The Looming Crisis In The Global Bond Market: A Posthaste Perspective

Table of Contents

The global bond market, a cornerstone of the global financial system, facilitates the borrowing and lending of capital between governments, corporations, and individuals. Its stability is vital for economic growth and stability. A significant disruption in this market could trigger a chain reaction with far-reaching consequences. This analysis aims to provide a clear understanding of the escalating risks and potential pathways forward.

Rising Interest Rates and Their Impact

The relationship between bond prices and interest rates is inversely proportional. When interest rates rise, the value of existing bonds falls, as newly issued bonds offer higher yields. The aggressive interest rate hikes implemented by central banks globally to combat inflation are significantly impacting bond valuations. This tightening monetary policy is designed to cool down overheating economies, but it comes at a cost.

- Increased borrowing costs for governments and corporations: Higher interest rates increase the cost of government borrowing, potentially leading to reduced public spending and slower economic growth. Corporations face similar challenges, impacting investment and job creation.

- Potential for widespread defaults on high-yield bonds: Companies with high levels of debt and already strained finances may struggle to meet their obligations in a rising interest rate environment, potentially leading to a wave of defaults. This could trigger a domino effect, impacting other financial institutions.

- Reduced investor demand for bonds: As yields on new bonds increase, investors may become less interested in holding existing lower-yielding bonds, leading to further price declines. This reduced demand could exacerbate the market downturn.

- Impact on pension funds and insurance companies heavily invested in bonds: These institutions, with large portfolios of bonds, face significant losses as bond prices fall. This could jeopardize their ability to meet future obligations to retirees and policyholders.

Inflation's Erosive Effect on Bond Yields

High inflation significantly erodes the real return on bonds. While a bond might offer a nominal yield, if inflation outpaces that yield, the investor's purchasing power actually decreases. Persistent inflation undermines investor confidence in bonds as a safe haven asset.

- Lower real yields make bonds less attractive compared to other asset classes: When inflation is high, investors may seek alternative investments, such as equities or real estate, that offer better returns that keep pace with inflation. This shift in investor preference can put further downward pressure on bond prices.

- Increased demand for inflation-protected securities: As a hedge against inflation, investors are increasingly turning towards inflation-protected securities (TIPS), which offer returns that adjust with inflation. This increased demand can drive up the prices of these specific bonds.

- Potential for a flight to safety into government bonds, potentially increasing their yields: During times of uncertainty, investors often seek the safety of government bonds. However, this increased demand can drive up yields, reducing the attractiveness of these bonds as a safe haven.

Geopolitical Risks and Market Volatility

Geopolitical events, such as wars, trade tensions, and political instability, significantly contribute to bond market volatility. These uncertainties create a risk-off environment, where investors seek safety, often leading to capital flight from emerging markets and increased demand for safe-haven assets like US Treasury bonds.

- Increased risk aversion leading to capital flight from emerging markets: Investors pull their money out of emerging markets perceived as riskier due to political or economic instability, putting downward pressure on their bond markets.

- Potential for currency devaluation affecting international bond investments: Currency fluctuations can significantly impact the returns of international bond investments, adding another layer of risk for investors.

- Uncertainty impacting long-term bond yields: Geopolitical uncertainty makes it difficult to predict future economic conditions, impacting the long-term yields of bonds. Investors demand higher yields to compensate for the increased risk.

The Role of Central Bank Intervention

Central banks play a crucial role in mitigating potential bond market crises. They can intervene through various tools, including quantitative easing (QE) – purchasing bonds to increase liquidity – and interest rate cuts to stimulate the economy. However, these interventions are not without limitations and potential negative consequences.

- Limitations of central bank actions in addressing structural issues: Central bank interventions may not be effective in addressing underlying structural issues contributing to the crisis, such as high levels of debt or unsustainable fiscal policies.

- Potential for unintended consequences, such as increased inflation: QE can lead to increased inflation if it's not carefully managed, undermining the very goal of stabilizing the economy.

- Moral hazard concerns: Central bank interventions can create a moral hazard, where investors take on more risk knowing that central banks might step in to bail them out in a crisis.

Conclusion:

The global bond market faces significant risks, including rising interest rates, persistent inflation, and geopolitical uncertainties. These factors create a volatile environment with the potential for a major crisis. The impact of such a crisis could be far-reaching, affecting governments, corporations, and individual investors alike. Central bank interventions can play a role in mitigation but are not a panacea. Understanding the dynamics of the global bond market is crucial for navigating these uncertain times. Stay informed and adapt your investment strategies accordingly to mitigate the risks of a potential global bond market crisis. Diversification and a thorough understanding of your risk tolerance are key to weathering potential instability in the global bond market.

