The Importance Of Net Asset Value In The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

Net Asset Value (NAV) represents the net value of an ETF's underlying assets. It's calculated by taking the total market value of all the ETF's holdings (in this case, the components of the Dow Jones Industrial Average), subtracting any liabilities like expenses, and then dividing by the number of outstanding shares. Understanding NAV is vital for assessing the true value of your investment in the Amundi Dow Jones Industrial Average UCITS ETF and making informed investment decisions. This ETF tracks the performance of the Dow Jones Industrial Average, providing investors with exposure to 30 leading US companies.

How NAV is Calculated for the Amundi Dow Jones Industrial Average UCITS ETF

The NAV calculation for the Amundi Dow Jones Industrial Average UCITS ETF is a daily process, reflecting the fluctuating market values of its underlying assets. The calculation involves several key steps:

- Asset Valuation: Each holding in the ETF, representing a component of the Dow Jones Industrial Average, is valued at its closing market price. This means the value of each company's stock within the ETF's portfolio is updated daily based on market movements.

- Liabilities Deduction: The ETF's expenses, including management fees and other operational costs, are deducted from the total asset value. These liabilities reduce the overall net asset value.

- NAV per Share Calculation: The final step divides the total net asset value (total assets minus liabilities) by the total number of outstanding shares of the Amundi Dow Jones Industrial Average UCITS ETF. This results in the NAV per share, which is the value of one share of the ETF.

This daily NAV calculation ensures that the reported value accurately reflects the current market worth of the ETF's holdings. The daily NAV is a critical figure used in ETF pricing and to represent the portfolio value. Understanding the daily NAV calculation helps investors appreciate the dynamic nature of their investment and how it is affected by daily market fluctuations in the Dow Jones Industrial Average components.

The Importance of NAV in Investment Decisions

NAV plays a vital role in guiding your investment decisions related to the Amundi Dow Jones Industrial Average UCITS ETF. By monitoring the NAV, you gain valuable insights into your investment:

- Performance Tracking: Tracking NAV changes over time allows you to monitor the performance of your investment. A rising NAV indicates growth, while a falling NAV suggests a decline in the value of your holdings.

- Identifying Mispricing: Comparing the ETF's market price to its NAV can reveal potential buying or selling opportunities. If the market price trades at a significant premium or discount to the NAV, it could indicate an arbitrage opportunity.

- Informed Decision-Making: Utilizing NAV data empowers you to make more informed decisions about buying, selling, or holding your Amundi Dow Jones Industrial Average UCITS ETF shares. Understanding the NAV helps you evaluate whether the market price fairly reflects the underlying value of the portfolio. Your investment strategy should consider the relationship between NAV and market price to maximize your returns.

Accessing and Interpreting NAV Information for the Amundi Dow Jones Industrial Average UCITS ETF

Finding the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF is straightforward. You can typically access this information from:

- The ETF Provider's Website: Amundi's official website will provide up-to-date NAV data for all their ETFs, including the Amundi Dow Jones Industrial Average UCITS ETF.

- Financial News Sources: Major financial news websites and platforms often publish daily NAV data for actively traded ETFs like this one.

Interpreting NAV data requires considering the broader market context. Market trends, economic factors, and even global events can significantly influence the NAV. For example, a period of market volatility might temporarily affect the NAV, even if the underlying companies in the Dow Jones Industrial Average are fundamentally strong. You should also be aware of the difference between the bid and ask prices. The bid price is what someone is willing to pay to buy your shares, while the ask price is what someone is willing to sell their shares for. These prices can differ slightly from the NAV, often due to market supply and demand dynamics.

Factors Affecting the Amundi Dow Jones Industrial Average UCITS ETF's NAV

Several factors can cause fluctuations in the Amundi Dow Jones Industrial Average UCITS ETF's NAV:

- Market Performance of Dow Jones Components: The performance of the individual companies comprising the Dow Jones Industrial Average directly impacts the NAV. Strong performance by these companies leads to a higher NAV, and vice-versa.

- Currency Fluctuations: While the ETF tracks a US index, currency exchange rates could indirectly affect the NAV if there are any international transactions or holdings related to the ETF's operation.

- Impact of Dividend Distributions: When underlying companies in the Dow Jones Industrial Average pay dividends, the ETF receives these dividends, which generally slightly increases the NAV before they are distributed to the ETF investors. However, the dividend payment itself will result in a minor decrease in the NAV immediately following the distribution.

Conclusion: The Crucial Role of Net Asset Value in Your Amundi Dow Jones Industrial Average UCITS ETF Strategy

Understanding and regularly monitoring the Net Asset Value of your Amundi Dow Jones Industrial Average UCITS ETF investment is crucial for making informed decisions. NAV provides a clear picture of your portfolio's true value, allowing you to track performance, identify potential mispricing opportunities, and adjust your investment strategy accordingly. Utilize Net Asset Value data for your Amundi Dow Jones Industrial Average UCITS ETF portfolio to ensure you are making the most of your investment. Monitor your Amundi Dow Jones Industrial Average UCITS ETF's Net Asset Value regularly and use this information to refine your investment strategy for optimal results. Understand the Net Asset Value of your Amundi Dow Jones Industrial Average UCITS ETF and take control of your investment journey.

