The KRW/USD And Trump's Influence: A Forecast For The South Korean Won

Trump's Trade Policies and their Impact on the KRW/USD

Trump's protectionist trade policies significantly impacted the KRW/USD exchange rate. His administration's focus on bilateral agreements and the imposition of tariffs disrupted established global trade flows, impacting South Korea's export-oriented economy.

-

Impact of Tariffs on South Korean Exports: The imposition of tariffs on steel and other goods exported from South Korea to the US directly affected South Korean businesses. Reduced demand led to decreased export revenue, putting downward pressure on the KRW/USD exchange rate. Data from the Bank of Korea during this period clearly illustrates this correlation.

-

Trade Negotiations and Agreements: Negotiations between the US and South Korea under the Trump administration resulted in revised trade agreements. While these aimed to address trade imbalances, the uncertainty surrounding the negotiations itself contributed to volatility in the KRW/USD. The resulting agreements, while potentially beneficial in the long term, caused short-term fluctuations.

-

Increased Protectionism and its Economic Effects: Trump's emphasis on protectionism created uncertainty in the global marketplace. This impacted investor confidence in South Korea's economy, which in turn influenced the KRW/USD. The decreased foreign investment further pressured the Won.

-

Specific Examples and Data Points: For instance, the announcement of specific tariffs often preceded immediate drops in the KRW/USD, reflecting market anticipation and subsequent reactions. Analyzing the specific data points related to these announcements provides strong evidence supporting this claim.

Geopolitical Factors and their Influence on the KRW/USD

Geopolitical factors, particularly those related to North Korea, played a significant role in influencing the KRW/USD exchange rate. The perceived risk associated with regional instability directly impacted investor sentiment and capital flows.

-

North Korea's Nuclear Program: Escalations in North Korea's nuclear program created periods of heightened geopolitical risk. This uncertainty often led to investors seeking safer havens, causing a strengthening of the US dollar and a weakening of the South Korean Won. News cycles related to North Korean missile tests, for example, consistently demonstrate this effect.

-

US-South Korea Alliance: The strong alliance between the US and South Korea provides a degree of stability. However, shifts in the relationship, even subtle ones, can impact investor confidence and influence the KRW/USD. Periods of strengthened alliance generally correlate with a stronger Won.

-

Other Geopolitical Risks: Other factors, such as regional tensions in East Asia and global events, also impacted the KRW/USD. These broader geopolitical risks created additional volatility.

-

Historical Events and their Impact: Reviewing historical events involving North Korea and the broader regional landscape reveals clear patterns of KRW/USD fluctuation in response to such events.

Post-Trump Era: Forecasting the KRW/USD

Predicting future movements in the KRW/USD requires considering several economic factors in both the US and South Korea. While the Trump era offered valuable lessons, the current global landscape presents a different set of challenges and opportunities.

-

Economic Conditions in the US and South Korea: The ongoing economic recovery in both countries, along with factors such as inflation and unemployment rates, will significantly impact the KRW/USD. A stronger US economy might lead to a stronger dollar, potentially weakening the Won.

-

Interest Rate Differentials: The difference between US and South Korean interest rates plays a crucial role. Higher US interest rates typically attract foreign investment, strengthening the dollar and potentially weakening the Won. Conversely, higher South Korean interest rates can strengthen the Won.

-

Future Trends Based on Economic Indicators: Analyzing key economic indicators, such as GDP growth, inflation, and trade balances, allows for informed predictions about the KRW/USD. These indicators provide valuable insight into the relative strength of both economies.

-

Potential Scenarios and Implications: Various scenarios, ranging from a continued strong US dollar to increased global uncertainty, need to be considered. Each scenario will have differing implications for the KRW/USD exchange rate.

Conclusion

This article examined the significant influence of Trump's economic and geopolitical policies on the KRW/USD exchange rate. We analyzed the impact of trade wars, geopolitical tensions, and other factors contributing to the Won's volatility. The analysis revealed the complex interplay between these factors and the resulting impact on the South Korean economy. The post-Trump era presents new challenges and opportunities, requiring a nuanced understanding of global economic trends to effectively forecast the KRW/USD.

Forecast Summary: While precise prediction is impossible, a continued focus on economic indicators in both countries, along with regional geopolitical stability, will likely be the primary drivers of the KRW/USD in the coming years. A strong US economy could put downward pressure on the Won, while increased regional stability could support its strength.

Call to Action: Stay informed about the KRW/USD exchange rate and its drivers by regularly checking for updates on currency forecasts and analysis. Understanding the factors impacting the KRW/USD is crucial for investors and businesses operating in or with South Korea. Learn more about navigating the complexities of the KRW/USD market with our expert insights. Stay ahead of the curve and master the KRW/USD!

Canadian Condo Investment A Changing Landscape

Canadian Condo Investment A Changing Landscape

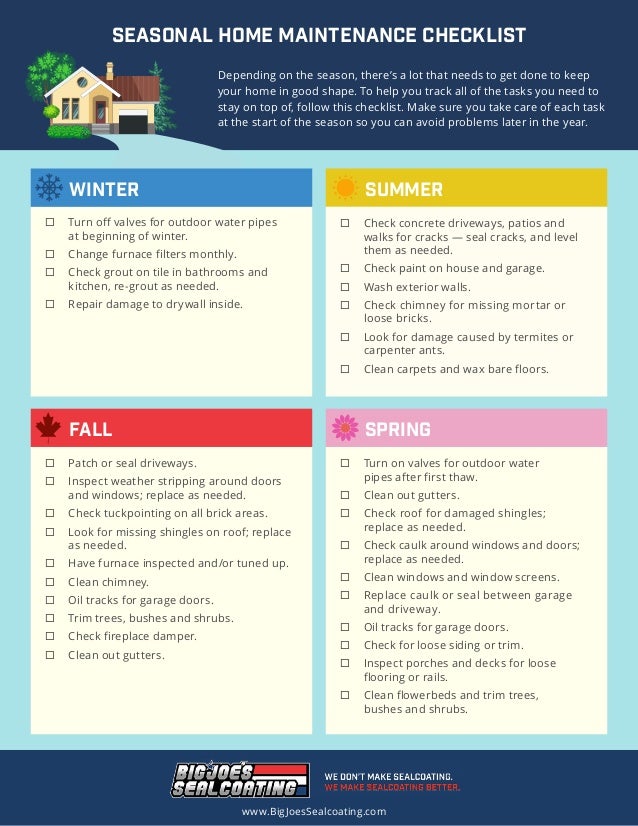

Building Your Winter Weather Timeline A Seasonal Checklist

Building Your Winter Weather Timeline A Seasonal Checklist

Creating A Personalized Winter Weather Timeline

Creating A Personalized Winter Weather Timeline

Our Great Yorkshire Life A Comprehensive Guide

Our Great Yorkshire Life A Comprehensive Guide

Josh Fitzpatrick Arrest Latest Updates On The Sextortion Case

Josh Fitzpatrick Arrest Latest Updates On The Sextortion Case