying self-driving technology.

- Key Milestones: Uber ATG has undertaken extensive road testing, accumulating millions of autonomous miles. They've also faced challenges, including accidents and regulatory scrutiny.

- Collaborations and Partnerships: Uber has partnered with various companies in the AV space, sharing resources and expertise to accelerate development. These collaborations range from sensor technology providers to mapping companies. Successful partnerships are crucial for navigating the complexities of autonomous vehicle development.

- Challenges and Successes: While Uber has faced setbacks, including the discontinuation of certain projects, its continued investment showcases its long-term commitment to driverless car technology. The acquisition and integration of relevant companies demonstrate their strategy for success in this space.

Uber's Potential for Growth in the Driverless Car Era

The widespread adoption of driverless cars could dramatically alter Uber's business model, presenting both opportunities and threats.

- Cost Reductions: Eliminating the cost of drivers represents a massive potential cost saving for Uber, boosting profitability and competitiveness.

- Market Expansion: Autonomous vehicles could enable Uber to expand into new markets and service areas, including autonomous delivery services, further diversifying its revenue streams.

- Challenges and Risks: Regulatory hurdles, technological limitations, and public acceptance remain significant barriers to the full implementation of driverless technology. Competition from other established players and emerging startups will also pose a challenge to Uber’s dominance in the market.

Investing in the Autonomous Vehicle Revolution through ETFs

Investing directly in individual companies like Uber carries inherent risks. Exchange-traded funds (ETFs) provide a diversified approach to participating in the autonomous vehicle revolution.

Identifying Relevant ETFs

Several ETFs provide exposure to the autonomous vehicle sector. While there isn't a single "driverless car ETF," various funds offer exposure to companies involved in related technologies:

- Technology ETFs: Many broad technology ETFs (like QQQ or VGT) include companies developing key components for autonomous vehicles, such as sensor technology or AI software. However, their exposure to the AV space might be indirect.

- Transportation ETFs: ETFs focusing on the transportation sector might hold shares of companies actively involved in the development and deployment of autonomous vehicles.

- Robotics ETFs: Robotics and automation ETFs often include companies developing the robotic components critical for autonomous driving systems.

(Note: Please conduct thorough research and consult the ETF fact sheets before making any investment decisions. Ticker symbols and ETF availability can change.)

Understanding ETF Risks and Benefits

ETFs offer both advantages and disadvantages compared to individual stock investments.

- Diversification: ETFs offer diversification by investing in a basket of companies, reducing the risk associated with a single company's performance.

- Volatility: The autonomous vehicle sector is inherently volatile, so ETF investments can experience significant price fluctuations.

- Expense Ratios: ETFs charge expense ratios, which should be considered when assessing investment performance.

Due Diligence and Investment Strategy

Investing in the autonomous vehicle sector requires thorough research and a well-defined strategy.

- Research: Analyze individual ETF holdings, performance history, and expense ratios carefully. Consider the underlying companies' financial health and future growth prospects.

- Financial Advisor: Consult with a qualified financial advisor to determine if investing in AV-related ETFs aligns with your personal risk tolerance and financial goals.

The Future of Driverless Cars and Investment Implications

The future of driverless cars is inextricably linked to advancements in various technologies and the regulatory landscape.

