The Power Of Simplicity: A High-Yield Dividend Investing Strategy

Table of Contents

Understanding High-Yield Dividend Investing

Defining High-Yield Dividends

What constitutes a "high-yield" dividend? It's generally defined by a dividend yield percentage significantly above the average for the market. The dividend yield is calculated by dividing the annual dividend per share by the current market price per share. A higher yield indicates a potentially higher return on your investment, but it's crucial to also consider the dividend payout ratio – the percentage of a company's earnings paid out as dividends. A high payout ratio, exceeding 100%, can be a red flag, suggesting the dividend may not be sustainable in the long term.

- Examples of high-yield sectors: Real Estate Investment Trusts (REITs), utility companies, and consumer staples often offer high dividend yields.

- Risks associated with high-yield stocks: While tempting, high-yield stocks can carry higher risk. Companies with exceptionally high yields might be facing financial difficulties, making dividend cuts a possibility.

- Importance of due diligence: Thorough research is essential before investing in any high-yield stock. Don't solely focus on the yield; understand the company's financial health, business model, and future prospects.

The Benefits of a Simple Approach

Simplicity in dividend investing offers significant advantages:

-

Reduced stress: A simple strategy minimizes the time and emotional energy spent on constant market watching and complex trading decisions.

-

Lower transaction costs: Frequent trading increases brokerage fees. A buy-and-hold strategy with high-yield dividend stocks reduces these costs.

-

Easier portfolio management: A smaller, well-selected portfolio is easier to track and manage than a large, diversified portfolio requiring constant rebalancing.

-

Less time spent researching individual stocks: Focusing on a few high-quality, well-researched companies reduces research time significantly.

-

Lower emotional involvement in market fluctuations: A long-term, passive approach minimizes emotional reactions to short-term market volatility.

-

Easier portfolio diversification: While diversification is still crucial, a simpler approach allows for easier diversification across different sectors and risk profiles.

Building Your High-Yield Dividend Portfolio

Identifying Reliable Dividend Payers

Selecting high-yield dividend stocks requires careful screening. Look for companies with:

-

Financial stability: Analyze balance sheets, cash flow statements, and debt levels to assess the company's financial health and ability to sustain dividend payments.

-

Consistent dividend history: A long track record of consistent dividend payments is a positive indicator of reliability. Look for companies with a history of increasing dividends over time (dividend growth).

-

Sustainable dividend growth: Assess the company's ability to continue increasing dividend payouts in the future. Consider factors such as revenue growth, earnings growth, and future expansion plans.

-

Checking dividend payout ratios: Ensure the payout ratio is sustainable, ideally below 70% to allow for reinvestment and future growth.

-

Analyzing company financials: Review key financial metrics such as debt-to-equity ratio, return on equity (ROE), and free cash flow to assess the company's financial strength.

-

Considering industry trends and competitive landscape: Understand the company's position within its industry and its competitive advantages.

Diversification and Risk Management

Diversification is key to mitigating risk. Don't put all your eggs in one basket!

- Diversification across different industries and market caps: Spread your investments across various sectors to reduce the impact of industry-specific downturns. Consider a mix of large-cap, mid-cap, and small-cap stocks.

- Regular portfolio rebalancing: Periodically rebalance your portfolio to maintain your desired asset allocation and avoid becoming over-weighted in any single stock or sector.

- Setting stop-loss orders: To limit potential losses, consider using stop-loss orders to automatically sell a stock if it falls below a predetermined price.

