The Next Fed Chair: Inheriting Trump's Economic Challenges

Table of Contents

Navigating the Trump Tax Cuts Legacy

The Trump administration's significant tax cuts, while aiming to stimulate economic growth, left a lasting impact on the US fiscal landscape. The next Fed Chair must grapple with the consequences of these policies, primarily concerning fiscal imbalance and long-term growth prospects.

Fiscal Imbalance and National Debt

The substantial tax cuts enacted in 2017 significantly increased the national debt. This increased debt burden presents a substantial challenge for the next Fed Chair.

- Increased government borrowing: The government's need to borrow more to finance its increased spending could compete with private sector borrowing, potentially driving up interest rates and crowding out private investment. This could stifle economic growth.

- Inflationary pressures: Managing inflation in a context of high national debt is a delicate balancing act. Increased government spending can fuel inflation, requiring the Fed to potentially raise interest rates, which can have its own negative economic consequences.

- Hawkish monetary policy: To control inflation in this environment, the Fed may need to adopt a more hawkish monetary policy stance, potentially slowing economic growth and impacting employment figures. This requires careful consideration of the trade-offs between inflation control and economic expansion.

Long-Term Economic Growth Prospects

The long-term impact of the Trump tax cuts on economic growth remains a subject of intense debate among economists. The next Fed Chair needs to thoroughly assess whether the stimulus provided sustainable growth or simply fueled short-term gains.

- Supply-side economics evaluation: The effectiveness of the supply-side economics approach implemented during the Trump administration needs a rigorous evaluation. Did the tax cuts actually boost investment and productivity as intended?

- Impact on investment and productivity: A thorough analysis of the tax cuts' impact on business investment and overall productivity is essential. Did the cuts incentivize businesses to invest more, leading to increased productivity and higher wages? Or did the benefits accrue disproportionately to shareholders?

- Future economic outlook: Predicting the potential for future economic stagnation or expansion in light of the tax cuts' legacy is crucial for guiding monetary policy decisions. The Fed Chair will need to consider potential long-term structural changes to the economy resulting from these policies.

Addressing Trade War Aftermath

The Trump administration's trade wars, characterized by tariffs and trade disputes with various countries, significantly disrupted global trade relations and supply chains. The next Fed Chair must navigate the complex consequences of this turbulent period.

Global Trade Uncertainty

The lingering effects of the trade wars continue to create uncertainty in the global economic landscape. The new Fed Chair must account for this uncertainty in their policy decisions.

- Tariff impacts: Assessing the long-term effects of tariffs on US businesses and consumers is paramount. Some sectors may have adapted, while others may still face significant headwinds.

- Supply chain disruptions: Managing potential inflationary pressures arising from disrupted supply chains is critical. The Fed must monitor supply chain dynamics closely to anticipate and mitigate inflationary risks.

- International cooperation: Promoting international cooperation to stabilize global trade is essential for long-term economic stability. The Fed can play a role in fostering international dialogue and cooperation on trade issues.

Impact on Inflation and Manufacturing

The trade disputes led to increased prices for some goods and disrupted various manufacturing sectors within the US. These consequences require careful consideration by the next Fed Chair when setting monetary policy.

- Inflation expectations: Analyzing the impact of trade wars on inflation expectations is crucial for informed policymaking. The Fed needs to understand how trade-related price increases affect consumer and business expectations.

- Manufacturing employment: Considering the implications for employment in key manufacturing sectors is paramount. The Fed Chair needs to factor in the employment impacts of trade disruptions when deciding on monetary policy.

- Mitigation strategies: Developing strategies to mitigate the negative consequences of trade disruptions is vital. The Fed may need to consider targeted policies to support affected industries and workers.

Maintaining Financial Stability in a Volatile Environment

The Trump administration's policies also included significant regulatory rollbacks in the financial sector. The next Fed Chair must assess the impact of these changes on financial stability and systemic risk.

Regulatory Rollbacks

The easing of financial regulations during the Trump era may have increased the vulnerability of the financial system to shocks. The next Fed Chair must carefully evaluate these changes.

- Market volatility: Evaluating the potential for increased volatility in the financial markets is critical. The Fed needs to monitor market conditions carefully to identify and address potential risks.

- Regulatory framework adequacy: Assessing the adequacy of existing regulatory frameworks in light of the rollbacks is essential. The Fed may need to propose adjustments to safeguard financial stability.

- Regulatory adjustments: Considering potential regulatory adjustments to ensure financial stability without stifling economic growth is a challenging but necessary task.

Managing Asset Bubbles

The low-interest-rate environment fostered during the Trump administration might have contributed to the formation of asset bubbles in various markets. The next Fed Chair must actively monitor and manage these potential risks.

- Asset bubble identification: Identifying and mitigating potential risks associated with asset bubbles is paramount to prevent future crises. The Fed needs robust surveillance mechanisms.

- Monetary policy tools: Implementing appropriate monetary policy tools to address asset bubbles without triggering a broader economic downturn is a delicate balancing act.