Featured Posts

-

Flying Around Memorial Day 2025 Expect Crowds On These Dates

May 25, 2025

Flying Around Memorial Day 2025 Expect Crowds On These Dates

May 25, 2025 -

Economische Recessie Relx Blijft Groeien Dankzij Ai Innovaties

May 25, 2025

Economische Recessie Relx Blijft Groeien Dankzij Ai Innovaties

May 25, 2025 -

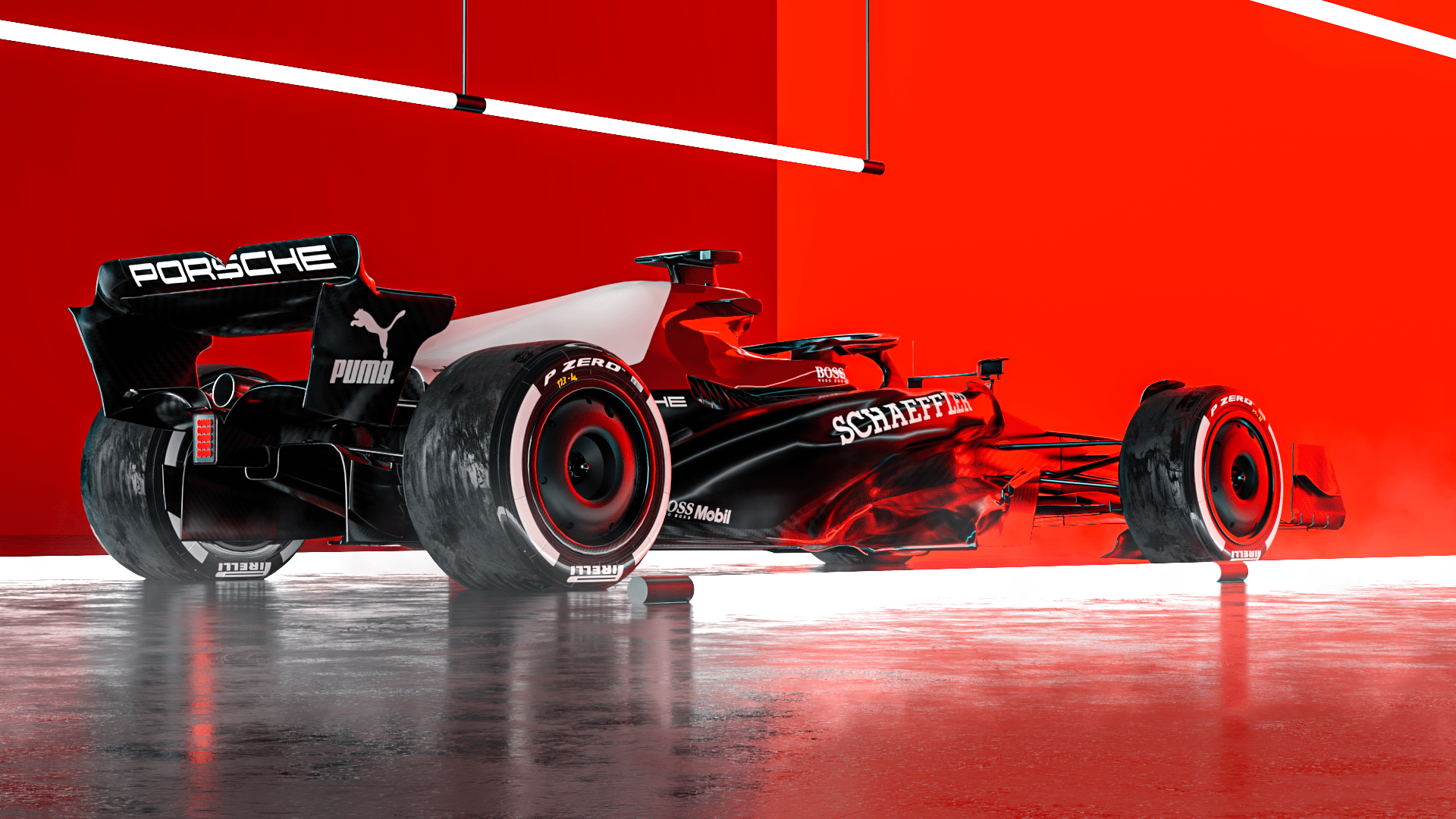

Koezuti Porsche F1 Motor Erejevel

May 25, 2025

Koezuti Porsche F1 Motor Erejevel

May 25, 2025 -

Kyle Walker Partied In Milan Hours After Wifes Uk Flight

May 25, 2025

Kyle Walker Partied In Milan Hours After Wifes Uk Flight

May 25, 2025 -

Ecb Faiz Indirimi Sonrasi Avrupa Borsalarinda Yasananlar

May 25, 2025

Ecb Faiz Indirimi Sonrasi Avrupa Borsalarinda Yasananlar

May 25, 2025

Latest Posts

-

Camunda Con 2025 Amsterdam Ai Automation And Orchestration A Winning Combination

May 25, 2025

Camunda Con 2025 Amsterdam Ai Automation And Orchestration A Winning Combination

May 25, 2025 -

Amsterdam 2025 How Orchestration At Camunda Con Will Boost Your Ai Automation Investments

May 25, 2025

Amsterdam 2025 How Orchestration At Camunda Con Will Boost Your Ai Automation Investments

May 25, 2025 -

Camunda Con 2025 Unlocking The Power Of Orchestration With Ai And Automation In Amsterdam

May 25, 2025

Camunda Con 2025 Unlocking The Power Of Orchestration With Ai And Automation In Amsterdam

May 25, 2025 -

Camunda Con 2025 Amsterdam Orchestration For Maximizing Ai And Automation Roi

May 25, 2025

Camunda Con 2025 Amsterdam Orchestration For Maximizing Ai And Automation Roi

May 25, 2025 -

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Needs

May 25, 2025

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Needs

May 25, 2025