Maximizing Your Returns with a High-Yield Dividend Investing Strategy

Reinvesting Dividends for Growth

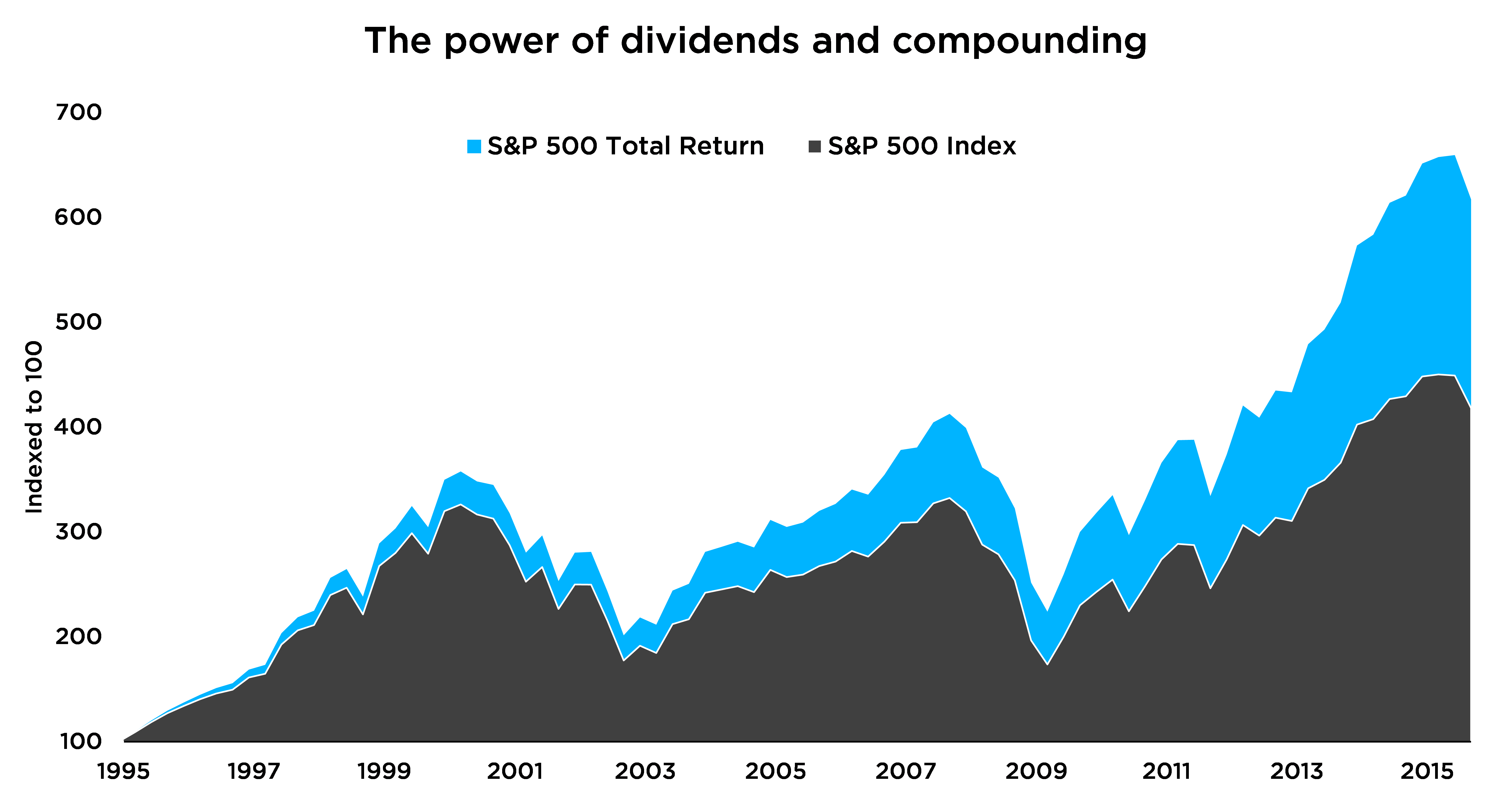

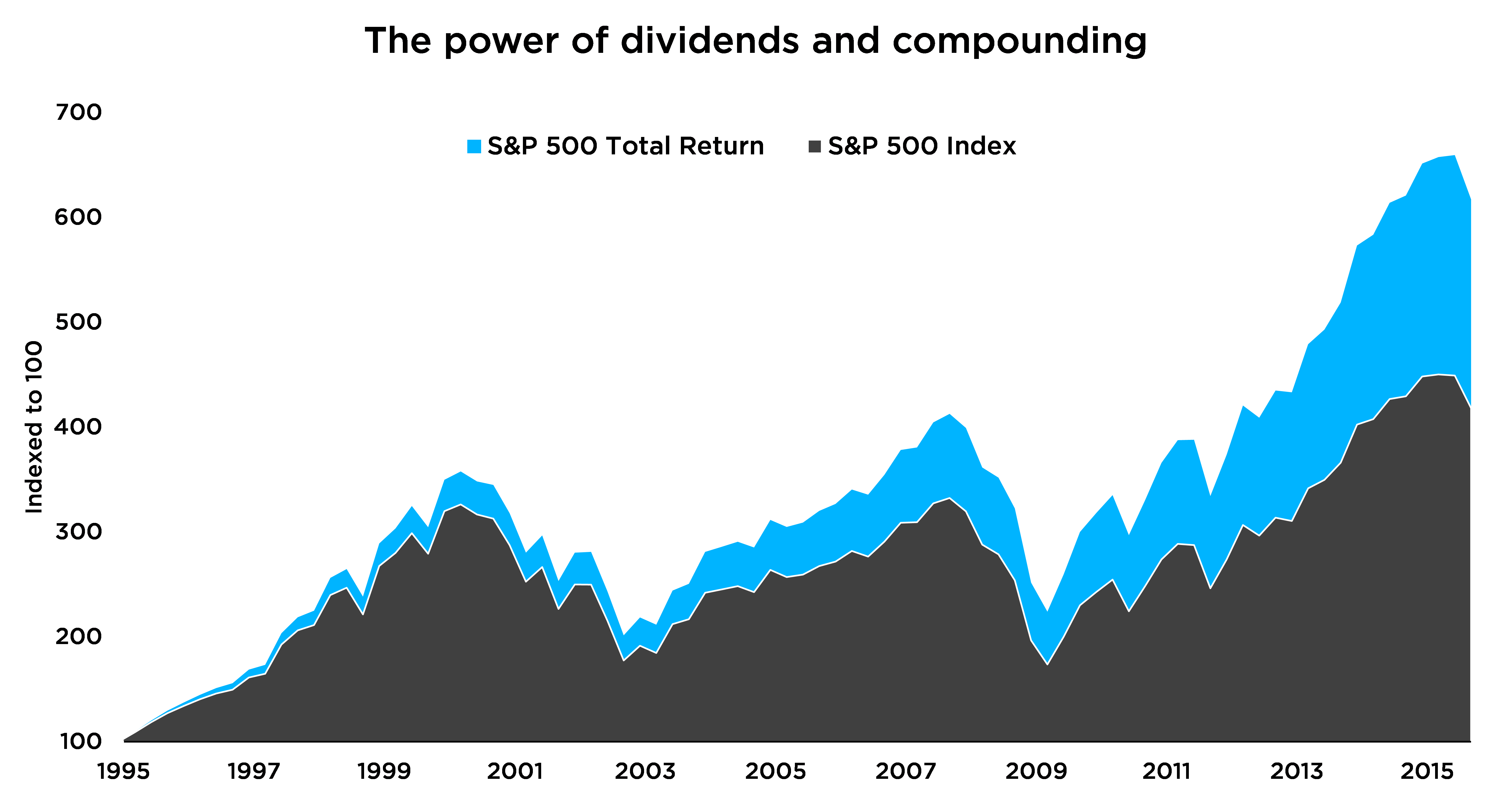

Reinvesting your dividends is crucial for accelerating wealth creation.

- Benefits of DRIPs (Dividend Reinvestment Plans): DRIPs allow you to automatically reinvest dividends to purchase more shares, increasing your ownership and future dividend income.

- The snowball effect of compounding dividends: The power of compounding means your dividends generate more dividends over time, significantly boosting your returns.

- Calculating potential future income from dividend reinvestment: Use online calculators to estimate the potential growth of your investments with dividend reinvestment.

Tax Implications of Dividend Income

Dividend income is taxable. Understanding the tax implications is vital for maximizing your after-tax returns.

- Tax brackets and dividend taxation: Dividend income is taxed at your ordinary income tax rate or a lower qualified dividend tax rate, depending on your income bracket and holding period.

- Tax-advantaged accounts (IRAs, 401(k)s): Investing in tax-advantaged accounts can significantly reduce your tax liability on dividend income.

- Consulting a financial advisor for tax planning: A financial advisor can help you develop a tax-efficient investment strategy tailored to your specific circumstances.