Technological Advancements and Market Predictions

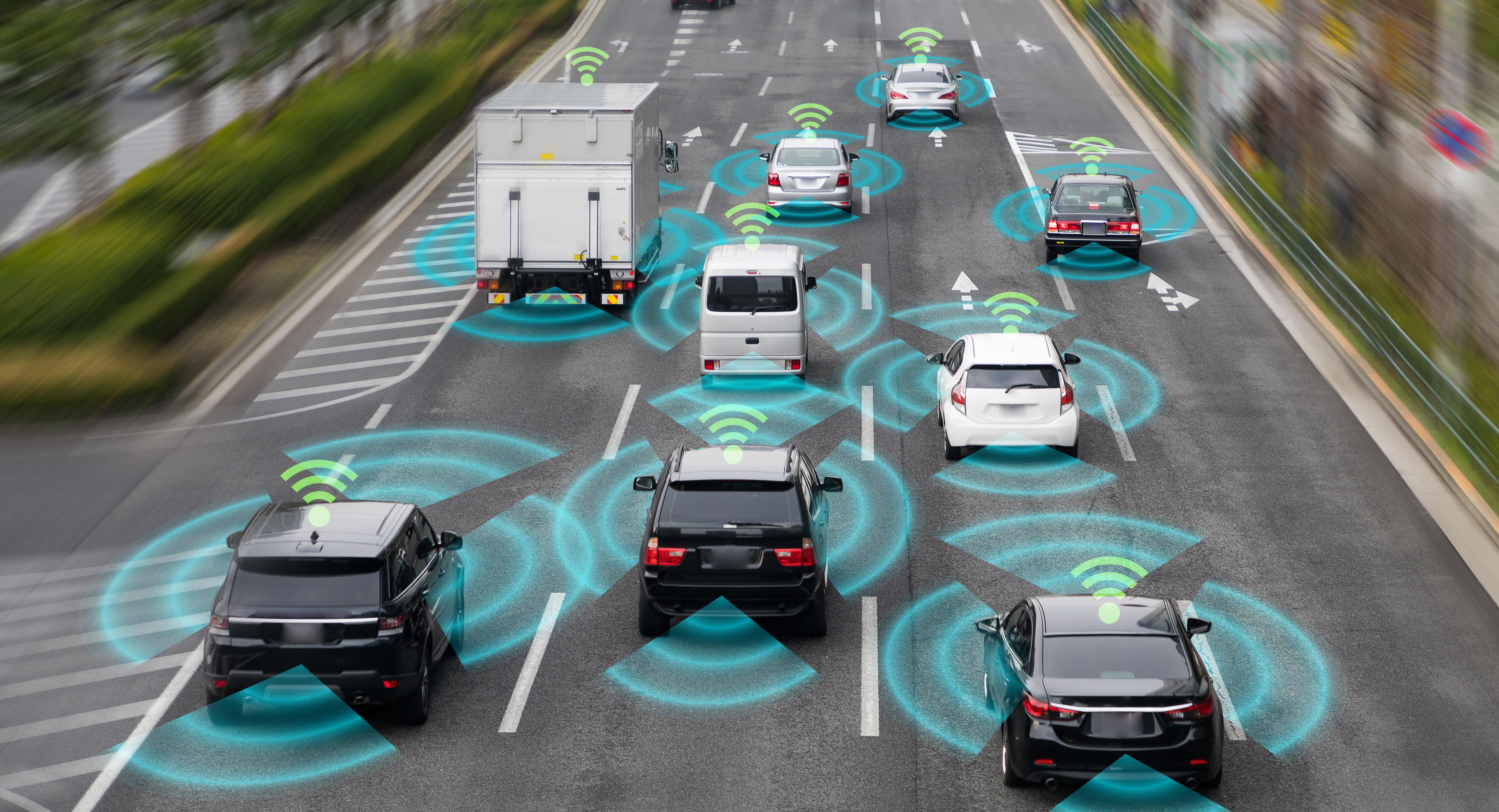

Ongoing advancements in artificial intelligence (AI), sensor technology (LiDAR, radar, cameras), and high-definition mapping are crucial for the continued development and refinement of autonomous vehicle technology. Market forecasts project substantial growth in the AV market over the next decade, although predictions vary widely.

Regulatory Landscape and its Impact on Investment

Government regulations significantly impact the autonomous vehicle industry's development and adoption. Varying regulations across different jurisdictions create complexity for companies and investors alike. Changes in these regulations could significantly impact investment opportunities.

Ethical and Societal Considerations

The widespread adoption of driverless cars raises important ethical and societal questions, including job displacement in the transportation sector and addressing safety concerns related to autonomous vehicle operation.

Conclusion: Navigating the Driverless Car Investment Landscape

The potential of driverless cars is undeniable, offering significant investment opportunities. Uber's position in the industry, coupled with the diversification offered by relevant ETFs, provides avenues for investors to participate in this transformative technology. However, it's crucial to conduct thorough research and due diligence before investing. Explore the potential of driverless car investments, research relevant ETFs for autonomous vehicles, and begin your journey into the exciting world of autonomous vehicle investment. Remember to consult with a financial advisor to create an investment strategy aligned with your individual risk tolerance and financial objectives.

Featured Posts

-

Will Stephen Miller Become The Next National Security Advisor Analysis Of Recent Reports

May 18, 2025

Will Stephen Miller Become The Next National Security Advisor Analysis Of Recent Reports

May 18, 2025 -

Finding Your Way Around Japans Metropolis Transportation Guide

May 18, 2025

Finding Your Way Around Japans Metropolis Transportation Guide

May 18, 2025 -

Bowen Yang Snl Should Embrace Stronger Language

May 18, 2025

Bowen Yang Snl Should Embrace Stronger Language

May 18, 2025 -

Japans Metropolis Planning Your Trip A Step By Step Guide

May 18, 2025

Japans Metropolis Planning Your Trip A Step By Step Guide

May 18, 2025 -

Trump Open To China Trip For Meeting With Xi Jinping

May 18, 2025

Trump Open To China Trip For Meeting With Xi Jinping

May 18, 2025

Latest Posts

-

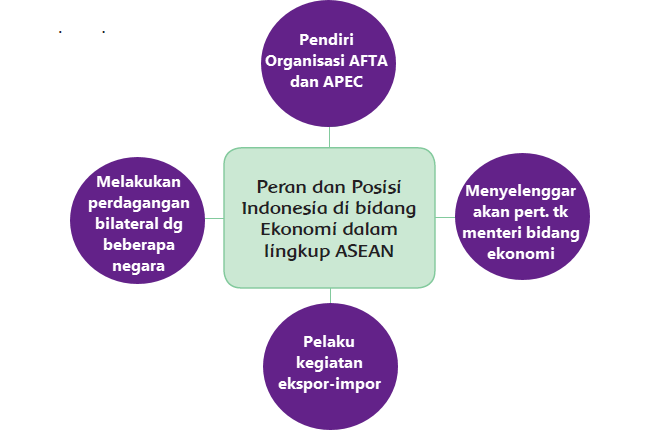

Infografis Kebuntuan Proses Perdamaian Israel Palestina Data Pbb Dan Peran Diplomasi Indonesia

May 18, 2025

Infografis Kebuntuan Proses Perdamaian Israel Palestina Data Pbb Dan Peran Diplomasi Indonesia

May 18, 2025 -

Abd Li Derginin Uyarisi Tuerkiye Israil Suriye Catismasi

May 18, 2025

Abd Li Derginin Uyarisi Tuerkiye Israil Suriye Catismasi

May 18, 2025 -

Analisis Film No Other Land Oscar Dan Isu Palestina Israel

May 18, 2025

Analisis Film No Other Land Oscar Dan Isu Palestina Israel

May 18, 2025 -

Infografis Tantangan Perdamaian Israel Palestina Persepsi Pbb Dan Posisi Indonesia

May 18, 2025

Infografis Tantangan Perdamaian Israel Palestina Persepsi Pbb Dan Posisi Indonesia

May 18, 2025 -

Ab Dli Dergi Tuerkiye Israil Suriye Catismasi Tehlikesi

May 18, 2025

Ab Dli Dergi Tuerkiye Israil Suriye Catismasi Tehlikesi

May 18, 2025