Featured Posts

-

Ohio Man Found Guilty In Child Sex Crime Case

May 24, 2025

Ohio Man Found Guilty In Child Sex Crime Case

May 24, 2025 -

Lady Gagas Snl Afterparty Appearance With Fiance Michael Polansky

May 24, 2025

Lady Gagas Snl Afterparty Appearance With Fiance Michael Polansky

May 24, 2025 -

Everything You Need Housing Finance Kids Activities At The Iam Expat Fair

May 24, 2025

Everything You Need Housing Finance Kids Activities At The Iam Expat Fair

May 24, 2025 -

Poor Glastonbury 2025 Headliners Leave Fans Disappointed

May 24, 2025

Poor Glastonbury 2025 Headliners Leave Fans Disappointed

May 24, 2025 -

Nyt Mini Crossword March 16 2025 Complete Answers And Clues

May 24, 2025

Nyt Mini Crossword March 16 2025 Complete Answers And Clues

May 24, 2025

Latest Posts

-

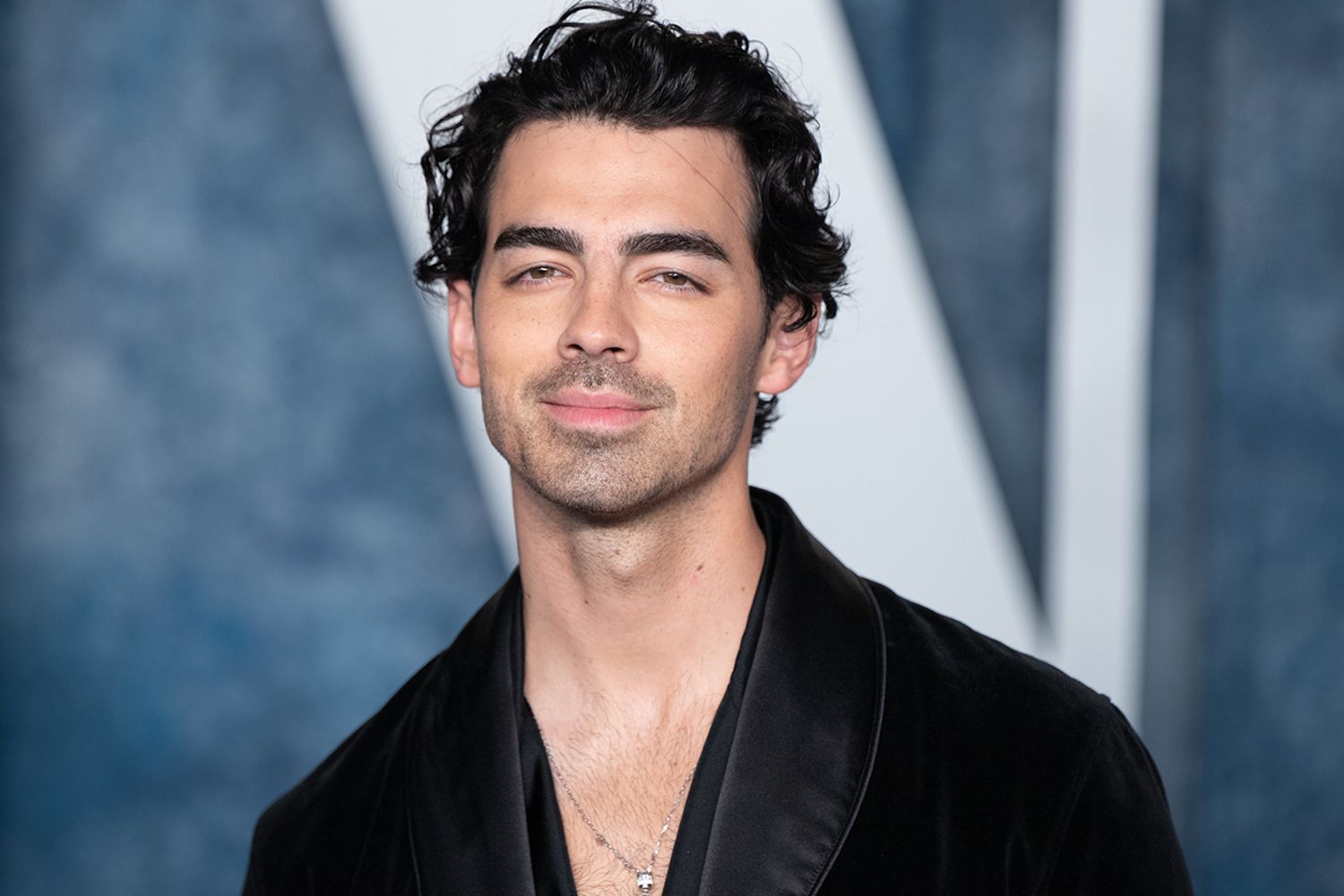

Joe Jonas Responds To Married Couples Argument About Him

May 24, 2025

Joe Jonas Responds To Married Couples Argument About Him

May 24, 2025 -

Joe Jonas And The Couples Argument A Viral Moment

May 24, 2025

Joe Jonas And The Couples Argument A Viral Moment

May 24, 2025 -

Jonathan Groffs Just In Time Opening A Star Studded Affair

May 24, 2025

Jonathan Groffs Just In Time Opening A Star Studded Affair

May 24, 2025 -

Jonathan Groffs Just In Time Tony Award Nomination Potential

May 24, 2025

Jonathan Groffs Just In Time Tony Award Nomination Potential

May 24, 2025 -

A Couples Fight Joe Jonass Response And The Internets Reaction

May 24, 2025

A Couples Fight Joe Jonass Response And The Internets Reaction

May 24, 2025