Conclusion

Simplicity, reliability, and long-term growth are the cornerstones of a successful high-yield dividend investing strategy. This approach enables passive income generation and wealth accumulation without the need for complex trading or constant market monitoring. By carefully selecting reliable dividend-paying companies and employing a disciplined investment strategy, you can build a portfolio that generates consistent income and contributes to your financial freedom.

Embark on your journey to financial freedom today! Start building your own high-yield dividend portfolio by researching reliable dividend-paying companies and adopting a simple yet effective investing strategy. Remember, consistent effort and a long-term perspective are key to success in high-yield dividend investing.

Featured Posts

-

Crazy Rich Asians Tv Adaptation A Look At The Creative Team

May 11, 2025

Crazy Rich Asians Tv Adaptation A Look At The Creative Team

May 11, 2025 -

Discovering Merlin And Arthur A Medieval Book Cover Mystery

May 11, 2025

Discovering Merlin And Arthur A Medieval Book Cover Mystery

May 11, 2025 -

The James Bond Question Henry Cavills Response

May 11, 2025

The James Bond Question Henry Cavills Response

May 11, 2025 -

The Thomas Mueller Situation Analyzing The Reactions And Possible Outcomes

May 11, 2025

The Thomas Mueller Situation Analyzing The Reactions And Possible Outcomes

May 11, 2025 -

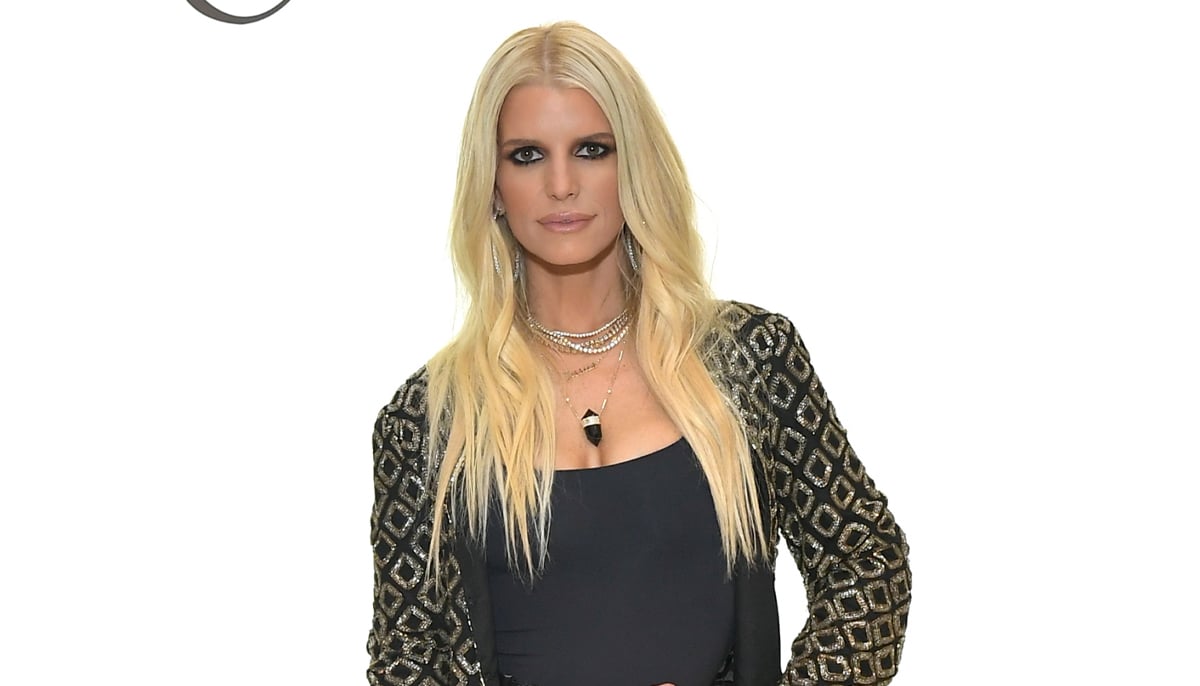

15 Years Later Jessica Simpsons Successful Stage Return

May 11, 2025

15 Years Later Jessica Simpsons Successful Stage Return

May 11, 2025