- Systemic risk protection: Protecting the financial system from potential shocks stemming from asset bubbles is a key responsibility of the Fed Chair.

Conclusion

The next Fed Chair faces an unprecedented set of challenges directly inherited from the Trump administration’s economic policies. Successfully navigating the legacy of tax cuts, trade wars, and regulatory rollbacks will require a nuanced understanding of macroeconomic dynamics and a commitment to robust financial stability. The choice of the next Fed Chair will have profound implications for the future of the US economy. Understanding these inherited challenges is critical for informed discussion and policy-making. Learn more about the candidates and their perspectives on these crucial issues related to the Fed Chair and Trump's economic legacy to ensure a well-informed approach to the future of the US economy.

Featured Posts

-

California Surpasses Japan As Worlds Fourth Largest Economy

Apr 26, 2025

California Surpasses Japan As Worlds Fourth Largest Economy

Apr 26, 2025 -

George Santos Faces Up To 7 Years In Federal Fraud Case

Apr 26, 2025

George Santos Faces Up To 7 Years In Federal Fraud Case

Apr 26, 2025 -

Will Trumps Influence Unite Or Divide Canada In The Upcoming Election

Apr 26, 2025

Will Trumps Influence Unite Or Divide Canada In The Upcoming Election

Apr 26, 2025 -

Fugro And Damen New Vessel For Royal Netherlands Navys Surveillance And Security

Apr 26, 2025

Fugro And Damen New Vessel For Royal Netherlands Navys Surveillance And Security

Apr 26, 2025 -

Het Onlogische Zoete Broodje Uit Nederland

Apr 26, 2025

Het Onlogische Zoete Broodje Uit Nederland

Apr 26, 2025

Latest Posts

-

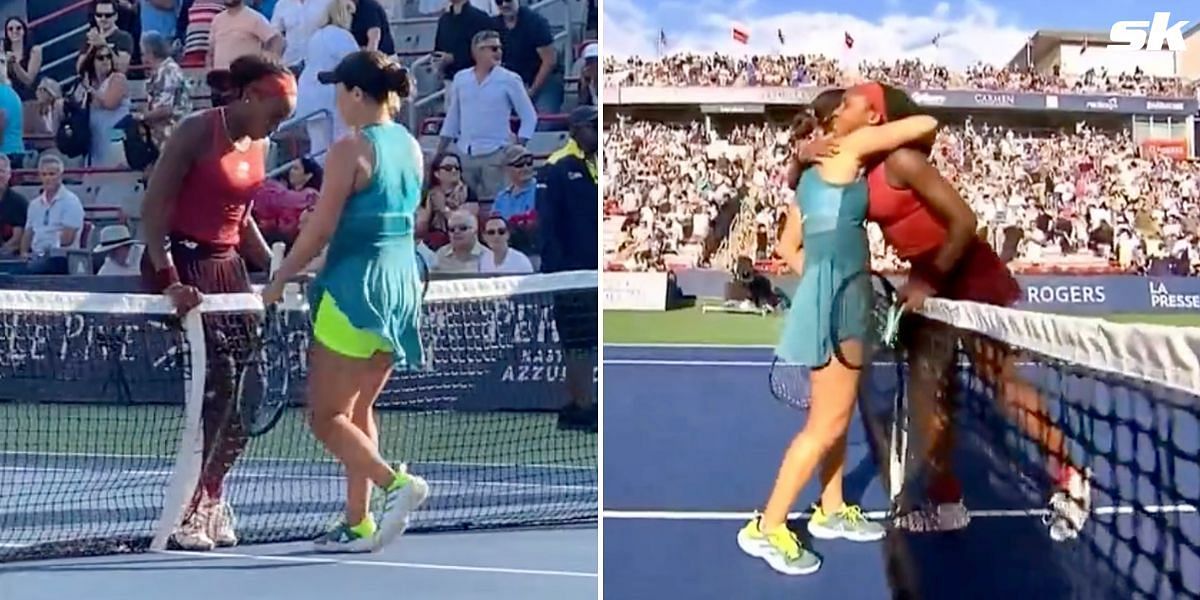

Charleston Tennis Pegula Triumphs Over Collins

Apr 27, 2025

Charleston Tennis Pegula Triumphs Over Collins

Apr 27, 2025 -

Charleston Open Pegula Upsets Defending Champion Collins

Apr 27, 2025

Charleston Open Pegula Upsets Defending Champion Collins

Apr 27, 2025 -

Pegulas Comeback Victory Over Collins In Charleston

Apr 27, 2025

Pegulas Comeback Victory Over Collins In Charleston

Apr 27, 2025 -

Charleston Open Pegula Upsets Collins In Thrilling Match

Apr 27, 2025

Charleston Open Pegula Upsets Collins In Thrilling Match

Apr 27, 2025 -

Pegula Rallies Past Collins To Win Charleston Title

Apr 27, 2025

Pegula Rallies Past Collins To Win Charleston Title

Apr 27, 2025